This Week:

- Why the NZ Super Fund Should “Invest” in Gold

- Gold Confiscation | Could it Happen in New Zealand?

- What Type of Gold Bar Should I Buy?

- New Zealand Inflation Up More Than Expected

Prices and Charts

Gold Breaks Out

Gold in NZ dollars broke clearly above the 200 day moving average (MA) this week. A feat it hasn’t managed since June. From here we can watch for gold to head back up to test the overhead resistance level around $1900.

It was interesting to see gold finally behave like a safe haven and rise, while share-markets have been taking a bit of hiding this past week.

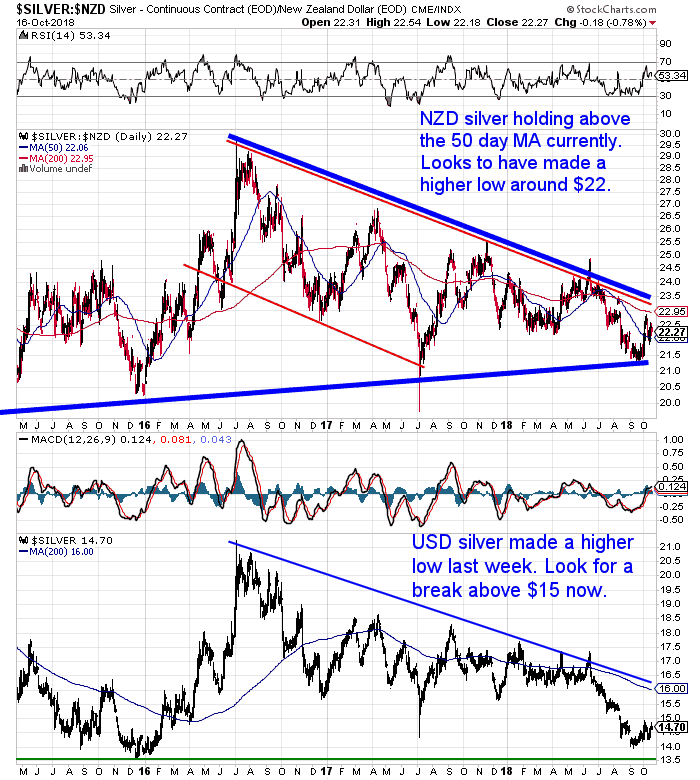

Whereas NZD silver was only up slightly on a week ago. But silver is holding above the 50 day MA. Look for silver to try and test the 200 day MA around $23 before long. A bottom looks to have formed just below $21.50.

The New Zealand dollar is back up to test the 50 day MA again. Stronger than expected inflation data is what the talking heads are saying caused the bump up.

But will that be enough to convince traders the dollar should be heading higher? Hard to expect the Kiwi to break above the 50 day MA when it hasn’t been clearly above this line since April.

But then again it’s times like this when these unexpected things happen!

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Free Shipping NZ Wide.

Why the NZ Super Fund Should “Invest” in Gold

The New Zealand Super Fund released their annual report last week. The report contained some interesting reading. The guardians of the fund (set up to help fund guaranteed superannuation) outlined how a repeat of the global financial crisis would see the almost $40 billion fund lose more than $22 billion. A loss of more than 50% of its assets.

See how the fund believes that such a fall will simply be a case of hold on and it will come right.

Instead we argue that a holding of physical gold in the Super Fund, could protect it in more than one way.

What are the odds of the fund guardians following such an approach? Read on to see.

Gold Confiscation | Could it Happen in New Zealand?

We had a potential client from Hong Kong ask this week how safe would gold stored in New Zealand be? Also what are the odds were of government confiscation of gold here?

We delve into the history of gold in New Zealand. And also look at some surprising laws in place regarding gold confiscation in Australia.

These laws would place New Zealand ahead of Australia when it comes to gold storage.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

What Type of Gold Bar Should I Buy?

Are you ready to buy gold but not sure what type and size gold bar to buy?

We’ve got you covered. Learn:

- When to choose gold bars over gold coins

- What size gold bar to buy

- Pros and cons of different gold bar sizes

- How you can borrow against 1kg gold bars

- What’s the most commonly purchased gold bar size

- Different brands of gold bars

- Cast bars vs minted bars

New Zealand Inflation Up More Than Expected – What’s Coming Next?

New Zealand inflation for the September quarter was 0.9% compared to expected 0.7%. This gives an annual inflation rate of 1.9% (1.7% expected).

So the higher oil prices and lower New Zealand dollar seem to be filtering through to other prices.

“Here’s the main influences in the quarterly figures:

Transport rose 2.4%, influenced by higher prices for petrol (up 5.5%).

Housing and household utilities rose 1.1%, influenced by higher prices for local authority rates (up 5.1%), construction (up 1.3%), and rentals for housing (up 0.4%).

Food prices rose 0.6%, influenced by higher prices for vegetables (up 11%).

Normally with inflation reaching this sort of level, the expectation might be to see rising interest rates, but the RBNZ has indicated it will ‘look through’ short term spikes in inflation caused by external things such as rising oil prices.”

Source.

A report by Infometrics forecasts that with rising transport costs and a higher minimum wage squeezing business profits, this could lead to disappointing economic growth in New Zealand in the next two years. This despite the latest GDP figures showing the fastest rise in two years.

This ties in well with what we reported earlier this month: Why it Might Be Premature to Celebrate the NZ GDP Numbers

“The 6-7% NZD fall we had during the June quarter gave a boost to exporter (farming) incomes. But the hangover is coming… Inflation lags currency moves by about 2-3 months so september quarter inflation will be sharply up and GDP result will be hammered by that high inflation. As a nation that imports far more than we export, and with little ability to increase agricultural capacity, we will be hurt more than we benefit by the currency falling.”

So far we have the higher than expected September quarter inflation. Now we’ll see if we get a corresponding fall in GDP later this year.

There is still debate among the bank economists whether the Reserve Banks next interest rate move will be up or down.

Kiwibank thinks inflation will force the the Reserve Bank to lift the OCR six months ahead of schedule.

While ASB still expects the bank to leave the official cash rate on hold until early 2020.

Maybe the economists might all be right though? Maybe we’ll see lower growth and higher inflation together. That would be stagflation and it still looks like a risk to us. Not a good combination at all – although much better if only you hold some gold and silver.

Read more: Could Stagflation Happen Again in New Zealand?

Make sure you have some precious metals just in case.

Check out the deals going currently.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

New Stock Arriving Soon – Learn More NOW….

—–

|