Prices and Charts

USD Gold Sets New All Time High

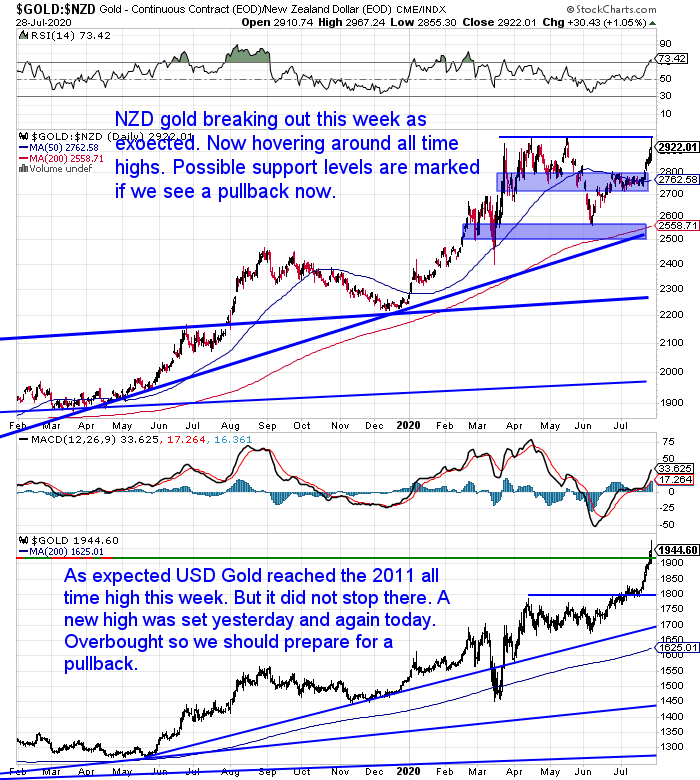

The big news this week arrived yesterday. Something we had been expecting. However, it arrived much faster than we thought it would. Gold in US dollars reached and then exceeded its previous all time high from 2011 of $1921.

Yesterday getting as high as $1980 before pulling back to as low as $1940. As we type gold is above $1950. It looks to be trying to consolidate some of the recent gains now. The question is can the previous all time high now become support? Meaning will the price hold above that level? Or will we see a more meaningful correction?

Your guess is as good as ours.

But a somewhat contrarian indicator of a short term top is an article on gold appearing in the NZ Herald. (See: Gold fever is back as prices close in on US$2000 an ounce.)

When the mainstream financial press starts talking about gold, experience tells us a correction is usually not far off.

The short term chart below marks support levels to watch for if (when?) this correction takes place.

However let’s also look at the NZD gold chart longer term view below.

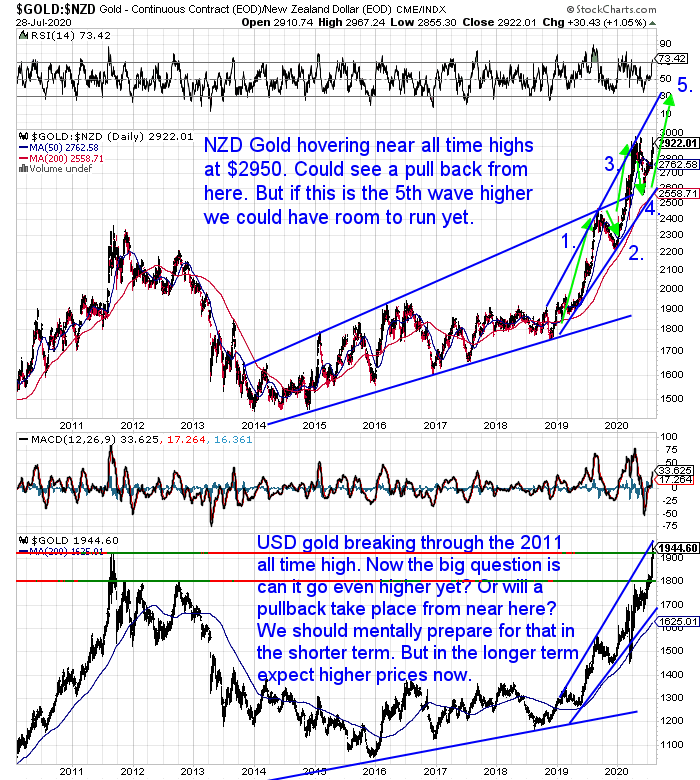

On this we’ve marked in green what Elliott wave technical analysis refers to 5 waves. Without getting too technical, this pattern has a rise up: Wave 1. Followed by a corrective wave 2 down, retracing part of the gains. Then another wave 3 up. Followed by a wave 4 correction. Then a final wave 5 up. Key to this is that each leg up takes the price higher than the previous wave up.

So that would lend weight to the NZD gold price setting a new all time high and rising even further yet.

Elliott wave then says an ABC correction will follow. This is a down wave. Followed an up wave and a second down wave. Taking the price lower than the first leg down.

Don’t get us wrong we think much higher prices are ahead for gold yet. But first, gold will likely need a breather before too long.

So just be prepared for this to happen, so it won’t surprise you when it does. Particularly if you’re buying at the moment.

3rd Phase of the Precious Metals Bull Market Begins

The new all time high in USD gold likely marks the beginning of the next phase of this precious metals bull market.

The first phase was the rise from 2000 to 2011. This was a greed driven run higher. Then we had the consolidation phase from from 2011 to 2020.

Now we are likely entering the fear driven stage. People are likely buying gold now, not simply because the price has risen – although that is a factor. But rather for gold’s monetary characteristics and as a store of value. Fear of a number of things is driving this move:

Fear is a much stronger emotion than greed. So our bet is that when this phase is over some years down the track, gold will be much higher – perhaps in the many thousands higher.

Silver Still Going Vertical

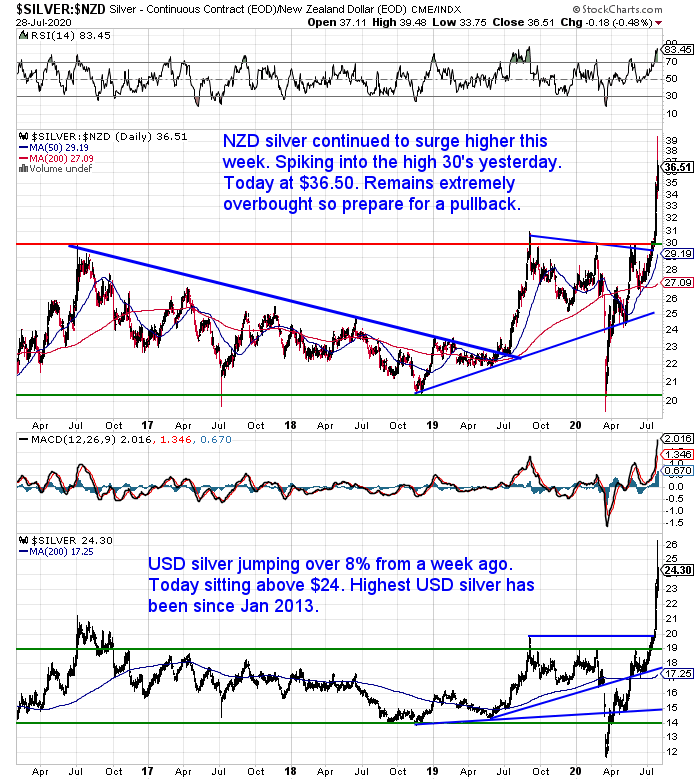

Silver in both New Zealand and US dollars continued it’s near vertical ascent this week. Up over 8%.

Silver remains extremely overbought. So as per gold, prepare mentally for a pullback before too much longer.

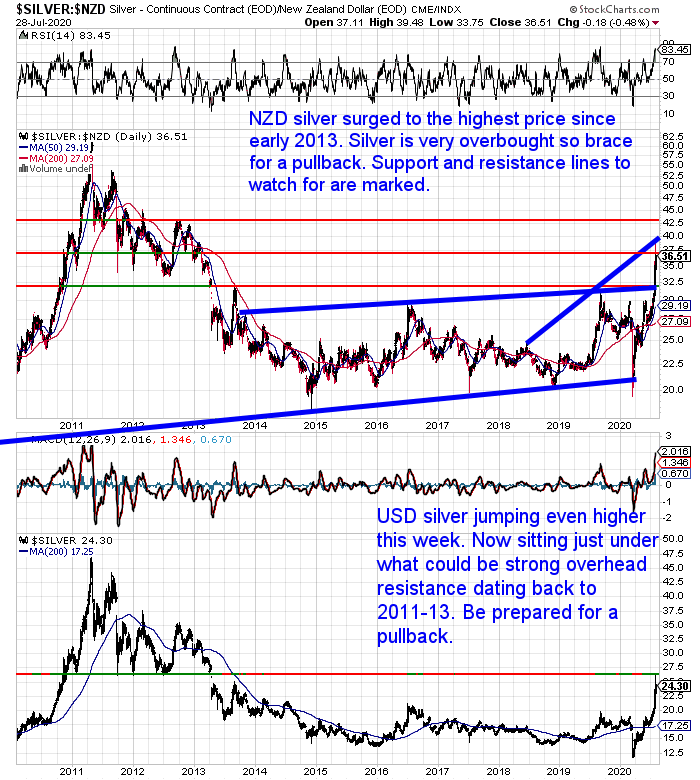

Turning to the longer term chart, we can see silver is sitting just below key overhead resistance levels. Support lines below are also marked. They will be good buying zones if a correction takes place from here.

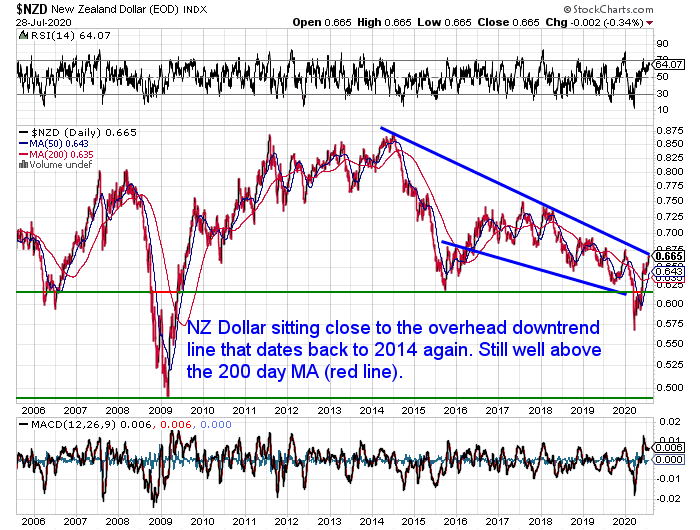

NZ Dollar Also Touching Resistance Level

The Kiwi dollar is also sitting just below an overhead downtrend line and resistance level dating back to 2014. So if gold and silver take a breather, the New Zealand dollar might too.

A weaker Kiwi dollar might potentially insulate local gold and silver prices a little in any fall.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

China/USA Ructions Point to a Global Financial System Reset

Simon Black at Sovereign Man this week wrote about the increasing tensions between the Chinese and US governments.

“…the US-China conflict escalated last week when the US government ordered the Chinese to close its consulate in Houston, Texas.

The Chinese government retaliated by closing a US consulate in China.

This is after months of sanctions, asset seizures, tariffs, arrests, expelling of foreign journalists, and plenty of tension about the Coronavirus.

I know there’s a lot of fear that an actual shooting war will break out between the US and China. And that is a possibility.

…Fortunately, a shooting war is unlikely. Why would China want to invade the US and deal with 400 million guns in the hands of the civilian population?

Why would the US want to invade China and deal with another Vietnam war?

War doesn’t benefit either nation, and on that basis it’s possible… but not probable.

What is likely is a total reset in the global financial system.”

How would such a reset affect New Zealand?

Here’s what we think…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Huh? Prepare for a Correction But Also a Short Squeeze in Gold?

You no doubt “get” we are saying to prepare for a correction in gold and silver in the not too distant future.

But you should also prepare for a potential “short squeeze” which could push gold even higher yet. (A short squeeze occurs in the futures market when traders who have bet on the price to fall are required to buy gold in order to cover their positions.)

This Bloomberg opinion piece points out:

A Mighty Short Squeeze May Be Building in Gold

“An increase in demand for physical deliveries could trigger a parabolic rise and cause problems for banks.”

The article highlights how:

“…far more investors are opting to take physical delivery [of gold] when contracts end, rather than roll them over. This chart from Longview Economics shows the number of contracts that are being converted into physical deliveries. Gold futures are a handy way to hedge financial risks. But they have never been used to buy bullion on this scale before:

The author then quotes Longview Economics:

“Bank runs occur when lots of depositors demand their money back at the same time. The bank, of course, doesn’t keep all their money in the bank. Deposits are lent out as loans (and so on). As such banks suffer short squeezes of liquidity if too many depositors ask for their money at the same time (unless, and until, the central bank steps in with newly created liquidity).

Just like in a bank run, therefore, if too many gold future holders decide to take delivery of physical gold at the same time (rather than simply rolling their contracts), then it’s likely the swap dealers won’t be able to satisfy all those demands (i.e. the physical gold isn’t there/available).

…If so, then this will be one of those ‘rare’ occasions when the message of the positioning, sentiment and other models is wrong – and markets don’t immediately mean revert but enter into one of their occasional parabolic price moves.”

So gold could go down – or could go up! Not very helpful we’d admit.

But the point here is if you’re looking at buying, maybe don’t go all in. Likewise don’t just sit on the fence and wait for the correction. In case that happens from much higher levels.

Instead a good buying plan is to split your cash up into a number of tranches or lots. Buy a slice of gold and/or silver now and then wait and see what happens. Price rises. At least you bought some lower. Price falls. Buy more at cheaper prices.

Please get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Is Inflation Coming? If So, What Kind? - Gold Survival Guide

Pingback: More All Time Highs: USD Gold Breaking $2000 - NZD Gold Over $3050 - Gold Survival Guide

Pingback: The Precious Metals Correction Finally Arrives! Gold and Silver Down Sharply - Gold Survival Guide