Gold Survival Gold Article Updates:

19 March 2015

This Week:

- What to make of all this interest rate stuff?

- The Rule of 3 – 7 days to go

- Gold miner bankruptcy – sign of the times?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1564.48 | – $24.54 | – 1.54% |

| USD Gold | $1173.20 | + $18.30 | + 1.58% |

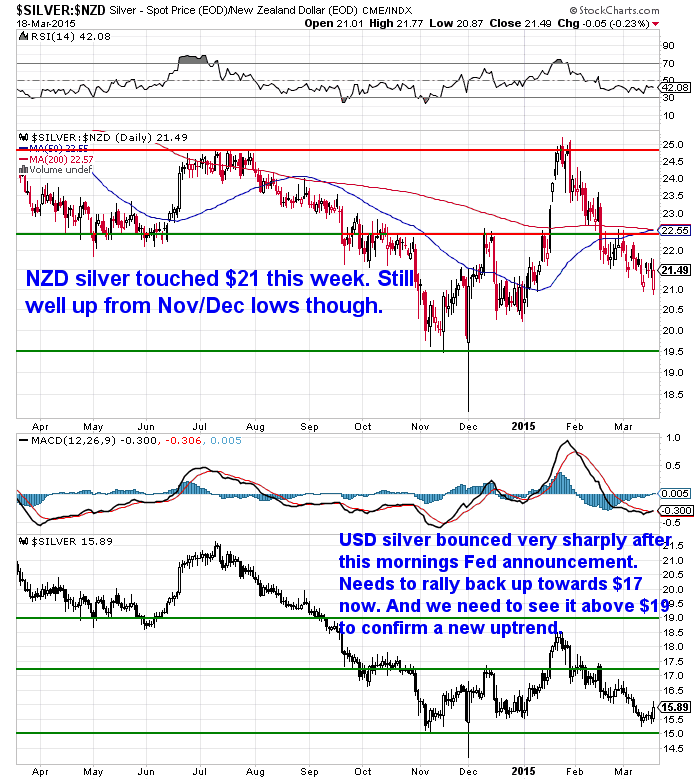

| NZD Silver | $21.49 | + $0.11 | + 0.51% |

| USD Silver | $16.11 | + $0.57 | + 3.66% |

| NZD/USD | 0.7499 | +0.0231 | + 3.17% |

Big moves in precious metals as well as in the dollar this morning. All because of one little word in (or rather not in) the Fed statement presumably.

We’ll come back to that after the charts.

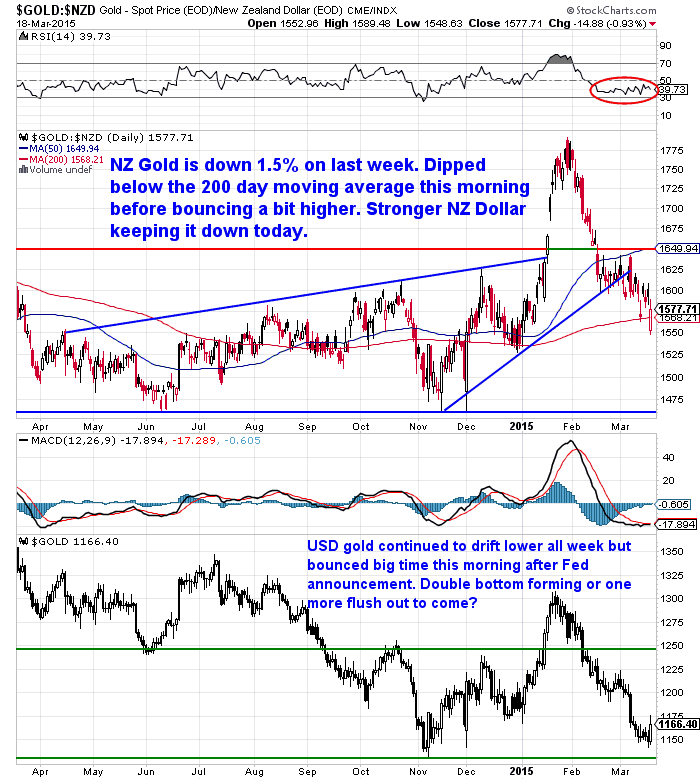

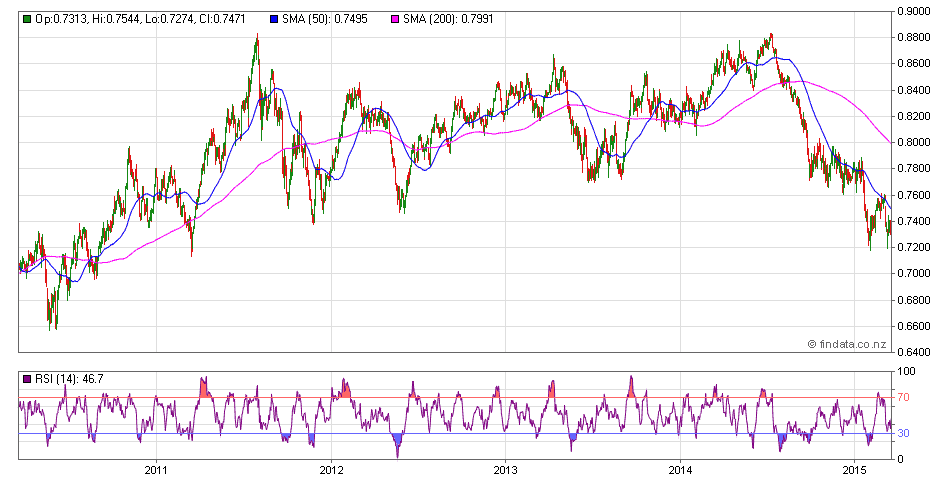

The NZ dollar has been the biggest impact on prices this week.

With local prices of gold and silver falling while US dollar prices are up for the week.

Gold in NZ dollars has dipped down to its 200 day moving average as we thought it might. While in US dollars it got close to last years lows but then bounced sharply higher on the Fed announcement.

Silver did much the same…

But it was the NZ dollar bouncing a giant 2 cents from 0.7295 to 0.7499 that had the biggest impact on local gold and silver prices.

The US Dollar had gotten too popular so it’s not surprising to see it moving lower from here and the Kiwi bouncing higher. Although we think the bigger overall trend of a rising US dollar might still be in play for a bit yet.

So what caused all these sharp movements in exchange rates, stocks and precious metals prices?

From the mouth of the Fed head came the words:

“Just because we removed the word patient from the statement doesn’t mean we’re going to be impatient,”

What?

The Fed is no longer patient but they’re not impatient about raising interest rates either?

We’re not sure what the word for that is then. mid-patience maybe?

Don’t you find it hilarious how much importance is placed on these utterings?

But it seems the mainstream take away has been that the Fed is still a little way off raising rates. One article said:

“Liftoff suspended

A recent spate of disappointing US economic data, such as lower retail sales and consumer sentiment, has led some economist to call for a rate rise to be delayed even further.

“The Fed is in no rush,” said Ward McCarthy, chief US economist at Jefferies.

“At the current juncture, the timing of the liftoff is still indeterminate and will depend upon the inflation data. The policy statement eliminated the use of ‘patient’ in forward guidance, but the FOMC also described the new forward guidance as being “consistent” with the prior forward guidance.”

He added: “The word ‘patient’ was removed, but the meaning of patient remained.”

However we couldn’t find too many reasons given for why gold moved so sharply higher.

Here’s a CNBC article that was titled “Gold surges after Fed removes ‘patient’ from statement”.

However it makes no comment as to why the surge in gold occurred. In fact it just has commentary from a swiss private bank that is negative on gold:

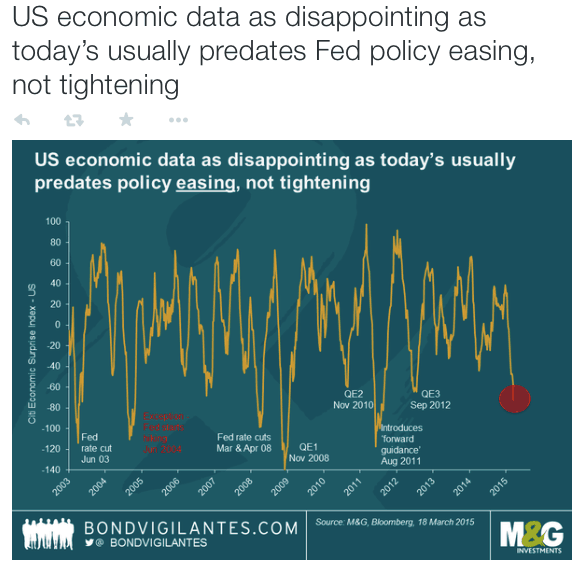

But there is other data that is starting to point lower and show that the rest of the world is beginning to slide.

See this chart from BondVigilantes twitter feed:

As the chart shows historically this weaker economic data leads to rate cuts not rises. But no one in the mainstream expects this.

Adrian Ash from BullionVault makes a good point that:

“a small, one-off rise from zero is all the Fed might manage this summer. And losing its patience today…just as the data urge more cheap money for the cheap-money addicts…would certainly fit BullionVault’s in-house model of public policy. It’s based on nothing but irony and banana skins.

Either way, everyone says the end of patience…never mind a rate hike…would be awful for gold and silver prices. [GSG: this was written before the Fed announcement]

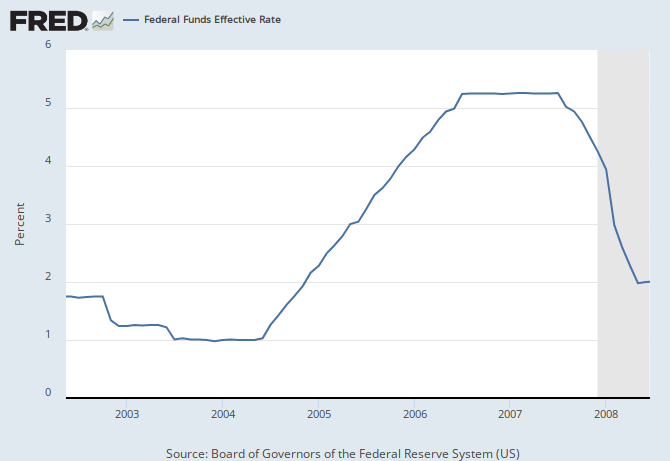

So just for the record, here’s what happened to Dollar gold prices last time the Fed boxed itself into raising interest rates….back to “normal” levels…after an “emergency” low.

Silver did the same. Only with bells on.”

That chart from the St Louis Fed shows that gold actually rose from 2004-06 when the Fed “normalised” rates from low levels after the 2001 tech crash.

So perhaps todays “surprising” rise in gold and silver is just doing what they did last time round?

Something else spotted by the National Inflation Association was that:

“The 15 FOMC participants who anticipate rate hikes to begin this year, project a median year-end Fed Funds Rate of only 0.625%. Only three months ago in its December 17th FOMC statement – those same 15 participants projected a median year-end 2015 Fed Funds Rate of 1.25%!

Over just the last three months, FOMC forecasts for the year-end 2015 Fed Funds Rate have been cut in half! The new projected year-end Fed Funds Rate of 0.625% would require a miniscule 2015 rate hike of only 50 basis points, which means the Fed isn’t serious about raising rates – and could soon change its mind and not raise rates at all!”

So what to make of all this interest rate stuff?

What will be the impact for gold and silver?

We see a couple of scenarios as possible:

Scenario 1: The Fed raises interest rates soon.

This would send even more money rushing back to the US from emerging markets in particular.

Insider Jim Rickards outlined this morning what this would mean in the Daily Reckoning:

These defaults could eventually set off the dreaded derivative time bomb. That would not be a good thing in case the name “time bomb” wasn’t a big enough hint for you.

[See here for a previous article of ours: A Beginners Guide to Derivatives]Scenario 2: The Fed continues to pretend but leaves rates as they are.

The easy money will continue to inflate the various bubbles worldwide in stocks, bonds, and real estate. So we’ll see prices continue to rise for some period of time longer – until…

They don’t anymore. Things would get very messy. Any fall will likely see more intervention by Central banks with different forms of helicopter drops.

So what impact of both of these scenarios on precious metals?

You might think the first scenario (interest rates rising) would mean gold and silver would fall.

However remember that chart we showed you earlier, taken from the St Louis Fed database, of gold and rising interest rates in the mid 2000’s?

Yes gold rose along with rates.

Read more: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold?

However we think the second scenario remains more likely.

With other financial assets continuing to rise, this could well see gold and silver head a little bit lower first. But we think if a bottom is not yet in we are very close.

It could be we need one more flush out to really get to maximum pessimism.

Also remember this is in US dollars we are talking about. As shown in the charts above gold in NZ dollars is still over $100 per ounce above its lows of last year. So we’ve got some room to fall without NZD gold hitting new lows.

REMINDER: Do You Know the Rule of 3? – Are You Prepared Accordingly? 7 days to go…

Three weeks ago we let you know about the launch of Emergency Food NZ.

http://freezedriedemergencyfood.co.nz

In case you missed it, we also mentioned that freeze dried long life food was only the first part of what we intended to offer.

We’ve also got something today that is even more important in preparing for the unexpected than food.

What is that?

Have you heard of the “Rule of 3”?

The rule of 3 says you can survive 3 minutes without air, 3 hours without shelter, 3 weeks without food, but only 3 days without water.

We’ve got the food covered, but the rule of 3 shows water is actually more important in a survival situation. (The aftermath of Cyclone Pam hitting in Vanuatu with some Islanders forced to drink sea water was a brutal reminder of this rule).

So we’ve now got a supply of what we believe are the most effective yet versatile water filters and purifiers available.

And so we thought you might be interested in hearing about what makes them so useful…

Gravity Water Filters

>>> These are gravity water filters.

They filter water without using electricity, making them reliable for use during all sorts of emergencies such as storms, power failures, solar flares, and EMP attacks.

And of course any natural disasters that may damage your town water supply such as earthquakes. Plus they offer a level of protection from any water borne viral outbreaks as has happened on occasion here in various towns around the country.

Gravity filtration has been used by relief organizations such as UNICEF, the Peace Corps, Red Cross Societies Internationally, missionaries and relief workers throughout the world.

Untreated water from stagnant ponds, rivers, lakes, streams, bores and wells all become drinkable water sources with one of these on hand.

Great for everyday use too

But what we personally really like about these filters is that they are great for everyday use to filter and purify the likes of chlorine and other chemicals from the local town supply. Giving our families clean, pure great tasting water everyday.

We love that they can even remove fluoride from town supply water with an added Arsenic/Fluoride filter element too.

>>>Get the full details of these water filters.

Great value for money

They also have the benefit of being great value for money. The filter elements are cleanable meaning they don’t have to be replaced as often as many other brands.

We can replace the water delivery we used to get at $12.30 a 17L container, for theequivalent of only 12 cents ongoing cost.

Best of Both Worlds

So you get quality healthy drinking water on a daily basis but also have on hand a water purifier for emergency situations, and even camping use too.

Benefit from Bulk Pricing

We’re about to place an order from the US supplier, so we thought we’d give you thechance to get some better pricing by locking in a bulk group order.

So you’ve got until Wednesday 25th March to place your order at a 10% discount with FREE shipping. You can compare the pricing to what you’d get on Amazon (don’t forget to check the shipping cost from Amazon to NZ which will be NZ$50 or more), and see this is a great deal.

We’ll complete the order on the 25th March so get in fast as there is also only limited stock from the supplier. (Seems a lot of water filters are being bought in the US currently!) Your order should then arrive within a couple of weeks.

Order yours today and be prepared.

Feel free to email us back or call 0800 888 465 if you have any questions.

Lots of Upside in Gold, Silver and the Shares of Miners

The 3 articles we’ve got posted on the website this week, all delve into the upside that exists in gold and silver, along with their accompanying shares. You’ll find links to these at the end of this email.

We learnt last week that Franco-Nevada co-founder and chairman Pierre Lassonde has been buying mining stocks for his own portfolio again since last October: “[The] gold stocks—just like in 2001—are at absolute rock bottom. In fifteen years, they have not been so low. So I think there’s a historical opportunity, a once-in-a-generation opportunity, right now.”

And Rick Rule, founder and chairman of Sprott Global Resource Investments, says in a few years, “people will call this the good old days.”

What they—and the other six guest stars of Casey Research’s just aired online event GOING VERTICAL—agree on is that it’s time to prepare your portfolio if you want a shot at vertical gains once the mining sector recovers.

Even the major gold producers are so undervalued that they could rise 150% – 200%. But the best of the best junior miners, the survivors of the bloodbath, are poised to generate returns of up to 1,000% or more.

Click here to watch the video recording of GOING VERTICAL, with its all-star cast: Pierre Lassonde… Bob Quartermain… Ron Netolitzky… Doug Casey… Frank Holmes… Rick Rule… Jeff Clark… and get one of Louis James’ favorite stock picks with vertical potential.

Don’t confuse the Franco Nevada company mentioned above with Allied Nevada Gold.

Why?

Because Allied Nevada Gold announced bankruptcy last week. Chiefly due to too much debt. It could well be the first of others to follow. But this could also be a good indicator that we are are at or near the bottom in gold and silver prices.

Maybe we need a few more mining bankruptcies to come first?

Another Sign of the Times

Attendees and exhibitors at the Prospectors and Developers Association of Canada (PDAC) conference aren’t having as much fun as they used to:

The article goes on to run through how many mining companies are slashing all sort of costs, including using AirBNB to find accommodation at the conference for staff instead of hotels.

“Another indication of tough times is the relative dearth of news from Canadian miners leading up to PDAC. In the first seven weeks of the year, miners typically issue streams of press releases about exploration results and fund-raising efforts ahead of the busy spring drilling season.

But data from a top Canadian press release service indicated the news flow from Canadian miners has dropped by more than half in the last four years.

“Everyone is pretty damn depressed,” Aston Bay’s Cox said. “I moved my company into a basement in Vancouver, Washington. This is a recession, I have no pride.”

We’re not 100% confident that the bottom is in for gold and silver. But we reckon we are pretty close. It’s very tough to bottom pick, but these levels are likely to be close in the long run. So a good chance to take a tranche now and keep some powder dry just in case. Let us know if you’d like a quote.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $12,995 and delivery is now about 7-10 business days.

This Weeks Articles:

|

|

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices

Spot Gold |

|

| NZ $ 1564.48 / oz | US $ 1173.20 / oz |

| Spot Silver | |

| NZ $ 21.49 / oz

NZ $ 690.77 / kg |

US $ 16.11 / oz

US $ 518.01 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! Ph: 0800 888 465 From outside NZ: +64 9 281 3898 |

|

|

| The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2013 Gold Survival Guide.

All Rights Reserved. |

Pingback: 3 Gold Myths - Gold Prices | Gold Investing Guide - Gold Prices | Gold Investing Guide