Here’s our summary of Jeff Berwick’s (Chief Editor of The Dollar Vigilante) keynote presentation at the Sydney Gold Symposium last month. It was entertaining to say the least. As like his mentor Doug Casey he’s not afraid to call it how he sees it, and smoke where he shouldn’t…

The End Of The Monetary System As We Know It

“The impending death of fiat currencies and what you can do to not only survive the collapse but prosper massively in the transition to a more peaceful, prosperous new world.”

Jeff Berwick Born was in Canada but is “just a human being”. He sailed around the world and visited over 100 countries, until his boat sank in El Salvador. He had a company that was worth $240m at the tech bubble peak and a week later was worth almost nothing.

He just couldn’t get a decent answer from anyone as to why this happened other than “sometimes it just happens” so went around the world and found out about Austrian Economics. Became a libertarian and Doug Casey became his mentor.

The point was made that Anarchists are often misunderstood. Anarchy means you don’t believe in forced government violence and theft – they are actually very peaceful people.

End of monetary system as we know it

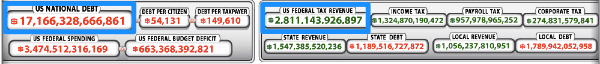

The US National Debt went really crazy in 1971 following the severing of the last link to gold.

It is $17 Trillion currently even though its supposedly frozen. [The debt ceiling hadn’t been raised at the time of his presentation].

The debt is actually $85 Trillion now if accounted for under GAAP accounting principles like a normal company would. This is $250,000 per person. So a family of 4 has over $1 million of US Government debt and liabilities!

So in the last few years the Fed has become the largest treasury owner in the world and is the major buyer of US debt now.

How long will it last?

Closer to a 100 days than 100 years. He agrees with John Butler that we are likely down to single digit years away until the end game. [Here’s exactly what John Butler had to say in Sydney and Auckland recently John Butler: “Remonetisation of gold is inevitable”]

Most of the charts he showed were “hockey stick charts” – completely unsustainable. Such as total credit market debt as a percentage of GDP (“even if GDP is “total Bulls**t”).

George Washington said “Avoid the accumulation of debt” but they obviously ignored that warning – although Washington was “a criminal too, but that’s another story”.

The Debt Ceiling

“Should be called the debt target because they always hit it!” One of many classic lines from Jeff!

“Barry” Obama in 2008 said Bush is unpatriotic for increasing the debt ceiling – “another criminal right there”!

The “total tax theft extortion revenue” of US government is about $2.3 trillion (and this could go down if the US economy continues to struggle).

In 1970s there wasn’t enough debt built up at only $900 Billion so Volcker could allow interest rates to rise at that time to about 18%. But today even if they reached that level, at $17 Trillion in debt every single cent of the US government $2.3 Trillion revenues would go towards paying the interest bill.

Debt is going up about a trillion a year so in fact even at only 10% interest rates would be $1.7 Trillion a year in interest on $17 trillion. That is almost all the US tax base, so they can’t and won’t let rates rise.

So interest rates will stay at 0% until the system dies in his opinion. Bernanke is getting out of town and “this new one Yellen is even worse. You can’t make this stuff up. It’s just like Rome.”

True money supply as calculated by Austrian economists

Since 2008 has gone near vertical and still at over 10% a year for past 5 years. Doesn’t expect that to stop anytime soon, in fact it’s more likely to increase.

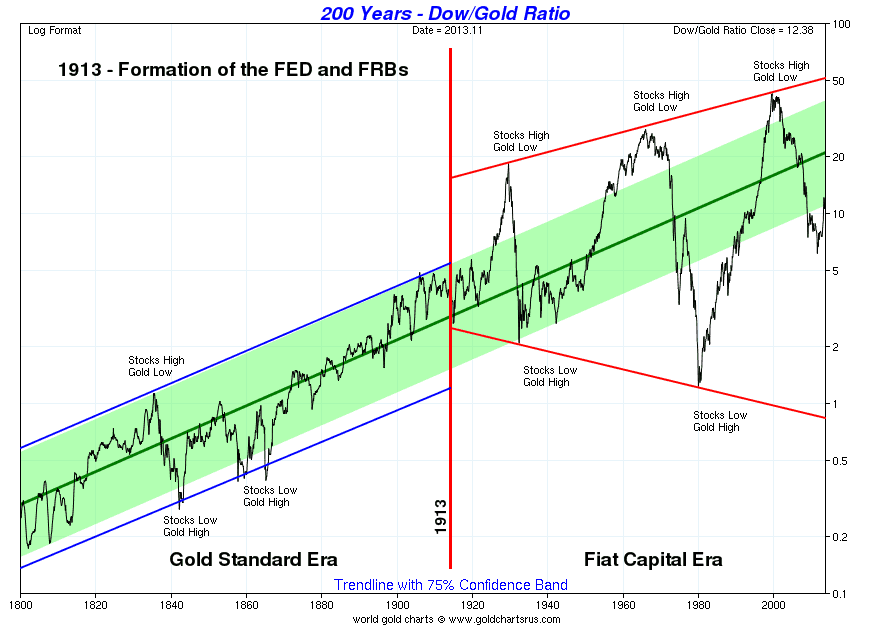

Dow to gold ratio chart since 1800

Green line through the middle is just the average overtime. Until the Fed was founded the Dow was increasing, that is business/capital was expanding. Since then it has trended down. If the long run average had continued on it would be at around 50 now – instead we are near 15. So that is the Fed stealing from the economy via money printing. Which distorts price signals, creates mal-investment and bubbles and eventually loses like the housing and tech bubbles. A lot of money gets lost because of money printing because people can’t tell what is real and what isn’t and what the price of things actually should be.

Poverty rates in the US

In 1965 20% of US children were in poverty and it’s still around 20% today. So the “war on Poverty” they started around 1965 doesn’t appear to have worked out too well.

Australia is also increasing its debt levels

He showed a chart of Australian government bonds – also another hockey stick chart. So after 2007/08 Aussie Governemnt debt has increased significantly. So if you’re wondering how Australia will come out of this that is another interesting chart.

The Australian dollar is much like the USD, in that it has had loss of value since 1971 of almost 90%.

Gold Reserves

Total gold holdings for Canada is just a measly 3.4 tonnes.

For Australia they have Forex reserves of $39 Billion, but gold reserves of just $3 Billion – so not much. [Although better than us here where NZ has none. See this previous article of ours: “How much Gold does the Reserve Bank of New Zealand have?”

So many of these countries don’t really have any gold. Even the US probably doesn’t, as if you don’t see something for 70 years it probably doesn’t exist!

But even if it does exist, the total amount in Fort Knox is around $300 Billion so that would last only 2 months of government spending!

Read more: Australia Has 80 Tonnes of Gold, How Much Gold Does New Zealand Have? >>

On Unemployment Rates

Unemployment rate if computed the way they did in 1980 would be over 20% -according to Shadowstats.

Labour Force participation actually rose from 1970 to 2000. But now it is at the same level it was in 1978 due to money printing, taxes and regulations.

Individual states in the US don’t have to pay for disability but they do for unemployment benefits. Those on disability have gone from 6.5 million to 9 million in just 6 years, since the federal government will keep paying for that. So there is a massive epidemic of people who are disabled in the USA – “everyone is in wheelchairs!”

So there is no recovery in any of these charts.

Those on Foodstamps have almost doubled since 2006

There used to be 26 million on them, now its over 50 million or 1 in 6 Americans who can’t afford to eat. 1 in 4 children are on foodstamps.

US hourly wage in gold since 1965

This measure went up in 90’s but now is below where it was in 1980.

3 gold grams per hr in 1970 now its less than 0.5 gold grams per hr. Shows a lot of destruction in purchasing power and standard of living.

So, only 2 options for the US government

1. Default

2. Inflate

Even though they’re talking about default currently [or they were when Jeff’s presentation was given] it won’t happen. They will hyper inflate instead.

We will see Cyprus like developments in the likes Spain, France, and Italy. Most governments including Canada, US have put in place bail in legislation for banks.

“Social (In)security” as he likes to call it!

The Federal Government takes the payment off everyone in the US and includes it in the US Govt revenue figures. Just imagine if a company did this? It would be like MacDonalds making pension fund deductions on behalf of it’s employees accounts and then including them as company revenue! So there is no way they can afford to fund peoples retirements as the money is not being set aside.

The Police State in the US Continues to Get Worse

Canada is also getting worse. He asked what the police force was like in Australia. An audience member replied they wander around dressed like paramilitary. To which Jeff replied – “Oh they’re doing that too – Do they have tanks yet?” Almost every police dept has tanks in the US. They bought so much for the illegal occupation of Iraq and Afghanistan that they started giving them to the police.

Canada is also getting worse. He asked what the police force was like in Australia. An audience member replied they wander around dressed like paramilitary. To which Jeff replied – “Oh they’re doing that too – Do they have tanks yet?” Almost every police dept has tanks in the US. They bought so much for the illegal occupation of Iraq and Afghanistan that they started giving them to the police.

“They’re getting ready for something. Just look at what happened in Boston. That was a 19 year old boy with a rice cooker and they shut down the whole city.” In his opinion they were conducting a test trial run to see if people accepted this police state lifestyle. And it seems they did. When they supposedly caught him there were people waving and cheering in the streets, so they definitely accepted it.

We are going to see more of this in the US. Who knows about Australia but definitely in the US.

More travel controls. More taxes.

On Japan

Japan will be one of the first to fall. Their debt to GDP is 260%. Since their Nuclear shutdown they have become a net importer now. Ageing population. Japan is a disaster in terms of the government, not the country “they still make good sushi”!

FACTA and Capital Controls

They’re making it so no US citizen is able to open a bank or brokerage account. anywhere in the world

Big news on the day of his presentation was that Chase Bank was going to limit cash withdrawals and ban international wire transfers on November 17th. This could be the beginning of capital controls.

[Note: we saw this news too and actually had a short discussion with Rick Rule about it that day. We noted it was only for certain business accounts according to the letter. Rick Rule commented that it would be the death of Chase if they did this carte blanche as customers would just leave them in droves for another bank. This subsequent article in Forbes outlines how it seems to actually be a case of Chase looking to increase revenues through forcing people into higher fee paying accounts. So they can still make wire transfers it will just cost them a bit. We’d imagine if capital controls were to start they would be across the board requirements instigated by the government, not just by one back on it’s own. Nonetheless it’s still another warning sign of how we are having less and less choice about what we do with our money].

So, How to Survive and Prosper Through This?

Retirement funds are being hit across the globe. They will probably force you to invest in 10 year government bonds and have 10% pa inflation so in 10 years your money is worth nothing.

So get your money out of the system. If you’re worried about gold and silver don’t be, as he doesn’t think gold and silver will go much lower. His analyst said $1200 will be the bottom and said this about a year ago, and so far that is looking like a pretty good call.

He noted that he had been told that last year 600 registered for the Gold Symposium and this year only 300 – a sign of lack of interest in gold. [One we noted too at the time of the symposium] He liked the fact as did Rick Rule – as it means cheap stuff to buy.

Amount of gold in the US held by Individuals for investment purposes

In 1958 this was 5%, in 1980 it was 3%, 2000 was .2%, 2010 it had gone up to 0.7% although this was just based upon the rise in the gold price.

So if Chase Bank and others start capital controls this percentage could head back up towards 5% again. If it did gold would be at $5,000 or $10,000 per ounce easy.

His prediction is gold will be worth a Trillion dollars – but – a big mac will cost you a Billion!

Spread your eggs (and your wings)

He believes you shouldn’t own all your gold in the country you live in. There will be a massive collapse and you could lose some of it, so spread your eggs is his mantra.

He lives a lifestyle where you are a permanent traveller, or prior tax payer where he legally doesn’t pay taxes.

Gold stocks when valued against gold are almost at a 13 year low. So looks pretty good to him now.

On Bitcoin

If you don’t know about it you should look into. He’s not saying put all your money into bitcoin, but it is an excellent way of transacting value. You can open a Bitcoin account in 1 second – try doing that with a bank account. Interestingly he noted that our very own Bank of New Zealand held on to 1 million dollars of his for a month when he was trying to transfer some money to Chile for a project. With Bitcoin there are no limits as to what you can transfer and no restrictions.

If you don’t know about it you should look into. He’s not saying put all your money into bitcoin, but it is an excellent way of transacting value. You can open a Bitcoin account in 1 second – try doing that with a bank account. Interestingly he noted that our very own Bank of New Zealand held on to 1 million dollars of his for a month when he was trying to transfer some money to Chile for a project. With Bitcoin there are no limits as to what you can transfer and no restrictions.

He first heard about Bitcoin when it was $3 in 2011. If it really catches on world-wide, as there is only 11 million bitcoins as they are divisible to the 8th decimal, 1 Bitcoin could be worth $1 million. But he’s not saying replace gold with Bitcoin but it is the electronic version of gold. So look into it.

So how can you protect yourself?

One of the answers was get a second passport. It’s not as important for Australians as it is for Americans. If an American has more than a few hundred thousand dollars then he basically needs to get some capital outside of the US. He doesn’t need to pay taxes in Canada because he has a second passport in another country. He said Australians can do this too, it’s only Americans who still get taxed once living abroad. But someone in the audience piped up to say that Australians now get taxed on overseas income too. “Really – oh you guys are screwed too! So get another passport”, was his answer.

You can set up your life to be a permanent tourist/prior tax payer. You just need a second passport and have to be away from your home country for a certain number of months each year.

Also set up an offshore company. Mitt Romney has 200 offshore companies – it’s totally legal.

At Dollar Vigilante they are helping people, mainly Americans, but also now many middle easterners like Syrians.

For Americans, Canadians and Europeans it’s really important to look at this option. Maybe not quite so vital for Australians but still something to consider.

Read more: Why New Zealand Won’t Have Any Say in a Global Currency Reset >>

Where does he recommend as an overseas destination?

Chile is starting to boom. Low government debt, their central bank is more Freidmanite or Chicago school – “which still sucks but is being than Keynesian”. Dollar Vigilante has a development there called Galt’s Gulch.

Mexico is interesting as well. Most people wouldn’t know it but heir stock exchange is up 600% in last 10 years. And he lives in the supposedly 4th most dangerous city on earth, Acapulco but it’s paradise. So don’t listen to the news as it’s meant to scare you and keep you in your place.

In Latin American he would look at Nicaragua. South American definitely Chile and also Columbia.

In Asia he likes Cambodia a lot and Myanmar is interesting too with all the changes going on there.

So don’t be afraid to get out there. Most western countries are drowning in debt and so there are better places to be.

On the US government shutdown

We’re going to stop working because we can’t agree on how to spend the imaginary money we don’t have”. Which has been great but they’ve only shut down about 15%. But they didn’t shut down anything that would be great to shut down, like the IRS, CIA, FBI, DEA, or ATF. They just closed some National Parks.

But in the end they will shut down – they just don’t know it yet.

The thing about the Government and Central Banks is that “they are either incredibly evil or incredibly stupid – or maybe both. Actually probably both”.

So it’s all going to fall apart in the USA. He wasn’t sure about what would happen in Australia, but if he had to pick one western country for the next 10 years then Australia might be it simply because it’s so big. The entire population is less than Mexico City! So you can get away. But there’s better places to go so go somewhere else!

—

Luckily there was time for some Q&A at the end of Jeff’s presentation…

Q&A

Q. What are the better jurisdictions to keep physical gold safe?

A. Switzerland has changed having bought into US FACTA so much so it’s probably not there anymore. He just keeps it all over the place. Has some in Australia and Singapore. Not New York not London. This is the most dangerous time for capital in human history so it will be who loses the least that wins.

Q. If you had $1 million in cash to invest right now with a 20 year horizon?

A. “20 years! I don’t even think 20 days ahead at the moment!” Most of his assets are in hard assets real estate in Foreign countries, gold precious metals, 20% in mining stocks and a little Bitcoin. He just keeps it out of the system with nothing in his bank count apart from covering expenses.

Q. There’s not enough gold to be money?

A. It’s a total myth started by the central banks and governments to keep you away from gold. Even if there was 1 oz on earth it would be enough as you could get a billionth of an ounce. It is very divisible.

Q. What’s your opinion as an alternative to Bitcoin where you have an electronic currency something like Goldmoney backed by gold, almost like a paypal type payments system backed by gold?

A. He hears this question a lot. People want to tie bitcoin with gold. James Turk of GoldMoney is looking into that right now. Where you can store gold in a vault and take it out and spend it on bitcoin.

Bitcoin is to money what the internet was to communication. There will be a lot of money made in the next 10 years in this sector, so if you’re looking for a business idea look at Bitcoin.

Q. Regarding the Dow Gold Ratio Chart – was confused about his statement on this as wouldn’t a lower value be better?

A. Well it would if you owned a lot of gold. He was more commenting that it showed how the Fed had stolen a lot of capital. The chart was on a trajectory for 100 years that was a lot higher. So the chart is just saying after the Fed was created the stock market went down in value in gold terms. The stock market shows how the businesses of the economy are operating and so more than 30% has been stolen away by the Federal Reserve.

If you’ve found this interesting then you might enjoy these other reports from keynote speakers at the Gold Symposium too:

Chris Powell: Gold price suppression – why, how, and how long?

Rick Rule at the Sydney Gold Symposium 2013

Gold Symposium 2013: Australia “The Lucky Country?”

Any thoughts on what Jeff Berwick had to say? Let us know you’re alive and leave a comment below!

Pingback: More Weakness Ahead for Gold and Silver? | Gold Prices | Gold Investing Guide

Pingback: Double Bottom for Gold in NZD? | Gold Prices | Gold Investing Guide

Pingback: Questions From Readers: Precious Metals & Kiwisaver, BoomBust Cycle, Gold & Silver Exit Strategies - Gold Survival Guide