By Hugo Salinas Price

I have kept track of International Reserves (excluding gold) for many years, with data helpfully provided every week by Doug Noland, at prudentbear.com, who obtained the information from Bloomberg.

Here is the graph I have elaborated with data since 1948, when there was still a modicum of reason operating in the financial world.

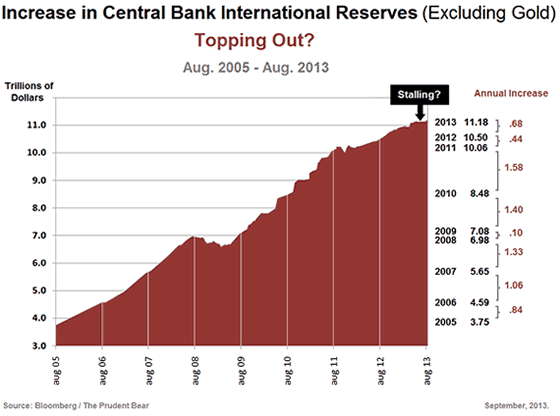

Lately, I worked out a graph showing in more detail the growth of these reserves in the period from August 2005 to August 30, 2013.

I draw your attention to the slump in reserves which took place during the year 2008-2009. It was an ugly period, financially.

Then, notice the slowdown in growth of reserves during the past two years (24 months).

Finally, notice that growth in reserves has stalled in the last few months of this year. Growth appears to be topping-out. Since April 13, when reserves passed the $11 Trillion mark at $11.082 Trillion, in the four months to August 30, they have only increased by $86 billion – 0.78%

If the growth in reserves registered from August 2009 to August 2011, which averaged $1.5 Trillion yearly, had continued from August 2011 to August 2013, international reserves would now be over $13 Trillion; as it is, they are stalled at just over $11 Trillion. $2 Trillion are missing!

International reserves have two sources of growth:

- Accumulation of Bonds (mainly Euro and Dollar Bonds) in central banks of the exporting nations, which come about due to export surpluses with which the exporters purchase bonds issued by the importing countries.

- Accumulation of interest earned on the bonds, re-invested in bonds.

The international reserves are thus a measure of the credit which the exporters are willing and able to grant the purchasers of their exports.

If international reserves are not growing, but stalling out, this means that the exporting countries are not extending further credit, for whatever reasons, to the importing countries, mainly the US and the Euro Zone.

Born of the liberation of the world’s money from the shackles which tied it to gold under Bretton Woods, the world’s great credit-expanding machine is slowing down. $2 Trillion in international reserves have not been generated in the last 24 months. The cause must be a decline in international trade, through which enormous export surpluses of the East were sold to the West on credit, and the East received bonds for the extended credit. The market for government bonds of the West has been the eastern exporting countries, which have used their vast export surpluses to invest in western bonds.

If the exporting countries – the East – are slowing down on bond purchases, it most likely means they have less surplus left with which to purchase the bonds. Of course, they might have generated surpluses and used them to invest in the “Emerging Markets” – another name for what used to be called the Third World. Perhaps they are buying up the underdeveloped and chronically deficit-ridden Third World? That may be, but such a policy could hardly account for a $2 Trillion slow-down in growth of international reserves.

A $2 Trillion market for bonds has not materialized in the last two years; it is no wonder that the Fed has stepped in with QE to purchase the bonds which must be sold to keep the US Government in operation, not to mention to stave off utter collapse if the word were to spread that “There is no market for US and Euro Bonds at the volumes that the sellers require!”

The US and the Euro Zone are finding that they cannot float further credit in the exporting countries. This is a serious condition; the West depends on a market which will accommodate its expansion of credit – a market for its government bonds – for without that continual expansion the whole house of financial cards comes crashing down.

There appears to be no further market where the US and the Euro Zone can float their bonds. The only recourse is to monetize their government debt (QE) and that means monetary inflation.

The consequence of monetizing debt will have to be rising interest rates.

If the government debt were not monetized, US and Euro Zone bonds would have to be thrown on the world market, but – who would purchase them? Interest rates would skyrocket, even if there were possible buyers, which is doubtful.

As it is, the US can only continue to monetize government debt. Higher dollar interest rates are inevitable and will cause further government deficits; the debt overhang in both the US and Euro Zone is so great that a rise of a few points in interest rates will explode the deficits, and so on and so forth.

Bottom line: Stalling growth in International Reserves tells me that a world financial collapse is in the offing.

Please draw your own conclusions.

This article originally appeared at plata.com.mx

Pingback: Gut Reaction on Gold and Silver | Gold Prices | Gold Investing Guide