Prices and Charts

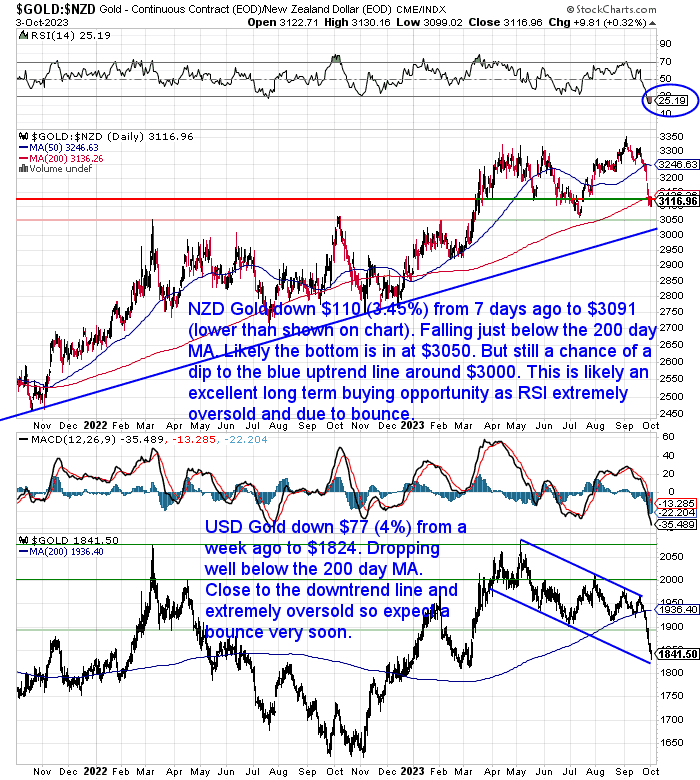

Large Fall in Gold

The possible further correction in gold we have been keeping an eye out for finally hit this week. NZD gold dropped $110 per ounce from a week ago, down almost 3.5%.

As a result the price is now back below the key 200 day moving average (MA). It remains a little above the long term blue uptrend line and also above the July low at $3050. The RSI overbought/oversold indicator (see blue circle) is in extreme oversold territory under 30. The most oversold it has been in many years.

So while a further drop down to the uptrend line is not out of the question, this very oversold reading points to a higher likelihood that we will see the price bounce up from here in the coming days. Also looking back over the last few years we can see that any dip below the 200 day MA has not lasted for too long and been a buying opportunity.

While there are no guarantees, this is likely to be looked back on as an excellent place to be buying.

USD gold dropped even further, down over 4% the past 7 days. It is now a long way below the 200 day MA and just touched the lower line in the downtrend channel. So this is likely a really good entry point here too. There is support a bit lower near $1800, but we’d hazard a guess that a bounce is likely from around here.

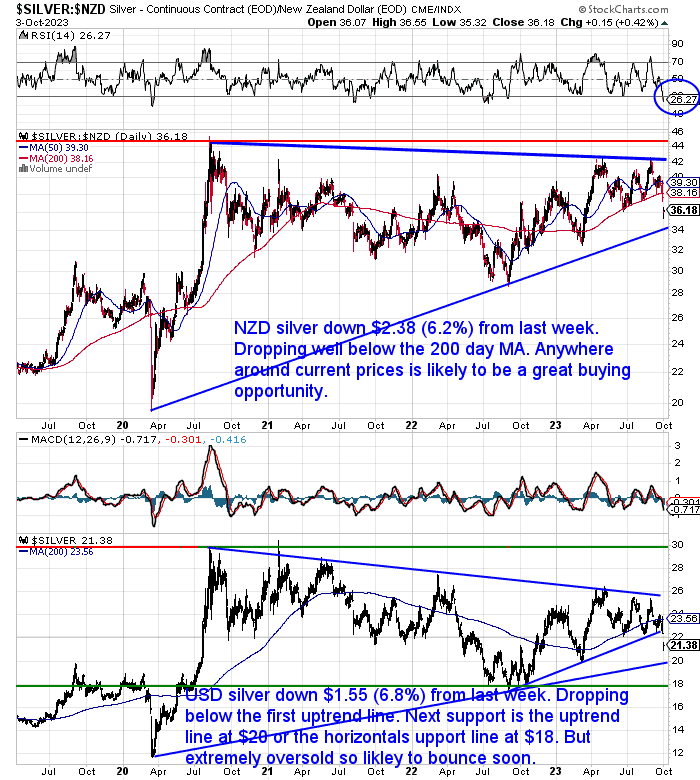

NZD Silver Down Over 6%

The fall in silver has been even more pronounced. Down $2.38 or over 6% from 7 days ago. Breaking below and now well under the 200 day MA, NZD silver is now not that far from the uptrend line dating back to the 2020 Covid bottom. But with the RSI in extreme oversold at 26 (blue circle), we’d say a bounce is more likely from around here. These sort of oversold positions only come around once or twice a year. Looking back we can see they have been pretty decent places to be buying. In the future, when we have the benefit of hindsight, we’d say right now is likely to be another one of those opportunities.

USD silver looks pretty similar in the chart. It was down close to 7%, falling below the short term uptrend line. Also not far from the uptrend line dating back to the 2020 low at around $20. Below that is the horizontal support line at $18.

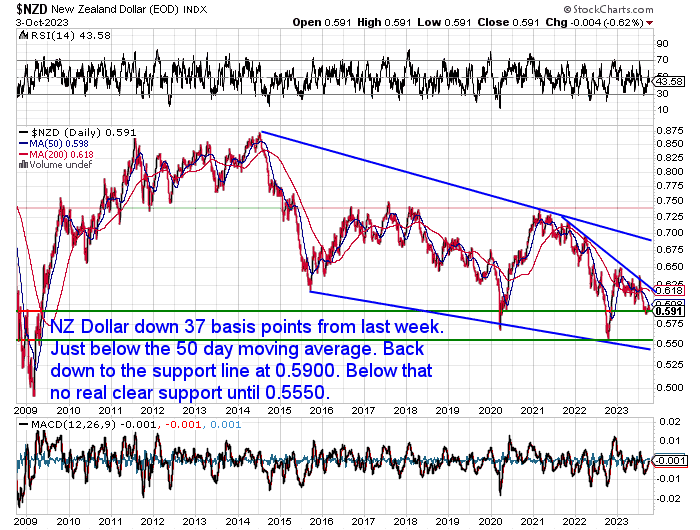

NZ Dollar Down 0.6%

The Kiwi dollar was down 37 basis points from 7 days prior. Sitting just below the 50 day moving average and now back down to the horizontal support line at 0.59. Below this there is no real major support until 0.55.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

COVID-19, War & Inflation Makes Us Wonder: What Use Will Silver Coins be in New Zealand in a Currency Collapse?

The world is facing unprecedented challenges and uncertainties, such as the Russian invasion of Ukraine, the fallout from the Covid-19 pandemic, and the looming threat of a global monetary breakdown. How would these events affect the New Zealand dollar and its purchasing power? How would you protect your wealth and trade in a post-currency world? Many people might think that silver coins are useless in such a scenario, and that they would be better off with more practical goods like food, water, or tools. But is that really the case?

In this article, we explore the advantages of silver coins over other tradable items in a currency collapse. We also discuss how the international reaction to the Russian invasion could speed up the end of the US dollar reserve currency system, how Covid-19 saw a huge increase in demand for cash but was it the best option? And how New Zealand has never seen a complete currency collapse but what has happened elsewhere during one.

Read on to find out why silver coins are not only a good investment, but also a vital form of insurance for the worst-case scenario.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

RBNZ Expanding Its Foreign Currency Reserves – Still No Gold

Earlier this year the RBNZ indicated that it was going to put more of its assets into foreign currency.

“The RBNZ announced that it and the Finance Minister Grant Robertson had agreed to a “new framework” for managing foreign reserves. As part of this, the amount held in offshore currencies would increase – but the RBNZ’s not telling us by how much.

Then later in the year the New Zealand government added half a billion dollars to the Reserve Bank’s balance sheet last month and gave it an indemnity to provide fire-power to intervene in currency markets.

Then in July came the selling of NZ$4 billion.

This is all ultimately about increasing the so-called foreign currency intervention capacity – which is essentially available foreign denominated money that the RBNZ could use to intervene in the foreign currency markets and affect the value of the Kiwi dollar, if necessary.

The sale of the NZ$4 billion in July increased the foreign currency intervention capacity to $16.699 billion. Previously the central bank had been maintaining an intervention capacity of around $12 billion.

And even though the RBNZ actually had a net gain in NZ dollars in August of the above mentioned $84 million, it has further increased its foreign currency intervention capacity during the month to $17.573 billion, which is a new all-time high.

But, obviously there’s still no indication from the RBNZ as to whether it plans to increase the figure still further.”

Source.

This doesn’t seem to make much sense to us. If the RBNZ was going to intervene if the Kiwi dollar got too low, they would have to sell these foreign currency reserves to buy the NZ dollar and push up the price. But they would be trying to fight the US central bank in doing this. Along with currency traders with very deep pockets. And given the USD reserve currency position that would seem like a sure loss. All that for likely only a short term impact.

Surely a better bet would be to hedge the potential for a weaker NZ dollar by doing what many other central banks are doing? That is to buy gold. We talked about this many times this year. Often focussing on China and Russia. But even much smaller nations like Singapore have been buying. With their gold reserves increasing by 50% in the first seven months of 2023.

But last we checked the RBNZ still has $0 in gold reserves. See: How Much Gold Does the Reserve Bank of New Zealand Have in 2023?

Higher Interest Rates, Higher Inflation = Stagflation

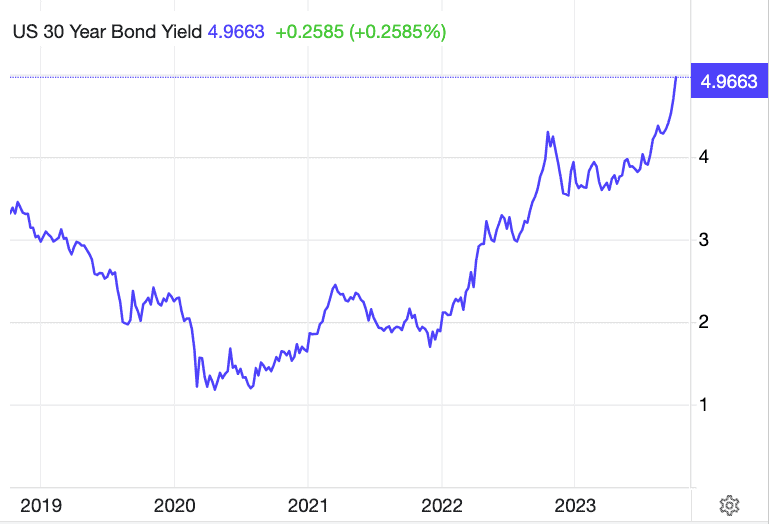

We keep seeing talk of interest rates having peaked. However it seems they just keep ticking higher. The other point that many commentators seem to miss is that the RBNZ and other central banks can only control short term interest rates. The long term, as in 10 and 30 year bond interest rates are controlled by the market.

So far, the market seems to be saying to expect higher interest rates for much longer than most think possible. Here’s the interest rate for US 30 year bonds surging higher in the last couple of months.

Meanwhile here at home businesses remained worried about inflation…

“Economists are cheered by signs the Reserve Bank’s monetary tightening is getting traction but remain concerned about the strength of inflationary pressures in the economy. The much-watched NZIER Quarterly Survey of Business Opinion (QSBO) for the September quarter was released on Tuesday and showed business confidence was improving slowly, the labour market was starting to show signs of slack as the RBNZ wants to see, but cost pressures – while easing – remain strong.”

Source.

To us this sounds like higher interest rates, higher inflation and lower growth. Last time we checked that spelt stagflation.

Maybe the markets are finally catching on to the idea that interest rates could stay up for much longer than most first thought. That might be why gold and silver have struggled lately.

But when they catch onto inflation also staying higher than expected, that is likely when precious metals will really start to catch a bid.

Stock Markets Looking Rocky

We wonder if this current capitulation sell off in gold and silver is actually the precious metals doing some forward looking trouble ahead? Or rather some traders selling gold to shore up cash reserves for possible trouble.

From ASB:

• US stocks have slumped, with the three main indices down 1.6%-2% at the time of writing, and the press higher in yields got “fresh legs” after jobs data supported the case for the FOMC to keep interest rates elevated (Bloomberg). European share indices were also down overnight.

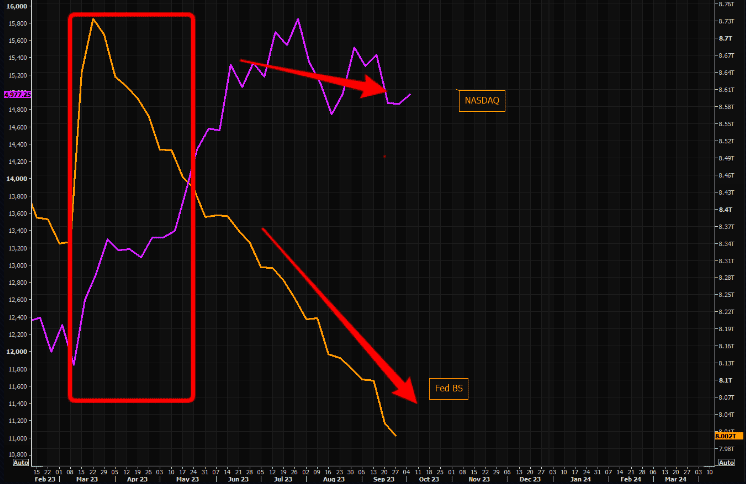

Stock Markets Heavily Correlated to Central Bank Balance Sheets

Stock market might also be feeling the effects of the US central bank balance sheet (BS) reduction. The Market Ear points out how the rise so far this year in the US NASDAQ tech dominated stock market index seems to be correlated to the central bank juice pumped into the market…

BS reduction a problem?

NASDAQ took off when Fed expanded the BS as the SBV situation spiralled out of control. Noteworthy is that NASDAQ has basically done nothing ever since that “extra” juice was sucked out of the market. Are equities becoming sensitive to the fade in the BS?

Refinitiv

Source.

Elsewhere The Market Ear also notes that:

1. The QT [quantitative tightening] trade is back on

2. A rise in bond yield of this magnitude typically ends in a financial accident

3. There are enough similarities to 2008 to warrant caution

Rising Interest Rates Reminiscent of 2008 and 1987 Black Monday Crash

So you’ve got the world reserve currency central bank reducing its balance sheet, and therefore unwinding some of the past excess cash. While long term bond yields spike higher. As they say there are similarities to 2008. But as our favourite newsletter writer Chris Weber also pointed out today, this sharp rise in interest rates is also reminiscent of the lead up to the “Black Monday” 1987 share market crash.

“Thirty-six years later, most people agree that it was many months of rising interest rates. It happened at a time when people had started to get used to falling rates, and seeing them rise so much at some point scared people into thinking that stocks were going to go back to those bad old days from 1966 to 1982.”

Sound familiar?

As noted already we can’t guarantee the bottom is in for gold and silver. If there was a share market crash there’s always the possibility that gold and silver could dip lower initially too. Like they did in 2008 before rebounding sharply.

But with the metals as oversold now as they have been in many years, the odds favour this being a rare buying opportunity. If you’ve been sitting on the fence, now is likely the time to at least dip your toe in the water of the gold and silver pools.

It’s always hardest to buy at times like these when everyone else is fearful of further falls. But history shows these times are often the best.

Please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|