Gold Survival Gold Article Updates

August 29,2013

This Week:

- Gold and Silver Almost Recoup April Losses

- Here’s how to see Ronald Stöferle (Writer of “In GoldWe Trust” Report) Live in Auckland for FREE!

- A Changing Gold Market

- The East Remains Key

Gold and Silver Almost Recoup April Losses

Yet again big moves over the past week for both precious metals. Doesn’t seem all that long ago that we were saying the exact opposite every week!

Gold today is at $1819.18 – up almost $100 per ounce in a week or 5.62%. Silver is today sitting at $31.54 per ounce. Up $2.56 per ounce or a massive 8.84% in a week. (In kilos we are at $1013.98 today and back above $1000 for the first time in a few months). The weaker kiwi dollar has magnified the rising prices of gold and silver with the NZD/USD cross rate at 0.7785 vs 0.7964 a week ago. Down almost 2 cents.

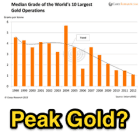

The charts of both metals show just how fast and furious the moves have been. Gold in NZ dollars is almost back to where it was before the smackdown that occurred in April at $1850. Interestingly this is also where the technically important 200 day moving average is too (red line in the chart). So we’d envisage there should be some tough resistance to overcome there. Particularly as we have moved into overbought territory on the RSI – above 70 for the first time since September last year.

However you have to temper this with the geo-political goings on. It looks to be more than saber rattling coming from the US and Co over Syria (which has really just been a matter of time and looks much like Iraq Redu). So gold seems to be reacting to this as is not unusual.

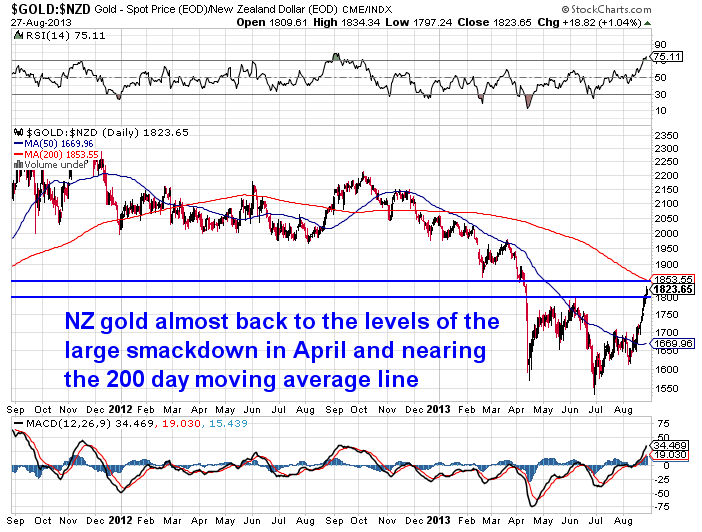

Turning to silver we see much the same action there. It too is approaching the level from where it plunged in April, along with the 200 day moving average. And silver is even more overbought than gold. So we are overdue a correction it would seem.

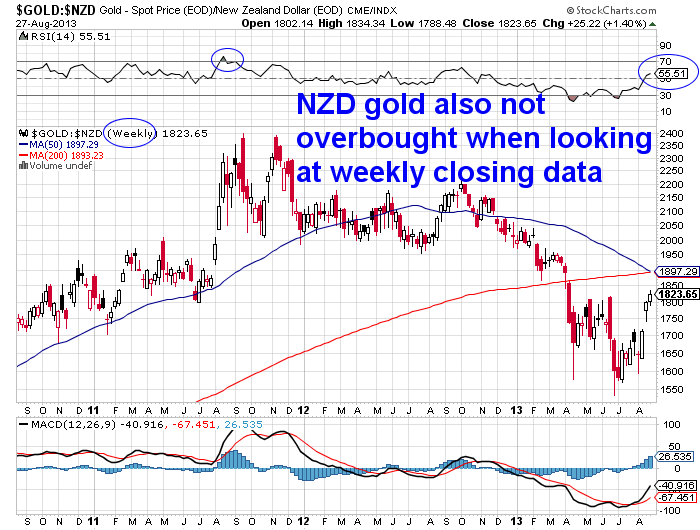

However if we look at a chart showing weekly closing prices instead of the usual daily we are still quite some way off being overbought. Compare the current reading of 58 with at the peak of 2011 for example (blue circles), so any pullback may not be that massive, or may be very short lived.

The weekly gold chart is not dissimilar. Also in neutral territory on the RSI compared to the 2011 high (blue circles).

It has been interesting to see both metals continue higher even with all the talk of Fed tapering continuing and with the mainstream opinion on whether they will reduce their bond purchases seeming to just be between whether it will be in September or later in the year. Not will they or won’t they.

We think it remains a case of see what they do not what they say. Particularly on the back of recent weak US housing data, they have plenty of room to wiggle out.

Here’s how to see Ronald Stöferle (Writer of “In Gold We Trust” Report) Live in Auckland for FREE!

Big news this week is that it has been confirmed that Ronald Stoferle of Incrementum and writer of the excellent “In Gold We Trust” report is being brought over to New Zealand next month by our friend Louis Boulanger for a one off presentation. In short the details are:

When: 4pm for 4.30pm start, Saturday the 14th of September

Format: 1hr presentation followed by Q&A (aim to finish at 6pm)

Where: Visitor’s Centre Holy Trinity in Parnell (Google Map link)

Cost: FREE!

Parking: Available

RSVP: please reserve your place by emailing Louis Boulanger at louis@lbnow.co.nz before the 11th of September.

We’ve just finished up adding the full details of the event along with background on Ronald Stoferle and his latest report to the website this morning. So we’d suggest you head over to there ASAP to see how to get your ticket for free.

We’ve just finished up adding the full details of the event along with background on Ronald Stoferle and his latest report to the website this morning. So we’d suggest you head over to there ASAP to see how to get your ticket for free.

See Ronni Stöferle (Writer of “In Gold We Trust” Report) Live in Auckland for FREE!

The great thing is through sponsorship it is a free event! With a 1 hr presentation from Ronald followed by Q&A it should be a great Saturday evening and it will be finished before the All Black South Africa Test so don’t worry! The venue seats 250 so be sure to reply fast to get your ticket given it’s free. Did we mention it’s free?

Also on the website this week is a great video from Mike Maloney for anyone wanting a refresher on monetary history over the past 140 years. By the end you’ll be able to answer

Also on the website this week is a great video from Mike Maloney for anyone wanting a refresher on monetary history over the past 140 years. By the end you’ll be able to answer

– Are we overdue for a new monetary system?

– Is war good for an economy?

– Why did Nixon sever the link between all currencies and gold?

140 Years Of Monetary History In 10 Minutes

Finally we have an article looking at the subject of Peak Gold. It has some interesting charts and looks at if we have reached peak gold what might it mean?

Finally we have an article looking at the subject of Peak Gold. It has some interesting charts and looks at if we have reached peak gold what might it mean?

A Changing Gold Market

We read a few news items this week that highlight again the significance of the East in the current precious metals bull market.

Jan Skoyles at the Real Asset Co in the UK has written some decent articles in the past few months. Her latest piece neatly summarises all the areas of the gold market she covered and is worth reading. Here’s the conclusion which we think is worth republishing (emphasis added is ours):

—–

“We draw two concluding points from our series of research.

– The gold price is not determined by demand and supply of physical gold. Instead it has become the victim of a highly speculative paper market where financial instruments have been created in order to derive benefit from the inherent desire felt by investors to own, trade and punt gold.

– The nature of gold demand is changing. As Eastern nations and emerging economies take their place on the global economic stage their investment decisions will also make an impact on markets. These countries do not wish to hold these paper products when they can own physical gold instead.

Since we started writing these articles gold market developments and other research have taken a series of twists and turns. Namely, we have seen a change in the way the mainstream look at gold, many now pay attention to levels of delivery on physical exchanges as well as premiums being paid in both China and India.

Since April we have also seen significant controls on gold come into play in the world’s largest buyer – India. Many analysts have used this development as a sign that the gold bull market is over. But China is steal India’s crown, and whilst official demand may subside in India we have little doubt that demand in neighbouring countries is going to increase…

As Terrence Duffy (President and Executive Chairman of CME Group), told Bloomberg following the April’s gold price fall: “…we saw all the gold stocks trade down significantly, we saw all the gold products trade down significantly, but one thing that did not trade down, was gold coins, tangible real gold. That’s going to show you, people don’t want certificates, they don’t want anything else. They want the real product.”

The World Gold Council referred to the ‘dichotomous nature’ of the gold market – this is clear as the paper gold market continues to tell a different story to the underlying physical market.”

—–

The paragraph we bolded is key. We indeed have seen a change in the the way the mainstream looks at gold. Just a few months ago very few would have heard the terms backwardation, and GOFO. And certainly as Jan points out it was very rare to see anyone discussing physical delivery levels or the premiums being paid for small bars and coins in China and India. As we’ve noted recently it doesn’t mean that a change is right around the corner in terms of the physical versus paper markets but it does seem we are a step closer to that eventuality.

The East Remains Key

The other significant piece we read this week was Grant Williams THINGS THAT MAKE YOU GO Hmmm… It also focussed on the East which given his location in Singapore he is well positioned to discuss. We’ve included his concluding remarks below:

—–

“Here in the East, there is a desire to own gold that utterly transcends anything commonly understood in the West. It is hard-coded into the DNA of several billion people, who, acting together, will provide a strengthening bid for gold for decades to come. Those people are getting wealthier, and with their increased wealth comes both an increased need to protect it and an increased desire to hold it in a form they have come to trust. And THAT, dear reader, is gold.

It’s simple.

The exodus of gold from the UK to Asia via Switzerland is no accident and no one-off. The surge in imports of gold into China through Hong Kong is, likewise, not a flash in the pan. Indians’ desire to own bullion, jewelry, coins — anything golden — is not going away. Trust me.

It is time to put aside Western attitudes to gold and gain an understanding of how it is viewed by the real buyers — those in the East. Those who buy physical metal to hold and to bequeath — not those who sit at home in front of their computers, buying and selling paper claims on a metal most of them have never seen up close — are going to determine the future path of the metal.

In the late 1970s, Asia was a poor continent, and though its appetite for gold was undiminished, its ability to purchase it was restricted.

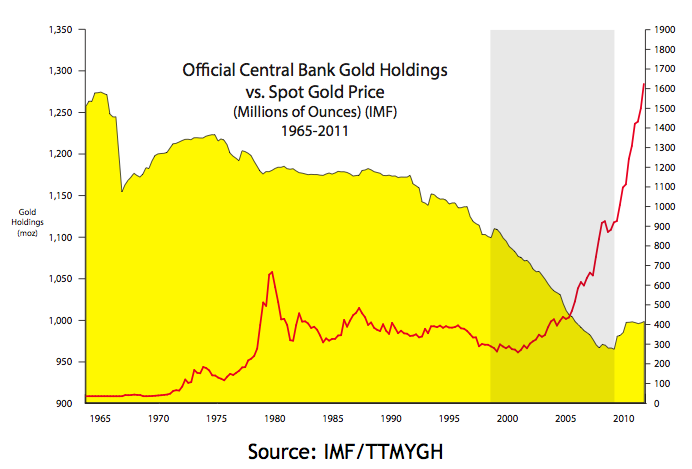

Source: IMF/TTMYGH

Through the 1980s and 1990s, central banks were continuous sellers of gold (chart above), which helped keep a lid on the price, but now … NOW, we have the makings of a perfect storm:

• The East has become far wealthier, and that wealth is increasing steadily.

• The large pool of available (and eager) buyers in the East is growing every day.

• Central banks — once the biggest sellers of gold — have not only become buyers but have begun to seek the return of their gold held overseas in a quest to perfect their assets.

• The central bank leasing scheme is unraveling before our eyes.

• Available physical supplies of gold have plummeted.

All these factors will undoubtedly conspire to make the next six months (and beyond) a lot less painful for holders of gold than the last six were — a shift that has already begun to take shape

As Roger Waters once wrote:

Who is the strongest?

Who is the best?

Who holds the aces?

The East

Or the West?

Those ‘aces’, in the form of physical gold, are moving inexorably East, and with them go prosperity, influence, strength, and, eventually, power.”

—–

Williams referred to “The exodus of gold from the UK to Asia via Switzerland” and this was the big news of the past week or so. Reuters reported that in the first six months of this year, the UK exported 797 tonnes (25.6 million ounces, or Moz) of gold to Switzerland, more than a 700% increase over the 92 tonnes (2.9 Moz) exported in the whole of last year. Why so many exports? How was this much gold available for export? And why Switzerland?

Many gold exchange-traded funds (ETFs) store their holdings in London vaults. With the huge outflows GLD and others have experienced this year, metal became available for export.

There are two main speculations as to why Switzerland was the destination. One is that investors have switched from “paper” gold investments to allocated deposit accounts. Probably the bigger reason, though, is the ongoing demand in Asia, mostly China and India. Switzerland can recast the gold bars into different-sized bars and coins and deliver them to end consumers who want to buy them.

This theme of gold flowing east seems to grow stronger each month of late. If you want to make sure at least a few ounces stays here in the west then get in touch and we can have some shipped your way wherever you are in NZ!

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Why are US Bonds being sold? |

2013-08-21 01:11:25-04Gold Survival Gold Article Updates: August 21,2013 This Week: More Gains for Gold and Silver Have We Seen “the Bottom”? A Tough Road to Hoe for the Fed RBNZ Implements LVR Restrictions More Gains for Gold and Silver The sharp upwards trend in precious metals has continued this week. We have seen both […]read more… 2013-08-21 01:11:25-04Gold Survival Gold Article Updates: August 21,2013 This Week: More Gains for Gold and Silver Have We Seen “the Bottom”? A Tough Road to Hoe for the Fed RBNZ Implements LVR Restrictions More Gains for Gold and Silver The sharp upwards trend in precious metals has continued this week. We have seen both […]read more… |

| Peak Gold |

2013-08-26 22:13:38-04See if we may have seen peak gold in terms of mine production and if so what this could mean for how miners operate in the current difficult gold environment… Peak Gold By Andrey Dashkov, Research Analyst In the mining business, it is said that grade is king. A high-grade project attracts attention and money. […]read more… 2013-08-26 22:13:38-04See if we may have seen peak gold in terms of mine production and if so what this could mean for how miners operate in the current difficult gold environment… Peak Gold By Andrey Dashkov, Research Analyst In the mining business, it is said that grade is king. A high-grade project attracts attention and money. […]read more… |

| See Ronni Stöferle (Writer of “In Gold We Trust” Report) Live in Auckland for FREE! |

2013-08-27 19:35:01-04As mentioned a couple of weeks ago there are a number of high profile speakers being brought to New Zealand by our friend Louis Boulanger in the next couple of months. We can now confirm details for the first event featuring Ronald-Peter Stöferle – writer of the “In Gold We Trust Report” and how to […]read more… 2013-08-27 19:35:01-04As mentioned a couple of weeks ago there are a number of high profile speakers being brought to New Zealand by our friend Louis Boulanger in the next couple of months. We can now confirm details for the first event featuring Ronald-Peter Stöferle – writer of the “In Gold We Trust Report” and how to […]read more… |

| 140 Years Of Monetary History In 10 Minutes |

2013-08-27 20:54:15-04We neglected last month to post the latest video from Mike Maloney in his Hidden Secrets Of Money Series. Part 2 was on the Seven Stages Of Empire and was a great history lesson even for those of us well steeped in precious metals and sound money. But at 30 mins not everyone will sit down […]read more… 2013-08-27 20:54:15-04We neglected last month to post the latest video from Mike Maloney in his Hidden Secrets Of Money Series. Part 2 was on the Seven Stages Of Empire and was a great history lesson even for those of us well steeped in precious metals and sound money. But at 30 mins not everyone will sit down […]read more… |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1819.18/ oz | US $1416.23 / oz |

| Spot Silver | |

| NZ $31.54/ ozNZ $1013.98/ kg | US $24.55/ ozUS $789.38 / kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$1098.76

(price is per kilo only for orders of 5 kgs or more)

(delivered and fully insured)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Gold Prices | Gold Investing Guide Could NZ Take a Pounding Like Emerging Market Currencies?