|

Gold Survival Gold Article Updates: {!date abb+1}

Sep. 19, 2014

This week:

- Gold and silver continue their fall

- Where to From Here for Gold and Silver?

- Report Live From Paris

There’s a lot happening in the financial world in the next few days and weeks. An email from Bix Weir nicely summarised what is in the pipeline currently…

—–

“With the stock market and US Dollar looking rock solid due to massive manipulation the Sheeple are fast asleep.

But behind the scenes the battles are RAGING!!!

A few things to take place OVER THE NEXT FEW DAYS/WEEKS:

1) Ron Paul’s original Audit the Fed Bill gets voted on today. Not sure what to expect but a YES vote speaks volumes as to who is winning the secret battles.

http://investmentwatchblog.com/ron-pauls-audit-the-fed-bill-to-get-a-vote-this-afternoon-call-your-congressperson/

2) Scotland votes tomorrow on their independence and either way the vote goes there should be chaos in the FX Derivative Market…as William Wallace says “FREEDOM!” 🙂

http://www.reuters.com/article/2014/09/17/us-scotland-independence-markets-analysi-idUSKBN0HC0CI20140917

3) All eyes are on the Fed’s FOMC meeting with an announcement due out today. Timing is everything!

http://online.wsj.com/articles/dollar-slips-against-yen-euro-after-hilsenrath-comments-1410887784

4) The new physical gold market, the Shanghai Gold Exchange, made a surprise announcement today that they will begin trading TOMORROW!!!

http://www.resourceinvestor.com/2014/09/16/shanghai-gold-trading-platform-given-surprise-laun

and finally…

5) Senator Carl Levin waits in the wings to BEGIN THE HEARINGS on commodity manipulation.

http://www.reuters.com/article/2014/08/08/us-usa-commodities-levin-exclusive-idUSKBN0G80EK20140808

Hmmm. And everyone thinks the gold and silver markets will NEVER be released from their control.

…and this is just through the rest of September!!!”

—–

Since this email the Fed minutes have been released. The reading between the lines that all the Fed followers do seems to say that the Fed thinks they may raise interest rates sooner than the previously expected, although they have left the phrase “considerable time” in the minutes in relation to how long rate will remain low.

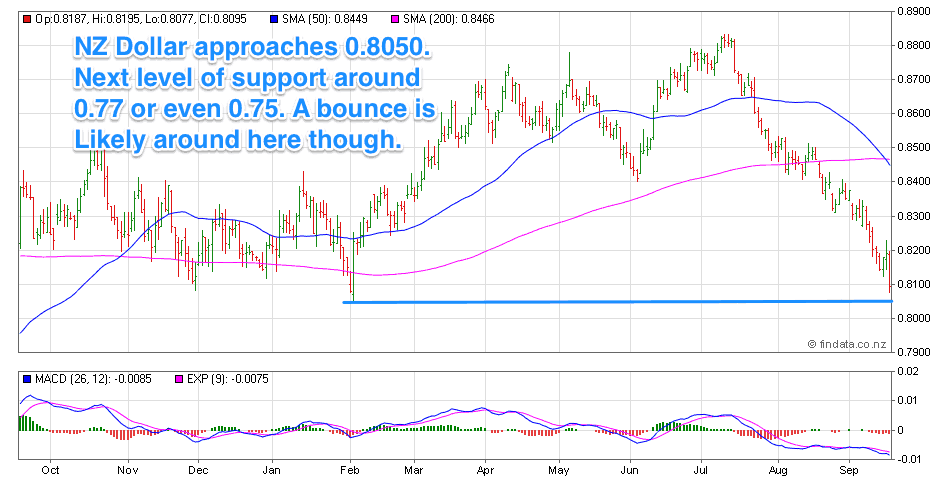

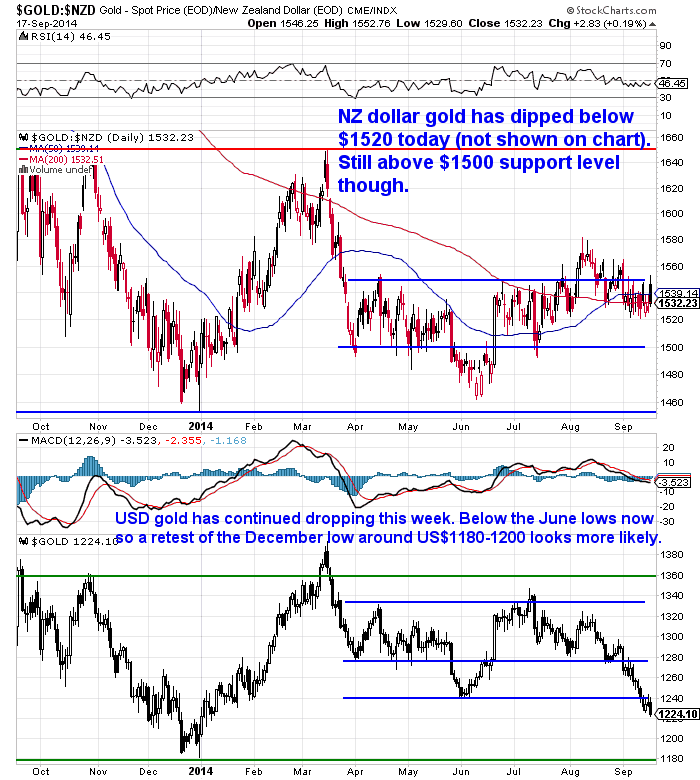

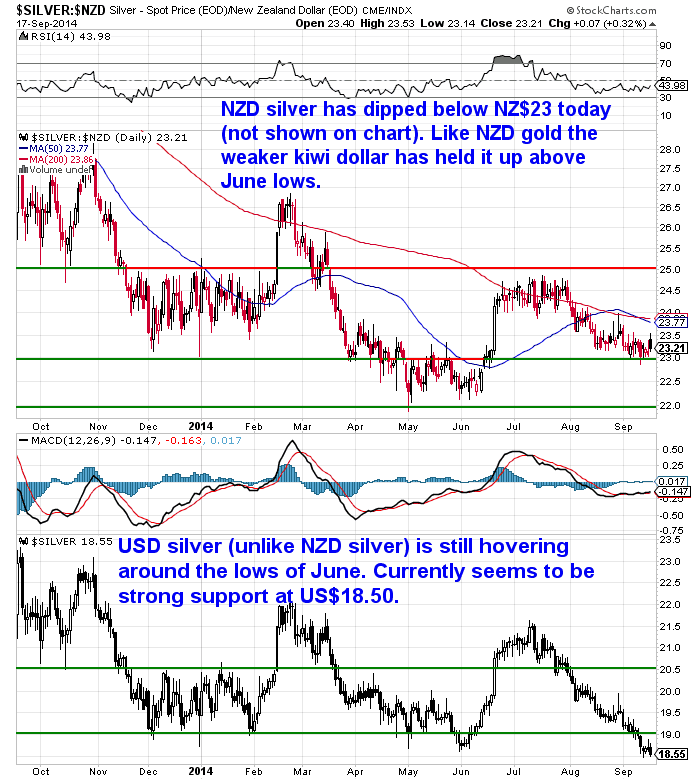

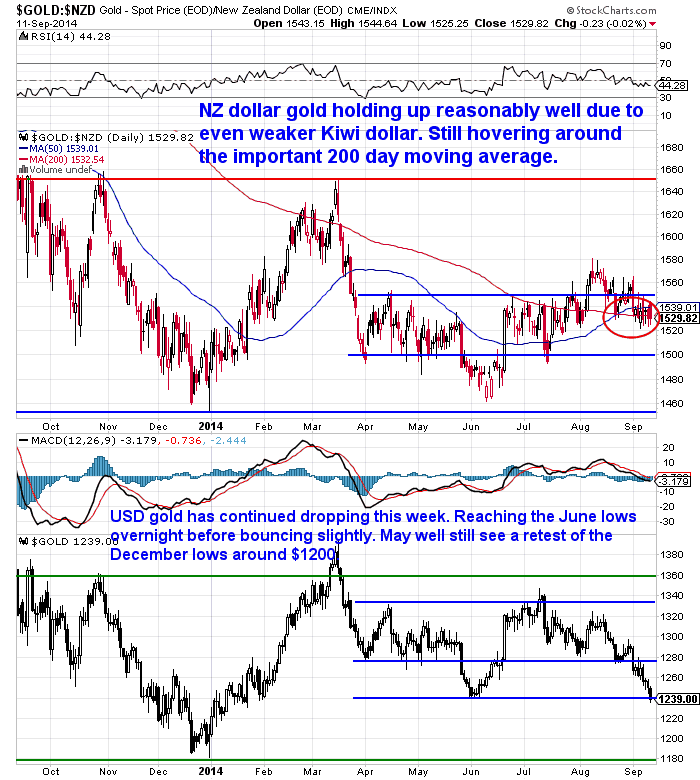

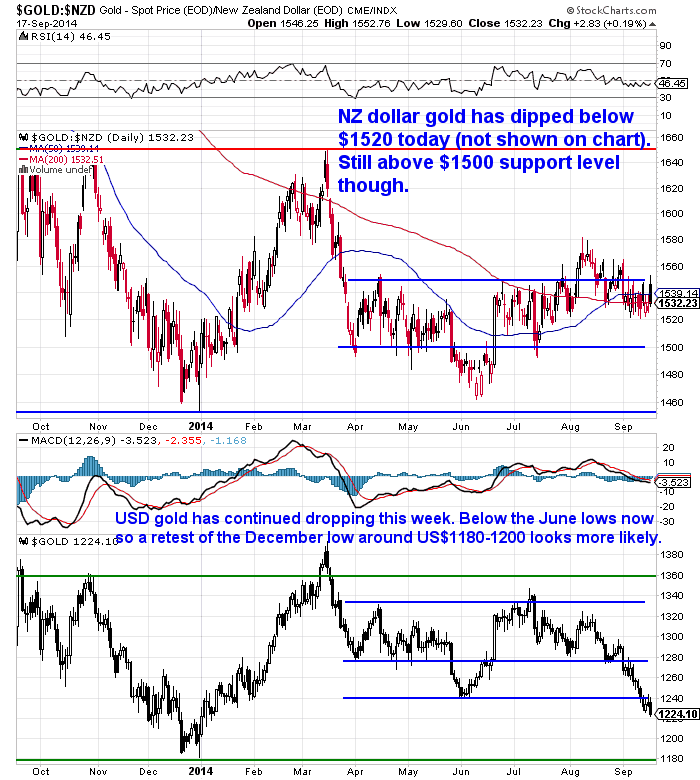

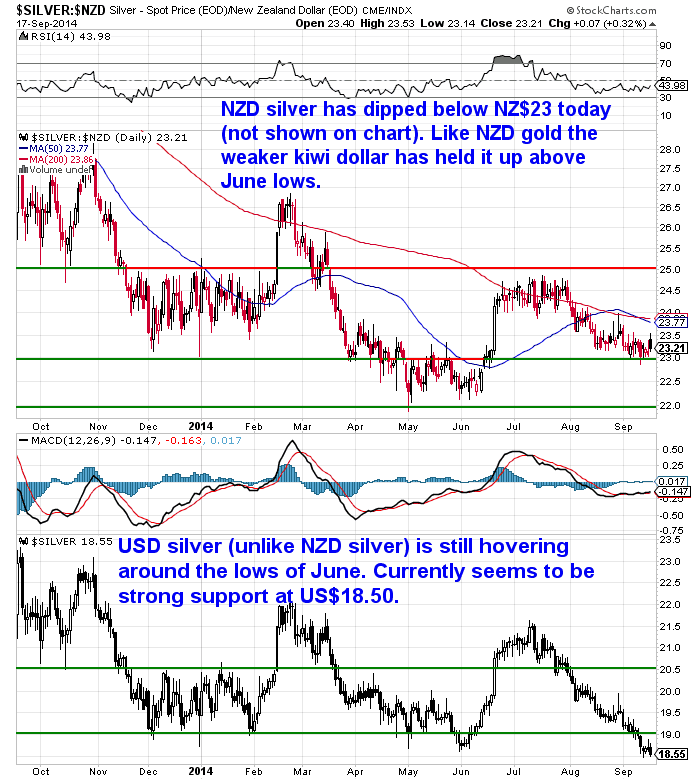

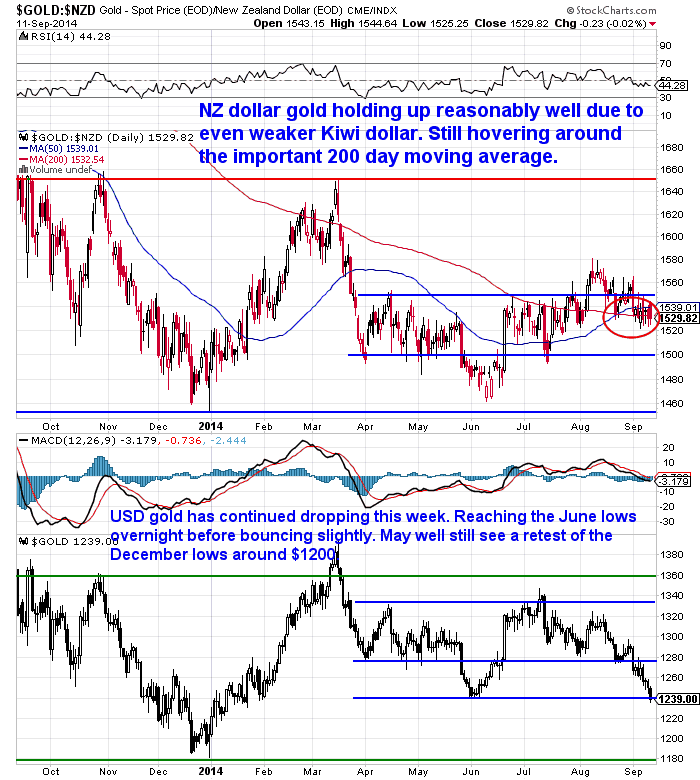

Gold in US dollars has dipped again since the announcement getting as low as $1222. It looks to be closing in on the previous lows of around $1200 or just below from December last year. Silver in US dollars also has dropped back. Once again at around $18.50 and matching the lows from back in June.

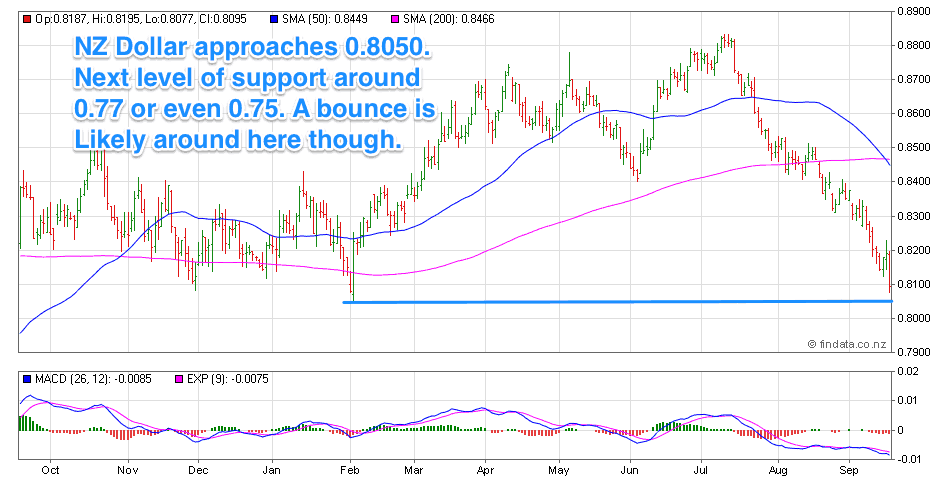

However yet again it is a different story in NZ dollar priced gold and silver. The Fed announcement also caused the kiwi dollar to lose over half a cent. So this has again dulled the fall for metals priced in New Zealand dollars.

Here are the specific changes in each since last week:

Gold in $US is down $26.19 to $1223.70 today – or in percentage terms down 2.09%.

While gold in $NZ is down $12.58 to $1512.42 or in percentage terms down a much smaller 0.82%.

Silver in $US last week was $19.01. Down 45 cents from then to $18.56 or in percentage terms down 2.36%.

Whereas Silver in $NZ last week was $23.19 down 25 cents or 1.07% to $22.94.

Where to From Here for Gold and Silver?

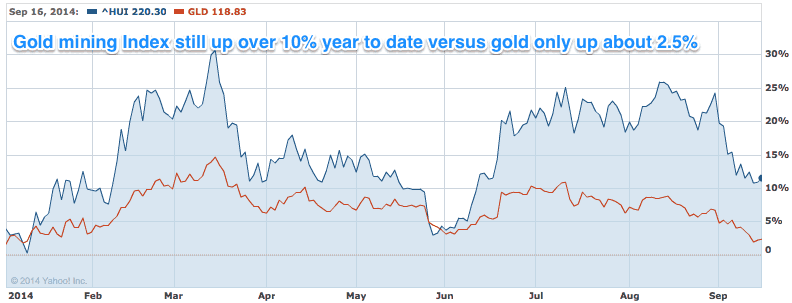

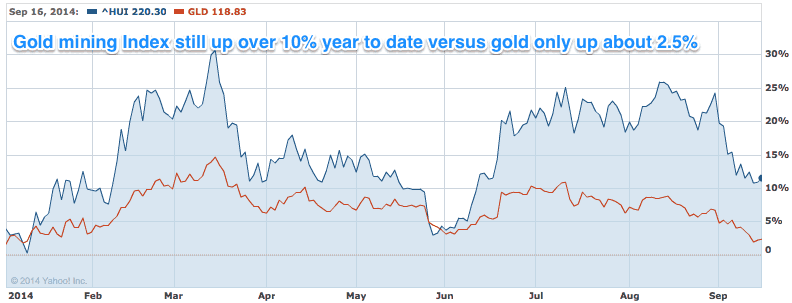

As always we can only guess. However a telling point remains that when we glance at charts comparing the year to date performance of both metals versus their respective mining indexes, the miners are still well up year to date. They also unlike the metals have not dipped down to reach (silver) or get close to (gold) their previous lows.

So while this remains the case we’ll guess that we are close to lows in the metals, given the miners often lead the metals.

Of course as Bix Weir says anythings possible – the Powers That Be can paint the numbers wherever they like in the short term.

Live Report from Paris

We’re in Paris this week.

So how are the French doing?

Judging by the restaurants, cafes and bistros, it would seem pretty okay. However we weren’t here during the height of the European sovereign debt crisis to compare what it was like in the real tough times. Although we have an inkling the French would still have been eating out even then so this may not be as good an indicator of how people are spending as it was at home in NZ back then.

And with even official unemployment here reported at over 10%, there must in fact be a lot of French residents struggling.

We arrived at our over priced pretty average Hotel in Bastille on Saturday night to the sound of raucous protesters and traffic. Bastille is the site of a fortress/prison that played a key role in the beginning of the French Revolution. The fortress was replaced by a memorial column and roundabout – hence the traffic noise. And due to the symbolism of 1789 it remains a very political piece of ground today. Hence the sounds of protesters are common here too.

Our French was too lacking to determine the cause of the protests though – but they were fired up by the sounds of it. But then on Saturday night in Bastille so was everyone – many people drinking not just in bars and restaurants but just in the streets, or on the edge of the road. Quite an eye opener for our 6 year old!

Our trip up the Eiffel Tower also showed evidence of a different kind of protest. Some enterprising types had sprayed a couple of phrases into the lawns of the Champs de Mars below for all visitors to the tower to clearly see. We were surprised they hadn’t been painted green and made illegible. After all it’s unlike any ruling government to allow a negative message to hang around long. However we later learnt it had only just been done. The translation was something like:

“Islamists in France , the Left guilty, Hollande liar. “

Francois Hollande is extremely unpopular here currently. Somewhat surprisingly the left wing president has actually instigated spending cuts. On top of the hefty tax increases on the rich (he tried but failed to raise them to 75%), which we just read has caused a fifth of France’s 100 richest people to move a total of €17 billion to neighbouring Belgium in recent years.

The spending cuts – which as everywhere it has become popular to term them austerity measures, – have lowered his approval ratings down to something like only 13%. We believe he has the uneviable title of Frances most hated president!

And it seems from what we read that deflation is coming to Europe so it may not going to get much better for Mr Hollande or the average French person in the street either.

Overall we still think the idea of higher interest rates here and in the US is not as much of given as most think it is. Who knows how things will play out but we’re pretty sure it won’t be as straight forward as the Fed and Co are trying to make us believe.

At some point there will be fireworks. So make sure you have some insurance against things turning out “not so rosy”.

You know where to find us if you need any help or have any questions.

This Weeks Articles:

|

Weaker NZ Dollar holding gold and silver up |

2014-09-11 22:19:10-04 2014-09-11 22:19:10-04

Gold Survival Gold Article Updates: Sep. 12, 2014 As we pondered last week, gold and silver have indeed fallen further this week. US Dollar gold last week was $1261.68. Now down $20.93 or 1.65% since then to $1240.75. While by contrast NZD gold last week was $1519 and is down 70 cents or just 0.04% […]

read more…

Do NOT Let the “Strong” US Dollar Illusion Lead Your Wealth Preservation Strategies Astray |

2014-09-16 03:52:05-04 2014-09-16 03:52:05-04

Here’s an informative piece that looks at how the US dollar has compared against various currencies of the world over the past few months and shows that there is more to this appearance of a “strong dollar” than meets the eye. Even our recently very strong local New Zealand dollar has fared much the same […]

read more…

The World Order Becomes Disorder |

2014-09-17 15:57:37-04 2014-09-17 15:57:37-04

Here’s a good summary of the geo-political issues currently simmering and how they may affect your investment decisions in the not too distant future…. The World Order Becomes Disorder By Donald G. M. Coxe, Chairman, Coxe Advisors LLC. Is the post-Cold War global boom over? Since the fall of Bolshevism, the world has seen remarkably sustained […]

read more…

|

|

2014-09-11 22:19:10-04

2014-09-11 22:19:10-04

2014-09-16 03:52:05-04

2014-09-16 03:52:05-04

2014-09-17 15:57:37-04

2014-09-17 15:57:37-04

Pingback: RBNZ “Jawboning” or Intervening to Lower the Exchange Rate? - Gold Prices | Gold Investing Guide - Gold Prices | Gold Investing Guide