Gold Survival Gold Article Updates:

October 02,2013

Note: We have a late notice today only special on Canadian Silver Maples. Jump to the end of the email if you want to see that before 5pm.

This Week:

- US Govt shutdown vs the debt “ceiling”

- How Likely is a Taper Really?

- See John Butler of Amphora Capital Live In Auckland or Wellington

- One day only special on Canadian Silver Maples

There was another decent fall for gold and silver overnight.

Gold in NZ Dollars fell 2.66% from yesterday to $1558.78, or down 2.57% from a week ago where it sat at $1600.

Silver also took it on the chin falling 2.10% overnight to NZ$25.62, or down 2.40% from last week.

This fall puts things in a very interesting position. You can see in the 2 year gold chart below the price has spiked down to a similar level to the April lows but still above the June lows. For the reverse head and shoulders pattern, that we have featured in our daily price alert the last few days (go here to sign up for that) to play out, we will need to see a decent rise from around these levels now.

If that doesn’t happen and we head lower from here we may be in danger of seeing the June lows taken out. Below is a longer term chart that shows the next major support levels if that was to occur.

The technically important USD $1300 level was broken overnight which is probably what helped to send the price tumbling as traders would have had sell stops at this level. So we now wait and see if gold bounces back from these levels or not.

US Government Shut Down (But not for good unfortunately)

The US government shut down overnight didn’t offer any support to the price but judging by how sharemarkets went up overnight, any worry over this was probably already priced in to both shares and gold.

Odds are this shutdown will be a non event. They’ll cobble together an agreement of some kind before too long and get a budget put together and all the “non-essential” government workers will get back to doing whatever it is they do.

The debt “ceiling” is likely to be a bigger event in our opinion.

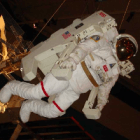

(We always like to put that in quotation marks as history shows it is anything but a ceiling) October the 17th is when the US government will somehow run out of jiggery pokery methods of staying under the current wee $16.39 trillion limit.

From Market Watch:

—–

“No talks are going on, and the president briefly called House Speaker John Boehner (R-Ohio) last Friday to reiterate he won’t negotiate. House Republicans worried about primary challenges in their safe GOP districts have dug in as well.

“The exit strategy for the debt ceiling is that one side will blink,” said Krueger. “Both sides are in their foxholes.”

The likelihood that the president will give in on this is “as close to zero as you can get in Washington,” said Krueger [Washington analyst for Guggenheim Partners]. “The president doesn’t have to run for re-election.” Unfortunately, everyone else does.

And the stakes of a technical default couldn’t be higher. “It’s something that could jar the entire global financial system, [which] is based on the premise that Treasurys are a riskless asset and you’re calling that into question…,” he said.”

—–

The last time there was a stoush over raising the ceiling it served to jolt the gold price higher . It would be logical to expect it to do the same this time. However with sentiment to gold currently near record lows it is anyones guess how gold will react in the short term. Longer term though history shows that the outcome should be a bit more certain.

Via the Daily Reckoning with data from the US Mint here’s why there is a correlation between US debt and gold:

—–

“Half of the $85 billion in assets the Fed buys every month are Treasuries. The Fed monetizes that debt by printing new money, transferring your purchasing power to the government as it increases its balance sheet. That pushes up the price of gold. Each dollar of federal debt the Fed monetizes brings the government closer its debt limit.

According to the International Business Times, former Mint director Edmund Moy directed his researchers to plot the correlation between gold prices and debt ceiling increases. Here’s what they found…”

—–

A couple things that stick out from the chart to us:

1. The gold price does indeed seem to rise in step with the US debt limit.

2. It’s interesting how the gold price seemed to get ahead of itself in 2011, jumping well above the debt limit but has now come back down below the current limit.

And so a perhaps not so bold speculation based upon this… The debt ceiling will again be raised and gold will before too long play “catch up” again as it has done for the past 5 years.

How Likely is a Taper Really?

Maybe even less likely now if we are to believe what various US Federal Reserve Bank members have been saying in the past few days.

They may get even more “freaky” yet according to one of its members…

—–

KOCHERLAKOTA SAYS FED MUST DO “WHATEVER IT TAKES” TO AID GROWTH

“…doing whatever it takes will mean keeping a historically unusual amount of monetary stimulus in place – and possibly providing more stimulus – even as: Interest rates remain near historic lows. Economic growth rises above historical averages. Per capita employment begins to rise appreciably. Asset prices rise to unusually high levels, leading to concerns about “bubbles.” The medium-term inflation outlook rises temporarily above 2 percent. It may not be easy to stick to this path.

But I anticipate that the benefits of doing so, in terms of employment gains, will be significant.” Source.

—–

On the same day Fed Governor Jeremy Stein also gave a speech which seemed to talk up the possibility of the Fed more closely targeting the labour market. i.e. the unemployment rate. He reckons they should link the pace of tapering to the unemployment rate, so the market knows exactly what the Fed is looking at. But of course he didn’t mention what rate exactly as a falling unemployment rate can be as a result of people giving up on looking for work!

While New York Fed President Robert Dudley said that “the amount of time that can pass between the decision to taper and actually raising short term interest rates could easily be a number of years”.

Meanwhile Chicago Fed President Charles Evans said that the timing on a reduction in bond purchases was ‘not yet certain’. He commented that the Fed may have to wait until 2014 to taper.

So these 4 comments all in a couple of days. Maybe the Fed is trying to tell us something? The point is we can expect more of the same from the Fed regardless as really they have very little choice. And if in doubt they will err on the side of caution which means more cheap money for longer. Hence an increase in the debt ceiling and a rising gold price.

Why do we pay so much attention to what the US federal reserve is up to?

As we state in the intro to one of this weeks articles “Well, with the US dollar remaining the global reserve currency, all those extra digital dollars they create find new homes across the planet including here. So it pays to keep one eye on US policy and the other on what is happening locally if you’re wanting to work out what bubbles will be created.”

And it seems asset bubbles are again being created the world over. Obviously you can’t have escaped the discussion in recent months here in NZ on rising house prices.

Similar in the UK where it is London experiencing significant house price rises.

While Australian capital cities also have hit new highs according to the latest data.

And at dinner with Ronni Stoeferle last month he reported similar froth in the Vienna housing market in his homeland of Austria.

So there could be a way to go yet for asset bubbles if the Fed and other central banks continue with the cheap money strategy. And Exter’s inverse liquidity pyramid shows it will be gold that is where this money escapes to last. So patience is a must as a precious metals holder!

Actually we almost forgot about silver!

So here is the NZD silver chart below. It’s not that dissimilar to gold. You can see the price is at a very similar level to the brief intraday dip that occurred in May of this year. And we are not a massive way from the June lows either. Not quite so symmetrical as the gold chart reverse head and shoulders but delicately balanced nonetheless too.

See John Butler of Amphora Capital Live In Auckland or Wellington

Details of number three in well known gold personalities to speak in NZ in September and October has just been announced this week. John Butler of Amphora Capital and author of The Golden Revolution will be speaking in both Auckland on Monday the 21 October and in Wellington on Tuesday 22 October. This is a paid event in association with the CFA Society of New Zealand. However admittance price does include a luncheon beforehand. See the link below for full details:

Details of number three in well known gold personalities to speak in NZ in September and October has just been announced this week. John Butler of Amphora Capital and author of The Golden Revolution will be speaking in both Auckland on Monday the 21 October and in Wellington on Tuesday 22 October. This is a paid event in association with the CFA Society of New Zealand. However admittance price does include a luncheon beforehand. See the link below for full details:

See John Butler of Amphora Capital Live in Auckland or Wellington

See Chris Powell of GATA Live in Auckland for Free

Last we heard there were still a few seats left to see Chris Powell of the Gold Anti Trust Action Committee on Sunday 13th October at 3.30pm. So if you missed our email last week or just haven’t gotten around to getting your complimentary ticket yet then get on and click the link below to read about how to get your ticket now before you miss out.

Last we heard there were still a few seats left to see Chris Powell of the Gold Anti Trust Action Committee on Sunday 13th October at 3.30pm. So if you missed our email last week or just haven’t gotten around to getting your complimentary ticket yet then get on and click the link below to read about how to get your ticket now before you miss out.

See Chris Powell of GATA Live in Auckland for Free

Other articles this week:

Just Say No to the Fed Head

Wondering what to expect from the front runner to be the next head of the US Federal Reserve? This article gives a good run down of her past and therefore what to expect for the future.

Wondering what to expect from the front runner to be the next head of the US Federal Reserve? This article gives a good run down of her past and therefore what to expect for the future.

Ground Control to Major Tom: Reserves Are in Jeopardy

And this one looks at the impact of the lower gold price on the reserves of gold miners and in turn on future global gold supply. Along with what opportunities this may bring.

And this one looks at the impact of the lower gold price on the reserves of gold miners and in turn on future global gold supply. Along with what opportunities this may bring.

Ground Control to Major Tom: Reserves Are in Jeopardy

Late notice special:

One of our suppliers has a “today only” special going on 500 Canadian silver maple coins – 1999 mintage. Until 5pm today these will be available for $14,625 pick up price or delivered for $14,720.75. At $29.25 per coin this is $920 less than the normal retail price.

The coins come in blister packs of 5×2 sheets of 10. They are Royal Canadian Mint sealed. First in – first served. Sorry for the late notice but only just heard about them in the last hour ourselves. Email or call now to grab them:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Chinese Housewives vs. Goldman Sachs: No Contest |

2013-09-24 18:06:23-04You’ve likely read a bit about the massive buying of physical gold going in the east. This piece has some interesting charts that show just how significant this buying is on a global scale… Chinese Housewives vs. Goldman Sachs: No Contest By Jeff Clark, Senior Precious Metals Analyst Goldman Sachs is once again predicting that […]read more… 2013-09-24 18:06:23-04You’ve likely read a bit about the massive buying of physical gold going in the east. This piece has some interesting charts that show just how significant this buying is on a global scale… Chinese Housewives vs. Goldman Sachs: No Contest By Jeff Clark, Senior Precious Metals Analyst Goldman Sachs is once again predicting that […]read more… |

| Another warning on interest rates and the NZ dollar |

2013-09-25 00:19:08-04LIVE SPOT PRICES/CHART Gold Survival Gold Article Updates: Sept. 25, 2013 This Week: The Big Picture is What Remains Most Important See Chris Powell of GATA Live in Auckland for Free Another Warning on Interest Rates and the NZ Dollar Not much change from last week with the local gold price today at $1600, […]read more… 2013-09-25 00:19:08-04LIVE SPOT PRICES/CHART Gold Survival Gold Article Updates: Sept. 25, 2013 This Week: The Big Picture is What Remains Most Important See Chris Powell of GATA Live in Auckland for Free Another Warning on Interest Rates and the NZ Dollar Not much change from last week with the local gold price today at $1600, […]read more… |

| Just Say No to the Fed Head |

2013-09-29 19:17:23-04You may have heard that Janet Yellen is likely to now front runner to take over from “helicopter” Ben Bernanke as the head of the US Federal Reserve next year. Why should we as NZers care who heads the US Central Bank? Well, with the US dollar remaining the global reserve currency, all those extra […]read more… 2013-09-29 19:17:23-04You may have heard that Janet Yellen is likely to now front runner to take over from “helicopter” Ben Bernanke as the head of the US Federal Reserve next year. Why should we as NZers care who heads the US Central Bank? Well, with the US dollar remaining the global reserve currency, all those extra […]read more… |

| See John Butler of Amphora Capital Live In Auckland or Wellington |

2013-09-29 20:57:47-04We now have details of the third well known gold personality to be brought to New Zealand by our friend Louis Boulanger: John Butler, Managing Partner and Chief Investment Officer of Amphora Capital based in London. John Butler will be speaking at two luncheons that are being sponsored by CFA Society of New Zealand. The […]read more… 2013-09-29 20:57:47-04We now have details of the third well known gold personality to be brought to New Zealand by our friend Louis Boulanger: John Butler, Managing Partner and Chief Investment Officer of Amphora Capital based in London. John Butler will be speaking at two luncheons that are being sponsored by CFA Society of New Zealand. The […]read more… |

| Ground Control to Major Tom: Reserves Are in Jeopardy |

2013-10-01 17:58:28-04The current low gold price spells trouble for some mining companies. Jeff Clark outlines how exactly, but also what the possible opportunity is for those in the know… Ground Control to Major Tom: Reserves Are in Jeopardy By Jeff Clark, Senior Precious Metals Analyst When you hear about the “gold reserves” a mining company has […]read more… 2013-10-01 17:58:28-04The current low gold price spells trouble for some mining companies. Jeff Clark outlines how exactly, but also what the possible opportunity is for those in the know… Ground Control to Major Tom: Reserves Are in Jeopardy By Jeff Clark, Senior Precious Metals Analyst When you hear about the “gold reserves” a mining company has […]read more… |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1558.78 / oz | US $1289.11/ oz |

| Spot Silver | |

| NZ $25.62/ ozNZ $823.77/ kg | US $21.19/ ozUS $681.26 / kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$895.23

(price is per kilo only for orders of 5 kgs or more)

(fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Gold Prices | Gold Investing Guide Why Bill Gross thinks interest rates will stay low