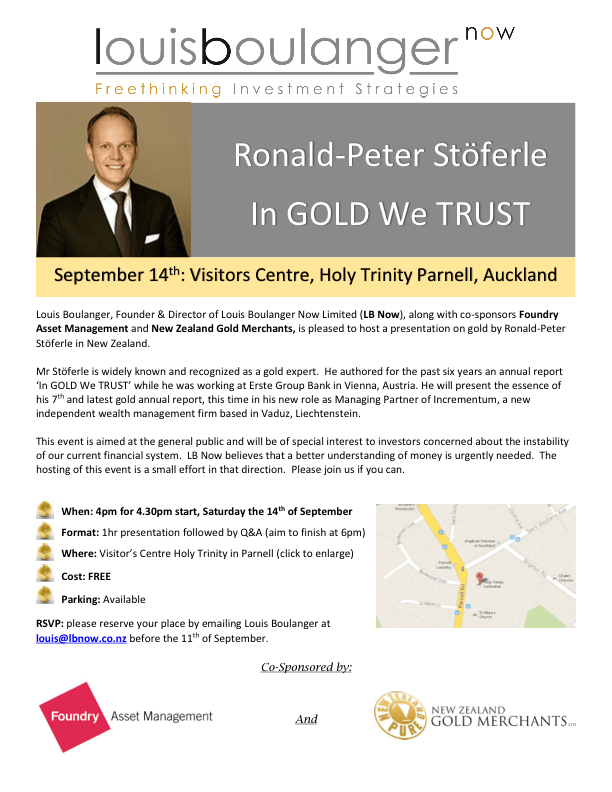

As mentioned a couple of weeks ago there are a number of high profile speakers being brought to New Zealand by our friend Louis Boulanger in the next couple of months. We can now confirm details for the first event featuring Ronald-Peter Stöferle – writer of the “In Gold We Trust Report” and how to get yourself a free ticket! When: 4pm for 4.30pm start, Saturday the 14th of September Format: 1hr presentation followed by Q&A (aim to finish at 6pm) Where: Visitor’s Centre Holy Trinity in Parnell (Google Map link) Cost: FREE! Parking: Available RSVP: please reserve your place by emailing Louis Boulanger at louis@lbnow.co.nz before the 11th of September. Ronald Stöferle formerly of Erst Group Bank and now Incrementum AG has written the widely followed “In Gold We Trust” Report every year since 2006 and this years version was packed with information showing the gold bull remains very much alive. So this is your chance to see him present in person and at zero cost! You can’t ask for better then that. See the PDF embedded below for full details. Space is limited to 250 so be in fast to secure your place. Be sure to tell Louis you heard about it from us at GoldSurvivalGuide. (There’s nothing in it for us but would be good to know how many readers will be there on the day and we’d love to meet you). Get your email in to Louis today! Click the image below to open your PDF invite:

Or click the link below to open the PDF in a new tab: In GOLD We TRUST Event Invite Ronald is being brought to Australia by ABC Bullion and below is a video he recorded for them outlining what he’ll be covering. We can expect much the same from him here in Auckland including an “on the ground” report of what is really going on in Europe currently. Also in case you have yet to read it, below is the latest “In Gold We Trust” report released last month. This was the introduction to the report Mr Stoferle wrote:

Attached please find my 7th annual – “In GOLD we TRUST” report, wdxzcovering the following highlights: Even though the consensus is convinced that the gold bull market has ended, we remain firmly of the opinion that the fundamental argument in favor of gold remains intact. There exists no back-test for the current financial era. Never before have such enormous monetary policy experiments taken place on a global basis. If there ever was a need for monetary insurance, it is today. In the course of the recent gold crash, the market has once again demonstrated its tendency to maximize pain. Massive technical damage has been inflicted. We are convinced that repairing the technical picture will take some time. Accordingly $1,480 is our 12-month target. We think that the correction that began in September 2011 exhibits strong similarities to the mid cycle correction of 1974 to 1976. That phase was similar to the current one, especially with respect to the marked disinflation backdrop, the presence of rising real interest rates and extreme pessimism regarding gold-related investments. This gold report is the first in which we offer a quantitative model of the gold price. The model justifies a considerable risk premium to the current price, although only small probabilities of occurrence of extreme scenarios have been factored in. Based on our conservative assumptions, we arrive at a long-term price target of $2,230. Due to the clearly positive CoT data as well as extremely oversold conditions, we assume that a bottoming process will soon begin. Regarding the sentiment situation, we see anything but euphoria in gold. Skepticism, fear and panic never signal the end of a long term bull market. We therefore judge that our long-term price target of $2,300, first stated several years ago already, continues to be realistic. Further topics of the report:

- Assessment of the current correction and the most recent events

- Stock-to-Flow Ratio as the most important reason for gold’s monetary importance

- The ongoing Remonetization of gold

- Reasons for “aurophobia”

- The expensive consequences of the cheap money policies

- Monetary Tectonics: Inflation versus Deflation

- Financial repression – the putative solution to the debt crisis

- Quantitative Valuation Model: Scenario Analysis

- Relative Value Analysis through Ratios

- Gold stocks close to a trend change?

Enjoy reading! All the best, Ronni

Click the link below to open the 2013 In Gold We Trust PDF in a new tab In GOLD we TRUST 2013 – Incrementum Extended Version And for a bit of a preview here is a link to an interview with him at BullMarketThinking.com. Finally in case you needed any more convincing to attend, below is the full bio for Mr Stöferle. Don’t delay though email Louis for your FREE ticket today:

Ronald-Peter Stöferle

Managing Partner & Investment Manager at Incrementum

Ronald, born 1980 in Vienna, Austria, is a Chartered Market Technician (CMT) and a Certified Financial Technician (CFTe). During his studies in business administration and finance at the Vienna University of Economics and the University of Illinois at Urbana-Champaign, he worked for Raiffeisen Zentralbank (RZB) in the field of Fixed Income/Credit Investments. After graduation, he participated in various courses in Austrian Economics. In 2006, he joined Vienna-based Erste Group Bank, covering International Equities, especially Asia. In 2006, he also began writing reports on gold. His six benchmark reports called ‘In GOLD we TRUST’ drew international coverage on CNBC, Bloomberg, the Wall Street Journal and the Financial Times. He was awarded 2nd most accurate gold analyst by Bloomberg in 2011. In 2009, he began writing reports on crude oil. Ronald managed 2 gold-mining baskets as well as 1 silver-mining basket for Erste Group, which outperformed their benchmarks from their inception. His favourite books are ‘The World of Yesterday’ by Stefan Zweig, ‘Human Action’, by Ludwig von Mises and ‘The Raven of Zurich: The Memoirs of Felix Somary’ by Felix Somary. His favourite quote is ‘Whatever you are, be a good one’ (Abraham Lincoln).

Pingback: Gold and Silver Almost Recoup April Losses | Gold Prices | Gold Investing Guide

Pingback: Could NZ Take a Pounding Like Emerging Market Currencies? | Gold Prices | Gold Investing Guide