This Week:

- When to Buy Gold or Silver: The Ultimate Guide (Updated)

- Why Buy Gold Now? Because I Don’t Know

- Has Gold Remonetisation Already Begun?

Prices and Charts

Gold Has Bottomed Out Again

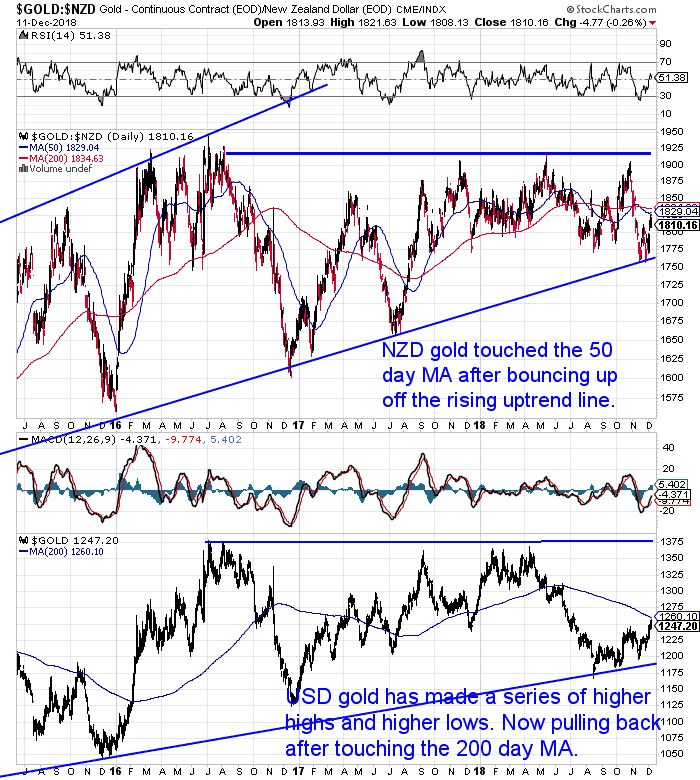

Gold appears to have bottomed out in both NZ and US dollar terms.

The local price this week moved up off the long term uptrend line. NZD Gold touched the 50 day moving average line but has now pulled back a little. Look for it to now make a higher low above $1775.

So if you missed buying the lows in late November you may get another bite of the cherry in the coming days.

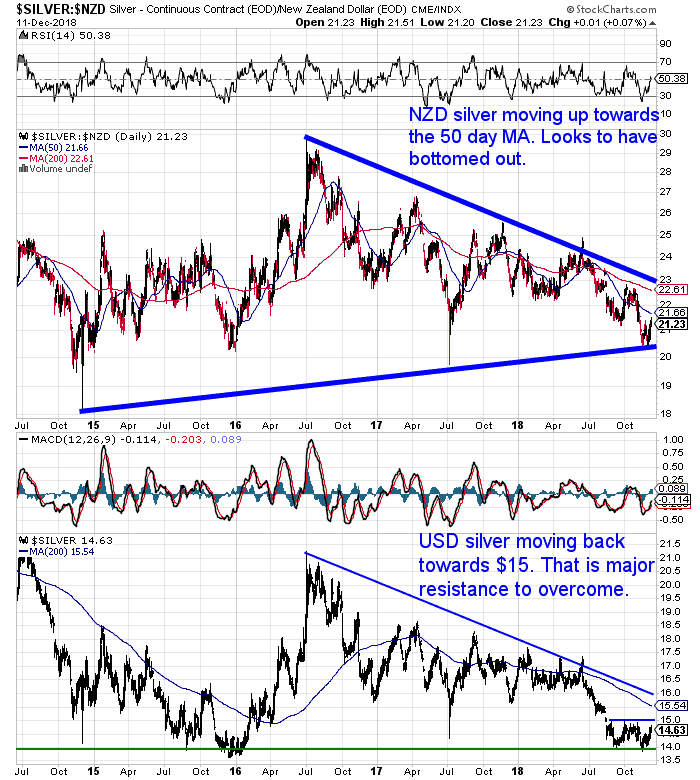

Silver also looks to have bottomed out. After touching the long term uptrend line twice, NZD silver has moved up over one percent this week. Getting close to the 50 day moving average line now.

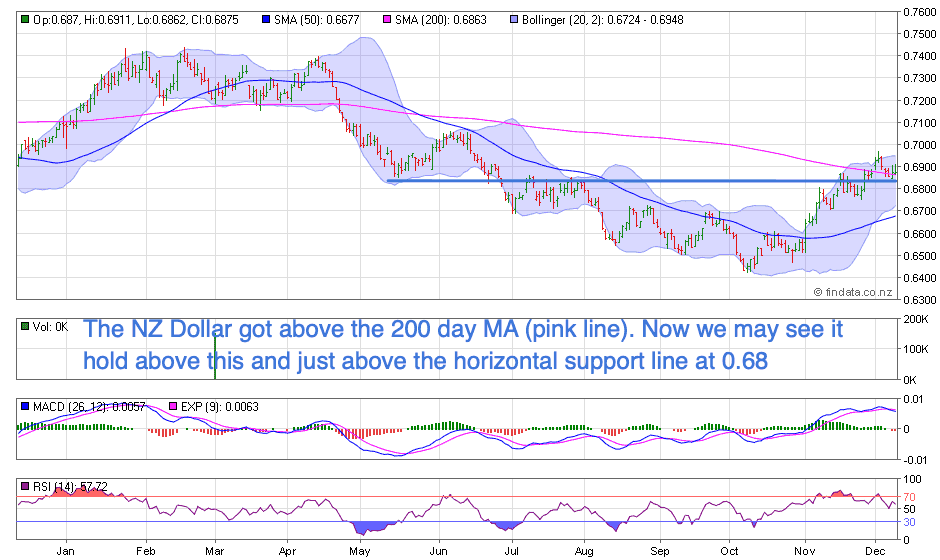

The Kiwi dollar got back above the 200 day moving average for the first time since April. We may now see this line act as “support”. Along with the horizontal support line just above 0.68. So the NZ dollar could consolidate around these levels now.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Free Shipping NZ Wide.

Has Gold Remonetisation Already Begun?

There have been some important changes in how gold is classified as far as banking capital is concerned.

In this article you’ll see how these may already be quietly returning gold to the centre of the monetary system…

Why Buy Gold Now? Because I Don’t Know

Sovereign Man reports central banks continue to buy gold hand over fist…

“Why?

Gold is for the I don’t knows.

And right now, there are a LOT of I don’t knows.

Markets have been going crazy over the past few months.

After a record bull run for stocks, we are now seeing massive volatility with the Dow regularly jumping 500+ points in a single day. Just yesterday, the Dow fell a whopping 800 points.

And there’s plenty of reasons for market to be worried today. For one, we’re 10 years in to a raging bull market… and it’s getting long in the tooth.

Plus, the Fed is raising interest rates. And when the price of money gets more expensive, people get a little tighter with it. That means it’s tougher for businesses and individuals to borrow. All things equal, higher rates mean lower prices.

Before last week, Fed Chairman Powell said rates were “well below” where they should be. And the markets reacted negatively.

Then, last week, after seeing how fragile markets were, Powell said rates are “just below” where they should be.

Just that one word difference sent markets soaring. But the joy was short lived.

There’s also the trade war with China, intensified by the Trump administration tariffs.

And then at the summit in Buenos Aries last week, China and the USA suddenly came to an agreement. They will halt the tariffs for 90 days for a three-month truce in the trade war. That sent markets soaring.

Then people read some tweet from Trump and worried the tariffs might be back on… markets dumped.

If there is one thing markets hate, it is uncertainty. And there’s plenty of uncertainty to go around today.

And while we’re seeing these late-cycle swings in the market, gold is as steady as ever…

While the DOW dips and climbs by hundreds of points, gold is still hanging out just below $1,250 an ounce. And it really hasn’t made any major moves up or down since 2013.

Yet today, an ounce of gold has about the same purchasing power as it had 1,100 years ago… talk about steady.

So while every other asset is still at or near all time highs, gold is relatively cheap.

Gold has held its ground during all this market volatility.

That is exactly how you want insurance to act. It holds steady in the face of craziness, even selling for a discount when everything else is as expensive as it ever has been.

It makes more sense to buy something cheap, that no one is excited about, while people clamber for exciting but massively overvalued stocks like Tesla and Netflix.

Since 2008 this massive monetary experiment of quantitative easing has sent stocks and assets to dizzying, unsustainable highs.

We think this experiment is coming to an end. The day of reckoning is close.

Stocks are up and down, trade wars are on and off, interest rates could keep soaring, or level off…

What do you do for the I don’t knows?

You get some cheap gold while you still can.

Source.

For even more reasons on Why to Buy Gold Now check out this post:

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Yield Curve Recession Indicator – Video Added

We added an excellent video from Mike Maloney to last weeks yield curve post.

He explains that the short end of the yield curve – the 3 month bill rate – is being manipulated by the Fed. This interest rate would likely be much higher today if the Fed wasn’t buying these bills to keep the rate low. So we would actually have a more inverted curve already if it weren’t for this. Therefore a recession may be closer than we think.

It’s not long so worth a quick watch:

The Yield Curve Recession Predictor: Impact on Gold?

When to Buy Gold or Silver: The Ultimate Guide (Updated)

Our feature article this week takes an updated look at the question: When to buy gold or silver.

This is a question that can have multiple meanings.

Firstly you might ask it from the point of view of when is a good time to buy precious metals (gold and silver) in general.

This in turn could depend on fundamental reasons for buying gold and silver. Such as how the economy is doing, the risk of financial panics or currency devaluations. But it could also depend on technical reasons or rather just purely timing when to buy gold or silverdepending on the price.

However the question may also refer to when should you buy gold or buy silver instead. That is whether to choose to buy gold over silver or vice versa.

Here’s what’s covered:

- 5 Factors to Consider in Deciding When to Buy Gold or Silver

- Using Technical Analysis to Determine When to Buy Gold and Silver

- Using Gold Seasonality to Determine the Best Month to Buy Gold and Silver

- Choosing Between the Two Precious Metals

- Gold and Silver Buying Strategy

Why Buying Gold This Year is Better Than Waiting Until Next Year

Here’s a timely excerpt from this week’s feature article:

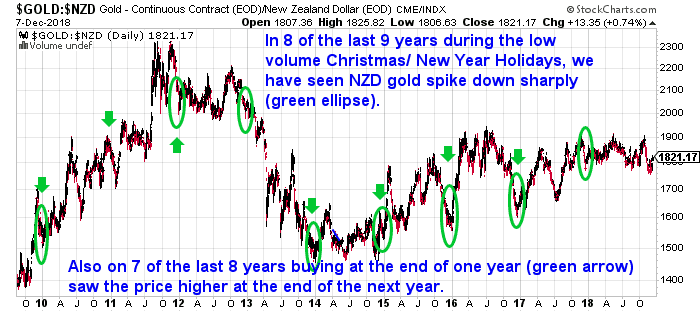

The chart of gold in NZ Dollars below, shows that you’ll also want to buy this year and not wait for next year.

As in 7 of the last 8 years buying towards the end of one year saw the gold price higher at the end of the following year (see the green arrows).

Also keep an eye out for sharp drops in the price of gold and silver over the low volume Christmas and New Year holidays.

In 8 of the last 9 years we have seen the gold price fall sharply around this time (see the green ellipses). Therefore also making it a good time to buy gold and silver near the end of the calendar year.

Will 2018 prove to be the same?

Order your gold or silver today to get in before the historical New year price rise.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

Back in Stock – Learn More NOW….

—–

|

Pingback: Discussions of QE in Australia Increasing - How About NZ? - Gold Survival Guide