Gold Survival Gold Article Updates

September 18, 2013

This Week:

- More Shenanigans in Gold

- Summary of last weekends Auckland, NZ, Presentation by Ronald Stoeferle

- Chris Powell of GATA in Auckland, NZ on Monday 14 October

- Gut Reaction on Gold and Silver

More Shenanigans in Gold

Well the price fell over the past week even more than we suspected it might. Gold in NZD is down just over $100 an ounce from a week ago at $1594. A move lower of 6%. You can see in the chart below that it has retraced just as rapidly as they came, all of the gains made in August.

Note how we have gone from overbought to almost oversold in the space of 2 weeks (see the RSI in red circle).

Silver has not yet retraced all of its August gains although is back down just under the 50 day moving average as well. But not quite so close to oversold as gold is. Down $2.13 an ounce on a week ago at $ NZ$26.47 or 7.44%.

The local precious metals prices have been impacted by the NZ dollar having a large move in a week of 2.16%. At 0.8226 from 0.8052 last Wednesday.

Coupled with the large moves down in USD priced gold through the important US$1350 support level on the back of a suspiciously large sell made at 2am New York time of 2000 contracts or 200 Tonnes! Marketwatch reported that:

—–

“…at 2:54:05 a.m. Eastern time, about 2,000 December gold futures contracts traded in a second, taking prices down from $1,354.80 to $1,344.50 and a trip in the circuit breaker shut down trading for 20 seconds.

‘Nanex said on its website that a closer look at the data reveals that the action was mostly likely caused by one large order to sell at the market.

‘The large order came “completely out of the blue,” said Eric Hunsader, a spokesman for Nanex. “There was very little other activity around that time.”

‘The halt was the “longest I’ve ever seen for major commodity futures,” he said, adding that 5 seconds is the norm.”

—–

“Funny” how we have seen a number of these large sell orders in times of low liquidity in recent months which makes no sense if you were trying to sell and make the most profit you could. Also they seem to come around important technical support levels that then trigger further sales when the main US markets open.

Actually, on second thoughts, maybe they do make sense from a profit perspective if the “seller” also has shorts placed below the technical support zone. Thus allowing them to then buy these back at a profit.

Some may find it discouraging that the price seems to be manipulated lower. However on Saturday night at the Library of the Holy Trinity Cathedral in Parnell Auckland, Ronald-Peter Stoeferle (or Ronni as he introduces himself) made a good point when asked his opinion on “manipulation”. His answer paraphrased was:

—–

Whether you call this manipulation or rather an intervention? Governments and central banks intervene in currency markets, stock markets and bond markets. So why not in gold markets? It is in their interests to keep the price of gold from rising too fast.

However if they are intervening, then DOW theory (technical analysis) says a primary trend in a bull market can not be manipulated for long. So the true price will shine through in the end.

—–

We made a wad of notes and have written them up for the benefit of those who couldn’t make it on a wet Auckland Saturday afternoon. So be sure to check that out at the link below.

While much of his presentation is based upon his latest “In Gold We Trust” report (which you should read if you haven’t and is linked at the bottom of the summary), he also gave his thoughts on tomorrow’s “taper”, some predictions on Europe, and answered a number of questions at the end.

While much of his presentation is based upon his latest “In Gold We Trust” report (which you should read if you haven’t and is linked at the bottom of the summary), he also gave his thoughts on tomorrow’s “taper”, some predictions on Europe, and answered a number of questions at the end.

All of which we managed to scrawl down – hopefully with some degree of accuracy. If you were there and we missed something please add it in the comments at the end of the article or if you have any queries on anything please also ask.

Summary: Ronald Stoeferle’s Auckland, NZ, Presentation. Saturday 14/9/2013

It was a very enjoyable night and great to meet a few subscribers too. Ronni was very easy to listen to. A few of us were lucky enough to enjoy a dinner down the road with him afterwards and learn a bit about Austria and the similarities with New Zealand.

Chris Powell of GATA in Auckland, NZ on Monday 14 October

Speaking of manipulation in precious metals, a reminder that Chris Powell of GATA (Gold Anti Trust Action Committee) will be in Auckland, NZ on Monday 14 October for a one off presentation. Stay tuned for details of the exact time and place for that one. But it will be a daytime event as Chris and organiser Louis Boulanger fly out to the Sydney Gold Symposium later that afternoon.

But it will, like Ronni, be free to attend and a purely educational event!

A week later after Chris, John Butler author of “The Golden Revolution” will be in NZ too – Monday 21st and Tuesday 22nd. More details to come on that one also.

Other Articles This Week

The latest from our favourite billionaire, Hugo Salinas Price, is sobering reading for anyone who thinks we are out of the woods yet. His analysis of global central bank paper assets also fits in with one of Ronni’s charts in his latest “In Gold We Trust” report. He also mentioned it on Saturday evening – disinflation as he termed it, due to the UK and Eurozone actually reducing their money supply in the past couple of years has somewhat cancelled out the growth from the US and Japan and China. This is a must read for sure and not overly long either.

The latest from our favourite billionaire, Hugo Salinas Price, is sobering reading for anyone who thinks we are out of the woods yet. His analysis of global central bank paper assets also fits in with one of Ronni’s charts in his latest “In Gold We Trust” report. He also mentioned it on Saturday evening – disinflation as he termed it, due to the UK and Eurozone actually reducing their money supply in the past couple of years has somewhat cancelled out the growth from the US and Japan and China. This is a must read for sure and not overly long either.

Significance of Stalling Growth of International Reserves

Gold mining stocks or shares have certainly taken a beating in the past 2 years. Not so great if you’ve been a holder of them over this time. However it means there is a lot of upside potential for those who are interested in taking a position now. And master speculator Doug Casey is thinking now might be a good time to get on board a few specific types of companies.

Gold mining stocks or shares have certainly taken a beating in the past 2 years. Not so great if you’ve been a holder of them over this time. However it means there is a lot of upside potential for those who are interested in taking a position now. And master speculator Doug Casey is thinking now might be a good time to get on board a few specific types of companies.

Doug Casey: 3 Stocks to Own When Gold Recovers

Gut Reaction on Gold and Silver

Even with the smack down at the end of last week, and the Fed announcement tomorrow, we are leaning towards the lows of June holding. Why?

Sentiment is still very very negative to gold.

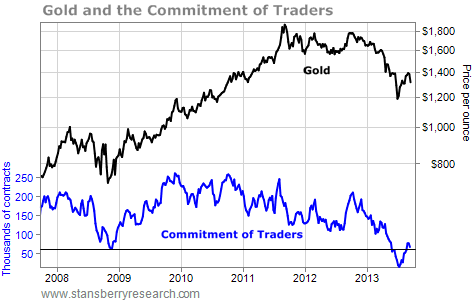

Firstly this can be seen quantitatively in the COT report from the paper COMEX futures market as noted on the Daily Wealth site this morning:

—–

“The last time gold was even close to this hated was back in 2008… And it soared 71% in the following 13 months.

This time around, it could go even higher. You see, gold is even MORE hated than it was in 2008…

The clearest measure of how hated gold has gotten is what real traders are doing with real money. And the real money has bailed on gold…

A couple of months ago, the Commitment of Traders report showed that “large speculators” – hedge funds – were more bearish on gold than they have been in years.

Take a look at the chart below. You can see how these large speculators bailed out:”

—–

So while we are up from the lows of June in the COT data we are only back to the level of the 2008 plunge!

Secondly we are witnessing it in the Western physical markets. Take this recent Bloomberg headline:

—–

Gold sales from Australia’s Perth Mint tumble in August

“Sales of gold coins and minted bars dropped 46 percent to 30,430 ounces last month from 56,488 ounces in July, according to data from the mint. Demand in August was 73 percent lower than the pace in April, when bullion entered a bear market.”

—–

Although the story reports they tumbled this was of course from a higher than normal level due to the buying surge that occurred after the April plunge. Nonetheless they are still well down on March it seems too.

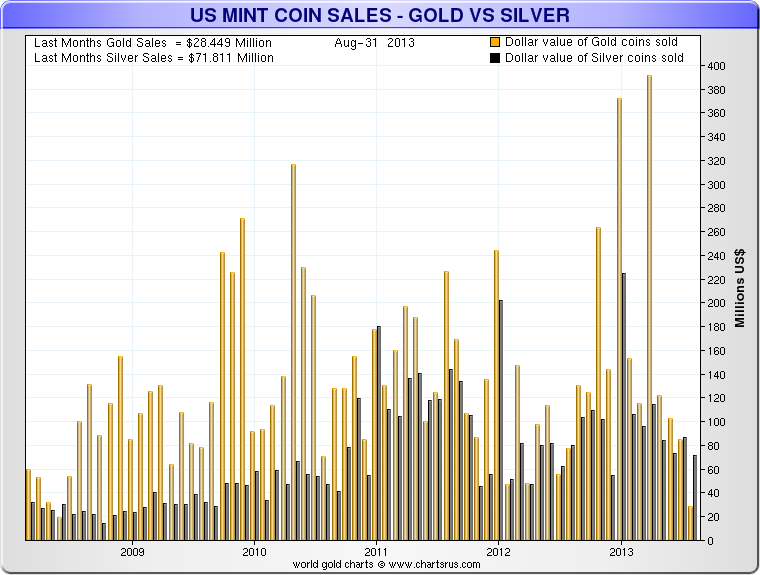

The US Mint also had its lowest sales of gold coins in 6 years according to the story.

—–

“The U.S. Mint sold 11,500 ounces of gold coins in August, the lowest since July 2007 and down from 50,500 ounces in July, according to that mint’s data. Coin sales have dropped since April, when they surged to a 40-month high of 209,500 ounces.”

—–

We wrote back in May “our hunch is that the bottom will arrive when there is very little buying interest (in the western hemisphere at least!)”.

And we noted in our feature article last week that there is a distinct lack of buying locally. These figures from the Perth Mint would seem to support this. As does the data from the US Mint. The chart below clearly shows the drop off in Gold from the US Mint from April to August. Although of interest is that the silver drop off has been nowhere as large in percentage terms.

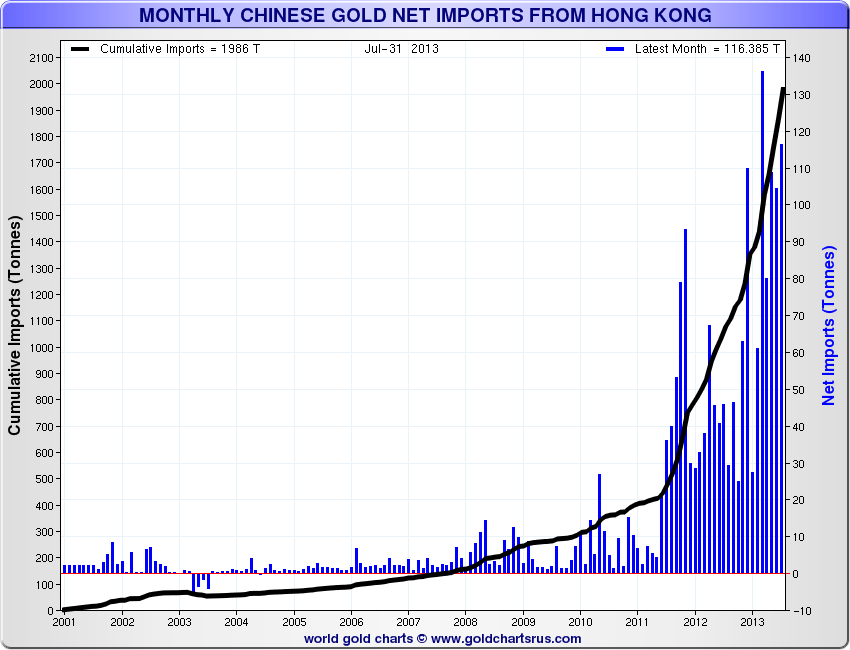

However China seems to so far be continuing to make up for the lack of demand in the West.

Chinese gold purchases for July exceeded 100 tonnes yet again as they did for the previous 4 months too.

Clearly seen in Nick Laird’s chart below.

So with these reports of reduced demand in the west, this could all be further evidence of the bottom being in as there does seem to be “very little buying interest (in the western hemisphere at least).”

Locally we are also not seeing much buying going on of late either. In the past, while somewhat anecdotal, we have seen this occur around lows too. As we said last week in our article NZD Gold and Silver Update: Is the Bottom in this Time?

“…on balance, the lack of buying at the moment could be the telling factor indicating a more lasting bottom is in.”

It’s a close call but our gut is that the lows of June will hold. Tomorrows Fed announcement will be interesting but it could be with the whack down last week that any reduction in printing from the Fed may already be priced into gold and silver. If you want to hold your nose and buy, or if you feel compelled to tomorrow after the Fed announcement you know where to find us:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Gold Wins Regardless |

2013-09-11 01:07:16-04Gold Survival Gold Article Updates: Sept. 11, 2013 This Week: NZD Gold and Silver Update: Is the Bottom in this Time? Trouble Continues in Emerging Markets Gold doing its job in India Gold Wins Regardless Overnight gold and silver have both backed off a bit further and coupled with a stronger NZ dollar […] 2013-09-11 01:07:16-04Gold Survival Gold Article Updates: Sept. 11, 2013 This Week: NZD Gold and Silver Update: Is the Bottom in this Time? Trouble Continues in Emerging Markets Gold doing its job in India Gold Wins Regardless Overnight gold and silver have both backed off a bit further and coupled with a stronger NZ dollar […]

|

| Doug Casey: 3 Stocks to Own When Gold Recovers |

2013-09-11 19:26:28-04Gold mining stocks or shares have certainly taken a beating in the past 2 years. Not so great if you’ve been a holder of them over this time. However it means there is a lot of upside potential for those who are interested in taking a position now. And master speculator Doug Casey is thinking […] 2013-09-11 19:26:28-04Gold mining stocks or shares have certainly taken a beating in the past 2 years. Not so great if you’ve been a holder of them over this time. However it means there is a lot of upside potential for those who are interested in taking a position now. And master speculator Doug Casey is thinking […]

|

| Summary: Ronald Stoeferle’s Auckland, NZ, Presentation. Saturday 14/9/2013 |

2013-09-17 00:48:24-04In Gold We Trust: Why Gold Insurance is More Important Now Than Ever. With his dry Austrian wit Ronald-Peter Stoeferle opened his hour plus talk with a few interesting anecdotes regarding Austria (his home country) being to Germany what New Zealand is to Australia. Namely the little brother and often mistaken for one and the […] 2013-09-17 00:48:24-04In Gold We Trust: Why Gold Insurance is More Important Now Than Ever. With his dry Austrian wit Ronald-Peter Stoeferle opened his hour plus talk with a few interesting anecdotes regarding Austria (his home country) being to Germany what New Zealand is to Australia. Namely the little brother and often mistaken for one and the […]

|

| Significance of Stalling Growth of International Reserves |

2013-09-17 01:48:43-04To follow is a warning from Mexican Billionaire Hugo Salinas Price. His analysis of Central Bank Paper Reserves is very telling. It is also quite timely with the US Feds announcement on a possible reduction in their currency printing due this week. The analysis shows just how big a conundrum the Fed finds itself in with regard to […] 2013-09-17 01:48:43-04To follow is a warning from Mexican Billionaire Hugo Salinas Price. His analysis of Central Bank Paper Reserves is very telling. It is also quite timely with the US Feds announcement on a possible reduction in their currency printing due this week. The analysis shows just how big a conundrum the Fed finds itself in with regard to […]

|

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1594/ oz | US $1311.22/ oz |

| Spot Silver | |

| NZ $26.47/ ozNZ $851/ kg | US $21.77/ ozUS $700.03/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$924.37

(price is per kilo only for orders of 5 kgs or more)

(delivered and fully insured)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Gold Prices | Gold Investing Guide Another warning on interest rates and the NZ dollar