Back on the 1st November we asked the question: “Is the New Zealand Dollar Now in a Longer Term Downtrend?” Let’s revisit what we said then. Then we’ll consider will the New Zealand dollar continue to fall?

Is the NZ Dollar Now in a Longer Term Downtrend?

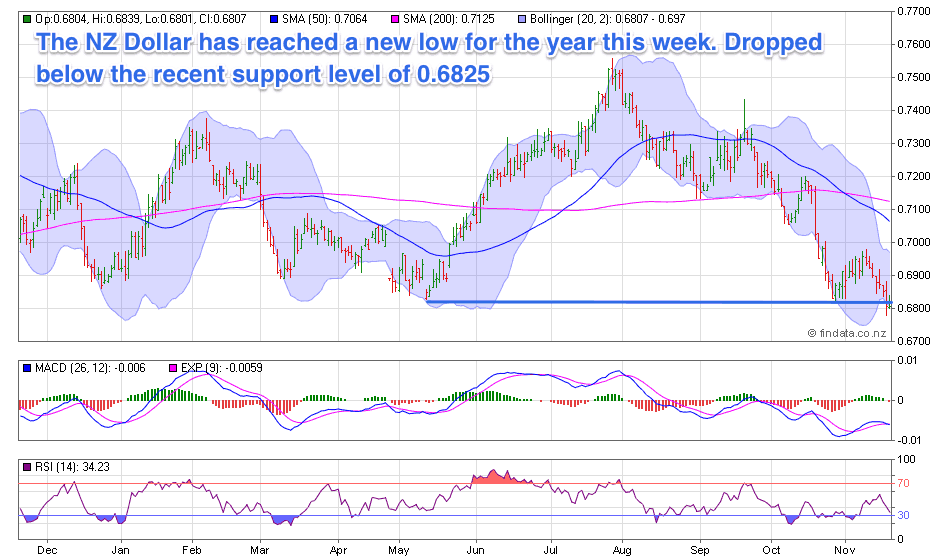

As noted already the NZ Dollar is still oversold. It looks to have found support at the 0.6825 level for now. So odds favour a short term bounce higher from here.

Maybe all the government policy news had been digested and priced in? Although we’re not so sure. The Kiwi Dollar is one of the few to be down against the US Dollar this year.

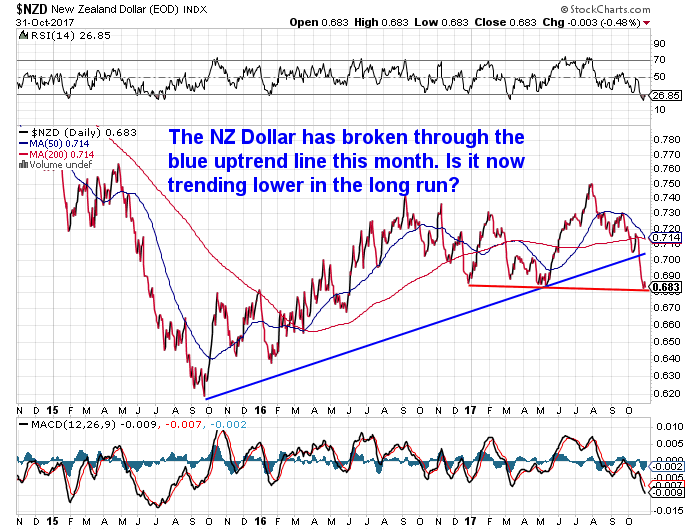

Below is a longer term NZ Dollar chart. The Kiwi has clearly broken below the blue uptrend line in October with the election result. At the same time it also seems to be in a slight downtrend for 2017.

So perhaps we are now in a longer term downtrend for the Kiwi Dollar?

What Has Happened With the New Zealand Dollar in the 3 Weeks Since Then?

Today the New Zealand Dollar has dropped below the horizontal support line from May and October of this year. The “Kiwi” is not only at a new low for 2017, but for the past 17 months too.

What Does This Mean Over The Longer Term for the NZ Dollar?

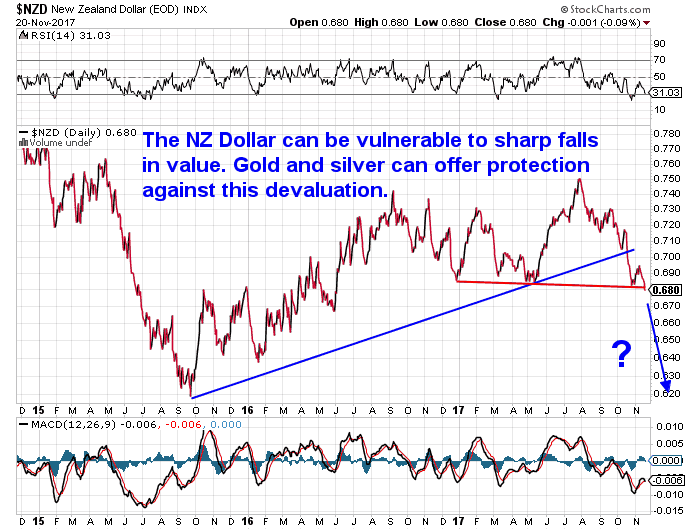

Not only does the Kiwi Dollar appear to have dropped below the horizontal support line. It also has dipped below the slight downtrend line from the start of 2017.

Where to Now? Will the New Zealand Dollar Continue to Fall?

Back in 2015 the NZ Dollar dropped from 0.76 to 0.62 in the space of 4 months. This past 4 months has also seen a sharp fall, but it is only a fall of half that amount (0.75 to 0.68).

But given the New Zealand Dollar has fallen below the downtrend line, it now looks vulnerable to a further fall from here.

Gold and Silver Offer Protection from NZ Dollar Depreciation

A falling NZ Dollar should be a good environment for holding gold and silver.

Why?

If the NZ dollar is falling, the US Dollar prices of gold and silver merely have to hold their ground to see a gain in price for NZ holders of precious metals.

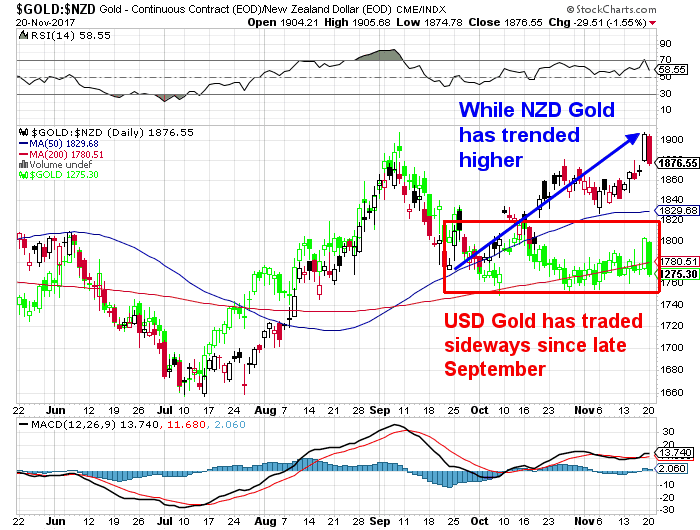

This is exactly what has happened over the past 2 months. USD Gold has traded sideways between US$1300 and US$1265 (see the green candlesticks in the chart below).

While the NZ Dollar gold price has trended higher for the past 2 months due to the weaker NZ Dollar (see the blue line in the chart).

NZ Dollar Gold and Silver Gains Could Be Amplified

But if the US dollar gold and silver prices head higher then that will amplify these gains. Given that gold and silver look to have bottomed out at the start of 2016 and be in quiet uptrends since then, the odds of these gains being amplified in New Zealand dollar terms looks pretty good.

Check out this post if any of the terms we use when discussing the charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Or get free access to our daily gold and silver price alert email, if you want to be kept up to date with short term gold and silver movements, and get help with timing lower risk times to buy gold and silver.

Read more – Latest update on the falling NZ dollar: NZ Dollar Falls – Why is the NZ Dollar Weaker and Where to Now?