Gold Survival Gold Article Updates

Nov 21, 2013

This Week:

- More Weakness Ahead for Gold and Silver?

- More Suspicious Sell Orders

- PAMP Forecasts Coming to Fruition?

- More on Why Chinese Gold Demand May Be Higher Than Official Reports

More Weakness Ahead for Gold and Silver?

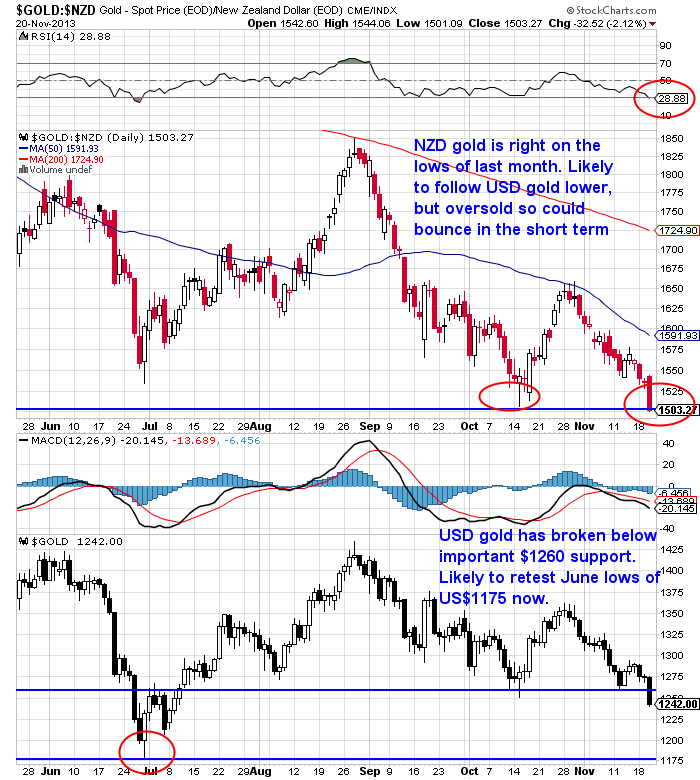

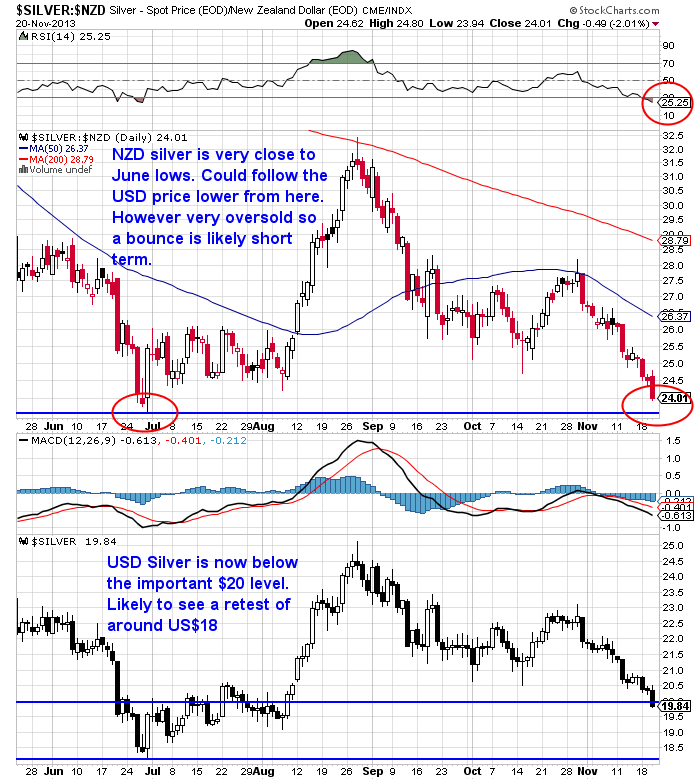

Gold and silver in NZ dollars have continued to head down so that both are now this morning touching lows from June and October respectively. Gold is down to $1509 per oz, which is right on where it bottomed out in October.

While silver is at $24.11 per oz and is just above the lows it touched in June below $24. We’d have to hazard a guess that both metals will go lower from here in NZ dollar terms.

Why is this?

Well, when looking at the US dollar price of gold this morning it fell below what has been solid support of late at around US$1260 (see the black candlesticks in the bottom half of the chart below). As we write it is actually at $1245 – below $1250 for the first time since July. So we’d have to say the odds would favour a retest of the June US dollar gold price lows of $1180. If that happens, then unless the kiwi dollar also weakens sharply from here, we will see new lows for NZ dollar priced gold.

Likewise silver this morning also fell below the important US$20 level, so odds favour it moving lower from here too, possibly to retest the June lows of around $18.

According to Reuters, gold is lower as the Fed minutes point to them tapering “at one of its next few meetings, provided this was warranted by economic growth”. Crikey – yet another proviso – surprising that anyone still listens to this.

We remain very doubtful of any taper whatsoever. Or if there is one how long lasting it possibly could be. Just the release of the Fed minutes last night caused the US 10 Year Bond rate to spike up to 2.79% from 2.70% (not shown in chart below). Recall that earlier in the year when the “Taper Talk” first appeared rates got as high as 3.00% after spending a long time around 2%.

So it’s hard to see how anyone can believe they can pull off a taper. The “recovery” is built upon the existing cheap rates. That is what is goosing stock and houses prices globally (and expensive Art as mentioned in one of this weeks videos – see below interview of Jim Rickards).

Plus as Jeff Berwick, Chief Editor of the Dollar Vigilante, stated at the Gold Symposium last month, the US can’t afford rates to rise due to the impact on servicing its government debt:

—–

“The “total tax theft extortion revenue” of US government is about $2.3 trillion (and this could go down if the US economy continues to struggle).

In 1970s there wasn’t enough debt built up at only $900 Billion so Volcker could allow interest rates to rise at that time to about 18%. But today even if they reached that level, at $17 Trillion in debt every single cent of the US government $2.3 Trillion revenues would go towards paying the interest bill.

Debt is going up about a trillion a year so in fact even at only 10% interest rates would be $1.7 Trillion a year in interest on $17 trillion. That is almost all the US tax base, so they can’t and won’t let rates rise.

So interest rates will stay at 0% until the system dies in his opinion. Bernanke is getting out of town and “this new one Yellen is even worse. You can’t make this stuff up. It’s just like Rome.”

—–

This weeks feature article is actually our summary of Jeff Berwicks keynote presentation at the Gold Symposium. Jeff covered a multitude of topics, including something that has been all the rage the past couple of days – Bitcoin. It was a very amusing presentation as he certainly calls it as he sees it. Obviously he covered gold too, along with internationalising your assets as well as yourself. There’s a wealth of information to dissect here.

This weeks feature article is actually our summary of Jeff Berwicks keynote presentation at the Gold Symposium. Jeff covered a multitude of topics, including something that has been all the rage the past couple of days – Bitcoin. It was a very amusing presentation as he certainly calls it as he sees it. Obviously he covered gold too, along with internationalising your assets as well as yourself. There’s a wealth of information to dissect here.

Jeff Berwick, The Dollar Vigilante: The End Of The Monetary System As We Know It

As mentioned earlier we’ve also posted an interview with Jim Rickards by Max “the Mouth” Keiser where they discuss the skyrocketing prices of Art and why gold isn’t following them currently. We’ve listed out the more than a dozen topics they cover so you can scan that first which should probably convince you to watch for 12 minutes.

As mentioned earlier we’ve also posted an interview with Jim Rickards by Max “the Mouth” Keiser where they discuss the skyrocketing prices of Art and why gold isn’t following them currently. We’ve listed out the more than a dozen topics they cover so you can scan that first which should probably convince you to watch for 12 minutes.

Jim Rickards: Why Central Bankers Care a Lot About Gold

More Suspicious Sell Orders

While Reuters may report that gold was lower due to the Fed minutes, there was yet again another big sell order on Comex before the Fed minutes were even announced at 6.26am (low volume time yet again) for 1500 contracts of gold.

ZeroHedge outlines the suspicious nature of this occurrence for the third time this year here. Then after the Fed minutes were released there was another “stop logic” trading halt due to a second even larger sell order.

All very fishy smelling.

On top of this was the news overnight that Venezuela have entered into a bargain with the devil.

They have been forced to enter into a swap agreement with Goldman Sachs for around 46 tonnes of its central bank gold. Chris Powell of GATA states:

—–

“The Venezuela newspaper El Nacional, the voice of that tortured country’s political opposition, reports today in the story appended here that, after triumphantly repatriating its gold reserves two years ago, Venezuela has sunk so much economically under its predatory socialist regime that it will raise cash by pawning its gold through Goldman Sachs.

That gold almost surely will be delivered by Goldman Sachs to the use of the Western central bank gold price suppression scheme.”

—–

Given that the newspaper article states the agreement began at a date in October maybe Venezuela’s gold is already being “put to work” by Goldman the “Vampire Squid”?

PAMP Forecasts Coming to Fruition?

You might recall that we reported a few weeks ago from the Gold Symposium that Swiss refiner PAMPs head of sales reported that we “may see more selling in the next couple of months” as Paulson and other large GLD ETF holders liquidate positions as the negative sentiment around gold will pressure their investors to exit gold positions before end of year. He thought this:

”might affect the gold price but then we will go into a real physical bull market. Might take more time for the gold price to recover because the physical market is having a long term impact on the gold price, but not a short term. Speculators are having a short term impact. What we might see is premiums getting much higher for gold. Because if demand picks up again we will need to get bars again from the market and convert them and there might be certain time lags to get them transformed. Might have a bottleneck again. So we’re very bullish for physical market next year. We believe a bit more washout before the end of the year but a physical economy for next year most probably.”

So perhaps this is the washout that PAMP expected before year end that is under way now?

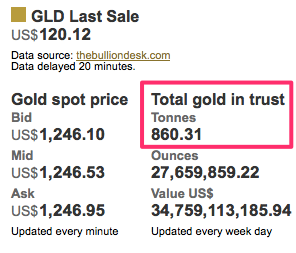

According to Reuters, “Holdings in the SPDR Gold Trust, the world’s largest gold-backed exchange-traded, fell 1.5 tonnes to 863.01 tonnes on Tuesday, their lowest since February 2009.”

We just checked the GLD website and it is down to 860.31 tonnes today, another 2.7 tonnes gone.

Maybe Paulson and other large GLD holders are starting to exit some positions as we write as part of this washout postulated by PAMP? It seems we may need one final push lower to exit the last of the weak hands.

More on Why Chinese Gold Demand May Be Higher Than Official Reports

In last weeks newsletter we discussed Eric Sprott’s recent open letter to the World Gold Council. He outlined how he believes their demand statistics likely significantly underestimate the actual demand numbers. He also looked at how great a role gold ETFs have played this year in supplying the demand – particularly from China.

This week Koos Jansen, who has been doing some great work on Chinese gold demand of late, also chimed in with his estimate of Chinese gold demand. It comes in at double the World Gold Council’s number of 1000 tonnes.

—–

“Just the official route has brought 826 tons of gold to China year to date, annualized 1100 tons. If we add 400 tons Chinese mining supply the total is 1500 tons othat will meet demand.

Whilst the World Gold Council estimates Chinese consumer demand will be over 1000 tons, my estimate is it will be over 2000 tons. In my humble opinion just the official route [via Hong kong only] raises a few eyebrows to the WGC demand numbers. If we then take into account gold is also shipped into China through other ports than Hong Kong, more eyebrows are raised.

In a future post I will describe in detail how I calculated my estimate.”

—–

We’ll be keeping an eye out for that.

In a previous post titled “Redistributing the chips” Jansen also made the comment:

—–

“The drop in the price of gold early April and the exodus to the east that followed were conceived coherent events to distribute core money prior to a change in monetary order. How else can we interpret the fact that SGE delivery in between 22 – 26 April was 117 tons, though mainland import from Hong Kong peaked in March! Net import was 61 tons in February, in March it broke all records reaching 130 tons. After this all-time import record, and the vaults were sufficiently packed, the price of gold plunged and the Chinese could buy inordinate amounts of physical gold on the SGE.

If you think about it, the redistribution of gold is the only logical thing to happen given the state the world economy is in. China is sitting on a pile of $3.3 trillion dollars, the possibilities for the developed economies of printing money and kicking the can are ending, the reserves of gold in the west are an imbalance relative to the economic power acquired by Asia during the last decade; gold has to go to China in order to equalize the chips. Not only Chinese official reserves are far behind, also grams per capita have a lot of catching up to do.”

—–

This agrees with a statement by Hugo Salinas Price in the other article we posted on the website this week, where he believes the low gold price is giving the chance for China to load up…

“The extraordinary accumulation of gold by China indicates that it is preparing for this change, and this cannot be taking place without the consent of those who dominate the West: the low price of gold is deliberately facilitating the process of preparation for the coming change.”

There does seem to be more and more evidence pointing towards a coordinated move to a new global monetary system as we’ve discussed a number of times in the past month or so following the Sydney Gold Symposium.

Salinas Price outlines why that unfortunately is not the best outcome for humanity as it will not mean a free market in money, but rather government controlled money with some link to gold. (Here’s where we previously talked about this: How Will It All End?)

Salinas Price outlines why that unfortunately is not the best outcome for humanity as it will not mean a free market in money, but rather government controlled money with some link to gold. (Here’s where we previously talked about this: How Will It All End?)

Salinas Price: The Siren-song of Welfare State

But, nonetheless it will be physical gold and silver that will still offer insurance against this outcome. And both yellow and grey insurance policies are today at close to lows for the past couple of years. So get in touch if you need to “complete a policy” and we can help you out:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David) goldsurvivalguide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Watch Chindia |

2013-11-14 22:27:20-05 Gold Survival Gold Article Updates: {!date abb+1} You’re receiving this email because you subscribed to information from either goldsurvivalguide.co.nz or BuyGoldAuckland.co.nz. We don’t wish to annoy anyone so if you no longer wish to receive emails from us just click this link to unsubscribe. Hi {!firstname}, This Week: Thoughts on Australia’s Prospects, Housing […] read more… 2013-11-14 22:27:20-05 Gold Survival Gold Article Updates: {!date abb+1} You’re receiving this email because you subscribed to information from either goldsurvivalguide.co.nz or BuyGoldAuckland.co.nz. We don’t wish to annoy anyone so if you no longer wish to receive emails from us just click this link to unsubscribe. Hi {!firstname}, This Week: Thoughts on Australia’s Prospects, Housing […] read more… |

| Jeff Berwick, The Dollar Vigilante: The End Of The Monetary System As We Know It |

2013-11-19 20:18:43-05 Here’s our summary of Jeff Berwick’s (Chief Editor of The Dollar Vigilante) keynote presentation at the Sydney Gold Symposium last month. It was entertaining to say the least. As like his mentor Doug Casey he’s not afraid to call it how he sees it, and smoke where he shouldn’t… The End Of The Monetary […] read more… 2013-11-19 20:18:43-05 Here’s our summary of Jeff Berwick’s (Chief Editor of The Dollar Vigilante) keynote presentation at the Sydney Gold Symposium last month. It was entertaining to say the least. As like his mentor Doug Casey he’s not afraid to call it how he sees it, and smoke where he shouldn’t… The End Of The Monetary […] read more… |

| The Siren-song of Welfare State |

2013-11-19 20:53:00-05 In our weekly newsletter a few weeks ago we did a piece looking at opinions on how the end game for the current monetary system will play out: How Will it All End? this featured opinions we’d heard recently at the Sydney Gold Symposium and presentations here in Auckland by the likes of John Butler, Chris […] read more… 2013-11-19 20:53:00-05 In our weekly newsletter a few weeks ago we did a piece looking at opinions on how the end game for the current monetary system will play out: How Will it All End? this featured opinions we’d heard recently at the Sydney Gold Symposium and presentations here in Auckland by the likes of John Butler, Chris […] read more… |

| Jim Rickards: Why Central Bankers Care a Lot About Gold |

2013-11-19 21:53:12-05 Jim Rickards is worth listening to. Given he is somewhat of an “insider”, we get an inclination as to where things are heading in terms of the global monetary system. While the Jim Rickards interview starts at 12:27, it is worth listening to the first half of the program where Stacey and Max discuss the […] read more… 2013-11-19 21:53:12-05 Jim Rickards is worth listening to. Given he is somewhat of an “insider”, we get an inclination as to where things are heading in terms of the global monetary system. While the Jim Rickards interview starts at 12:27, it is worth listening to the first half of the program where Stacey and Max discuss the […] read more… |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1509.39/ oz | US $1245.85/ oz |

| Spot Silver | |

| NZ $24.11/ oz NZ $775.12/ kg | US $19.90/ oz US $639.78/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

Note: – Prices are excluding delivery – 1 Troy ounce = 31.1 grams – 1 Kg = 32.15 Troy ounces – Request special pricing for larger orders such as monster box of Canadian maple silver coins – Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more. – Foreign currency options available so you can purchase from USD, AUD, EURO, GBP – Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Double Bottom for Gold in NZD? | Gold Prices | Gold Investing Guide