Prices and Charts

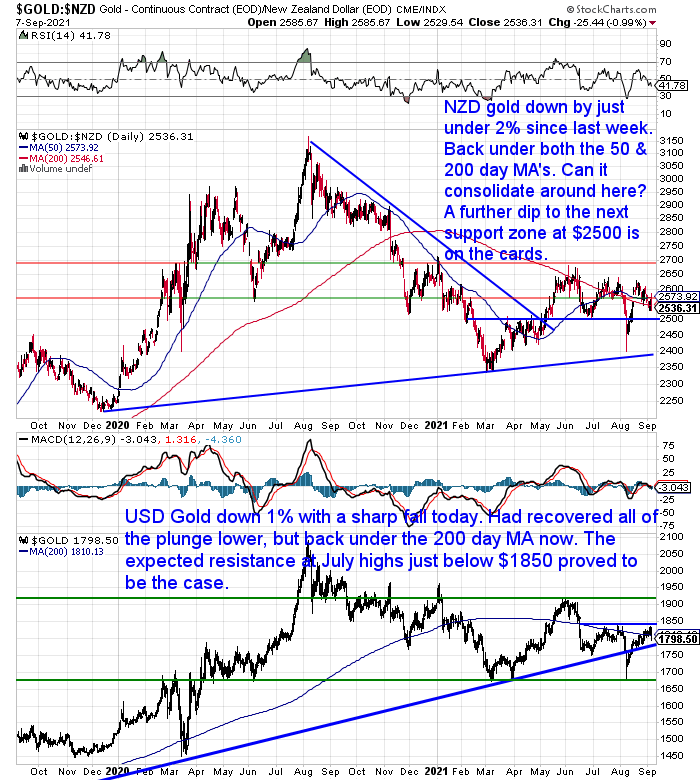

Volatile Week for NZD Gold

It’s been a fairly volatile week for precious metals. There was a big jump higher over the weekend, but then a sharp pullback overnight. As a result gold in NZ dollars is down just under 2% from 7 days ago. Back under both the 50 and 200 day moving averages.

So there is now a higher chance that we could see a further dip down to the next support line at $2500.

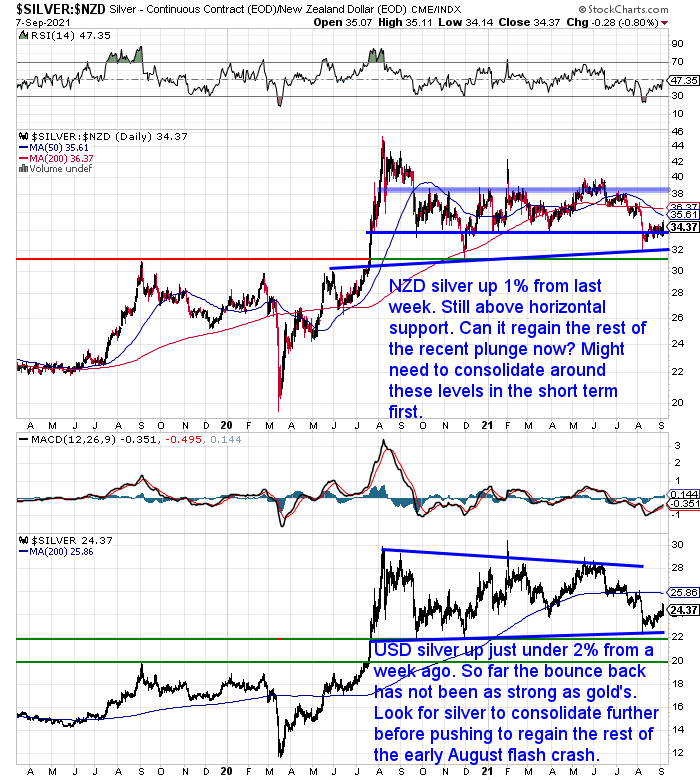

NZD Silver Doing Better Than Gold – Up 1%

Meanwhile silver in New Zealand dollars followed gold higher over the weekend. But the jump was bigger. And while silver also pulled back overnight it was not as much as gold. So, unlike gold, silver is actually up close to 1% from 7 days ago.

Although silver is still yet to regain all of the plunge from the flash crash. So it might need to consolidate a bit further around current levels.

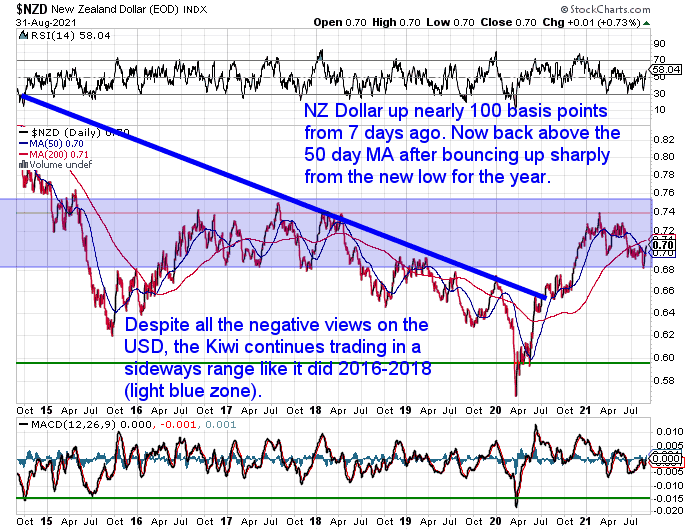

NZ Dollar Continues to Strengthen

The New Zealand dollar was up 50 basis points or 3/4 of a percent. But is down a little from highs hit earlier in the week after getting close to overbought. So a further pullback might be in order after such a huge run higher over the past couple of weeks.

We also take a closer look at the Kiwi dollar in this week’s feature article below.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

The Strengthening NZ Dollar – How Will This Affect Gold Bought in NZ in 2021

This week’s feature article examines the New Zealand dollar in more detail. We look at whether expectations of an ongoing strengthening of the Kiwi are justified. And what this might mean for buying gold and silver here.

Also our thoughts on risks to the New Zealand economy and recovery.

It covers:

- Gold, Silver and NZ Dollar Exchange Rates: A Reader Question

- NZ Dollar Strong Relative to What?

- What Does the NZ Dollar Do Versus Gold (and Silver)?

- New Zealand Has Downside Risks Still

- Likely All Fiat Currencies Will be Devalued

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Question of the Month Winner

Congratulations to S.H. who is the winner of our question of the month for August.

A 1oz silver coin is on it’s way to her for her question which proved popular with other people too:

“Would the government be able to confiscate gold I own in NZ for any reason?”

Here was out response in case you missed it last month:

Gold Confiscation | Could it Happen in New Zealand Today?

Two Veteran Investors Recommending Gold

Veteran investor and founder of Mobius Capital Partners, Mark Mobius said that investors should look to have 10% of a portfolio in gold as he expects currencies to be devalued following the unprecedented stimulus rolled out to fight the covid pandemic.

At this stage, “10% should be put into physical gold,” said Mobius in an interview to Bloomberg adding that currency devaluation globally is going to be quite significant next year given the incredible amount of money supply that has been printed.

Source.

Around the same time David Paulson – the former hedge fund manager who generated $20 billion during the 2009 financial crisis also said that gold is set to go parabolic like it did in the 1970’s…

“Paulson, 65, is increasingly concerned about rising prices, he said in an episode of “Bloomberg Wealth with David Rubenstein.” The rapidly expanding money supply could push inflation rates well above current expectations, he said, and gold, which he’s backed for years, is primed for its moment.”

Source.

In answer to the question, “Do you think that gold is a good investment at this price?”, he replied:

“Yeah, we do. We believe that gold does very well in times of inflation. The last time gold went parabolic was in the 1970s, when we had two years of double-digit inflation.

The reason why gold goes parabolic is that basically there’s a very limited amount of investable gold. It’s on the order of several trillion dollars, while the total amount of financial assets is closer to $200 trillion. So as inflation picks up, people try and get out of fixed income. They try and get out of cash. And the logical place to go is gold. But because the amount of money trying to move out of cash and fixed income dwarfs the amount of investable gold, the supply and demand imbalance causes gold to rise.”

You can read and watch some highlights of the interview here.

If you’re keen to follow these veterans into gold or silver then please get in touch.

While Auckland remains in Level 4 we can continue to take orders and lock in prices for gold and silver. However like last year, dispatch of orders will have to wait until the lockdown is lifted and normal courier deliveries resume. Although, currently imported orders are continuing to be delivered via Fedex. So that is an option if you are looking to spend more than around NZ$10-15,000.

Please get in contact if you’d like a quote or have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Is One of Our "Two Veteran Investors Recommending Gold", the COMEX Whale? - Gold Survival Guide