Prices and Charts

Gold Hits New All Time Highs in USD and NZD

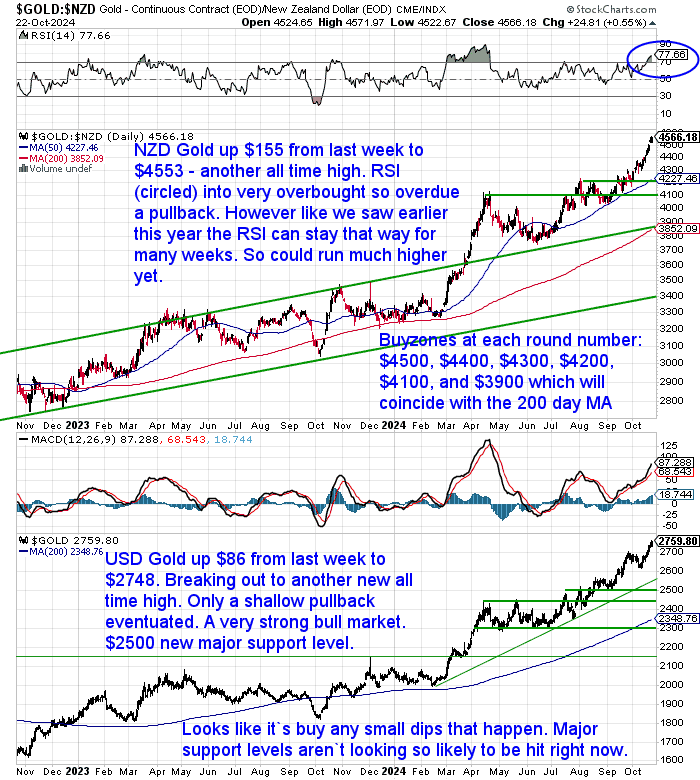

Gold in New Zealand dollars is up 3.5% or $155 from a week ago. It has surged around $300 just this month. We had been watching for a decent pullback but instead gold just continues its march upwards. It is now very overbought on the RSI (circled). However, early this year it stayed that way for almost 2 months. So maybe we are about to see a repeat of a run higher like that where gold rose about $700? The buy zones are each $100 round number lower from here. But it’s anyone’s guess as to whether they come sooner or much later now. We repeat this is a very strong bull market with very few new people getting on board yet.

In USD, gold was up $86 to $2748. It was just a shallow pullback and then gold broke out to a new all time high on Friday night. $2500 is a major support level. But it looks like the best bet is to buy any small dips that happen. Major support levels aren’t looking so likely to be hit right now.

Silver Breakout!

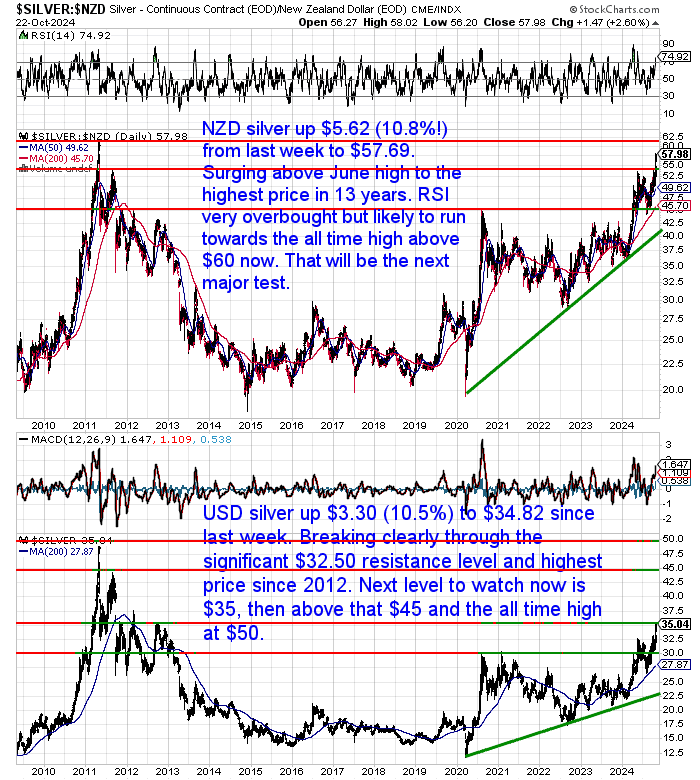

After some frustrating sideways action for the past few months, silver has broken out.

In NZD silver is up $5.62 or almost 11% from a week prior. It surged above the June high on Friday night (the red horizontal resistance line) and has continued on upwards from there. It is also very overbought on the RSI. However silver looks likely to run up towards the all time high above $60 now. That will be the zone for the next major test.

It was the same story for USD silver. Jumping $3.30 (10.5%) to break clearly through the $32.50 resistance level. Sitting at $34.82 right now. So very close to the next overhead resistance line at $35. Above that is $45 and the all time high at US$50.

NZ Dollar Struggling to Move Higher

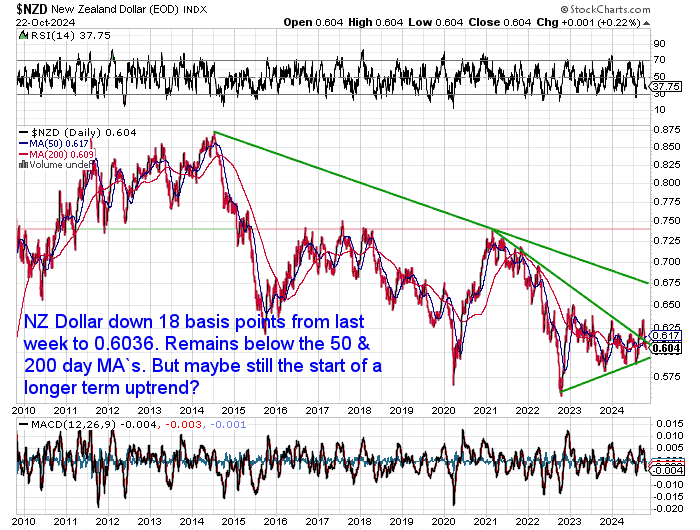

The NZ dollar remains stuck below the 50 and 200 day moving averages. Down 18 basis points from last week to 0.6036. However despite that we still wonder if we are at the start of a longer term uptrend against the USD?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Silver’s Price Potential: A Glimpse into the Future

In this week’s featured article, we explore an exciting question: What price could silver reach in the future? The article dives into different methods of projecting silver’s potential value, from using the gold-to-silver ratio to adjusting for inflation and even comparing silver to the Dow Jones Index.

You’ll discover how historical trends and current market conditions suggest silver may have significant room to grow. These projections range from the moderate to the eye-opening, offering insight into silver’s potential as both an investment and a hedge against economic uncertainty.

If you’re curious about where silver prices might head and want to learn how high they could climb, don’t miss this fascinating deep dive!

Check out the full article below:

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

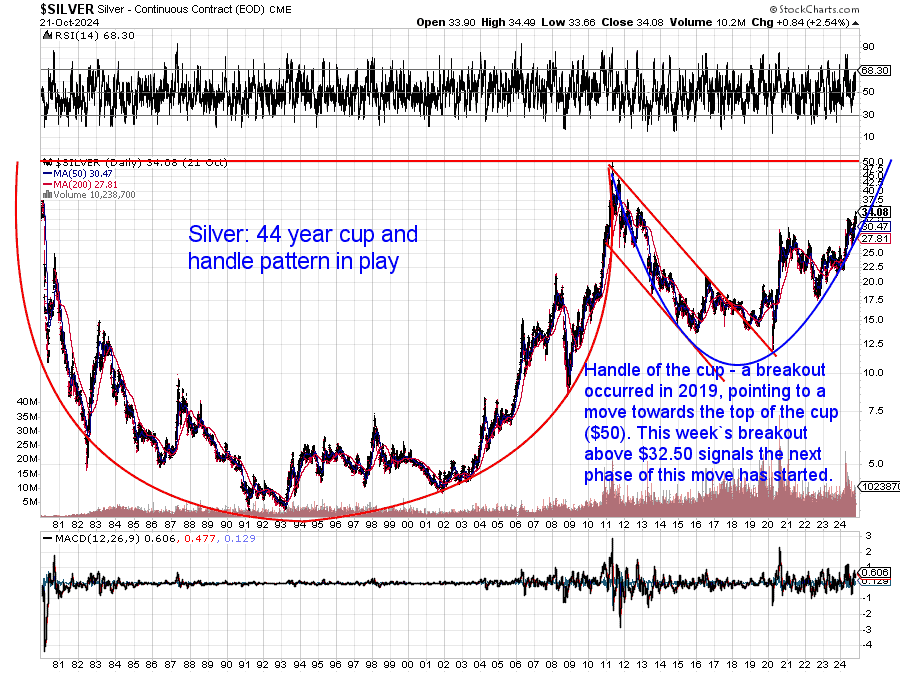

44 Year Silver Cup and Handle

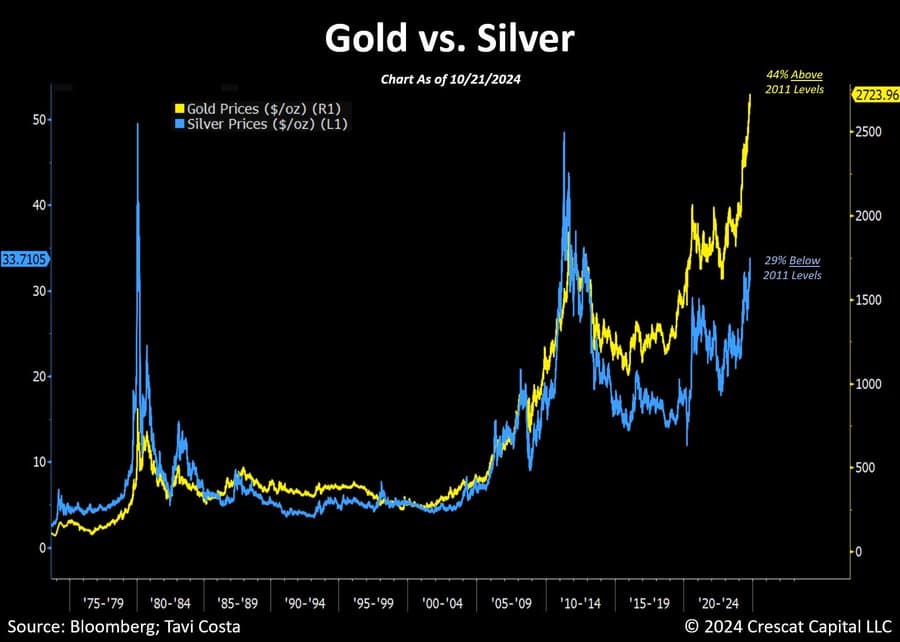

This week’s breakout in silver pushes the grey metal to a 12-year high. But it is still one of the most undervalued metals in history. There’s no other asset we can think of that is yet to beat its 1980 high. Even with this recent jump the gold to silver ratio is still way up there at 79. Meaning it takes 79 ounces of silver to buy just one ounce of gold.

This cup and handle pattern that we last featured back in April looks like it is now beginning the next phase of the move back to the all-time high.

But once that high is broken, we can expect a move in the magnitude of the cup. So a price target of around US$100. Check out this week’s feature article above for other price targets.

Rate Cuts and Higher Inflation

Gold has made multiple all-time highs this week in both USD and NZD terms. Tavi Costa believes it because investors are starting to price in rates cuts combined with higher inflation:

“Gold is rising as the market begins to price in the likelihood of a Fed forced to cut rates further, despite persistent inflation, in my view.

Other metals are likely just waking up to this reality.

Gold is now 44% above its 2011 peak, while silver remains nearly 30% below its level from the same period.

However, don’t misinterpret the situation.

Gold is also signaling the potential for another wave of inflation ahead, making the Fed’s job even harder as interest payments for federal and local governments are already nearing 5% of GDP.

Not to mention:

China’s possible stimulus could add even more fuel to the inflation fire, in my opinion.

This gold move is critical but keep an eye on other metals and commodities that typically lag behind it.”

Famed investor Paul Tudor Jones also believes higher inflation is the only way out for the US and its ballooning debt.

“All roads lead to inflation… I’m long gold”. The playbook to get out of this is you inflate your way out… That’s how you reduce your debt to GDP”.

Short 5 minute video here.

Silver Short Squeeze?

As noted already there has been a significant breakout in silver this week.

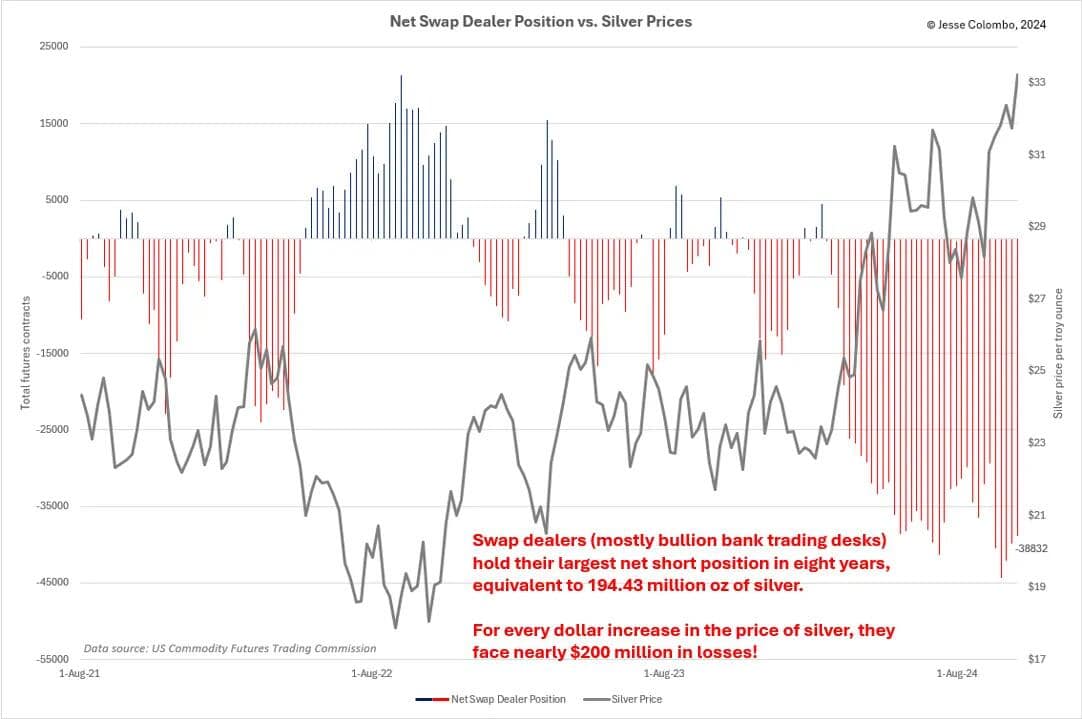

Jesse Colombo believes that:

“…a significant portion of Friday’s silver buying volume was likely driven by short-covering. Short-covering happens when traders who have bet against an asset, like silver, through short-selling are forced to buy it back as the price rallies, in order to limit their losses. As the asset’s price rises, these traders become increasingly desperate to buy it back to close their positions, which in turn fuels the rally even further. If the buying is aggressive enough, this can lead to a short squeeze, amplifying the upward momentum.

A key condition for a short squeeze is the presence of unusually heavy short positioning in the asset. This is currently the case in COMEX silver futures, where swap dealers—mainly bullion bank trading desks—hold their largest net short position in eight years, totaling 38,832 contracts. This is equivalent to 194.43 million ounces of silver, or roughly 23% of the annual global silver production—a staggering figure.

Many analysts believe that bullion banks like JPMorgan and UBS are engaging in aggressive naked short-selling—dumping silver futures without actually holding the physical silver to back them up—in an effort to manipulate silver prices downward. There is a strong chance that these banks will end up on the wrong side of the trade as this rally continues, triggering a powerful silver short squeeze. Given the current size of their short position, bullion banks face nearly $200 million in losses for every dollar increase in the price of silver. This means they lost nearly $400 million on Friday alone! Now, just imagine what will happen as silver climbs by $5, $10, $20, and beyond from this point.”

Source.

So a short squeeze could be what boosts silver up to the all-time high in short order.

Bank of America: Gold ‘last safe haven’ as Treasurys face risks from soaring US debt

Last week we featured favourable comments on gold from UBS bank. This week it’s Bank of America.

“Gold is increasingly attractive as other traditional “safe haven” assets face mounting risks, Bank of America strategists said.

The strategists said investors, including central banks, should rotate into the precious metal, which bulls tout as a hedge against inflation and debt debasement resulting from rising government borrowing.

“Gold looks to be the last ‘safe haven’ asset standing, incentivising traders including central banks to increase exposure,” the strategists said in a Wednesday note.

They explained that with US debt expected to keep soaring, Treasury supply faces risks. At the same time, higher interest rate payments as a share of GDP will make gold an attractive asset in the next few years.

Rising spending is alson’t merely a US issue. The analyst notes that the International Monetary Fund predicts new spending could amount to 7%-8% of global GDP annually by 2030.

“Ultimately, something has to give: if markets become reluctant to absorb all the debt and volatility increases, gold may become the asset of choice. Central banks in particular could further diversify their currency reserves,” the analysts wrote.”

Source.

What to Expect From This Week’s BRICS Summit

Lots of internet chatter about this week’s BRICS summit and a possible BRICS gold backed currency. We’d say this is still premature talk. But In Gold We Trust Report gives a run down of what’s on the agenda for the meeting:

“Let’s overview what we can expect from this Summit.

Listed under the priorities are:

– Enhancing the role of BRICS states in the international monetary and financial system.

– Developing interbank cooperation, providing assistance in transforming the international payment system, and expanding the use of the national currencies of BRICS states in mutual trade.

– Strengthening cooperation on the use of payment systems and financial technologies.

Russia has already launched the new “BRICS Pay” payment system, and a new BRICS currency, called “The Unit” could be announced at the summit.

What exactly “The Unit” will entail remains uncertain, but we will monitor and report on events as they unfold.”

Source.

Silver looks like a fuse has been lit and we are in the early stages of lift off. So could be a good time to start or add to your holdings.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|