Update 2018: The RBNZ bank dashboard has now been published. See this post for the full details of what is included and what its shortcomings may be: RBNZ Bank Financial Strength Dashboard: How Helpful is it?

Last month the Reserve Bank quietly published its RBNZ Bank Dashboard initiative for quarterly bank disclosures. The full riveting read is here.

Martien Lubberink (Associate Professor at the School of Accounting and Commercial Law at Victoria University) welcomed the bank dashboard, saying:

“The Dashboard approach is meant to improve the timeliness, accessibility and comparability of bank disclosures. It does so by offering detailed prudential bank data centrally, electronically, timely, and comprehensively. This dovetails with the RBNZ’s supervision philosophy, which relies on market discipline more than many other prudential supervisors.

This is awesome: a central repository, offering relevant data in a timely fashion.”

Source.

What Information Will the RBNZ Bank Dashboard Provide?

The idea of the RBNZ Bank Dashboard is that people interested in the soundness of their bank (probably actually very few people in New Zealand unfortunately! – although we’re sure our readers will be among those who are interested), will be able to go to the RBNZ website and view all the data about their bank. Plus compare it directly with other banks.

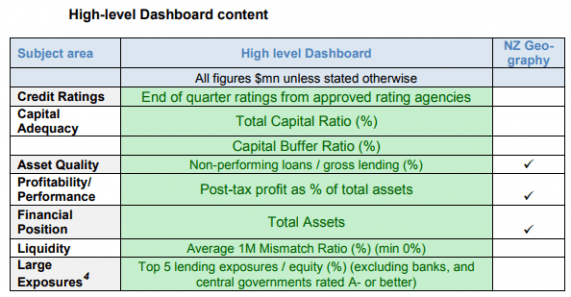

The table below taken shows what data will be available:

This RBNZ bank dashboard is certainly an improvement on having to go to each banks website and dig through reports to find the numbers. Lubberink has previously written with concern about the state of New Zealand Banks. See: Just How Well Capitalised are New Zealand Banks?

So this data may well be of some help. However we have a few thoughts to add…

As one reader commented:

“Yes, the RBNZ’s Dashboard will be a good development when it arrives next May

However,the key risk of banks at the moment is their mortgage lending. Over the last 5 years it has been extremely lax with high DTIs etc, – but there is no disclosure that readily allows a depositor to see how egrediously [sic] loose the lending has been. None, – apart from the effects of reckless lending such as ballooning house prices, low rental yields, and increasing ratio of household debt to household income at levels that will soon cause financial instability.”

But Just How Much Use Will the New RBNZ Bank Dashboard Be?

So the idea is that the public can visit the RBNZ website and get a gauge on the relative risks between New Zealand banks. At a glance this seems like a good idea. Particularly when there is no deposit insurance, it behooves every depositor to know how their bank shapes up.

“[T]he Reserve Bank views capital as “the single most critical piece of information in assessing financial stability,” with a bank’s capital ratio indicating its ability to “withstand a range of risks, including credit risk, liquidity risk and operational risk.”

However Toby Fiennes, the Reserve Bank’s head of prudential supervision also noted that:

“Bank failures are correlated with capital in the sense that the more capital there is the less likely there is going to be a bank failure. But it isn’t a perfect match because there could be all sorts of things that are hidden. And bank failures can happen very quickly,” said Fiennes.

“It [the dashboard information] does show the relative resilience of the banks. So a bank with more capital and more liquidity is, other things being equal, going to be more resilient and therefore safer than one with lower levels.”

So while it might be a good idea to know how resilient your bank may be, there are a couple of considerations that may make this somewhat redundant.

Here’s Where the RBNZ Bank Dashboard May Not Help

- New Zealand does have a highly concentrated banking system, made up of only a few banks.

- Also perhaps the greatest risk to NZ banks would come from an offshore event, affecting the flow of credit into New Zealand (which we require given that we borrow much more than we save).

The point being that if one bank was in trouble it would be highly likely that a number of them may be experiencing similar problems.

See what would happen when a bank fails in New Zealand and why some or even all your savings might be at risk if your bank did fail: RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)

Just another reason why you might want to buy some gold or silver. There’s plenty more reasons though:

Why Buy Gold? Here’s 14 Reasons to Buy Gold Now

Why Buy Silver? Here’s 21 Reasons to Buy Silver Now

Pingback: Update: RBNZ Bank Financial Strength Dashboard - How Helpful is it? - Gold Survival Guide