…And Our Thoughts on Each of Them

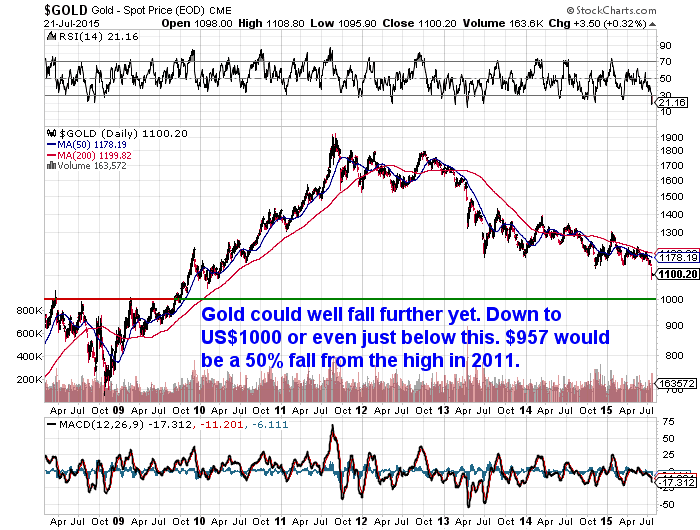

Unless you’ve not been following the financial news you’ll have no doubt heard gold has taken (another) beating over the past few days. The headlines in the financial press have been about how it is at 5 year lows. Which is true in US dollars as per the chart below.

So Why is Gold Falling Again?

As usual who really knows? But we’ll hazard a few guesses such as:

Gold Falling Reason 1. Chinese Gold Reserves Lower Than Expected

China announced on Friday an updated total gold reserves that was a 57 % increase to 1658 tons since its last announcement in 2009. A total that was much lower than many expected. Although this shouldn’t have been a real surprise. As we reported a few months ago, Jim Rickards made a well reasoned argument to expect this:

“Meanwhile, China will probably announce its increased gold holdings later this year. But don’t expect fireworks. China has three accounts where they keep gold — the People’s Bank of China, PBOC…the State Administration of Foreign Exchange, SAFE…and the China Investment Corporation, CIC. China can move enough gold to PBOC when they are ready and report that to the IMF for purposes of allowing the yuan in the SDR. Meanwhile, they can still hide gold in SAFE and CIC until they need it in the future. The IMF will also probably admit China to the SDR basket later this year. Far from launching its own gold-backed currency, China will be acknowledging that the SDR is the true world money as far as the major powers are concerned. Why would China want to give up on fiat money any more than the US Fed or the European Central Bank? All central banks prefer paper money to gold because they can print the paper kind. Why give up on that monopoly of power? Time to build your personal reserve Gold is still the safest asset, and every investor should have some in their portfolio. The price of gold will go significantly higher in the years ahead. But contrary to what you hear from the pundits and read in the blogs, gold won’t go higher because China is confronting the US or launching a gold-backed currency. It will go higher when all central banks — including those of China and the US — confront the next global liquidity crisis. It will be worse than the crisis in 2008, and will see individual citizens stampede into gold to preserve wealth in a world that has lost confidence in all central banks. When that happens, physical gold may not be available at all. The time to build your personal gold reserve is now.”

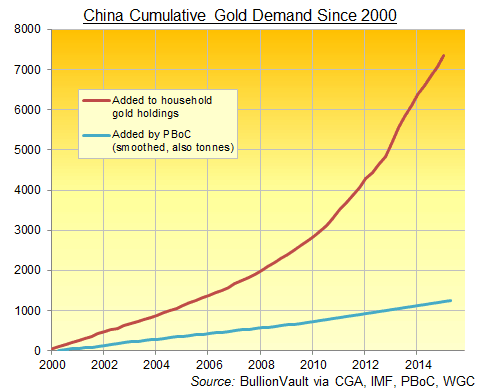

Rickards was right on the China announcement being underwhelming. He’s likely right that they are “hiding” a lot more gold in the State Administration of Foreign Exchange, SAFE…and the China Investment Corporation, CIC too. Will he also be right about gold moving much higher in the future? Have you built your “personal reserve” yet? Adrian Ash of Bullionvault also noted that Chinese households have bought 6 times as much gold as the central bank since the turn of this century.  So even if the numbers are correct as far as government reserves go, private citizens have been buying up even more.

So even if the numbers are correct as far as government reserves go, private citizens have been buying up even more.

Gold Falling Reason 2. Fed will raise interest rates this year

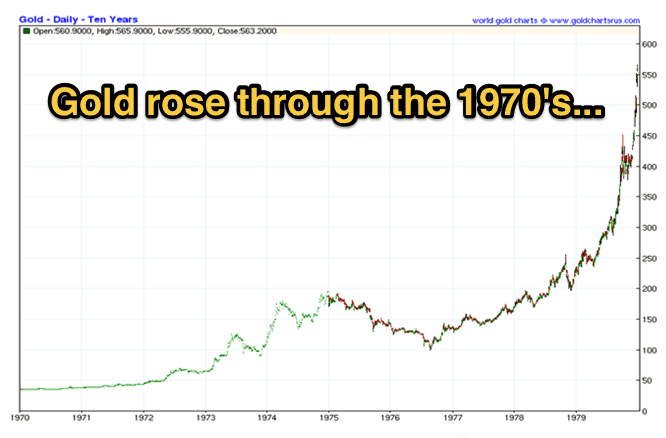

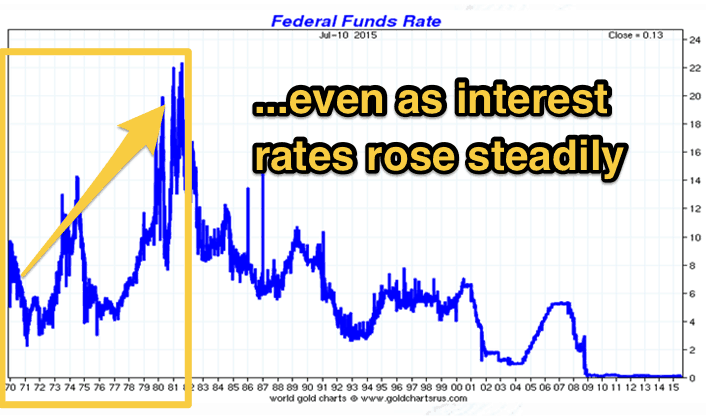

The other narrative growing stronger is that the Fed will raise interest rates later this year and that will be even more negative to gold. That’s the line from Bloomberg and others. We heard the same thing from a business reporter on the radio Monday morning here in NZ, while talking about gold being at record lows and likely to go much lower later in the year due to fed rate hikes. Who knows whether the fed will actually raise rates this year? They’ve managed to talk about it for many many months without actually doing it yet. However if they do, we think the odds favour gold doing the opposite and surprising people to the upside. This will likely come after the final capitulation which we are likely seeing now. Just as occurred in 1976 when gold fell from $200 to $100 and then rose to $850 over the next 3 years. There is also evidence from the 70’s for gold rising while interest rates rise as shown clearly in the 2 charts below.

So don’t believe the hype that rising rates are guaranteed to be negative for gold.

So don’t believe the hype that rising rates are guaranteed to be negative for gold.

Gold Falling Reason 3. Massive short sales of paper gold

This one seems like the big culprit. As noted on Goldcore:

“Paper contracts, the equivalent of 24 tonnes of gold were dumped onto the Globex electronic trading exchange in New York in less than 2 minutes. The action took place at around 9.30 Shanghai time. Japanese markets were closed ensuring a minimal amount of liquidity and potential buyers to support the price. There is some discrepancy in the figures reported by different analysts and media. Astute analyst Bron Suchecki of the Perth Mint points out that the selling began on the COMEX in the August futures contract: “Below is a 1 second time interval chart of the August futures contract from Reuters. The area in the red circle is the 4 seconds of the Nanex chart above, which puts the move into context.

Note that the volume traded in this one minute was 7,164 contracts, which at 100 ounces a contract is about 22 tonnes.” That a single entity or a group acting in concert would choose to sell a position in huge volumes at a time when an absence of buyers would guarantee them a poor price is a sign that forcing down the price was the likely objective of the concentrated selling. Who these “anonymous funds” may be is unclear – the Telegraph describes them as “speculators”. “

But as GATA’s Chris Powell says: “But might not those “powerful speculators” be central banks themselves?” GATA over the years has provided plentiful evidence that the centrals planners require gold not to rise too high for fear of alerting the public to the deficiencies of the global monetary system over which they preside. We wonder whether this is in fact close to the last nudge lower. As we are likely now very close to the overall position in gold futures of commercial traders actually being net long. A very rare event. If this is the case then we might be getting close to the point of maximum pessimism, when there are no sellers left and gold begins its next leg up.

Pingback: How Much Further Might Gold Fall - What About in NZ Dollars? - Gold Prices | Gold Investing Guide