Prices and Charts

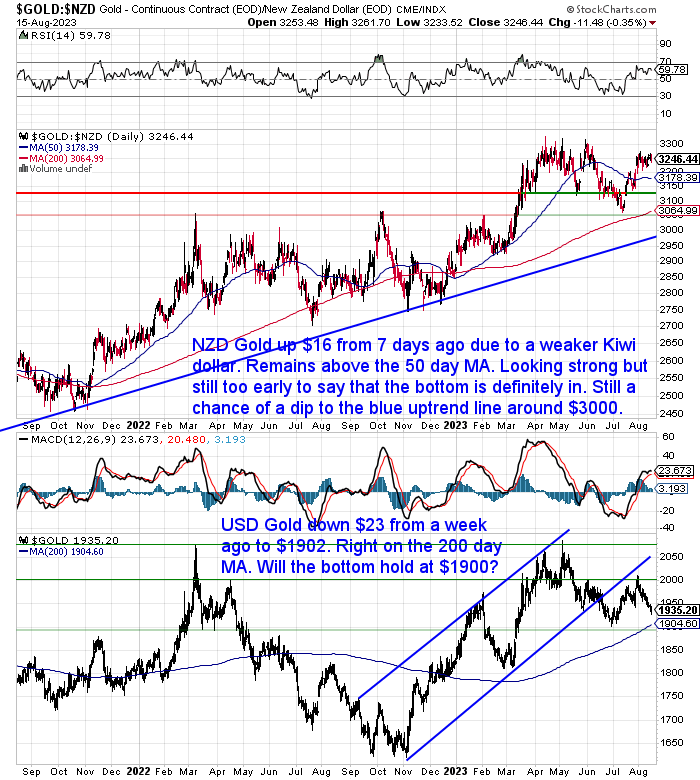

Weaker Kiwi Dollar Holds Up Local Gold Price

A sharply weaker Kiwi dollar gave the local gold price a boost, despite a falling USD price of gold. Gold in NZ dollars was up $16 from a week prior. It remains above the 50 day moving average (MA) and continues to look pretty solid. If we see a pullback, buy zones are at the 50 day ($3178) and 200 day MAs ($3065). Still even a chance of a dip to the blue uptrend line around $3000.

While gold in USD was down $23 (-1.2%) from 7 days ago to $1902. That is just under the 200 day MA that we have been watching for. So we could be close to a bounce for USD gold.

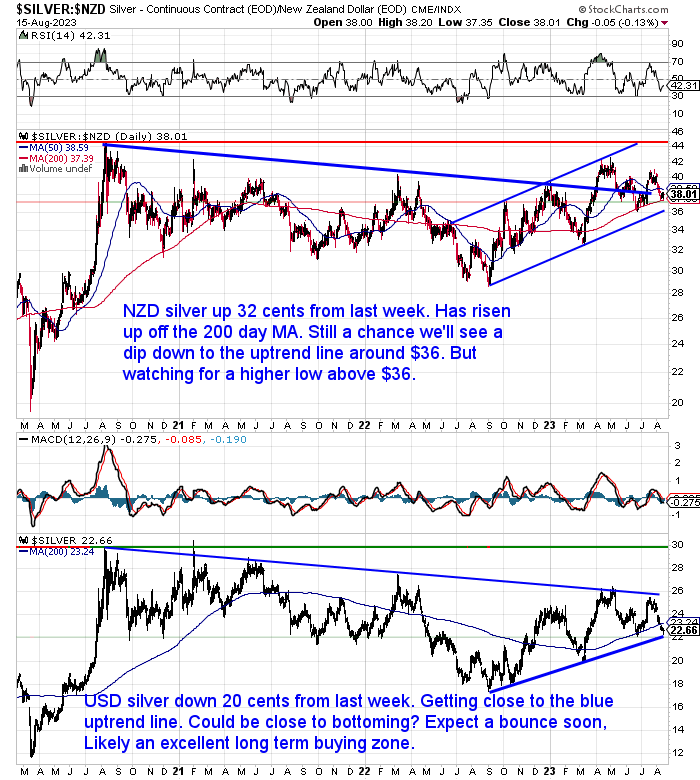

Silver Close to Bottoming Again?

Silver in NZ Dollars was up 32 cents from last week. Again solely due to the weaker Kiwi dollar. NZD silver rose up off the 200 day MA, just as it did back in June and July. We could yet see a pull back to the blue uptrend line, although that is now above the $36 as well. So will the June bottom at $36 hold? Anywhere between here and $36 is looking like a very good buying opportunity for long term holders of silver.

USD silver was down 20 cents and unlike the NZD price is below the 200 day moving average. It’s also very close to the blue uptrend line and so likely close to bottoming out. We expect to see a bounce soon. Great buying zone.

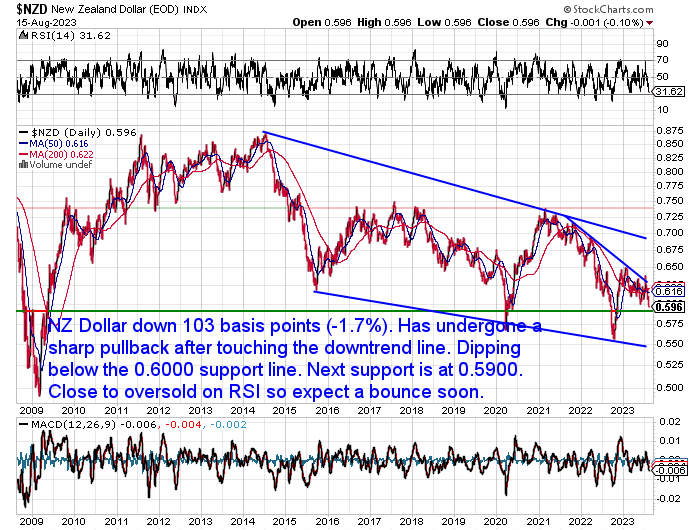

NZD Dollar Down 1.7%

As already covered the Kiwi dollar took a hit this week, falling 103 basis points (-1.7%). It has experienced a very sharp drop after touching the overhead downtrend line. This week dipping below 0.6000 for the first time since November 2022. The next support area is the round number of 0.5900. With the RSI close to very oversold we should expect a bounce in the Kiwi soon.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Exit Strategies For When the Time Comes to Sell Gold and Silver

Two weeks ago we shared 7 indicators that will give a pretty good idea of when it is time to sell gold. We also touched on some reasons why you might not have to sell your gold at all.

So this week we expand upon those reasons and explore a critical aspect of precious metals investing that’s often overlooked: exit strategies. While we frequently discuss the reasons for buying gold and silver, it’s equally important to have a plan for when it’s time to sell.

If you’re curious about when to sell and what options you might consider, our latest article has you covered. We discuss the uncertainty of predicting future gold and silver prices, why relying solely on a dollar price might not be ideal. Along with how to gauge the right time to “spend” your precious metals wisely.

Find out how we prefer to track various indicators against real assets like property and businesses, discover potential strategies for maximizing your gold and silver investments, and explore intriguing concepts such as gold-backed bonds, collateralisation, and even becoming part of a “silver bank.”

Read the full article and you’ll be able to craft a solid exit strategy for your precious metals holdings. As always, your insights and thoughts are valued. Join the conversation by leaving a comment below the article.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Inflation – Not Beaten Yet?

We’ve been keeping track of a number of inflation news items over the past week which all feed into one another. So it’s all about inflation from here on…

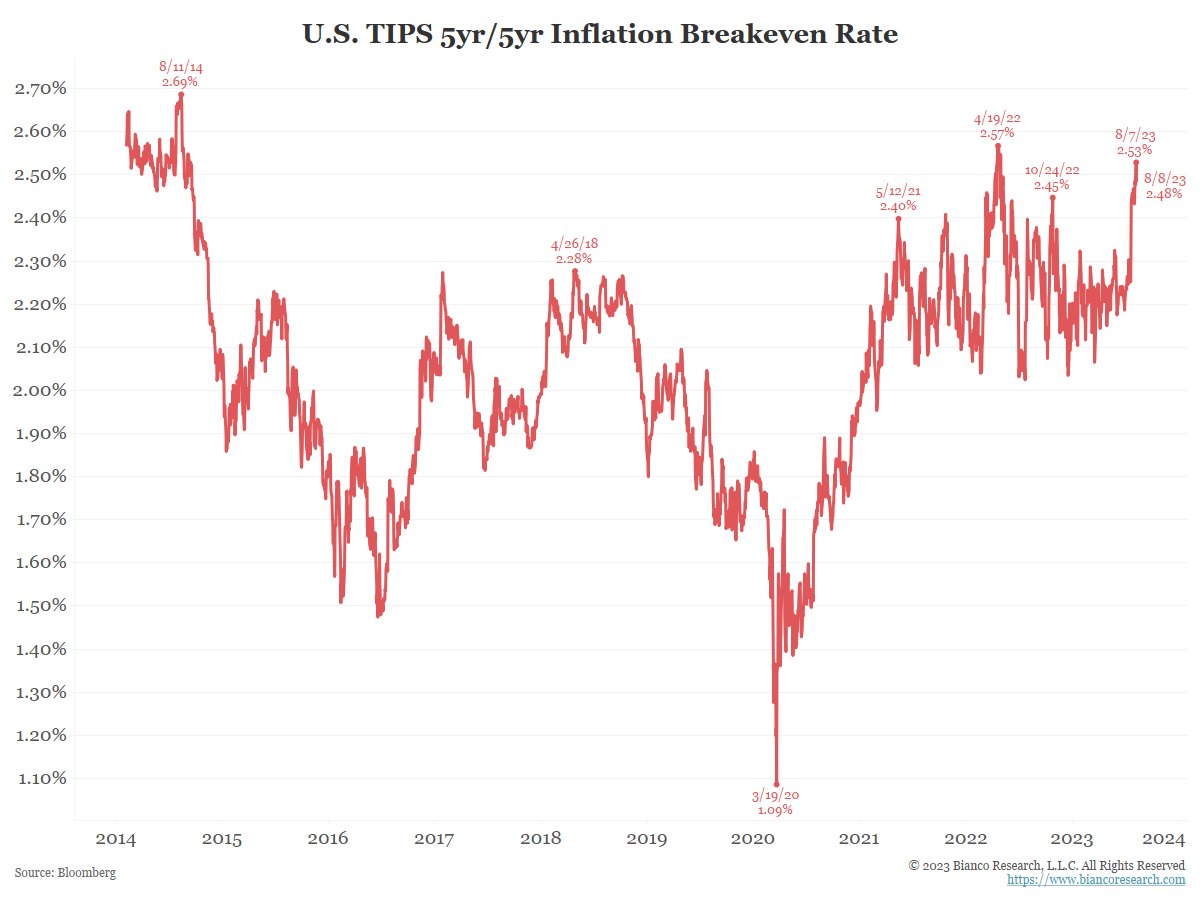

Jim Bianco shared this chart a few days ago:

“The Fed’s favorite measure of “inflation compensation” (their term) is the 5-year/5-year inflation break-even rate.

It shows the market’s pricing of the average inflation rate in five years for the next five years (this supposedly removes short-term distortions like gyrations in crude oil and gasoline prices).

It is again getting close to a new nine-year high.”

Source.

Source.

While in the US, headline inflation posted its first rise in 12 months.

Oil Hits New Highs for 2023

Plus we have oil reaching new highs for the year. Bianco also points out that if crude oil holds at these high levels then gasoline prices are also going to continue to head even higher.

“If the crude chart above holds, then this gasoline chart, which has been at its 2023 higher for many days, is not done going higher.”

Source.

NZ Petrol Prices Highest in a Year

While here in NZ petrol prices are at the highest levels since July 2022.

“On top of that, of course, we’ve also got – in the third quarter of the year – the reversal of the [fuel excise duty] subsidy that was in place,” [economist Simon] Bagrie told AM. “Petrol’s going to be a pretty big contributor to third-quarter inflation and that’s going to add, potentially, a little bit of stickiness into that declining inflation dynamic.”

Bagrie said the major contributor to the rise in oil prices was supply cutbacks.

…”The flip side is that global demand conditions are still looking pretty brisk,” Bagrie explained. “So you get less supply and a little bit more demand because the global economy has outperformed all expectations in the last two to three months – you’ve got a recipe for higher prices, not lower prices.

“In the last 12 months, we’ve seen energy prices… be a big negative contributor to inflation coming down – what we’re going to see in the next six months is it’s going to reverse on the other side.”

Source.

But Consumers Expect Lower Prices

Meanwhile we have a consumer inflation survey from the Reserve Bank shows that households think inflation is going to be NEARLY back in the RBNZ’s 1% to 3% target range in two years’ time, while house prices will rise next year and continue to rise.

What if people are wrong about this? What if they are just experiencing the “recency effect”? Where the recent past is projected into the future.

What if History Rhymes?

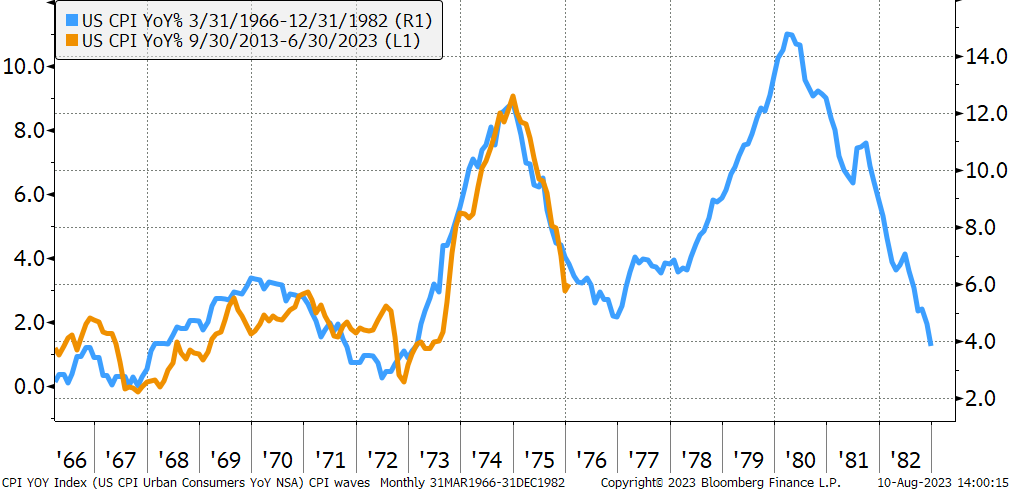

See this very interesting chart comparing US CPI from 1966 to 1982 with 2013 to 2023.

What if another wave of inflation is around the corner? Just like that which occurred in the mid 1970’s.

Source.

Blackrock: “Inflation rollercoaster”

Huge investment management company Blackrock expects the US economy to flatline for a year before inflation returns in 2024. They say to get ready for a generational shift to ‘full-employment stagnation’.

“The labor market is about to put inflation on a “rollercoaster,” according to BlackRock strategists.

That’s because rising wages can stoke inflation, which raises the risk of rebounding prices.

“We believe this structural labor shock is poised to take over as the driver of inflation as the pandemic-driven spending mismatch unwinds.”

Source.

Here in NZ, evidence of just what Blackrock is saying:

“Median wage and salary increases are now outstripping inflation, after the consumer price index increases dominated the country. The latest data from Stats NZ showed the median weekly and hourly earnings from wages and salaries increased by 7.1 and 6.6 percent respectively, in the year to the June 2023 quarter.”

Source.

Add higher fuel costs and to us the odds seem pretty high of another inflation uptick coming in the next year or so. Just when people are getting used to prices falling.

Meanwhile…

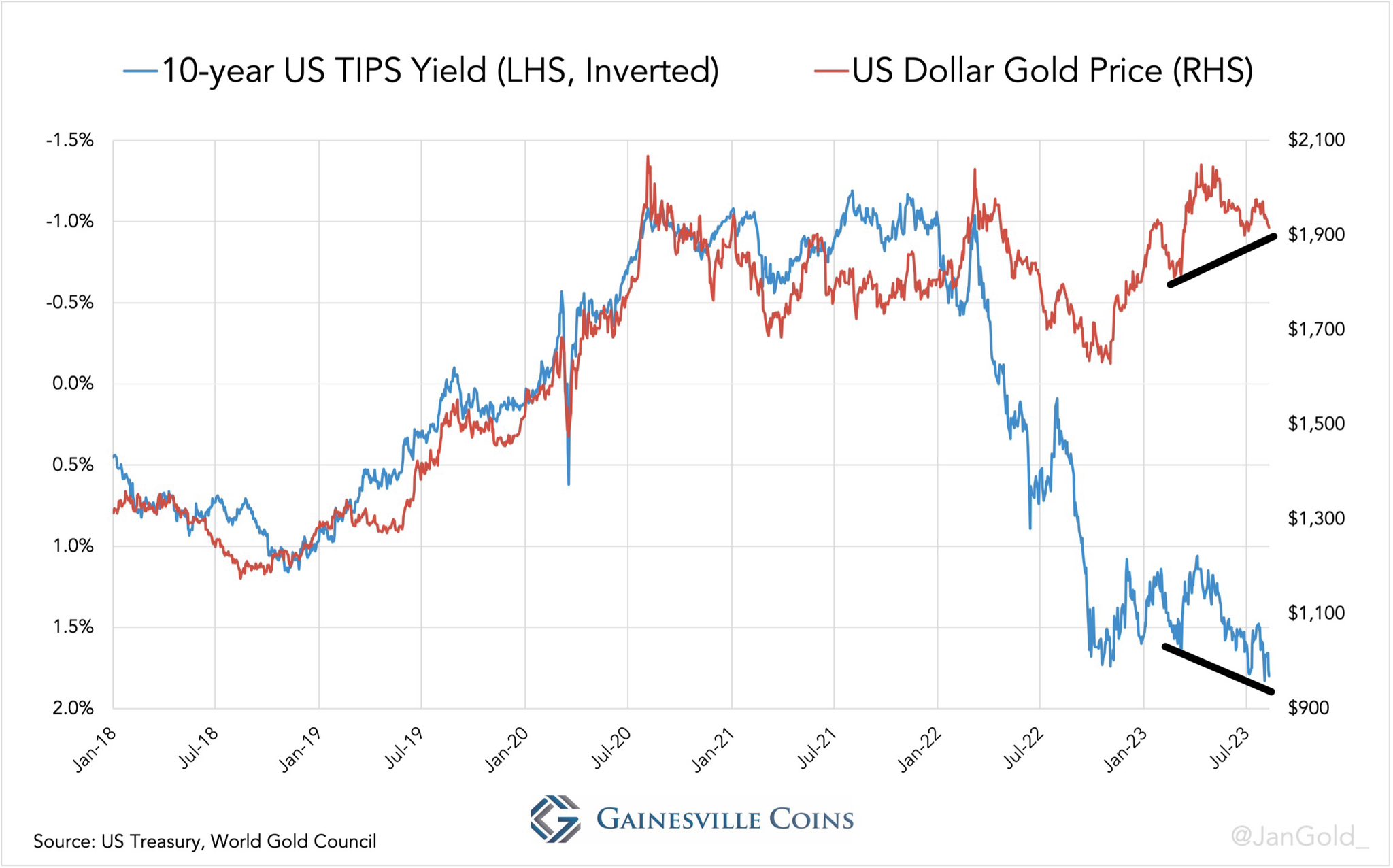

“Gold continues to show incredible strength versus real rates, ripping higher while rates go up!”

Source.

Gold would be expected to fall when real (after inflation) interest rates rise. (note that in the chart the yield is inverted so a falling blue line means higher interest rates). This is a very positive sign. So price holding up despite headwinds, terrible sentiment, retail buying very low. These all add up to likely indicators of a great time to buy. If you agree…

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Positive Sign: Silver Short Positions Dropping - Gold Survival Guide

Pingback: Singapore Increases Gold Reserves by 48% Since Dec 2022 - Gold Survival Guide