There can now be little doubt. A new secular bull market in gold is underway. A bull market refers to a market where the price is rising. As opposed to a bear market where the price falls.

In NZ Dollars gold has quietly been in a bull market since 2014. Even in US Dollars gold has been rising since late 2015.

But hardly anyone has been interested until the past few months.

In fact it wasn’t until late June when gold broke out to multi year highs in US dollars that people started to take notice.

A New Gold Bull Market is Underway

Even though we buy gold here in New Zealand in New Zealand dollars, it still seems to be the US dollar price that most people take notice of. (For more on why you shouldn’t do this see: Why You Should Ignore the USD Gold Price When Buying Gold in New Zealand).

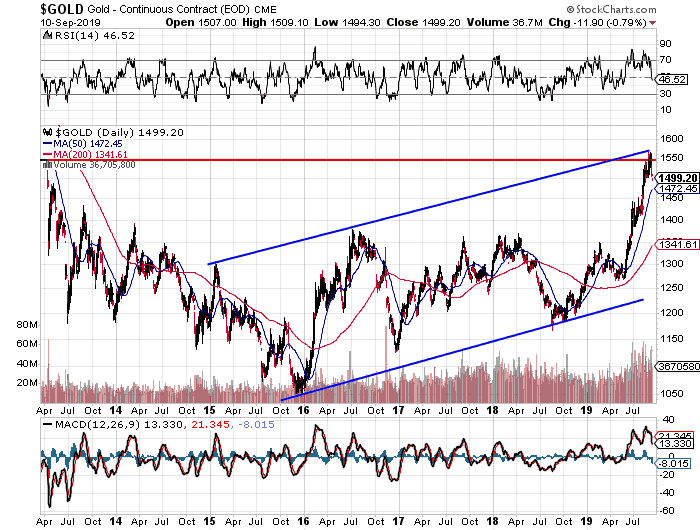

So it’s this USD gold chart that has gotten people interested…

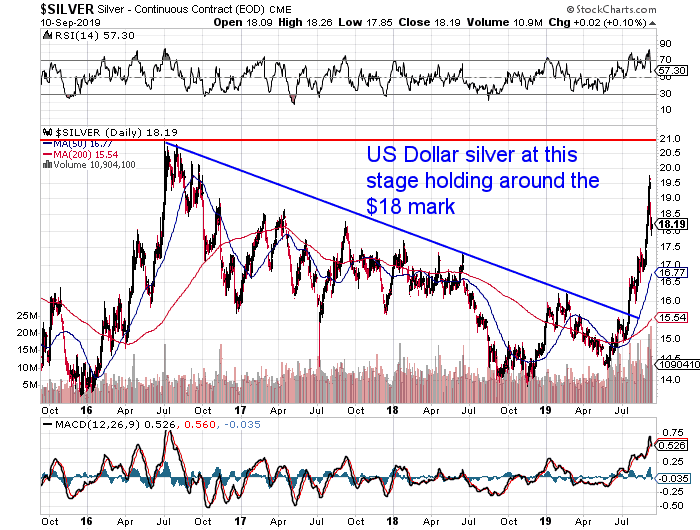

Silver has also joined the party over the last month. Another confirmation that we are once again in a precious metals bull market.

So far the market has played out much as we suspected it would. At the end of July we outlined our thesis for why there wouldn’t be much, if any, of a correction in the short term. Sure enough gold continued to rise after only a brief pause. Right the way through August in fact.

Gold is Falling. Is the Rise Over Already?

But after such a strong run higher gold has fallen sharply over the past few days. Silver even more. So some might be thinking the run higher has stopped already.

Why This Correction May Only be a Brief One

While a pause is quite healthy, there is a chance this correction could be quite brief and short-lived. We’ll outline some of the reasons why below…

A bull market rides higher with lots of smaller gains stitched together over many days or weeks. In the case of the recent gold bull run we have hardly seen a down day since this current breakout began in May. Just a couple of short sideways consolidations.

So then to make up for these we will see a short sharp downdraft. Often this may occur over only a day or a just number of days.

This is what seems to be taking place right now. Over the past few days we’ve seen silver with sharp falls such as of about 5% and 3%. But after a near vertical rise this shouldn’t be a surprise. While gold has had down days of about 2% and 1%.

That is the way a bull market operates. It likes to take as few people along for the ride as possible. These sharp plunges scare new buyers off. Even though overall the market is still sharply higher.

Now the difficulty is in picking when to buy if you have been waiting.

While it is tempting to think gold and silver will fall further, we’re not so sure.

Gold may not get back much below US$1500.

In the early phases of a bull market, many people get stuck on the sidelines waiting for the bottom they think is coming. Or, even if their target price arrives, they fear even lower prices are still ahead. So they continue waiting.

What we’ve seen happen before is that when precious metals prices start rising again, they do so with even fewer people on board than before the sharp falls began.

Most Have Yet to Accept That a New Precious Metals Bull Market is Underway

Alasdair Macleod shared this tweet recently. Pointing out how most people have so far completely missed the gold rally. So the bigger move is yet to come…

No One “Buying the Dip”

Here’s another indicator that points to the current correction being a pretty short shallow affair…

Even though gold and silver prices are down from recent highs, so far this week we’ve had very few transactions. So to us it seems like very few are buying this dip.

That could be a contrarian indicator that prices won’t go too much lower. Perhaps we’ll instead see some sideways movement for a period of time? Maybe a few weeks?

Why the Next Wave Up Could Be Even Bigger

But regardless of whether prices go much lower than this, we believe are precious metals bull market is underway. Higher prices are ahead.

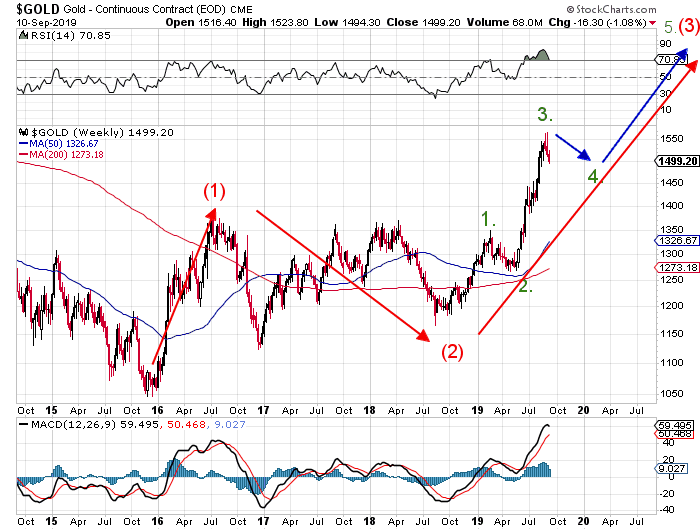

Elliot Wave theory predicts where prices may move to in a series of “waves”. We won’t get into it in too much detail here. But basically it consists of 5 waves:

Wave 1 – Up

Wave 2 – Down

Wave 3 – Up

Wave 4 – Down

Wave 5 – Up

These waves each fit inside a larger 3 wave structure:

Wave (1) – Up

Wave (2) – Down

Wave (3) – Up

The current wave structure looks promising.

In the precious metals sector, history shows that the most “impulsive” move often comes in the 5th of these waves.

Which wave are we in currently?

We’ve plotted a few numbers on this weekly chart below. It’s possible that the current move lower is the 4th wave of 5, inside the 3rd wave of 3. History shows this wave 4 down might be a fairly shallow and brief fall.

Then to follow will be the 5th wave.

As already noted this may be the most dramatic. So we could be in for quite a ride.

Here’s a thought that ties into what we wrote about earlier…

The fact that buyers are scared off in the wave 4 fall, might be why the 5th wave up is also often the strongest one? As these buyers who have been on the sidelines enter the market, it pushes the price higher again.

Here’s a good point made in an email a client sent to us this past week too:

“It will be [a] bigger move [in gold] than the last time [10 years ago], because of the current financial reset debt levels & the likely QE ‘cures’ that will follow.

We are more globally synchronized in potential debt failure, Australia, NZ & China have joined the debt zombies of Europe & The Sub-Prime Car Loans, Student Debt & Echo-Property re-inflate of the US.”

What Could Drive the Gold Bull Market Even Higher?

Here’s what Graham Summers believes could send this bull market much higher than most would expect…

Central Bankers Are Revving Up the Helicopters

By Graham Summers

Three former central bankers are openly advocating for central banks to implement “helicopter money” during the next economic downturn.

Helicopter money consists of the Fed printing money and funneling it directly into the economy by either:

– Directly financing government budgets.

– Paying money directly to citizens.The idea of helicopter money has been floating around economic circles for years, but to my knowledge this is the first time we’ve seen three former central bankers openly calling for it.

These central bankers are:

– Philipp Hildebrand: Former head of Switzerland’s central bank

– Stanley Fischer: Former vice-chair of the Federal Reserve

– Jean Boivin: Former Deputy Governor of Canada’s central bankPut simply, these are three HIGHLY connected and influential former central bankers. In this regard, their article can be considered a blueprint for what’s to come as far as central bank policy during the next economic downturn.

What’s Different About an “Impulsive” Bull Market Rally?

So an “impulsive” bull market rally (i.e. the 5th wave) may be the most dramatic. Here’s what’s also different about an “impulsive” rally…

The data we glean from the gold Commitment of Traders report may be less meaningful. The extremes we have been seeing in the commercial traders positions in the futures market have often pointed to reversals in the gold price. But in a bull market these may not mean much now:

What to Do if You’re Sitting and Waiting to Buy?

At the end of the day we, like anyone else you read, are merely guessing as to what the price of gold and silver may do in the short term.

But we are very confident that a new precious metals bull market is underway. So what price you buy at in the next few days or weeks may not be that material in the long run.

Therefore your best bet may be to split any funds you have into a few tranches. Then buy some gold or silver now and keep cash in case we see lower prices ahead.

This is a good tool to overcome the “analysis paralysis” that is common to first time buyers trying to time their entry.

If you’ve got any questions let us know here.

Pingback: The Correction is Here - Gold Survival Guide

Pingback: Gold Prices Moving in Tandem with Negative Yielding Debt - Gold Survival Guide

Pingback: Is Now a Good Time Buy Gold in New Zealand? - Gold Survival Guide

Pingback: NZ Housing to Gold Ratio 1962 - 2019: Measuring House Prices in Gold

Pingback: When to Buy Gold or Silver: The Ultimate Guide (Updated 2019) - Gold Survival Guide