Gold Survival Gold Article Updates:

May 15, 2013

This Week:

- Negativity Remains High

- Where to for the NZ Dollar?

- Professor Fekete in Laymans Terms

- The End of QE?

Negativity Remains High

We’ve had a few people unsubscribing lately with comments like “I’ve lost $45k in silver and don’t want a reminder of it when I see your charts”. Or “Just too depressing”. (We don’t wish to bother anyone who doesn’t want to receive these weekly updates, feel free to unsubscribe at any time.)

While we understand why people might not want a daily reminder of prices if they are below where they purchased, we think this might be a bit of an anecdotal indicator that we are getting close to the bottom in prices. Further evidence we are edging closer to that point of maximum pessimism in precious metals and the time when things turn up. As we wrote at the start of the year…

“To be honest we wouldn’t be surprised to see them [precious metals prices] fall further yet. With the likes of Jim Rogers and Marc Faber both thinking gold may have further to fall yet it would be remiss of us to disagree with them. As we’ve mentioned many times in the past gold did fall 50% in the middle of the 1970’s bull market…

So our guess (and of course that is all it is) is we won’t see a 50% fall right at this stage. However in the first half of 2013 maybe there is a chance of prices falling further than they have to date though….”

We also thought that… “new highs could be on the way later in 2013 for both USD and NZD priced gold.

Why then?

Because that would make it a 2 year correction or consolidation for gold and an almost 2 and a half year correction for silver. We’d imagine that should be long enough to shake out all the latecomers and when the weak hands are gone is usually when the bull markets run strongest.”

At the moment new highs later in the year don’t seem that likely, but it would only take some unforeseen event to occur to usher in a speedy rise. But anyway our key point remains that the weak hands need to be flushed out and we may be getting closer to that point, but it still may take another downdraft yet to get complete capitulation.

The Charts

So how are we looking in terms of prices now? Does a downdraft look likely at the moment?

In last weeks article on silver we featured a chart showing a short term breakout may be coming as NZD silver had been trading in a narrower and narrower range. We said odds favoured a break lower given the intermediate trend has been down. How has it played out since then?

Well NZD silver has continued to trade relatively sideways, but since last friday when we published the chart it has edged slightly higher hinting at a break upwards in price. However we have also added a red line at the $29 level, as it is still yet to decisively break above this level. So still too early to call an upwards breakout we’d say.

Where to for the NZ Dollar?

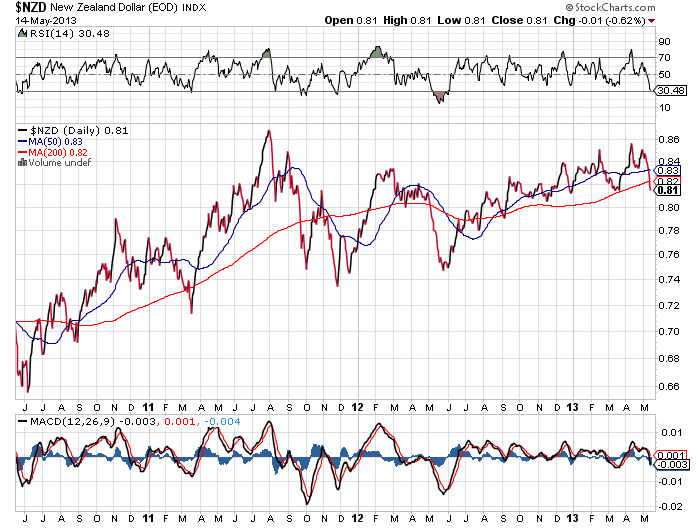

The trend of a lower kiwi dollar has continued since last week and so has effectively cancelled out the falling price of silver in USD. Hence silver has remained fairly flat in NZ dollars terms. You can see in the NZ dollar chart below this morning the dollar was below 0.82 for the first time since March and below its long term 200 day moving average for the first time since the middle of last year.

Where to now?

As we said last week we think the kiwi will have its turn to fall eventually, but perhaps not just yet. Seems it may be the Aussie dollars term at the moment. Back to the Kiwi, its getting close to oversold territory too on the RSI so we could see it bounce higher before too long.

Of course we’re not forex day traders! We just keep an eye on the big picture and the NZ dollar is part of that. Currently the big picture remains a strengthening kiwi dollar but remember precious metals are a hedge against a falling currency. And right now buying that hedge is comparatively cheap even with the dollar down from its highs.

How about Gold?

NZD gold continues to edge its way higher towards what will be major resistance at $1800, poking its head above $1750 earlier this week for the first time since the plunge. So not much change from last week really.

Professor Fekete in Laymans Terms

If you’ve followed our site for any length of time you’ll have no doubt read some of the work of monetary scientist Professor Antal Fekete. We posted a video interview with the Professor a few weeks back with links to more of his work contained in that.

Anyhow, one of the common criticisms of his work is that it is too “intellectual” for the layman. In the interview link above Max Keiser did a pretty good job of breaking down some of his ideas for us but really only touched on a few points.

This week we read a great interview with him over at the Daily Bell by Anthony Wile. It’s probably one of the best pieces featuring Professor Fekete that we’ve read. Simply because Anthony manages to get him to expand upon many ideas in much simpler terms than we’ve read elsewhere. It really is a must read. Interesting to hear the professor use the term hyper-deflation for the first time too and what he means by it…

This week we read a great interview with him over at the Daily Bell by Anthony Wile. It’s probably one of the best pieces featuring Professor Fekete that we’ve read. Simply because Anthony manages to get him to expand upon many ideas in much simpler terms than we’ve read elsewhere. It really is a must read. Interesting to hear the professor use the term hyper-deflation for the first time too and what he means by it…

Antal Fekete: Gold Backwardation and the Collapse of the Tacoma Bridge

China Continues Buying Up a Storm

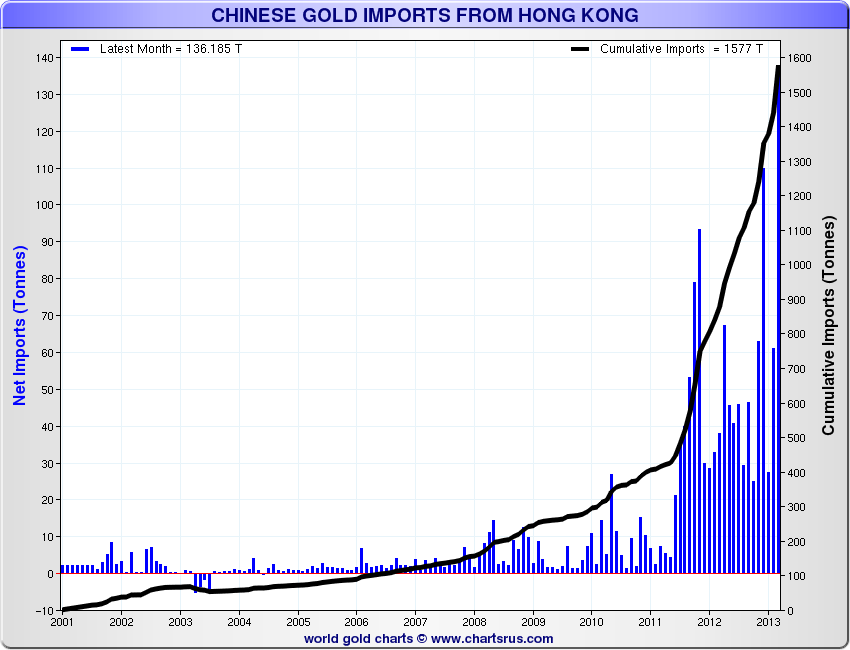

The chart of the past week was this one from Nick Laird of Sharelynx showing China’s gold imports via Hong Kong. We’ve seen other numbers stating imports at over 300 tonnes but we prefer Nick’s as they take into account the re-importing of gold back into Hong Kong so has a likely more accurate number of actual demand in China.

Nonetheless this chart shows a massive jump in March with 136 Tonnes of gold imported. So it will be very interesting to see what happened in April when the buying frenzy after the fall occurred! It would be a surprise if it was not even greater.

Update on Premiums

Unfortunately we’ve never been able to find numbers for New Zealand in terms of precious metals imports/exports (if you know of any statistics please let us know). But undoubtedly last month the numbers would have been much greater than normal here too.

However things have slowed off now here and it seems around the globe too in terms of purchasing as we have seen premiums on the likes of Canadian Silver Maples drop off in the past week or so. Although not back to the levels of before the plunge yet.

So it seems so far it has been a production bottleneck rather than shortages of actual physical gold and silver. Our contacts have stated that the big 1000oz LBMA bars remained available for immediate delivery following the sell off. This would be backed up by the fact that premiums of lesser known products did not really rise during the sell off or at least not very markedly.

But of course it would be interesting to see what would happen if we had some further major “event” that unleashed further buying and not just buying fueled by cheaper prices as we saw last month. We wonder if supply of the larger bars could keep up with demand then?

The End of QE?

A final comment on the “news” via Wall Street Journal writer and Fed mouthpiece Hilsenrath that…

“Federal Reserve officials have mapped out a strategy for winding down an unprecedented $85 billion-a-month bond-buying program meant to spur the economy – an effort to preserve flexibility and manage highly unpredictable market expectations…

Officials say they plan to reduce the amount of bonds they buy in careful and potentially halting steps, varying their purchases as their confidence about the job market and inflation evolves. The timing on when to start is still being debated.”

Sheesh, how does anyone believe this stuff? We haven’t seen an explanation yet as to how this occurs without them collapsing the whole house of cards. A few points to consider:

1. The Fed is creating something around $1 trillion a year which is almost the same as the US budget deficit. It seems the US might be close to needing to borrow just to pay its interest bill.

2. Interest rates would likely rise if the Fed (who we’ve seen numbers that show they buy 70% of US treasuries) stopped buying treasuries. This would be extra bad in light of point 1.

3. Everyone else is only just getting in on the act (stimulus/currency printing). US exporters would struggle if the other major trading partners had lower interest rates and weaker currencies.

4. Cheap money is causing stocks and house prices to rise. No cheap money = falling asset prices = not good.

We fail to see how they can possibly dial back without causing havoc. But if you repeat it often enough maybe enough will believe it.

If you don’t believe the central planners and would like to hedge while prices are low get in contact. You can order via:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| The RBNZ joins the Currency Wars (Sort of) |

2013-05-09 04:12:00-04 2013-05-09 04:12:00-04 |

Gold Survival Gold Article Updates: May 09, 2013 This week: Have We Seen the Bottom for Silver in NZD? The RBNZ joins the Currency Wars (Sort of) Sorry we are slipping – getting this out even later this week. On the plus side it gives you the weekend to peruse our ramblings if you […]

| If Cyprus Is the Bellwether, then Canada Is the Red Flag |

2013-05-10 02:08:33-04 2013-05-10 02:08:33-04 |

If Canada is the red flag then we’re not sure what they makes little old New Zealand! Given we were the first country to have a depositor haircut or “bail-in” scheme openly discussed and planned for over some years now. If this is all news to you then here are links to some of what […]

| Antal Fekete: Gold Backwardation and the Collapse of the Tacoma Bridge |

2013-05-14 20:53:54-04 2013-05-14 20:53:54-04 |

If you’ve followed our site for any length of time you’ll have no doubt read some of the work of monetary scientist Professor Antal Fekete. We posted a video interview with him a few weeks back with links to more of his work contained in that. Anyhow, one of the common criticisms of his work is […]

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1739/oz | US $1424.07/oz |

| Spot Silver | |

| NZ $28.65/ozNZ $921/kg | US $23.46/ozUS $754.21/kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo)

$994.68

(price is per kilo for $50,000 plus)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.