Gold Survival Gold Article Updates:

June 5, 2013

This Week:

- RBNZ Jawboning But May Follow Through

- Turning Israeli, I Really Think So

- Debt Ceiling: Forgotten But Not Gone

Gold and silver have looked a bit stronger this week, perhaps not surprisingly given, as reported last week, the record short positions by speculators and record long positions by the bullion banks.

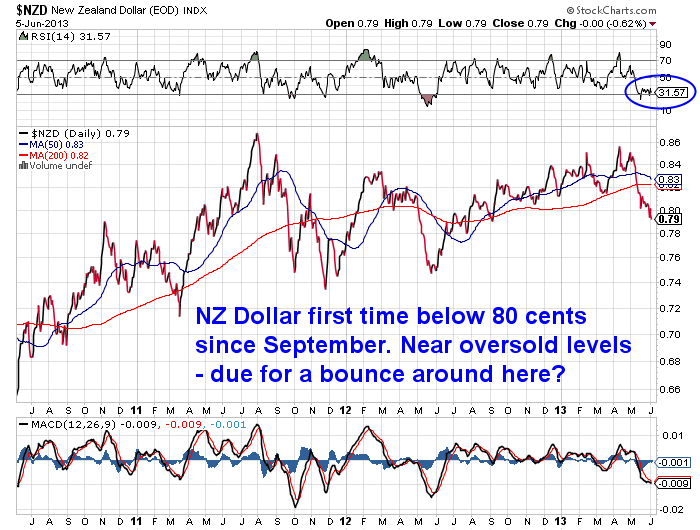

Also helped locally by the kiwi dollar being even weaker this week, where it has dipped down below 80 US cents last night as well as on Monday. The NZ dollar has been looking oversold so is due a bit of a bounce, but it will be interesting to see if it follows the Aussie dollar lower in the short to medium term or reverts to the long term trend of strength against the US dollar.

So both metals in NZ dollar terms are up today and close to testing resistance levels. NZ Dollar gold is just above the 50 day moving average (blue line) which it hasn’t managed to stay above since late last year.

RBNZ Jawboning But May Follow Through

Continuing on the topic of the NZ dollar, the RBNZ did its best last week to talk the kiwi dollar lower and so may have had a bit of short term impact with this. In case you missed it last Thursday, RBNZ head Wheeler talked up the possibility of further rate cuts but only if other “macro prudential tools” (don’t you just love Central Banker speak?) manage to take the heat out of the housing market:

“The Reserve Bank has been responding to the rising exchange rate through two avenues: in maintaining the Official Cash Rate (OCR) at an historically low level; and through a degree of currency intervention.

“The downward pressure on inflation exerted by the high exchange rate means that the OCR can be set at a lower level than would otherwise be the case. In recent months we have undertaken foreign exchange transactions to try and dampen some of the spikes in the exchange rate.

“But we are also realistic. We can only hope to smooth the peaks off the exchange rate and diminish investor perceptions that the New Zealand dollar is a one-way bet, rather than attempt to influence the trend level of the Kiwi. We are prepared to scale up our foreign exchange activities if we see opportunities to have greater influence.”

Mr Wheeler said that the Bank is also concerned about the financial stability risks associated with the housing market, in particular the scale of housing lending, and especially high loan-to-value ratio (LVR) lending.

“Risks associated with excessive housing demand could normally be constrained by raising official interest rates and letting them feed through into higher mortgage costs. However, this would carry significant risks of a further strengthening in the exchange rate and further downward pressure on tradable goods prices. This might, in turn, be expected to push CPI inflation further below the 1 to 3 percent target range.

“This is where macro-prudential policies can play a useful role in promoting financial stability. Capital and liquidity overlays can help build up buffers in the banking system while adding to the cost of bank funding. And loan-to-value restrictions may help to reduce the actual supply of mortgage lending.

“If house price pressures abated, it would increase the possibility that the OCR could remain at its current level for longer than through this year. Similarly, if housing pressures are much less of a concern and the exchange rate continues to appreciate and the inflation risk looks low, it may create opportunities to lower the OCR,” Mr Wheeler said.”

This is a bit stronger language than we have heard to date. Particularly the comment that “We are prepared to scale up our foreign exchange activities if we see opportunities to have greater influence.” So the RBNZ may potentially do more than the somewhat paltry $256 million foreign currency intervention in April to try and stem the rise of the dollar (previous efforts back in 2007 totaled $2.36 billion). Also the odds look more likely of the RBNZ introducing some kind of lending restrictions on banks.

In fact this is looking very likely now as they have released a consultation paper on their “macro prudential tools” which says:

“The Reserve Bank’s intention in undertaking this consultation is to ensure that the banking system is sufficiently well positioned so that LVR restrictions could be applied in the relatively near future should this be considered necessary,”

“The RBNZ would primarily target mortgage loans with LVRs of 80 percent and above, and focus on a ‘speed limit’ approach (whereby it would restrict the share of new lending that banks can extend to borrowers with low deposits), rather than banning such loans altogether,” Westpac Banking Corp senior economist Felix Delbruck said in a note.

“The RBNZ is keen to give macro-prudential tools a fair crack – possibly before moving the OCR. As such the implication could be a later start to rate hikes as the RBNZ watches for any impact on lending and the housing market (which at this stage is very uncertain),” Delbruck said.”

So as we’ve been saying for a while we could yet see the opposite of what the bank economists are projecting and see lower rates rather than higher rates in the future.

Turning Israeli, I Really Think So

You might recall last week we mentioned Israel and how their central bank had already taken this approach. Introducing 25% minimum deposits for first home buyers while cutting interest rates at the same time.

So from this speech it seems Mr Wheeler is also, like Israel, looking to stoke a bubble with one hand (low interest rates) and try and quell it with the other (lending restrictions). Will he be successful in walking the fine line? From what we’ve read it hasn’t worked so far in Israel although it’s only been in place for months.

But we’d say the law of unintended consequences, which all governments and central banks have trouble avoiding, is more likely to come into play. For example, raising the minimum deposit level may well just push buyers into other 2nd tier forms of lending instead, as while bank rates remain low, so too are borrowing rates on secondary loan markets.

Given the latest OECD report lists NZ housing in the “overvalued but prices are still rising” category and in 4th place overall, it’s no surprise the RBNZ is talking tough. That said there’s no reason why we can’t go higher from here. And we doubt the RBNZ game is to tank the housing market here given the impact that would have on the banks – well then again maybe it is according to Lindsey Williams in this video.

This Weeks Articles/Videos

This weeks feature article is a summary of information presented by author Mike Maloney, looking at the fundamental indicators in gold and silver markets. The video is also posted but we have summarised all the main points into written form in case you prefer to read than watch.

Maloney covers a number of measures that we’ve discussed over the years so we thought no need to reinvent the wheel ourselves as he covers them off nicely. So if you’re worried about your holdings of precious metals or unsure about whether to buy, this article provides some good metrics as to why the bull market is not over yet.

Maloney covers a number of measures that we’ve discussed over the years so we thought no need to reinvent the wheel ourselves as he covers them off nicely. So if you’re worried about your holdings of precious metals or unsure about whether to buy, this article provides some good metrics as to why the bull market is not over yet.

Why It’s Not Time to Sell Gold & Silver Yet

We like the dry wit of Grant Williams of Vulpes Asset Management. And he’s back again with another great presentation, which again we get to watch for free via the wonders of youtube.

We like the dry wit of Grant Williams of Vulpes Asset Management. And he’s back again with another great presentation, which again we get to watch for free via the wonders of youtube.

This is a good follow on from his previous video “RISK” and his Things that make you go Hmmm article on a similar topic:

Grant Williams Presentation: Gold Price not the same as the Price of Gold

We also have a well put together piece outlining why those that have sold out of precious metals and related investments recently may live to regret it:

We also have a well put together piece outlining why those that have sold out of precious metals and related investments recently may live to regret it:

And finally a few more reasons from resources veteran Rick Rule why the bull market is not done yet:

And finally a few more reasons from resources veteran Rick Rule why the bull market is not done yet:

Rick Rule’s Reasons to Buy Gold and Select Gold Stocks

Debt Ceiling: Forgotten But Not Gone

We’ve been keeping an eye on the topic of the US debt ceiling of late as it has been virtually forgotten about by the short sided mainstream media. You might recall we’ve posted a number of charts in the past that show the close correlation between US debt ceiling levels and the price of gold.

At the end of January we noted that the ceiling was “temporarily suspended” until May 19th.

That date has been and gone so what happened?

Well, once again the Congressional Budget Office has taken “extraordinary measures to avoid hitting the $16.4 trillion debt ceiling until October or November“. In a nutshell this means they will stop various non essential payments for a while to avoid the US from defaulting.

These “extraordinary measures” mean the deadline can be put off until about October or November. So it will be interesting to see if the limit is extended yet again then or if they come up with some other inventive means of avoiding default. Last time there was a serious tussle over the limit, gold put in an equally serious rise of a few hundred dollars in short order. So we will diary in the last quarter of the year to see if the debt ceiling debate returns and is the impetus for a rise in precious metals.

If you want to get in now while all seems quiet, serene and peaceful (the best time to buy insurance), then get in contact.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| A Currency War Special |

2013-05-29 03:58:20-04 2013-05-29 03:58:20-04 |

Gold Survival Gold Article Updates: May 29, 2013 This Week: A Currency Wars Special Daily Bell: “Neo Nazi Social Credit Strikes in New Zealand” Objective Versus Subjective Contrarian Signals Prices have not moved too much from last week – as always you can see them over to the right. So we don’t have too […]

| Rick Rule’s Reasons to Buy Gold and Select Gold Stocks |

2013-05-30 21:24:03-04 2013-05-30 21:24:03-04 |

Here’s some sage advice from an expert and veteran in the junior resources mining sector. Not just on junior miners, but also with respect to holding physical gold itself… Rick Rule’s Reasons to Buy Gold and Select Gold Stocks By Jeff Clark, Senior Precious Metals Analyst Interviewed by Jeff Clark, Casey Research Jeff Clark: First, […]

| Grant Williams: “Gold Price” not the same as “Price of Gold” |

2013-05-30 22:21:43-04 2013-05-30 22:21:43-04 |

Back at the start of April we posted a video of a presentation by Grant Williams of Vulpes Investment Management entitled Risk – it’s not just a board game. We’ve just watched his latest presentation made to the CFA institute in Singapore, which while 48 minutes long is still well worth a watch as he […]

| Why It’s Not Time to Sell Gold & Silver Yet |

2013-06-03 22:44:51-04 2013-06-03 22:44:51-04 |

Just over 3 years ago we wrote an article asking the question When will you know it’s time to sell gold? In this article we wrote about 7 factors that would give an indication as to when it was time to swap gold for another asset class. Some were objective and measurable and some more […]

| Seller’s Remorse |

2013-06-04 18:36:18-04 2013-06-04 18:36:18-04 |

This is a clever take on why those that have recently sold precious metals shares (and the metals themselves for that matter), should have looked more closely at the information that is floating around, along with that information buried a bit deeper before they made their decision to sell… Seller’s Remorse By Jeff Clark, Senior Precious Metals […]

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1766 / oz | US $1405.03 / oz |

| Spot Silver | |

| NZ $28.43 / ozNZ $914 / kg | US $22.62 / ozUS $727.18 / kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

“Introducing 25% minimum deposits for first home buyers while cutting interest rates at the same time.”

So, in addition to “youth rates”, among other challenges, this would build a taller wall between the older and more established “haves” and the younger and less established “have nots”. The rich rentiers get richer and the poor surfs get poorer.

Pingback: Why are US Bonds being sold? | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide A Look at Gold & Silver in NZ, US & Aussie Dollars