This Week:

- Negative Rates Are Taking Over the World… Are You Prepared?

- Speaking of Bond Guru’s…

- Could New Zealand interest rates end up negative eventually as well?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1827.98 | + $43.72 | + 2.45% |

| USD Gold | $1292.20 | + $29.30 | + 2.32% |

| NZD Silver | $24.84 | + $0.69 | + 2.85% |

| USD Silver | $17.56 | + $0.47 | + 2.75% |

| NZD/USD | 0.7069 | – 0.0009 | – 0.12% |

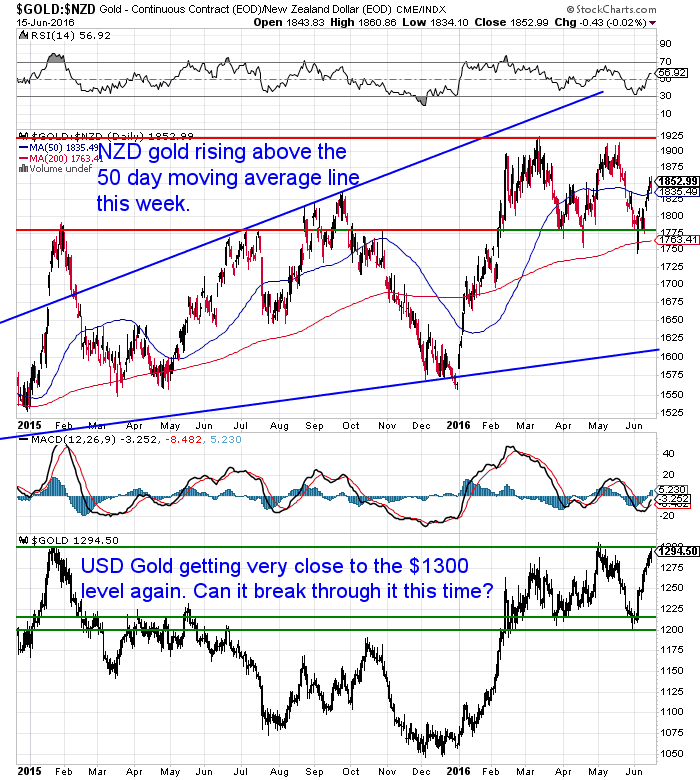

Barely 2 weeks ago gold had dropped sharply lower. In NZ Dollar terms it briefly touched $1750 before bouncing back. Since then it has been a steady march higher.

Today the price is back above the 50 day moving average. As suspected NZD gold seems to be consolidating the sharp rise from the start of the year. The chart below shows it doing this in the range of $1775 and $1925.

While the lower half of the chart shows the US Dollar gold price is again very close to the US$1300 resistance level. Can gold get above it this time – the third time since early 2015?

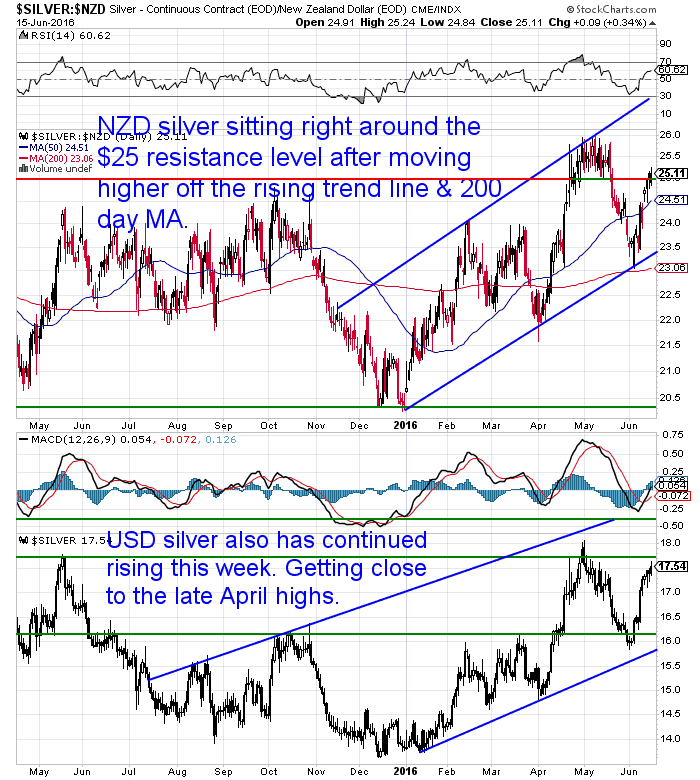

Silver too has bounced back sharply from the start of June. Today it is hanging around the $25 mark. This was the level NZD silver struggled to get above for so long until it was breached in April.

So silver remains in the steady uptrend it began at the start of 2016 (indicated by the blue trend lines).

How brief the corrections in gold and silver were likely surprised many people. We still get the impression that most don’t believe a new bull market in precious metals has begun. But our bet is we will continue to see a rise in prices in the coming years. Of course not without decent corrections along the way.

As we’ve been saying the strengthening NZ dollar is likely to dampen the gains in precious metals for NZ holders. However the Kiwi like all currencies will continue to lose value against gold and silver, just perhaps at a slower rate due to our higher interest rates compared to many other nations.

Negative Rates Are Taking Over the World… Are You Prepared?

Speaking of our higher interest rates here in New Zealand. Even with them not rising or potentially even falling further we are still higher than many others around the world.

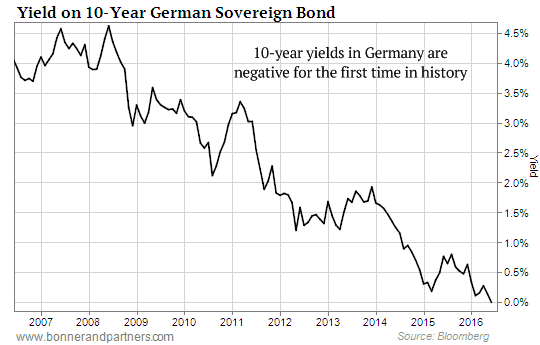

The looming “Brexit” vote has sent many people rushing into the likes of the “safe haven” German 10 Year government bonds which has pushed up their prices.

When bond prices rise it means their yield falls. So German bonds have now joined the sub-zero ranks, returning MINUS 0.007%.

The first time in history they’ve been in negative territory.

We’ve got an article on the site this week looking at the significance of these negative rates spreading across the globe. Here’s just one amazing statistic from it:

So this trend seems to be accelerating. See what some very large companies are doing as a result of this…

So this trend seems to be accelerating. See what some very large companies are doing as a result of this…

Negative Rates Are Taking Over the World… Are You Prepared?

We’re hearing more warnings about these crazy negative interest rate policies too. This week famed bond fund manager Bill Gross tweeted:

Simon Black at SovereignMan.com summarised it well:

“Gross wrote that more than $10 trillion in government bonds actually have NEGATIVE yields, and that interest rates are at the lowest levels in financial history.

For example, the British government just issued its lowest-yielding bonds since 1694.

This has very dangerous implications.

Goldman Sachs recently calculated that a mere 1% rise in US Treasury yields would trigger over $1 trillion in losses, exceeding all the losses from the last crisis.

(Bear in mind that interest rates need to rise by at least 3x that amount just to reach their historic averages… so this is entirely plausible.)

Most of those losses would be suffered by Western banks, the majority of which have insufficient capital to withstand such a major hit.

Gross describes this potential risk as a ‘supernova’.

…Remember that a supernova is an ultra-bright flash of light that results when a star explodes at the end of its life.

The explosions are so powerful that astronomers can see these incredible stellar events even from distant galaxies.

In 2015 the brightest supernova ever recorded was found in a galaxy some 3.8 billion light years from earth.

The supernova was over 500 BILLION times brighter than our sun. Incredible.

But given the star’s extraordinary distance from our planet, the explosion actually occurred 3.8 billion years ago… a long time ago in a galaxy far, far away.

It took all that time for the light from that supernova to reach us.

That’s what’s happening now in our financial system.

The financial supernova happened years ago. But the light… and the consequences… are finally starting to reach us.”

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Learn More.

—–

Speaking of Bond Guru’s…

Another respected bond fund manager, DoubleLine’s Jeffrey Gundlach also warned that ‘central banks are losing control’. News agency Reuters reports:

… Jeffrey Gundlach, the chief executive of DoubleLine Capital, said on Tuesday investors are dropping risky assets and turning to safer securities including Treasuries and gold because they are losing faith in central banks. –

The Daily Bell made an interesting observation about some of the rhetoric appearing concerning central banks:

“Increasingly, central banks themselves are being blamed.

This only means one thing to us. Central banks are being blamed for a reason.

And the plan is to realign them. And probably combine them.

Out of many, only a few. The explanation will be that the banks are not big enough. Or that there are too many of them and the numbers need to be reduced.

…This time perhaps, the damage will be so significant and the chaos so severe that central banks themselves will be blamed. Institutionally, this has not happened before in the modern era.

Those who have the power to rearrange the system will only cast blame in this direction if they intend to generate a major realignment.

We’ve already pointed out that various unsigned mega-trade agreements like TIP are ushering in a new kind of international operating system.

This is one we have called “corporatism,” in which various corporations will gradually accrue more power than nation-states themselves. The leading figures of the future are to be technocrats, highly competent and entirely subservient to the new system.

Within this context it could be that central banking is about to be rearranged as well.

First the central banks – and the larger monetary system – will be blamed. Then the monetary system will be reconfigured.

Could New Zealand interest rates end up negative eventually as well?

Have you noticed the appearance of a few more NZ housing bubble articles lately?

Like this one in the Herald?

Nation of Debt: Ready, set, crash – could New Zealand be next to fall?

It begins:

The article covers a lot of ground and makes many good points about how out of whack things are. Although, many of the solutions of those interviewed we’d disagree with.

One blaming the free market – of which we definitely don’t have, so how can you blame it?.

Another saying more regulation is required, while the article points out regulations are what encourage banks to lend against housing in the first place!

But what we were really left wondering was, with more of these articles appearing in the mainstream (Here’s another from this week: Bryan Gould: Housing bubble dangerously inflated), does this mean the bubble is actually not yet ready to pop?

Rather would the bursting be more likely to happen when no one expects it?

While we still get the feeling most people probably don’t expect a plunge in house prices, do they expect them to keep rising even higher?

So then we wondered, what could send house prices even higher still?

The obvious answer would seem to be – even lower interest rates.

As we noted earlier more and more across the globe rates are turning negative. We’re at record lows here too. But if they keep dropping across the globe then surely ours can fall even further yet as well?

Sure, they’ll need to be marginally higher than elsewhere to attract capital here which our lopped sided imbalanced economy requires everyday. But they could go a fair bit lower yet.

Could New Zealand interest rates end up negative eventually as well?

We were forwarded the an article during the week that looked at where we might be heading with negative interest rates using Australia as an example. The writer Dmitry Orlov answered 3 questions:

1. Why did zero interest rates become necessary?

2. Why are negative interest rates now necessary? and,

3. Why are negative interest rates a really excellent idea?*

* if you ignore certain unintended consequences (which is what everyone does all the time, so let’s not worry about them just yet).

Here is his well reasoned explanation:

“1. Interest rates went to zero because economic growth went to zero.

…Interest rates and rates of growth are related: a positive interest rate is little more than a bet that the future is going to be bigger and more prosperous, enabling people to pay off the debts with interest. This is an obvious point: if your income increases, it becomes easier to repay your debts; if it stagnates, it becomes harder; if it shrinks, it eventually becomes impossible.

2. Once you are faced with a continuously shrinking economy, just holding interest rates at zero is not sufficient to forestall financial collapse. The interest rates must go negative.

…Australia has amassed a huge pile of debt—over 120% of GDP—and most of it is mortgage debt on overvalued real estate. Now that Australia’s economy, which was driven by commodity exports to China, has tanked, a lot of this debt is being turned into interest-only loans, because Australians no longer have the money to repay any of the principal. But what if they can’t make the interest payments either? The obvious solution is to refinance their mortgages as interest-only at zero percent; problem solved! Of course, as conditions deteriorate further, the Australians will become unable to afford taxes and utilities. Negative interest rates to the rescue! Refinance them again at a negative rate of interest, and now the banks will pay them to live in their overpriced houses.

3. Are you starting to see how this works? Whereas before you had to be careful about taking on debt, and had to have a plan for how you will repay it, with negative interest rates that is simply not a consideration. If your debt pays you, then more debt is always better than less debt. It no longer matters that the economy continuously shrinks because now you can get paid just for twiddling your thumbs!

But are there any unintended consequences of negative interest rates?

…The unintended consequence of negative interest rates is that they destroy money. This is true in an entirely trivial sense: if you deposit x dollars at -ρ% annual, then a year later you will only have x(1-ρ) dollars because xρ dollars has been destroyed. (In case you prefer to count on your fingers and toes, if you deposit $10 at -10% annual, then a year later you will only have $9 because $1 has been destroyed.) But what I mean is something slightly more profound: negative interest rates erode the very concept of money.

Negative interest rates are an excellent idea—and perhaps the only way to keep the financial game going a bit longer—but, given these unintended consequences, they are also a terrible idea. The bankers know that. They want to preserve their cult’s status, and constantly talk about raising interest rates. But they haven’t yet, because they also know that just a small increase will result in trillions of dollars of losses, triggering widespread business failures and ushering in the Greatest Great Depression Ever. This is not a problem for them to solve; this is a predicament. They will delay and pray, and make pronouncements loaded with keywords designed to please the high-frequency trading algorithms that are in charge of artificially levitating the “free market” with judiciously timed injections of “free money.” But in the end all they can do is act brave, wait for a distraction and then… run for the exits!

And your job is to make it to the exits before they do.”

We’d rather not try and time our exit. Instead preferring to be mostly out of the system well before the trouble appears.

While the trouble could well be many years into the future yet too, that’s not to say gold and silver can’t rise for many years yet as well, before the whole thing comes to a head.

Gold rose from 2001 to 2011 before the fall of the past few years. So it could well rise for another 10 yet.

But don’t leave your run for the exits too late!

Free delivery anywhere in New Zealand

Our offer of free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured remains.

Todays price is $14,800 and delivery is now about 7-10 business days.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

This Weeks Articles: |

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices Spot Gold |

|

| NZ $ 1827.98 / oz | US $ 1292.20 / oz |

| Spot Silver | |

| NZ $ 24.84 / oz NZ $ 798.60 / kg |

US $ 17.56 / oz US $ 564.53 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Unsubscribe | Report Abuse

[COMPANY_FULL_ADDRESS]

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |