Gold Survival Gold Article Updates:

April 10, 2013

This week:

- Preparing for Inflationary Times

- Has New Zealand Been a Test Case for Depositor Haircut Scheme? Short Answer: “Looks Likely”

- Has Anti Gold Talk Reached Extremes?

- NZ to Also Bypass USD in Forex Transactions with China?

Quite a bit to get through this week!

First up big news was the Bank of Japan’s (BoJ) surprise announcement that it will double its balance sheet over the next 2 years via QE. The BoJ will buy the equivalent of 70% of monthly Japanese bond issuance! Crikey! That makes Ben look like he’susing a pea shooter on the US economy.

All that money is going to find it’s way across the globe too and so no surprises that the NZD has gone up even more versus the Yen. Japanese investors will be looking where they can park funds to escape devaluation. The Japanese Bond market has had massive price swings since the announcement too. This is probably a much bigger deal than most realise and could set off the next round in currency skirmishes with China and Korea perhaps?

Gold and Silver Chart Action

The precious metals did bounce up after the BoJ announcement but with the kiwi strengthening further the local prices of both metals are not that dissimilar from last week. Gold remains in this downward trend channel having bounced off the bottom early this week.

Silver has been volatile over the past week but today is up slightly on a week ago. Yesterday it looked like silver had dropped through the support line we’ve had on the chart for a while, but today it is back above it so not conclusive yet.

Where to from here?

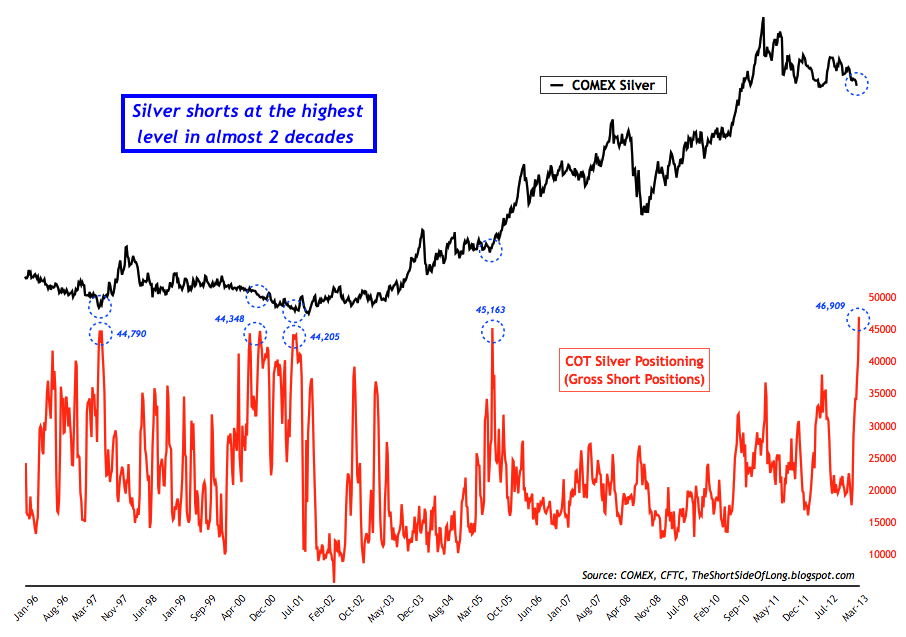

Well if commitment of traders data is anything to go by we should be due an upwards movement in both metals soon. See below chart for silver from The Short Side of Long.

With silver shorts at record highs in the past this has been a precursor to higher prices.

For more on this topic and charts of gold short positions too, see these 2 articles as well:

80% Chance of 40% Silver Short Squeeze

Gold and Silver COT Report for April 5

Preparing for Inflationary Times

This week we were reading about Murray Rothbards “3 phases of inflation”. We certainly appear to be in Phase 1 currently where “the money supply grows at a faster pace than the overall price level. Despite surging supplies of base money, savers hoard cash, instead of spending it. So inflation does not show up in the prices of goods and services.

But Phase 1 is almost over and Phase 2 is about to begin.

“Unfortunately, the relatively small price rise [i.e., low inflation] often acts as heady wine to government,” Rothbard observes. “Suddenly, the government officials see a new Santa Claus, a cornucopia, a magic elixir. They can increase the money supply to a fare-thee-well, finance their deficits and subsidize favored political groups with cheap credit, and prices will rise only by a little bit!

Read more: “Phase 3” Inflation!

We’ve heard the Green Party use this argument as to why we should be printing money here. Something like “They’ve been printing overseas but prices haven’t risen there so why not do it here.” Rothbard outlines why this proves to be a false premise as Phase 1 leads to Phase 2:

“Rather than hold onto its money to wait for price declines, the public will spend its money faster, will draw down cash balances to make purchases ahead of price increases. In Phase 2 of inflation, instead of a rising demand for money moderating price increases, a falling demand for money will intensify the inflation.”

So this article we’ve posted on the site is very timely in that it looks at what some of the possible catalysts may be for a rise in inflation.

So this article we’ve posted on the site is very timely in that it looks at what some of the possible catalysts may be for a rise in inflation.

Read More: Preparing for Inflationary Times

And just in case you were sick of Cyprus, this article shows you why you shouldn’t be. Louis James gives a stark warning about what may lie ahead given the debacle that occurred in Cyprus. He shares with us how to prepare and has us thinking whether we have done sufficient yet…

Read More: Ignore Cyprus at Your Own Risk

Last night we just finished reading a very interesting piece by Grant Williams in his “Things that make you go Hmm”. He gives a great run down of the likely pitfalls of the Bank Of Japan’s massive money printing they announced last week.

This prompted us to take a look at a video of the presentation he made at the Mines & Money conference in Hong Kong last month that we’d read some good reports about lately. So if you’re new to the precious metals game then this is a must watch and even if you’re not you may well learn something, particularly about gold leasing.

This prompted us to take a look at a video of the presentation he made at the Mines & Money conference in Hong Kong last month that we’d read some good reports about lately. So if you’re new to the precious metals game then this is a must watch and even if you’re not you may well learn something, particularly about gold leasing.

Watch: Risk – It’s Not Just a Board Game

Has New Zealand Been a “Test Case” for Depositor Haircut Scheme? Short Answer: “Looks Likely”

Last week we asked the question “Has New Zealand Been a “Test Case” for Depositor Haircut Scheme?“

This week on King World News Jim Sinclair said:

Sinclair: “How in the world can Lagarde say that Cyprus is a one-off? The spreading of bail-in being written into Canadian law, New Zealand law, as well as in other countries, tends to indicate that what has been done in Cyprus is in fact a test case for further application. If it wasn’t, it was an economic act of war by Europe against Russia.

Eric KIng: “Jim, when you see that being written into law in countries elsewhere, they are not setting that up for no reason.”

Sinclair: “No. They are not writing that in because some junior clerk supports the approach. When countries write things into legal documents it passes legal review. So the possibility of that being a mistake is nil….”

So Jim reckons Cyprus was a test case – well maybe for actually taking a haircut but just like Sir Ed and Everest, New Zealand got there first! Well, to continue the metaphor, at least we were the first ones to build the barbershop, even if we weren’t the first ones to actually give a haircut!

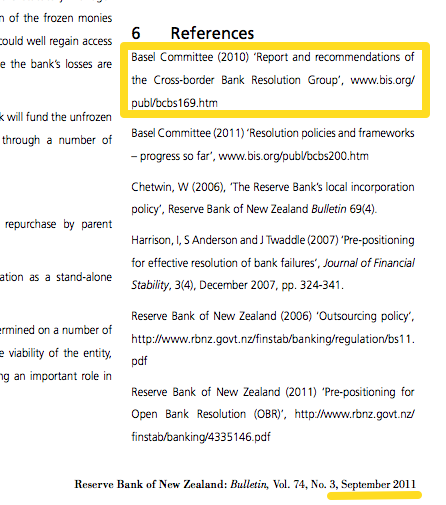

This morning from Jim Sinclair’s JSMineset.com, comes more evidence that this depositor funded model has been looked at on a widespread basis from as far back as March 2010.

A document from the Bank for International Settlements (BIS), signed by over 20 institutions including various major Central Banks such as those of England, Germany, France, Switzerland and the US Fed. It clearly shows that taxpayer funded bailouts are not the recommended course of action in the case of bank failures, but rather “Losses should be allocated among shareholders and other creditors, where possible; and private sector resolutions rather than public ownership should be facilitated.”

“Hi Jim,

Why does everyone seem to think that Canada, Cyprus and New Zealand are the only countries preparing for bail-ins?

CIGA Janice

Basel Committee on Banking Supervision

Report and Recommendations of the Cross-border Bank Resolution Group

Click here to read the full report…

This is the policy that the central banks are following. Check out the list of central banks consulted on the formulation of this – last page. The Fed is represented, so it should not have come as a surprise to Mr B. or was it the tilt of the cards that provoked the “angry” reaction?

Underlining is mine in the below quote.

Recommendation 10

National authorities should adopt crisis management and resolution strategies that reduce moral hazard by minimising public expenditures. Losses should be allocated among shareholders and other creditors, where possible; and private sector resolutions rather than public ownership should be facilitated….

Dear Janice,

The backpedalling and denials which have emanated from just the same bodies that signed on to this Cyprus template is because it was used in Cyprus, revealing its existence ahead of time. This was constructed for the next large banking problem and not for slamming an island tax shelter like Cyprus. Here is the undeniable template to confiscate deposits with legal grounds. Clearly if this was expected by any public, few would carry large balances in any bank. This should answer clearly the question, can central planners do really stupid things at just the wrong time and wrong targets?

Respecfully,

Jim

Funnily enough this same BIS document is referenced at the very end of a RBNZ paper from 2011 on the Open Bank Resolution (OBR).

So it would add weight to the speculation that maybe NZ was put forward as a guinea pig to see if the public reacted to the idea of a haircut? We got EFT-POS first so why not a bank haircut too?!! And maybe as Jim Sinclair has theorised above, Cyprus let the cat out of the bag faster than intended.

Has Anti Gold Talk Reached Extremes?

We wrote back in February, we wanted to see more anti gold talk as that would be indicative of getting very close to a bottom. Since then we’ve had a number of investment banks redo their gold price forecasts and for this year they’ve all been down. The latest was from Societe Generale calling for gold to drop to US$1373 an ounce. Sprott Asset Management pulled this report to pieces pretty thoroughly but Dr Alex Cowie at Money Morning Australia also outlined how far off base the reports author was with his previous calls for gold to fall.

Dr Cowie also uses a chart from the Sprott report which shows global central bank balance sheets. We’ve shared previous charts that mainly refer to US Federal reserve balance sheets and how the gold price rises in line with this.

But this chart is better in that it includes 4 major central banks – the USA, EU, UK and Japan and the price of gold. Interestingly the European Central bank balance sheet has been falling which effectively has cancelled out the US Feds currency printing. So possibly a reason for a falling price of gold? Now with the announcement by the Bank of Japan to double its balance sheet in 2 years the blue line in the chart will be heading higher once again and odds are the green line (price of gold) will follow it as it has done in the past.

NZ to Also Bypass USD in Forex Transactions with China?

On Friday we made a note to ourselves about the NZ PM being in China for talks with new Chinese President and how we wondered if they also discussed direct currency transaction between the Kiwi and Chinese currencies to the exclusion of the US dollar? Just like has recently been agreed between Australia and China.

Well on Monday we then noticed the following report:

John Key hints at China exchange rate policy

So this is just further evidence of the slow but steady change in the global monetary system, along with other recent occurrences such as the rise and rise of Bitcoin or the BRICs “New IMF”.

Demand for Physical Silver Coins is High

It appears that the demand for physical silver is high right now as suppliers have just put their premiums up due to shortages at the Royal Canadian and US Mints.

If you’re wanting silver coins from Canada, today’s deal for 500 x 1oz (99.99% pure) Canadian Silver Maples delivered and insured is $18840.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

goldsurvivalguide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Has New Zealand Been a “Test Case” for Depositor Haircut Scheme? |

2013-04-03 02:35:26-04 2013-04-03 02:35:26-04 |

Gold Survival Gold Article Updates: April 2, 2013 This Week: Has New Zealand Been a Test Case for Depositor Haircut Scheme? Finally, More Reporting on RBNZ OBR from the NZ Mainstream Press More on RBNZ Looking to Increase Banks Capital Ratios Overnight gold and silver took a shellacking. Gold dropped down into the US$1570 […]

read more…

| Preparing for Inflationary Times |

2013-04-03 21:08:00-04 2013-04-03 21:08:00-04 |

Learn what 3 possible catalysts may be for the next big moves in inflation and the price of gold. Then see what 4 conclusions can be draw about the coming rise in inflation… Preparing for Inflationary Times By Jeff Clark, Senior Precious Metals Analyst – All this money printing, massive debt, and reckless deficit spending […]

read more…

| Dont ignore Cyprus |

2013-04-03 21:27:08-04 2013-04-03 21:27:08-04 |

Louis James gives a stark warning about what may lie ahead given the debacle that occurred in Cyprus. He shares with us how to prepare and has us thinking whether we have done sufficient yet… Ignore Cyprus at Your Own Risk By Louis James, Chief Metals & Mining Investment Strategist Archimedes once said that if […]

read more…

| Risk – It’s Not Just a Board Game |

2013-04-09 18:15:07-04 2013-04-09 18:15:07-04 |

Last night we just finished reading a very interesting piece by Grant Williams in his “Things that make you go Hmm” newsletter available for free subscription here. He gives a great run down of the likely pitfalls of the Bank Of Japan’s massive money printing they announced last week. This prompted us to take a […]

read more…

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1861.56/oz |

US $1584.93/oz |

Spot Silver |

|

| NZ $32.90/oz NZ $1057.82/kg |

US $28.01/oz US $900.63/kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuideToday’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo)

$1142.45

(price is per kilo for $50,000 or more)

Buy direct from the mint but at cheaper prices using our discount code GSG001.

Click here for more info

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

I wonder for how long precious metals will remain in the lows. European economies are made to consider paying off debts in gold. Plus, the debate of bringing back gold standard is finding more support looking at the shaky economies across east and west.

Hi Andrew,

Thanks for your comment. Yes there remain many gold positive factors across the globe (or at least what should be gold positive factors). However the mainstream do still seems to see things as not too bad. Sharemarkets are up just about everywhere and this is likely attracting funds that might otherwise be looking at gold. So we just don’t know if the bottom is in yet. More on this topic in our next article due out later today.

Pingback: Global co-ordinated Central Bank action? | Gold Prices | Gold Investing Guide

Pingback: The “Grey Swan” of Interest Rate Derivatives | Gold Prices | Gold Investing Guide

Pingback: Physical Gold and Silver Markets in NZ Decoupling From the Paper Markets -