|

Gold Survival Gold Article Updates:

Sept. 25, 2014

This Week:

- Everything falling

- RBNZ “Jawboning” or Intervening to Lower the Exchange Rate?

- Kings, Popes, Taxes and Modern Day Serfs.

RBNZ “Jawboning” or Intervening to Lower the Exchange Rate?

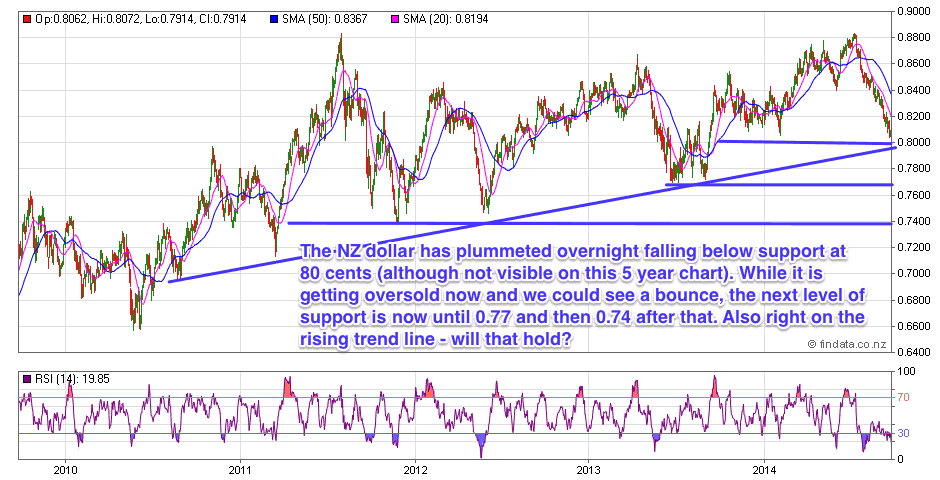

It appears the RBNZ might again have intervened in the foreign currency markets. The NZ dollar has dropped over 1.5 cents overnight.

This was after the RBNZ released a statement saying:

—–

“The exchange rate has yet to adjust materially to the lower commodity prices. Its current level remains unjustified and unsustainable. We expect a further significant depreciation, which should be reinforced as monetary policy in the US begins to normalise”.

—–

It also stated that:

—–

“Unjustified and unsustainable are important considerations in assessing whether exchange rate intervention is feasible. Another consideration is whether conditions in the foreign exchange markets are conducive to having an impact on the exchange rate.”

—–

Source.

Well if you talk it lower first like this, then that would probably make exchange markets “conducive” to giving it a further nudge by selling NZ dollars. We will have to wait until the RBNZ announces it forex reserves in about a months time to see whether they have actually intervened recently. On Monday they will release figures but only for August.

So while it may have been a market reaction to these comments, given how sharp the move was it wouldn’t be a surprise if the RBNZ had again sold a decent pile of NZ dollars to push the currency lower.

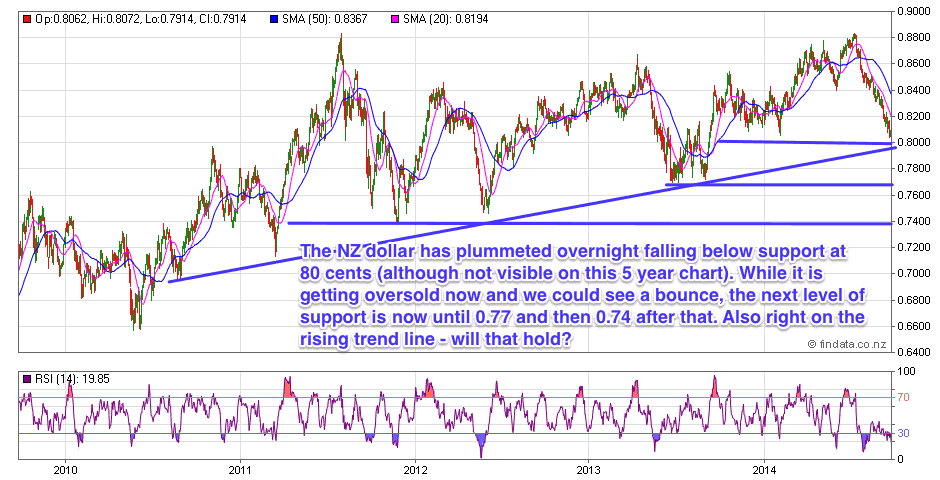

Whatever the cause the upshot is the NZ dollar is now below the recent horizontal line of support at 80 cents and hanging right around the rising trendline. So if this doesn’t hold the next stop is below 77 cents or even 74 cents.

Both gold and silver have also had further falls this week.

Silver in particular plunged on Friday US time when 2.5 Billion paper ozs were sold in 10 minutes. See this chart from “Brother John”:

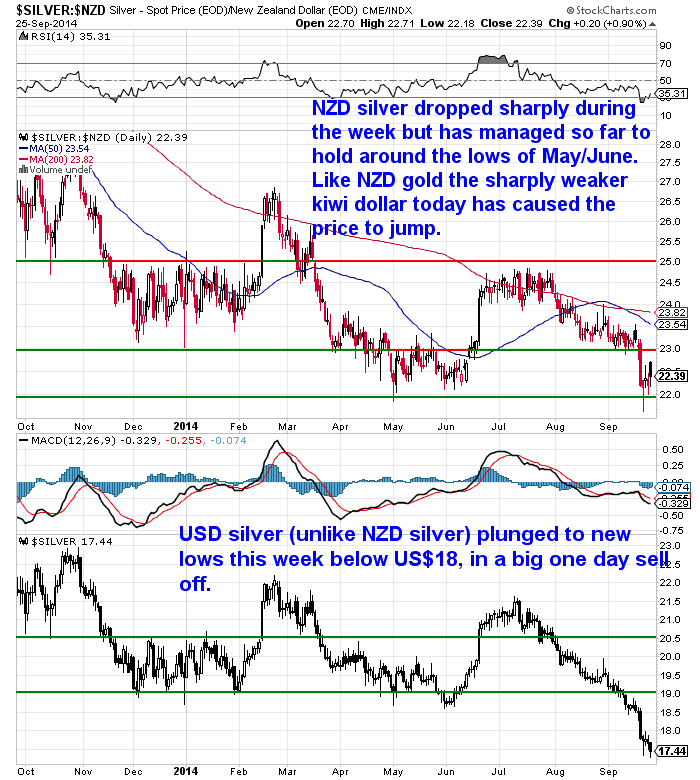

Silver in US dollars plunged below the US$18 mark.

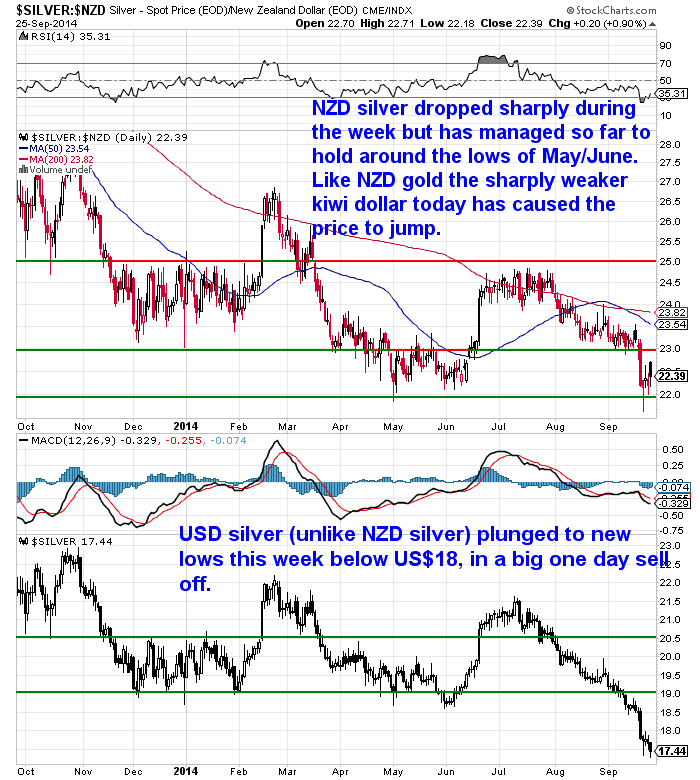

There are various theories on where it might find support from here. We sent out an email alert on Sunday as we thought it might actually fall further on Asian market opening around Midday Monday. You see, we thought stop losses might be triggered in Asian markets Monday after the fall occurred Friday US Time. In the end this didn’t happen and silver hasn’t moved much lower in US dollars. Of course in NZ dollars with the kiwi dollar falling sharply silver has now jumped up again, as per the chart below.

Silver in US dollars last week was $18.56. It is down 1.01 cents to $17.55 or in percentage terms down 5.44% since then.

Silver in NZ dollars was last week at $22.79. It is down 61 cents or 2.67% since then to $22.18.

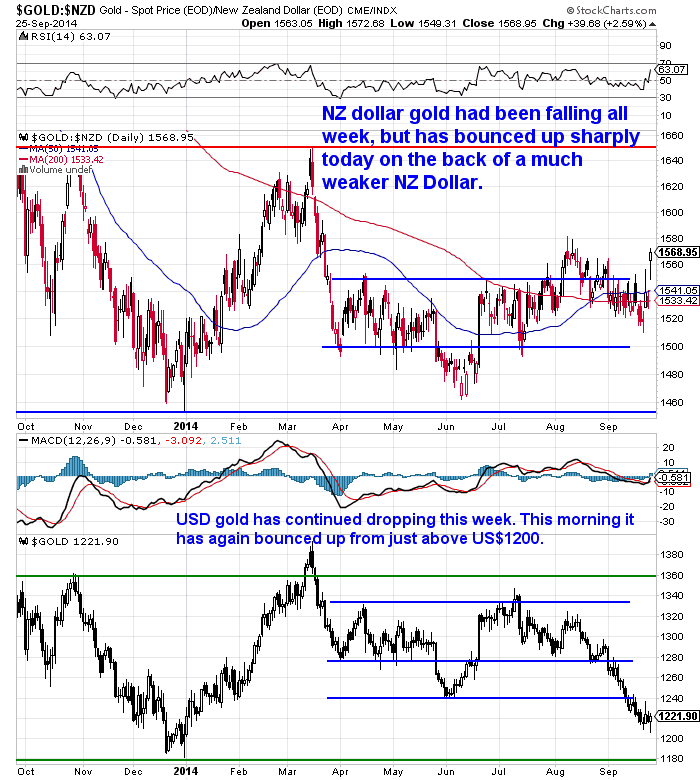

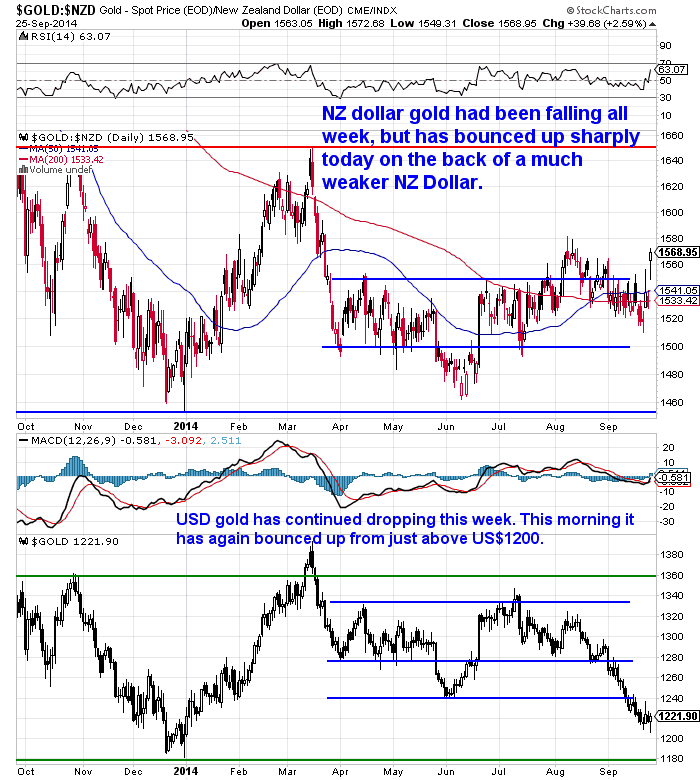

Gold is US$ has also moved lower during the week.

Dipping down close to US$1200 again this morning before bouncing back up to US$1225.50. There seems to be support just above US$1200 for now at least. So there has not been much change since last week. Just a fall of $4.01 or 0.32%.

It’s a different story for gold in NZ dollars though. The weaker kiwi has seen the local NZ dollar gold price bounce up almost $40 an ounce just since yesterday. This is also about the same as the change from last week. With NZD gold up $39.07 or 2.59% to $1544.04 from last Thursday.

All this talk of falling prices has us thinking.

The mainstream line seems to be the US dollar will continue to rise versus other currencies due to a supposedly strengthening US economy and the threat of rising interest rates.

The theory then goes that a rising US dollar means falling gold and silver prices as they are meant to be inversely correlated.

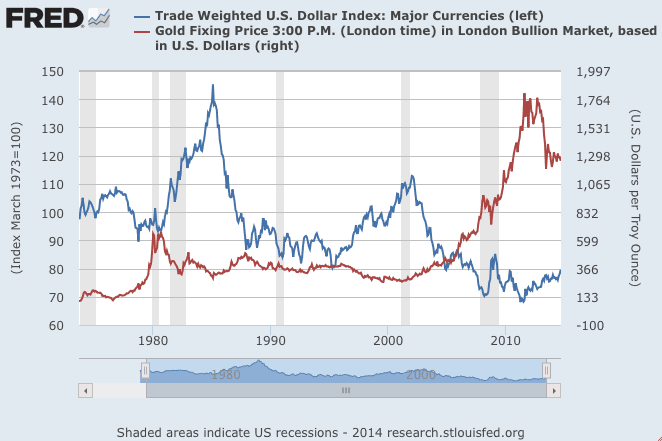

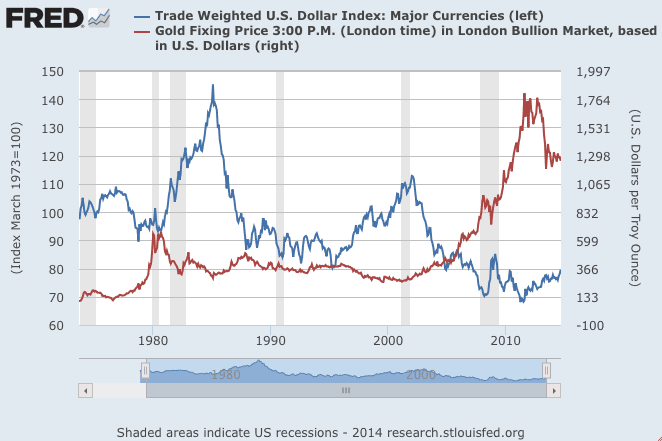

If you just glance at a chart comparing the USD index to gold this might seem to be the case.

See below:

http://research.stlouisfed.org/fred2/graph/?g=KMy

However Adrian Ash of Bullionvault made some interesting observations recently on this correlation.

Over the last 40 years, gold has been twice as likely to rise when the US currency is weakening on the forex market than when the Dollar Index is getting stronger. No surprises to most there.

However it should be noted that some 30% of the time gold and the US dollar have actually moved in the same direction.

Significantly when gold has risen against a background of US Dollar strength, gold priced in Dollars has in fact gained 24% year-on-year on average. Whereas it’s only averaged 18% gains when the Dollar’s been falling.

Why does this matter for New Zealand buyers and holders of precious metals?

Well, if we are in a period when the US dollar is rising against other currencies such as the NZ dollar (as it has done for the past 2-3 months).

And if, (and perhaps this might seem like a big if currently!) we could be about to enter into one of the 30% of the time when gold also moves higher, then history tells us that not only are the gains in gold bigger than when the US dollar is weakening against other currencies, but you would also get the “double banger” of a weakening kiwi dollar at the same time.

Put more simply, therefore this could mean bigger gains ahead for NZ holders if the kiwi dollar weakens while gold in US dollars actually gains in price.

The times when gold and the US dollar rise together is usually when a crisis occurs and people buy gold as well as the US dollar. Most people aren’t thinking a crisis is ahead but of course that is exactly the time to be buying your insurance!

Kings, Popes, Taxes and Modern Day Serfs.

We noted last week we were in Paris. While there we took a trip to the spectacular Palace (and gardens) of Versailles. This showed the share level of opulence that the Kings Louis XV, Louis XVI and of course Marie “Let them eat cake” Antoinette surrounded themselves in just prior to the French revolution. While spectacular it was also quite obscene given this extravagance was of course funded by the taxes levied on the people.

The Palace of Versailles – Outskirts of Paris.

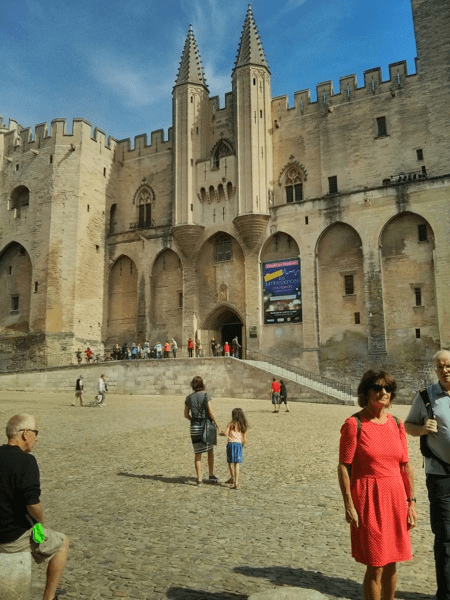

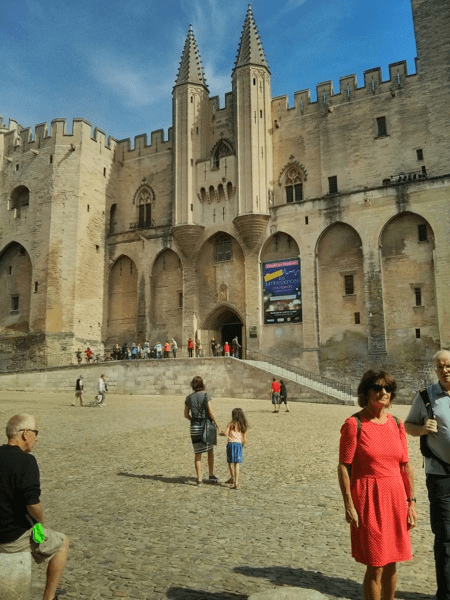

We’re actually staying with friends near Toulon in the south of France now. We took a trip a couple hours north to the fantastic ancient walled city of Avignon and checked out the Palace of the Popes. Unbeknownst to us, 9 popes lived here over about a century back in the 1300’s.

The Palace of the Popes – Avignon, France

Much like Versailles, the impressive gothic palace was also built on the back of taxes levied upon the people. Each new pope made his own extravagant additions to the palace. And the land to build it was actually “donated” by one woman to save her soul and life.

Our visit to both these ancient marvels got us thinking. The wealthy controlling elite of today are a darn site brighter than the Kings and Popes of old. They are not nearly so obvious or public in their extravagances. They might have learnt from the beheadings of old.

However it is also not so obvious to the people that there are being duped and ripped off. Back then the average serf knew they were being taxed and knew the taxes were funding the Kings/Popes extravagances.

Today the banking class quietly skim their profits from the people through inflation and leave the supposed “necessary evil” of government to take the blame for the taxes. They also let we modern day serfs think we have some control by giving us the choice of who to elect as our slave masters – Tweedledum or Tweedledee.

On the back of the recent elections, here’s hoping a few more people wake up to that fact.

Anyway on that cheery note we’ll sign off as it’s pushing on for 1am here in France. David is on deck back in the not so ancient NZ. Silver remains close to it’s lows of the year, making the Canadian Maple Leaf 500 x 1 oz monster boxes a good buy currently. Let us know if you’d like a quote.

This Weeks Articles:

Gold Survival Gold Article Updates: {!date abb+1} Sep. 19, 2014 This week: Gold and silver continue their fall Where to From Here for Gold and Silver? Report Live From Paris There’s a lot happening in the financial world in the next few days and weeks. An email from Bix Weir nicely summarised what is […]

read more…

Don’t Be a Freedom Wimp: Live from the Casey Research Summit in San Antonio |

2014-09-17 21:30:26-04

2014-09-17 21:30:26-04 2014-09-25 12:06:58-04Here’s some highlights from the recently concluded Casey Research Summit… Don’t Be a Freedom Wimp: Live from the Casey Research Summit in San Antonio By Doug Hornig, Senior Editor On Day Two of the Casey Research Summit in San Antonio, the emphasis was decidedly on the “deep state,” as Doug Casey termed it: what it […]

2014-09-25 12:06:58-04Here’s some highlights from the recently concluded Casey Research Summit… Don’t Be a Freedom Wimp: Live from the Casey Research Summit in San Antonio By Doug Hornig, Senior Editor On Day Two of the Casey Research Summit in San Antonio, the emphasis was decidedly on the “deep state,” as Doug Casey termed it: what it […] 2014-09-25 12:23:00-0409/17 Prof. A. Fekete: The clearinghouse of the gold standard This is the ninth video (12 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: […]

2014-09-25 12:23:00-0409/17 Prof. A. Fekete: The clearinghouse of the gold standard This is the ninth video (12 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: […]

Pingback: France vs Monaco vs UAE + Triple bottom for gold? - Gold Prices | Gold Investing Guide