Prices and Charts

NZD Gold – Next Lower Low is the Final Low?

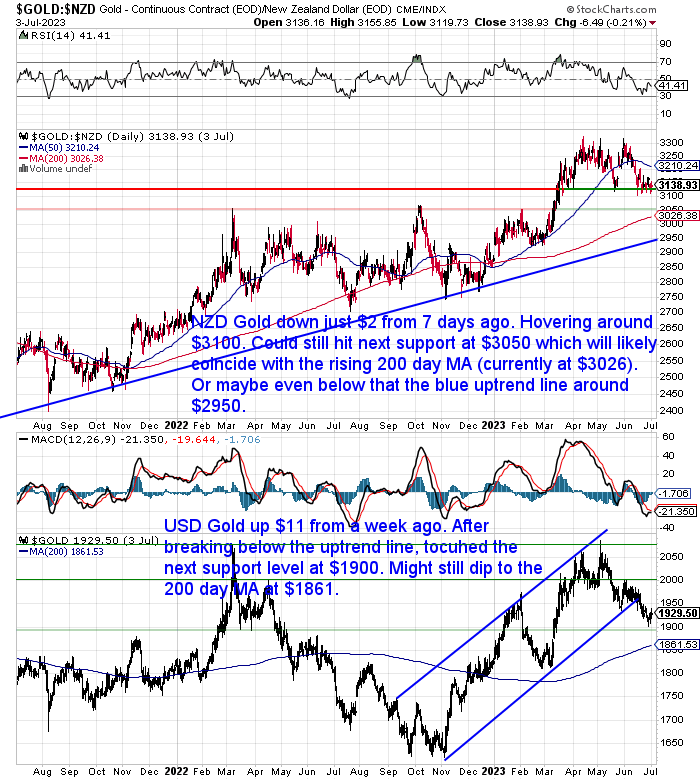

Gold in NZ dollars has barely changed from a week ago. Down just $2 to $3110.50 (it’s 4th July holiday in the USA today so none of the charts show today’s prices). NZD gold is hovering around the $3100 level. But it’s still likely to hit the next level of support at $3050. If this happens it will also likely coincide with the rising 200 day moving average (currently at $3026). Or maybe even drop down to the blue uptrend line.

We’re probably not really quite ready to say the bottom is in yet. But it is likely getting very close. The odds favour another lower low and our guess is that one will be the final low in this correction. So in the short term we may see a dip lower yet. However on a longer term risk to reward basis, it is likely heavily favoured to the upside. Because we may see gold fall $150 further to say NZ$2950 in the next week or 2. However the upside for this next cycle could be in the vicinity of $1000-$1800 higher than current levels. So that is a very good reward to risk set up.

A similar situation exists for USD gold. It is up just $11 from last week. After breaking below the uptrend line it touched the next support level at $1900. But it is up from there currently. So we might see a final dip down to the 200 day MA, currently at $1861 and rising. Again the same excellent risk to reward situation exists regardless of which currency you look at gold in.

Silver to Follow Gold Lower One More time?

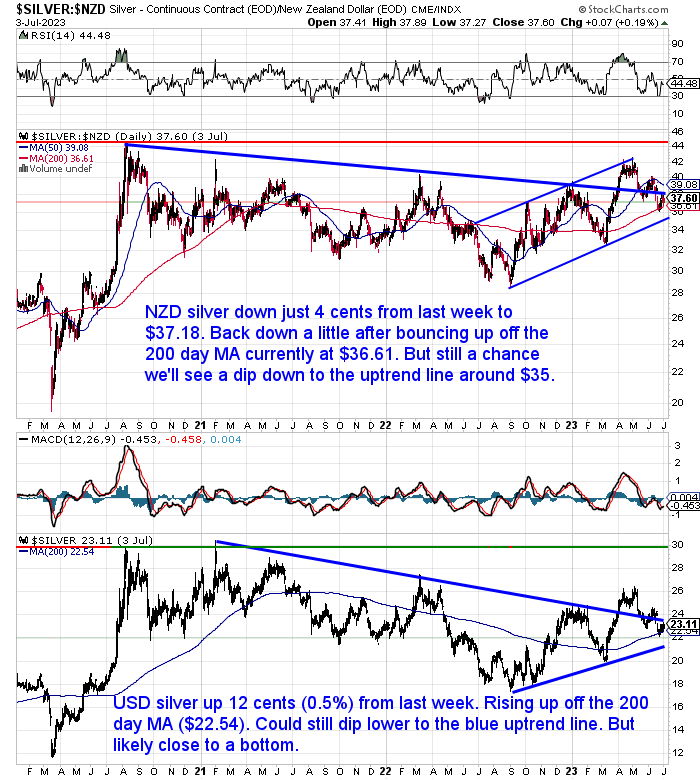

NZD silver is barely changed from 7 days ago. Down just 4 cents to $37.18. It had risen up nicely off the 200 day MA but is back down closer to that line again today. Silver is further into the correction than gold. However, if we are right about one more dip for gold, it will be difficult for silver to rise much from here. We think more likely there is also a final dip for silver. Maybe down to the blue uptrend line around the $35 mark?

Once this correction is complete, then silver should look to challenge the 2020 high around $44. As this is also where the upper line in the rising trend channel will be.

In USD terms silver is similarly positioned. With odds favouring a final dip down to around $21 where the rising support line is. But the bottom is getting very close.

Stronger NZD Holds Back Local Precious Metals Prices

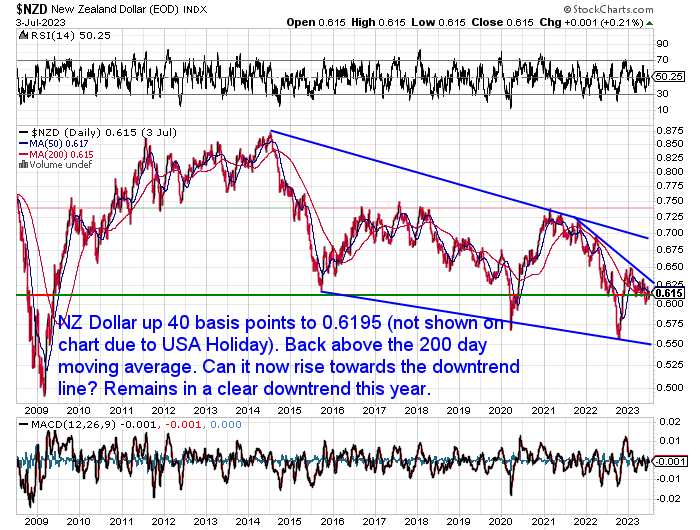

A stronger Kiwi dollar has held local precious metals prices back this week. The NZ dollar was up 40 basis points or 0.64% from last week. Perhaps we’ll see it head back towards the blue downtrend line now. But overall the Kiwi remains in a clear downtrend for the year to date.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Silver Bullion Storage: How to Prevent Tarnishing

We’ve had quite a few questions in the past about how to avoid silver tarnishing during storage. So this week’s feature article looks at both the causes along with prevention strategies including:

- Understanding the Risk of Tarnishing including:

- Moisture

- Air

- Light

- Chemicals

- Storing and Protecting Your Silver

- Storage Best Practices

- Silica Packs and Tarnish Prevention

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Ray Dalio: Great Disorder is Coming

Ray Dalio, the founder of hedge fund Bridgewater Associates, last week wrote an op-ed in Time magazine: “Why the World Is on the Brink of Great Disorder”.

Dalio is a global macro investor with over 50 years of experience. But he is also a keen student of historical cycles. Using them to understand the current state of the world and therefore what is likely to happen in the future.

It’s worth a read but if time is short here’s a quick summary:

Dalio identifies three significant trends reminiscent of the 1930-1945 period:

- high levels of debt and central bank intervention,

- growing wealth gaps and populism, and

- rising conflicts between great powers, particularly the US and China.

He believes that the US is in the middle of a short-term debt cycle, characterised by central banks tightening money to combat inflation. However, the high levels of debt make it challenging to strike a balance between interest rates and inflation. So we will likely reach a major “inflection point” and a need for financial restructuring. He predicts worsening debt and financial conditions, possibly within the next 18 months.

Dalio was also recently interviewed on this topic by Thomas Friedman (36 mins) which you can watch here.

Yet Even More on the BRICS+ Currency Announcement in August!

One symptom of the coming disorder could well be the emergency of new currencies. Such as the BRICS+ currency we have looked at the past 2 weeks.

The significance of a BRICS+ currency announcement in August should not be downplayed. We have seen it mentioned more and more recenlty. (For more see: A Gold Backed BRICS Currency in August 2023? and More on the Possibility of a BRICS Gold Backed Currency)

Alisdair Macleod points out that it is somewhat of a “Geopolitical evolution…”

The increasing number of nations seeking to join BRICS brings geopolitics into the spotlight. If all join, that’s 36 nations, with over 60% of the world’s population and one-third of global GDP.”

Source.

However we’d also agreed with Alisdair Macleod that it is likely just a first step and they are likely still a fair way off any implementation. Maybe just a bureaucratic “announcement of an announcement” type situation in August…

“It is probable that an announcement concerning the new currency will come out of the summit, but it is likely to be preliminary in nature, and gold might not even be mentioned at this stage. And it would make more sense for Glazev’s brief designing such a currency to be officially expanded from that of the EAEU committee, involving China more directly. That being the case, the only practical means of tying the new trade currency to multiple commodities and national interests is to use gold.

It increasingly suits Russia to see this move announced, and the timing could well coincide with or shortly follow Putin’s next push in Ukraine. But we should not expect this new currency to arrive shortly, only that it is being planned.”

Another Mainstream Contrarian Gold Indicator

Sentiment towards gold remains extremely poor. Somewhat surprising since gold is actually up in 2023 in both USD and NZD terms. But you certainly wouldn’t think it. As we’ve been saying, demand is low evidenced by the backlogs on most products having dropped substantially. Along with the falling silver coin premiums.

Now here’s the latest contrarian indicator. A terrible article on gold on Bloomberg: “Gold Is No Longer a Good Hedge Against Bad Times”. But here’s why we’d say it’s likely a contrarian indicator that a bottom is close.

The author Tyler Cowen who is a “professor of economics at George Mason University” is a perfect example of someone writing with authority but who has zero understanding of gold. He says gold is “a little boring and likely to remain so for the foreseeable future”. Of course gold should be boring! That is the point in that it will hold its value and protect your purchasing power over the long run.

Next he says “gold prices decline when real interest rates rise”. Or conversely he could have said that gold prices rise when real interest rates fall. Which is exactly what has been happening for the past couple of years as inflation has been and remains higher than interest rates. Cowan obviously believes that is about to change. We have our doubts.

But here’s the line that shows he has zero understanding of gold:

“The price of gold also goes up (down) when demand for it as a commodity goes up (down). So, if say China becomes a major global economic power, the Chinese economy will need more gold, if only for its commodity uses, and that in turn will boost gold prices, as it did starting in 2002.” He then argues that “gold is no longer a good hedge against bad times, as it correlates with both low interest rates and global economic growth.”

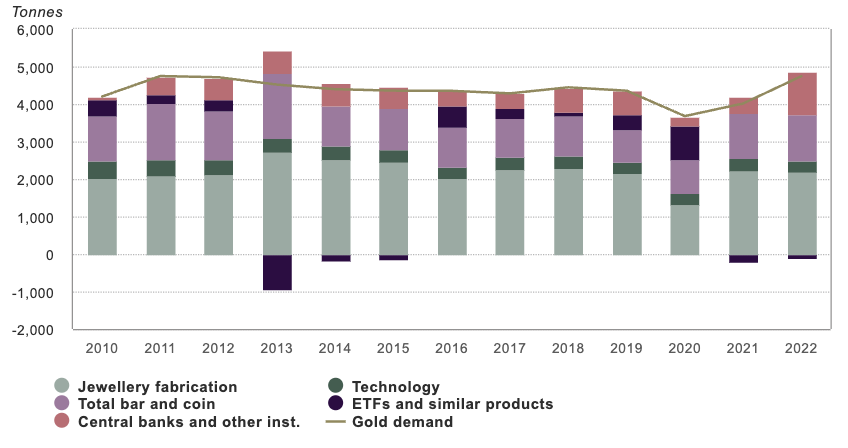

But what commodity uses is he referring to? Gold actually has very little industrial uses. Cowen only needed to refer to the World Gold Council annual demand trends report to see that technology uses make up just a small single digit percentage of total gold demand (see the dark green sliver on each year on the chart below).

Source.

So our guess is that this article on gold in the mainstream press will in hindsight be viewed as a bottom indicator. Why?

In analysing this article, we’re reminded that back in September 2022 the Wall Street Journal also wrote “Gold Loses Status as Haven.” USD gold bottomed soon after that and began a huge 7 month run higher.

Then looking back even further, back in 2015, ABN AMRO bank also pooh poohed gold’s safe haven status. Going as far as to expect gold to fall to $800 in 2016. Instead gold ended its 7 year correction and bottomed out soon after this.

So we wouldn’t be surprised if this latest mainstream bearish headline also ends up being a bottom indicator. As we said earlier, if it’s not already here, there is probably only one last dip to come.

Be ready for it but also don’t worry too much about trying to time it exactly. We are likely much closer to the bottom than the top. So any purchase made around these levels will likely be looked back on fondly in the years to come.

Please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Bank Deposit Protection Bill Passes Final Reading - Gold Survival Guide

Pingback: The Gold Standard & A Free Market For Money: What Do We Think About It?