We first met Darryl Schoon in 2009 in Canberra, and had an interesting conversation with him at the airport on the subject of inventor and futurist Buckminster Fuller. Interestingly he refers to that 2009 symposium and Bucky Fuller in this article where he also covers golds ascent and subsequent fall, along with Professor Fekete’s backwardation thesis and the “end game”. Plus a mention of a couple of books, one of which we’ll have to check out ourselves as we hadn’t come across it previously. Plenty to sink your teeth into as always from Darryl and details of what looks to be an interesting conference coming up shortly if you are in or can make it to the USA…

THE PRICE OF GOLD AND THE ART OF WAR Part IV

If you wait by the river long enough, the bodies of your enemies will float by

Sun Tzu, The Art of War, 5th century BC

WHITHER GOLD

After the 1999 gold crisis, bankers could no longer force the price of gold lower by loaning central bank gold and selling it in the open market. In 2001, as demand—and the price of gold—rose, the bankers were forced to flood markets with discounted ‘paper gold’, gold futures, i.e. paper promises of future gold deliveries at lower prices, in order to contain gold’s rising price.

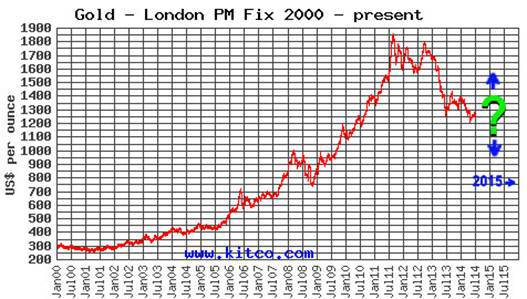

GOLD’S CONTROLLED ASCENT: 2001 – 2011

The bankers sold their paper promises of cheaper gold on COMEX to contain gold’s rising price in an acceptable range for the next ten years, i.e. a controlled ascent, with two notable exceptions. The first was the 2008 global economic collapse. The second was the euro zone sovereign debt crisis in 2011.

In both crises, the price of gold began to rapidly rise, breaking above the bankers’ control at A and B (see gold trendline chart); when increasingly fearful investors turned to gold signaling that a severe financial crisis was underway; a signal bankers’ feared could destroy confidence in their lucrative and long-running ponzi-scheme of credit and debt.

GOLD TRENDLINE 2000-2014

Severe financial crises such as the 2008 global economic collapse and the 2011 eurozone crisis are an anathema to the bankers’ confidence game of credit and debt; a game where confidence is critical to keeping credit and debt circulating in increasing amounts and sufficient velocity, a monetary phenomena masquerading as growth necessary to pay down constantly compounding debts accrued when money is issued in the form of credit from central banks.

If investors suddenly withdraw from stocks and bonds and buy gold and silver, the price of gold and silver will explode upwards triggering an exodus from stocks and bonds; and the bankers’ ponzi-scheme will collapse as the circulation of credit and debt will fall below the levels necessary for markets to effectively function—this is the raison d’être for the bankers’ war on gold.

If you know the enemy and know yourself, your victory will not stand in doubt; if you know Heaven and know Earth, you may make your victory complete.

Sun Tzu, The Art of War, 5th century BC

GOLD’S ASCENT AND FALL: 2011 – 2015

It was the 2011 eurozone crisis (the second breach, B, of the gold trendline) that is responsible for gold’s present malaise, i.e. its fall from $1900 to $1200. In the summer of 2011, the EU sovereign debt crisis had rapidly worsened and the price of gold skyrocketed, rising from $1480 in July to $1900 by September.

The explosive breach of the gold trendline in the summer of 2011 is responsible for gold’s subsequent fall and present low price. This is because gold’s near vertical ascent is what bankers feared most, a spectacular 28.4 % rise in two months; that, if allowed to continue, would signal to investors that it was time to trade their stocks and bonds for the safety and profits of gold and silver.

Of the bankers’ reaction, I wrote:

When Europe’s debt contagion spread in the summer of 2011, the price of gold began moving rapidly higher which bankers feared could itself turn into runaway contagion…Jesse’s Café Americain traced the planned ambush of gold by central banks during their September take-down…Gold had risen to a record high, $1900, on September 1st and on September 2nd, central banks then took corrective action, dropping their lease rates for gold sharply lower into negative territory.

This meant that central bankers would actually pay bullion banks to borrow their gold and sell it on the open market. The new supplies of gold capped gold’s increasingly steep seven month rise and, by the end of September, the price of gold fell back to $1600.

After Sept 2nd, gold lease rates still remained negative, insuring a continued low price for gold even as the European debt crisis accelerated and the global economy slowed. This is exactly what central bankers intended. Gold is a barometer of systemic distress and central bankers wanted to conceal the flames rising from their now burning house.

drschoon,Gold Fire Sale, February 2012

After gold’s explosive breakout in 2011, the bankers have done everything in their power to force gold lower so investors will not be tempted to abandon increasingly volatile and unstable paper markets for the safety and upside of gold and silver.

This is why gold is $1,200 today instead of $2,200, $2,600 or higher. Demand for gold from the east—China, India and Russia—continues to increase, financial and geopolitical crises continue to proliferate and yet gold continues to trade in a moribund, depressed range.

Bankers have successfully overcome free market dynamics by distorting the price of gold primarily through the use of ‘paper gold’, gold futures sold at a discount enabling bankers to artificially force the price of gold lower.

In Gold Bulls Retreat As Short Holdings Rise to Highest Ever , Bloomberg News reported:

… The most-traded Comex gold option on Oct. 3, 2014 was for the right to sell December futures at $1,100 an ounce, or almost 8 percent below where prices ended the day… Short positions increased 4.5 percent to an all-time high of 81,262 contracts. The bearish holdings doubled since the last week of August.

As the pressure on the banker’s faltering ponzi-scheme continues to increase, so, too, does the bankers’ need to constrain the price of gold as another explosive breakout could gain sufficient momentum to overcome the bankers’ considerable resistance—a possibility that has stiffened the bankers’ already considerable resolve.

In the end game, however, resolve isn’t enough.

FEKETE, BACKWARDATION AND THE BANKERS’ END GAME: 2015 – ?

The conclusion from November’s missive is reiterated. November’s conclusion itself is a reiteration of the October missive’s conclusion. The bases for both metals – on both the nearest contracts – have moved into backwardation. The height of the backwardation has no precedent since 2008. For those heavily skewed towards silver over gold, the outperformance of silver is likely to commence with no notice.

Sandeep Jaitly, Fekete Research: Gold Basis Service, November 27, 2014

On November 9, 2014, Dr. Fraser Murrell’ article, Permanent Gold Backwardation = Global Meltdown– An analysis of the potential for permanent gold backwardation to lead to global financial crisis and an enormous increase in the gold price shed light on Professor Antal E. Fekete’s and Sandeep Jaitly’s work on backwardation and precious metals.

Dr. Murrell wrote:

Antal Fekete warned many years ago that a “permanent gold backwardation” would act as a financial black hole that would consume the entire global financial system…some “financial experts” (who have called Fekete a “pseudo-expert”) including Dr Tom Fischer with help from Bron Suchecki (Perth Mint), have claimed that backwardation represents nothing special and that it creates no arbitrage opportunity and so it has NO effect on the economy.

However, their argument fails to understand the nuance of “fractional reserve bullion banking” whereby (in addition to buying and leasing physical gold) a bullion bank can create (out of thin air) and sell into the market gold certificates which carry none of the costs of holding physical gold The extra saving results in the arbitrage.

… (1) when there is high market demand for physical relative to future gold, the bullion banks can arbitrage by selling (expensive) spot certificates and buying (cheap) futures, and (2) when there is high market demand for future gold relative to spot gold, the bullion banks can arbitrage by buying back (cheap) certificates and selling (expensive) futures.

There is however one obvious risk in this business, namely that they get stuck with a full arbitrage book in a permanent backwardation – whereby they have sold (unbacked) gold certificates and the market never swings back into a contango to let them out…

… Over the last three years the bullion banks and governments have tried to break the backwardation and normalize the economy by dumping huge amounts of physical gold and “paper gold” at the gold spot price.

But they have failed, because although they have reduced the gold price from $1,900 back down to $1,200, they have not been able to create a lasting contango. Instead, the gold buyers and hoarders have dug in, bought everything and demanded more – which has only strengthened the backwardation.

Sooner or later, the bullion banks and governments will run out of ammunition and they will be forced to step back and allow the market to do its thing…The gold price will eventually peak in the tens of thousands of dollars and unless the bullion banks unwind their short positions, they will either default or go bankrupt.

I count Professor Antel E. Fekete and Sandeep Jaitly as colleagues and friends. In 2009, I was in Canberra, Australia at the Gold Standard Institute symposium as a speaker with Professor Fekete and Sandeep Jaitly when Bron Suchecki spoke, not as a representative of Perth Mint but as one whose knowledge about the gold refining industry contributed needed light on an otherwise opaque subject.

Dr. Murrell’s article, however, on Professor Fekete and backwardation sheds even more light on an even more opaque subject—the backwardation of gold and silver in the end game. Professor Fekete’s thesis that permanent backwardation in the end game will lead to hyperinflation and a total collapse of fiat money and the triumph of gold is in line with my own prognosis.

A recent book, Gold Value and Gold Prices, 1971-2021 by Gary Christenson also bears special attention regarding gold’s price in the end game; although it should be noted the dollar terms in which Gary Christenson values gold are subject to extreme change should hyperinflation destroy fiat currencies as current currency yardsticks may not be tomorrow what they are today. In such terms, gold’s final resting place will be far higher.

I also recommend Fiat Paper Money; The History and Evolution of our Currency by Ralph T Foster, a disturbing book that should be given perhaps as a gift to all economic Luddites who still believe paper money, stocks and bonds will hold their value in the coming days.

On January 24th in Spokane, WA, I, and noted silver expert, David Morgan along with Marshall Thurber will present The Checkerboard Game—the Future of Money, Power and Consciousness, for event details see http://drschoon.com/events/.

When David Morgan suggested the topic of change should be covered in addition to gold and silver, I asked Marshall Thurber if we could do The Checkerboard Game, a profound life-altering experience about economic and social change, a game he had created for the Positive Deviant Network where I had presented my paper predicting a cataclysmic economic collapse. This will be the first time The Checkerboard Game will be available to the public.

In my current youtube video, The Checkerboard Game and the PDN, I talk about how The Checkerboard Game was created. Marshall was a student of both Buckminster Fuller and Edwards Deming (the father of the quality revolution), two of the greatest minds of the 20th century.

Today, in January 2015, we are well into the end game. Capitalism’s fatal wasting disease, deflation, is gaining momentum around the world as it also did during the 1930s. The present power structure does not have much time left. Its fall has begun and so has the emergence of the better world to come.

Buy gold, buy silver, have faith.

Darryl Robert Schoon

Pingback: Predictions for 2015 - both ours and others - Gold Prices | Gold Investing Guide