Prices and Charts

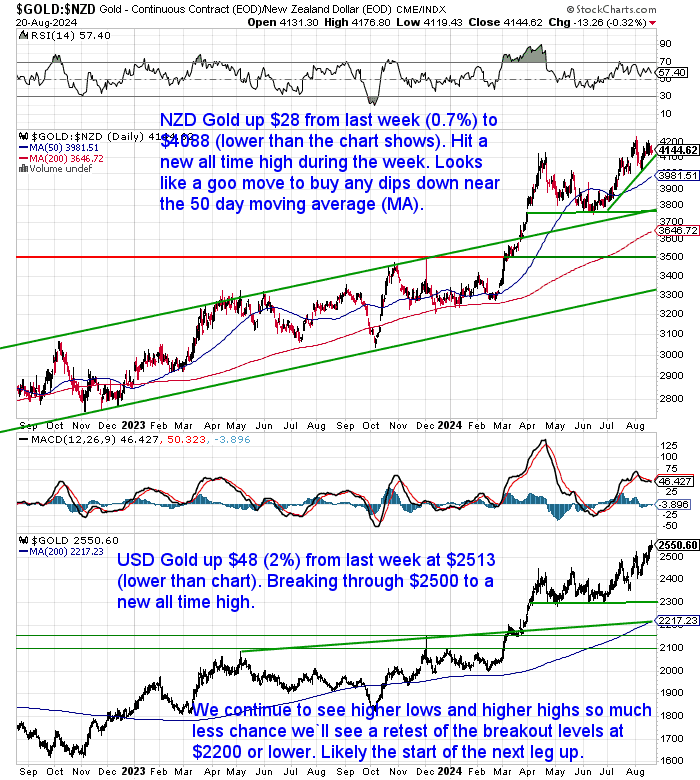

USD Gold Breaks $2500 to New All-Time High

Gold in New Zealand dollars edged to a new all-time high this week. Up $28 or 0.7% from a week ago to $4088. It looks like any further dips down to the 50-day moving average will be good buying opportunities. Perhaps $4000 will be the new floor for NZD Gold? Otherwise, $3800 is looking like strong support.

Gold in USD reached a significant round number today. Breaking through $2500 to another new all-time high. Once again without the spotlight on it. Today USD gold is up $48 (2%) from 7 days prior to $2513. It continues to make a series of higher highs and higher lows – the very epitome of a bull market. This is likely the start of the new leg higher. It wouldn’t surprise us to see $3000 in the next year.

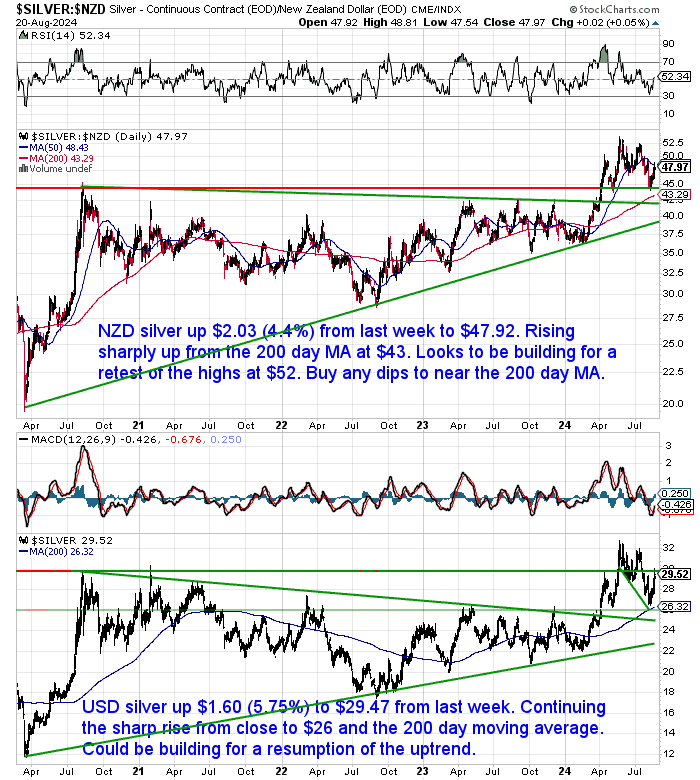

Silver Surging 5%

While gold was hitting all-time highs, silver actually outperformed it. NZD silver was up $2.03 or 4.4% from last week. It continued its sharp rise from near the 200-day moving average. It looks to be building for a retest of the highs around $52. Any further dips to the 200-day MA look like strong buying opportunities.

USD silver jumped $1.60 or 5.75% from a week ago. Sitting at $29.47 it is once again testing the 2020 highs. Looks as though it is likely to get through there before too long. So could be building for a resumption of the uptrend from earlier this year. Keep buying those dips lower as $26 may be the new floor.

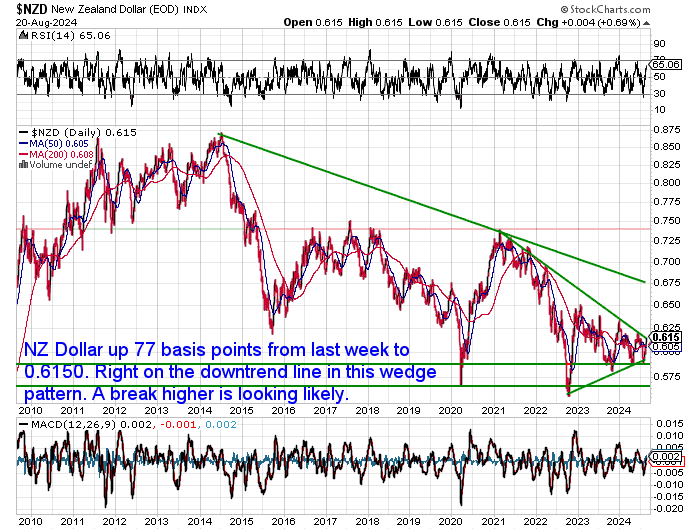

NZD Dollar Jumps Despite Rate Cuts?

The Kiwi Dollar is up 77 basis points or 1.27% from last week to 0.6150. It now sits right on the downtrend line in the wedge formation. It looks like a breakout could be coming soon. Our guess is that it will be higher.

But after the RBNZ cut interest rates last week you may be wondering why the Kiwi is actually stronger. Shouldn’t it be falling if yields are lower in New Zealand?

It’s probably more a case of the US dollar being weaker. It is down against most currencies likely on the expectation that the US central bank will also be cutting interest rates soon.

There is also an expectation of a significant downward adjustment to the US job growth numbers tomorrow. See:

Expect the BLS to Revise Job Growth Down by 730,000 in 2023, More This Year.

This could put a real dent in the view of how “strong” the US economy has been.

So our call at the start of the year, for the USD to weaken, might be finally about to happen.

Therefore while we still expect NZD prices of gold and silver to rise, they will likely not be as high as for USD precious metals prices.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Is Your Currency Doomed? Why Gold Might Be a Lifeline (Even in New Zealand)

Throughout history, empires have risen and fallen, and their currencies along with them. This week’s feature article explores the concept of fiat currencies (like the New Zealand dollar) and their potential vulnerabilities.

The article investigates:

- The historical instances where fiat currencies have lost value or even collapsed entirely

- Why some experts believe modern fiat currencies could face a similar fate

- Whether this logic applies to New Zealand’s relatively stable economy and currency

Feeling a sense of unease about the long-term stability of traditional currencies? This article explores the potential benefits of gold as a form of wealth protection, even in a developed economy like New Zealand.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Gold Stocks Are Starting to Indicate Higher Gold Prices Ahead

Last week we touched on how gold was close to breaking out versus the US stock market.

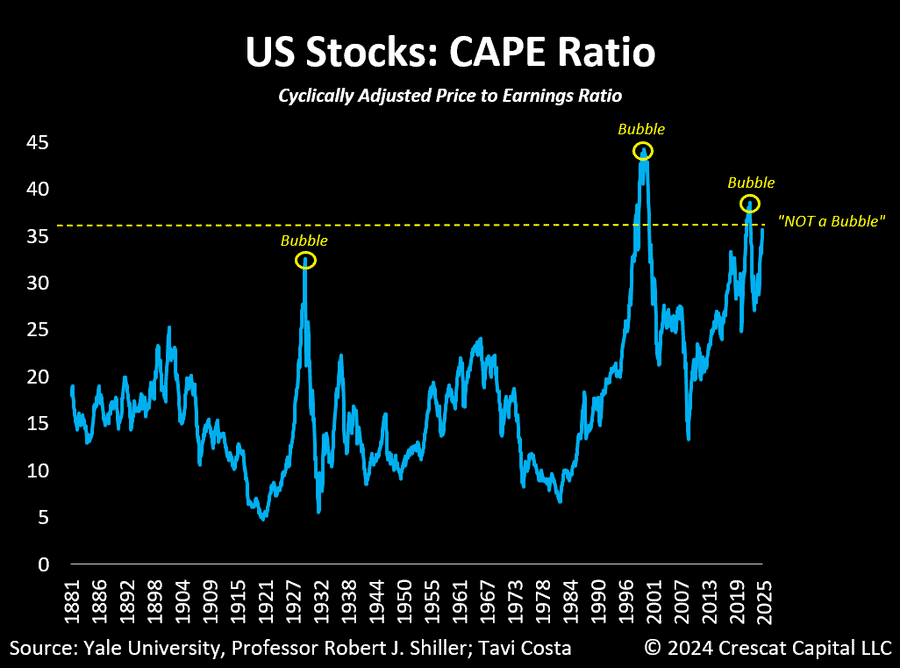

Here’s a series of charts related to this from Tavi Costa. First up a comparison of a common method of valuing stocks the price-to-earnings ratio. When this ratio gets really high it simply shows people are prepared to pay a lot for the earnings of a company:

“Everything seems obvious when we look back at history.

That’s the beauty of hindsight research.

It’s interesting that, despite the similar valuation characteristics of prior speculative environments, the prevailing opinion today is that this is NOT a bubble.

Regardless of how much is left in the tank, the risk-reward of being heavily invested in US stocks seems entirely imprudent at this point.”

Source.

So perhaps we are close to a top in stocks?

Next, here’s a very surprising chart for us too. We certainly favor bullion over gold and silver mining stocks. The metals themselves have vastly outperformed the mining indexes for many years now. But…

“What if I told you that junior gold miners have outperformed the Nasdaq 100 over the past year?

This industry is so despised that people have a hard time believing it until they see the data.”

Source.

If you are considering some mining shares then be sure to check this out:

Gold Mining Shares vs Physical Gold Bullion – Which to Buy

Will the Light at the End of the Tunnel Turn Out to be Higher Interest Rates?

The theme (apart from Japan) seems to have switched to the expectation of interest rate cuts.

It’s started here. But also in the likes of Canada. In Europe too. ASB reports:

• Sweden’s Riksbank cut its policy rate overnight. The Executive Board cut the policy rate by 25 basis points to 3.5%. This is the Riksbank’s second rate cut following the first cut from the 4% peak back in May. There was a dovish shift in the Board’s guidance on the rates outlook, suggesting two to three further cuts ahead this year (Source Bloomberg).

• The Bank of Japan released a pair of research papers highlighting the persistence of inflationary pressure in the economy, indicating there is still a case to be made for another interest rate hike (Bloomberg).

• Australia: …Our CBA colleagues think both inflation can slow quicker than the RBA’s central scenario and unemployment can lift faster, which is why they are sticking with the call for the RBA to cut in Q4 2024.

• Canada CPI: The headline consumer price index increased 0.4% on a non-seasonally adjusted basis in July, in line with the Bloomberg consensus forecast. Annual inflation slowed to 2.5% from 2.7% in June and a peak of 8.1% in June 2022. The BoC’s preferred inflation measures also moderated during the month (Source Bloomberg). The data should keep the Bank of Canada comfortable on its rate-cutting path.

This 1news article seems to be the overriding consensus globally:

“There is light at the end of the tunnel for the economy, as inflation and interest rates continue to ease. ASB’s latest quarterly forecast indicates economic growth will be flat or down for the rest of this year

…ASB chief economist Nick Tuffley said the economy had been showing “increasing signs of brittleness under the continued pressure from high interest rates”, but there were brighter days ahead.

“Painful as it is, inflation is getting under control,” he said.

“Recent encouraging signs suggest the Reserve Bank can be confident inflation will fall below 3% over the second half of this year and remain well contained beyond 2024.”

Source.

However, we’d be more inclined to think that Doug Casey may be right:

“The Fed can manipulate interest rates to some degree, but the market is much bigger than the Fed. As the dollar is debased and the US becomes less creditworthy, the world will dump dollars. Inflation and creditworthiness are the two major things that control real interest rates.

As a secular trend, interest rates are headed higher. I would not be surprised if they exceed their 15-18% peak of the early 1980s. That will be scary, and gold will profit from that fear. Don’t forget that gold hit its first peak of $850 back in 1980, just as interest rates were also hitting all-time highs.”

Source.

Those are some pretty significant numbers. We are yet to see any mainstream economists even entertain the fact that higher interest rates are still to come.

But that is our guess too. That the current cutting cycle might be just a short-lived downtrend in a longer uptrend for interest rates.

As Doug points out, higher rates didn’t harm gold in the 70’s. In the article linked above you’ll see he also thinks this is just the start of the next move higher in gold. If you’re not on board yet then please get in touch.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|