|

Gold Survival Gold Article Updates:

Aug. 22, 2014

This Week:

- NZ Dollar Breaks Below Key Support

- Another Gold Indicator Flashing Buy – 80% Gains Ahead?

- Government Bond Yields Continue to Fall

- Miners Still Looking Good Despite Flat Gold and Silver Prices

Quite a bit of action overnight in the precious metals resulting in some movement in prices since last week.

Gold in US dollars is down $21.27 per ounce or a hefty 1.62% from a week ago to $1292.39. While Gold in NZ dollars is only down $10 or 0.64% to $1545 due to a further weakening of the Kiwi dollar.

You can see in the chart below that NZD Gold has pulled back to 200 day moving average (MA) as we thought it might last week. However mainly care of the weaker NZ dollar it has managed to bounce off the 200 day MA and move back up in the past couple of days.

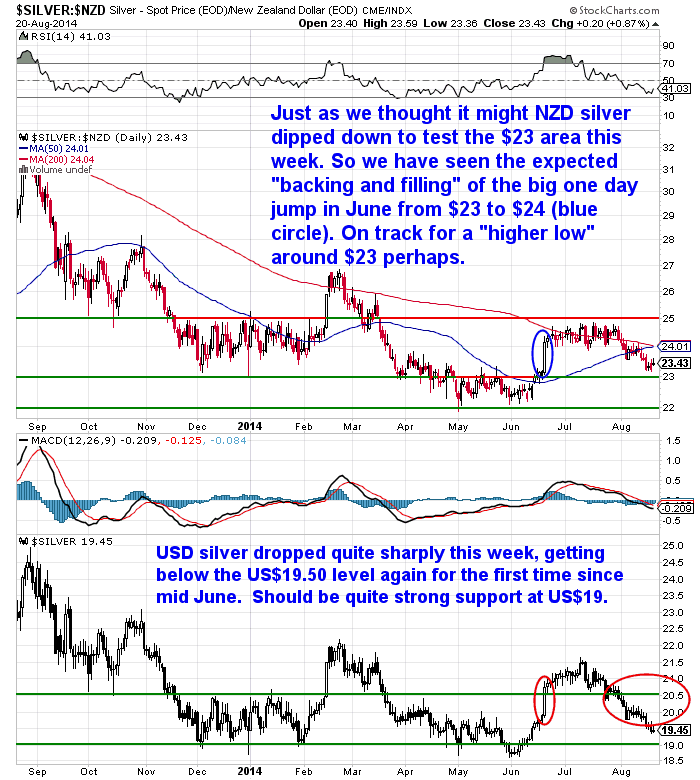

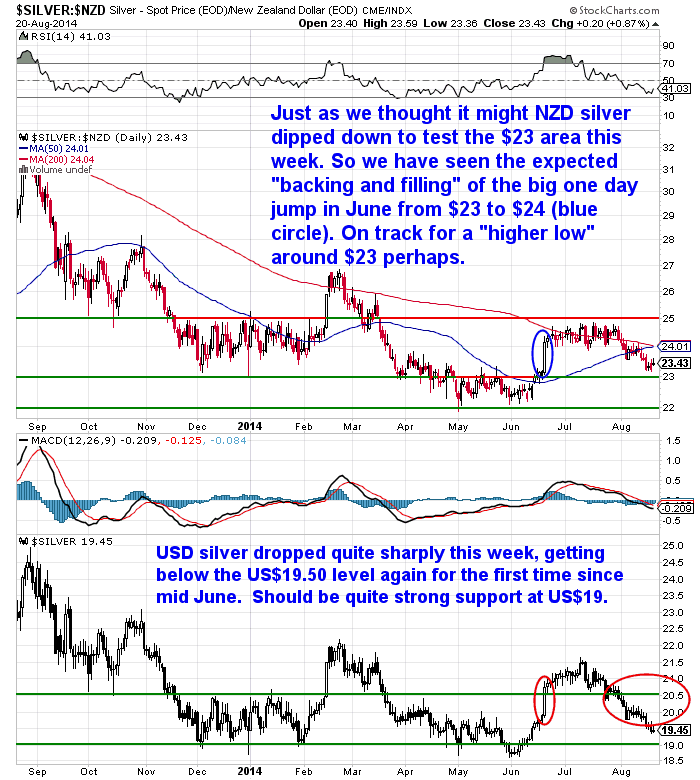

Meanwhile silver definitely remains weaker than gold. In US dollars it is down 37 cents or 1.86% to US$19.51 from last week. And even with the weaker Kiwi, silver in NZ Dollars is still down 20 cents or 0.85% to $23.33.

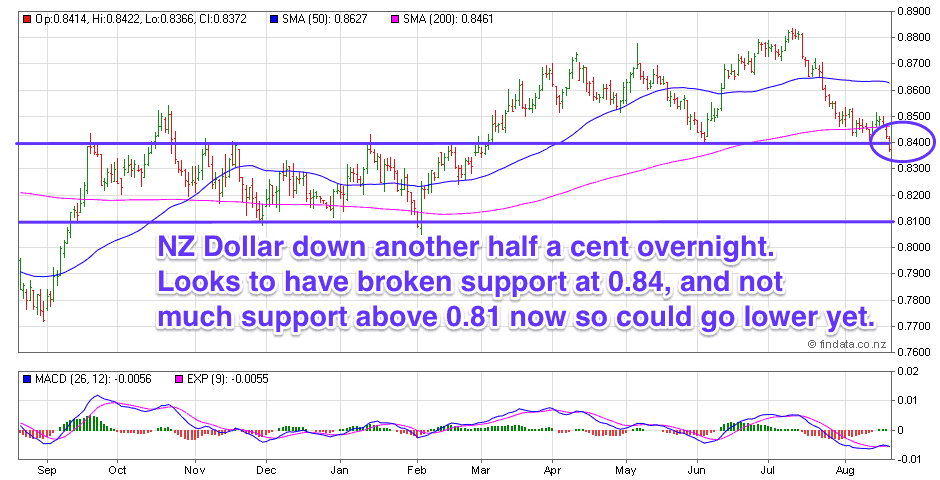

NZ Dollar Breaks Below Key Support

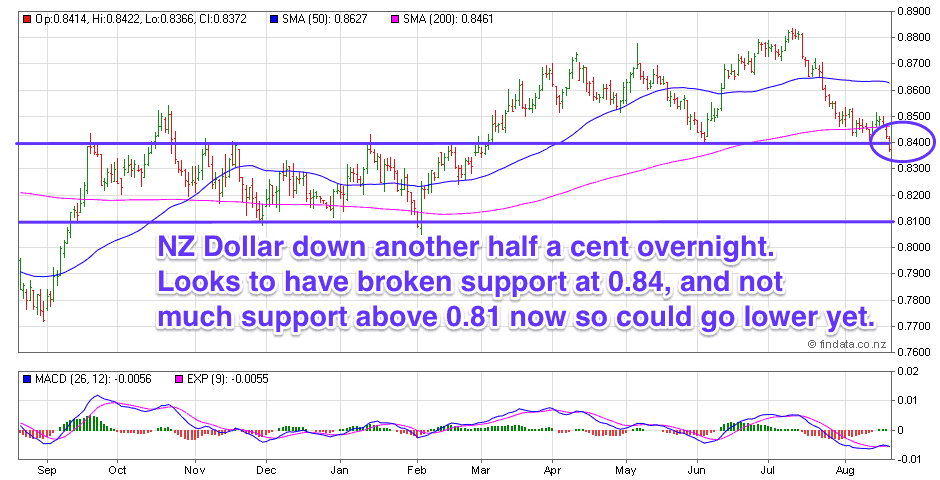

As noted already the NZ Dollar has fallen again this week.

Possibly on the back of a slight fall in the global dairy index again on Wednesday morning and US Central Bank minutes released this morning saying they might raise interest rates sooner than originally planned.

Anyway the significant point here is that overnight the NZ Dollar actually dipped below the important 0.84 level.

Why is this level important?

Well, take a look at the chart below. This was the level the dollar struggled to break through late last year ands early this year i.e. resistance. It was also the level it bounced off June i.e. support.

So the fact it has edged below it likely means it is heading a bit lower yet. There isn’t much support above 0.81 from what we can see, so we could see a test of that level in the not too distant future.

Another Gold Indicator Flashing Buy – 80% Gains Ahead?

Our feature article this weeks looks at another technical indicator for gold. Having proven quite accurate in flashing a sell signal back in early 2012, this long term change of trend indicator is now flashing a buy signal for Gold in both US and NZ dollars. Our feature article this weeks looks at another technical indicator for gold. Having proven quite accurate in flashing a sell signal back in early 2012, this long term change of trend indicator is now flashing a buy signal for Gold in both US and NZ dollars.

Another Gold Indicator Flashing Buy – 80% Gains Ahead?

Government Bond Yields Continue to Fall

As noted earlier too, overnight Federal Reserve minutes spooked a few with talk that they may raise interest rates sooner than they originally predicted. We shall see about that one. The Fed is good at talking a good game if nothing else.

However the trend in government bonds remains down with interest rates continuing to fall. Since we mentioned this a month ago https://goldsurvivalguide.co.nz/rbnz-lifts-interest-rates-nzd-falls/ the yield on the US treasury bond has edged even lower. Down from 3.29% to 3.22%.

Likewise NZ government bond rates have also edged lower from 4.22% to 4.15%.

So with all the talk of higher interest rates, both here and in the US of late, why then are government bond yields actually falling? Or said another way, why is demand for government bonds rising?

Beats us! Some might argue it is due to heightened “geopolitical risk”. That might have some impact, but maybe it is worry about Europe teetering on deflation. Bond yields in Germany and the UK are reaching record lows of late. So that in turn is driving more investors into US bonds.

Perhaps this deflationary fear could also be having an impact on the price of silver too? With it underperforming gold of late.

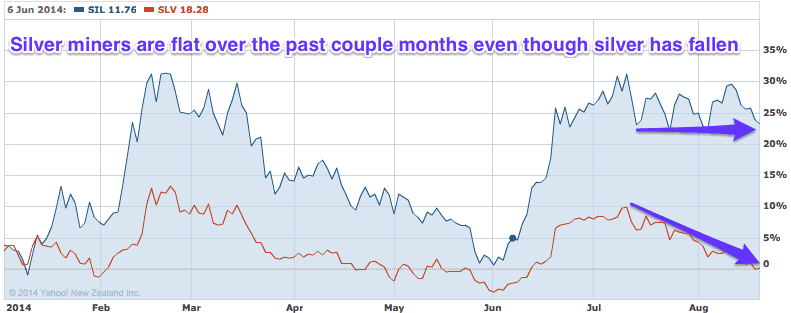

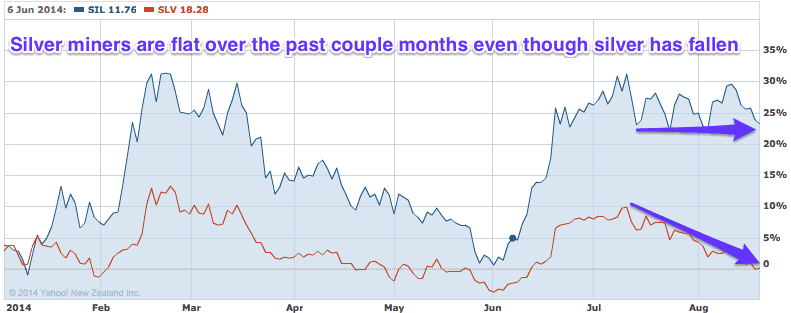

Miners Still Looking Good Despite Flat Gold and Silver Prices

However investors in gold and silver miners don’t seem too concerned of late. News this week was that George Soros doubled his investment in the gold miners Index GDX during the last quarter.

With the miners actually holding up quite well even with flat gold and falling silver prices, he seems to be on to a good thing there. Buyers like Soros of the mining companies seem to be confident that gold and silver prices aren’t going any lower from here. Since most just won’t be profitable if they did.

Here’s the charts comparing gold miners and silver miners to the price of the metals themselves for the year.

If you like the sound of the technical indicator flashing buy from this weeks feature article, or that the miners holding up well might be a sign of gold and silver not going much lower, or some protection from a weakening NZ Dollar, then you might want to grab a few ounces of gold or kg’s of silver. Please get in touch and we’ll happily answer any queries you have.

This Weeks Articles:

| Gold in NZD Has Broken Out of a 2 Year Downtrend |

| 2014-08-14 21:54:22-04

Gold Survival Gold Article Updates: Aug. 14, 2014 It will just be a short newsletter today sorry (or perhaps that is a good thing!). A stomach bug is sweeping through the household and we’re feeling far from our sharpest today. Gold Survival Gold Article Updates: Aug. 14, 2014 It will just be a short newsletter today sorry (or perhaps that is a good thing!). A stomach bug is sweeping through the household and we’re feeling far from our sharpest today.

Luckily we have 2 excellent articles on the site already for you and we would recommend you scroll down and check both of them out.

Top 7 Reasons I’m Buying Silver Now is an excellent summary of the big picture reasons for buying silver – particularly at what is once again very cheap levels. […]

read more…

Another Gold Indicator Flashing Buy – 80% Gains Ahead? |

| 2014-08-19 22:52:48-04

We just read this interesting article from Stansberry & Associates Jeff Clark (not to be confused with Casey Research’s Jeff Clark whose articles we also sometimes feature). headlined: Gold Soared 80% the Last Time This Indicator Flashed “Buy” It got us thinking about how this same gold indicator might look for gold in NZ Dollars. […] We just read this interesting article from Stansberry & Associates Jeff Clark (not to be confused with Casey Research’s Jeff Clark whose articles we also sometimes feature). headlined: Gold Soared 80% the Last Time This Indicator Flashed “Buy” It got us thinking about how this same gold indicator might look for gold in NZ Dollars. […]

read more…

Special Edition: Our Highest-Rated Speech of All Time |

| 2014-08-20 04:25:09-04

Here’s a jaw-dropping overview of how freedom is being eroded in the US. Quite a disturbing video on just how degraded the US has become, but still a very enlightening presentation from a previous Casey Research Summit… Special Edition: Our Highest-Rated Speech of All Time By Olivier Garret, Chief Executive Officer Never in my life have I seen […] Here’s a jaw-dropping overview of how freedom is being eroded in the US. Quite a disturbing video on just how degraded the US has become, but still a very enlightening presentation from a previous Casey Research Summit… Special Edition: Our Highest-Rated Speech of All Time By Olivier Garret, Chief Executive Officer Never in my life have I seen […]

read more…

Prof. Antal Fekete: The Positive Theory of Gold – Episode 05/17 |

| 2014-08-20 04:41:35-04

05/17 Prof. A. Fekete: The Positive Theory of Gold This is the fifth video (14 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The […] 05/17 Prof. A. Fekete: The Positive Theory of Gold This is the fifth video (14 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The […]

read more…

|

|

Our feature article this weeks looks at another technical indicator for gold. Having proven quite accurate in flashing a sell signal back in early 2012, this long term change of trend indicator is now flashing a buy signal for Gold in both US and NZ dollars.

Our feature article this weeks looks at another technical indicator for gold. Having proven quite accurate in flashing a sell signal back in early 2012, this long term change of trend indicator is now flashing a buy signal for Gold in both US and NZ dollars.

Gold Survival Gold Article Updates: Aug. 14, 2014 It will just be a short newsletter today sorry (or perhaps that is a good thing!). A stomach bug is sweeping through the household and we’re feeling far from our sharpest today.

Gold Survival Gold Article Updates: Aug. 14, 2014 It will just be a short newsletter today sorry (or perhaps that is a good thing!). A stomach bug is sweeping through the household and we’re feeling far from our sharpest today. Here’s a jaw-dropping overview of how freedom is being eroded in the US. Quite a disturbing video on just how degraded the US has become, but still a very enlightening presentation from a previous Casey Research Summit… Special Edition: Our Highest-Rated Speech of All Time By Olivier Garret, Chief Executive Officer Never in my life have I seen […]

Here’s a jaw-dropping overview of how freedom is being eroded in the US. Quite a disturbing video on just how degraded the US has become, but still a very enlightening presentation from a previous Casey Research Summit… Special Edition: Our Highest-Rated Speech of All Time By Olivier Garret, Chief Executive Officer Never in my life have I seen […]

05/17 Prof. A. Fekete: The Positive Theory of Gold This is the fifth video (14 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The […]

05/17 Prof. A. Fekete: The Positive Theory of Gold This is the fifth video (14 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The […]

Pingback: “Golden cross” for NZD gold and silver has occurred - Gold Prices | Gold Investing Guide - Gold Prices | Gold Investing Guide