Prices and Charts

Gold Bounces From Extreme Oversold

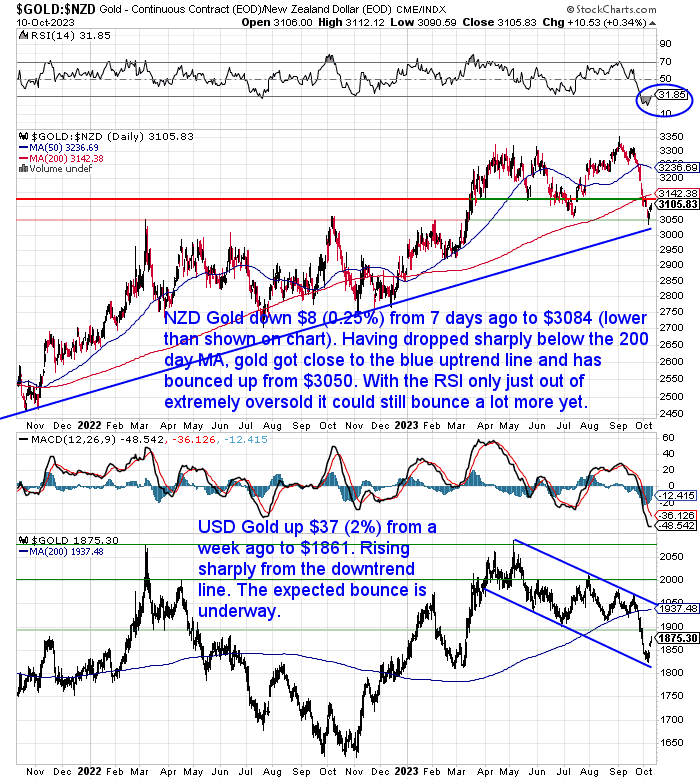

As we thought might happen, gold in NZ dollars bounced up after hitting extreme oversold levels last week. This bounce coincided with the outbreak of war between Israel and Hamas in the Gaza strip (more thoughts on whether that was the cause of the jump or not in this week’s feature below).

But regardless of the cause, NZD gold has risen up after getting close to the blue uptrend line. It still remains below the 200 day moving average (MA) and with the RSI (circled) only just out of extreme oversold it could still bounce a bit higher yet. Despite the almost $300 fall, NZD gold remains clearly in the long term uptrend. Bear in mind it’s always difficult to time the exact bottom. But we are still in an excellent buying zone at current levels.

USD gold was up $37 (2%) from a week prior. Rising sharply off the short term downtrend line. So the expected bounce is clearly underway there too.

Silver Also Out of Extreme Oversold

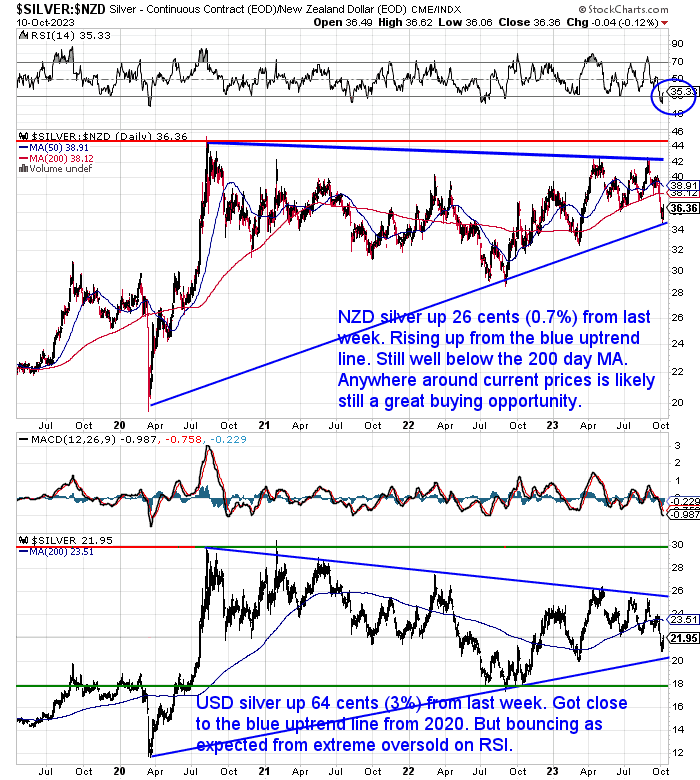

Silver in New Zealand dollars has bounced up from the blue uptrend line dating back to 2020. Up 26 cents (0.7%) with the stronger Kiwi dollar holding it back. Silver remains well below the 200 day MA. Our guess is buying anywhere around current levels will still be an excellent buying opportunity.

USD silver also got close to the 2020 uptrend line. Jumping 3% from a week ago as expected after getting to extreme oversold levels on the RSI.

NZ Dollar Jumps Higher

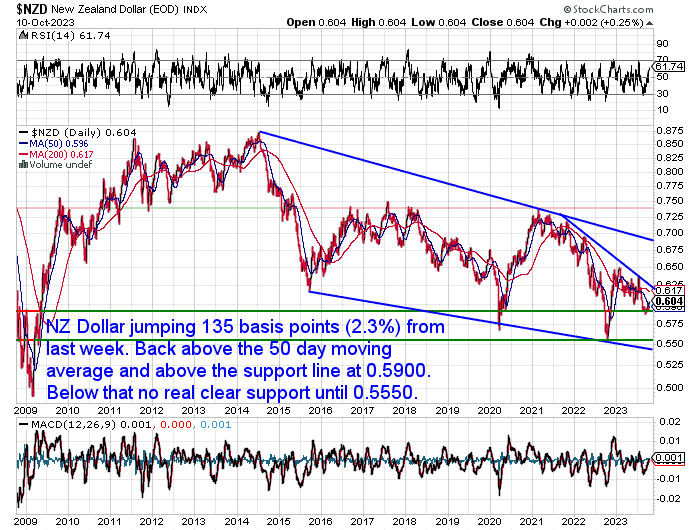

The Kiwi dollar was up 135 basis points from 7 days prior. This 2.3% surge has it back above the 50 day MA and the 0.5900 horizontal support line. Looks to be trying to carve out a bottom.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

How Does War Affect the Gold and Silver Price?

With a war breaking out on Israel’s border with the Gaza strip, there is also potential for a wider war in the middle east. You may be wondering how this could affect the gold and silver price?

History shows that wars can have different impacts on precious metals, depending on the duration, severity, and outcome of the conflict. In this week’s feature article, we examine how past wars have influenced the gold and silver price, and what we can expect if a prolonged war occurs. We also look at how inflation can also be a by product of wars …

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Record High Interest Rates – What will Break First?

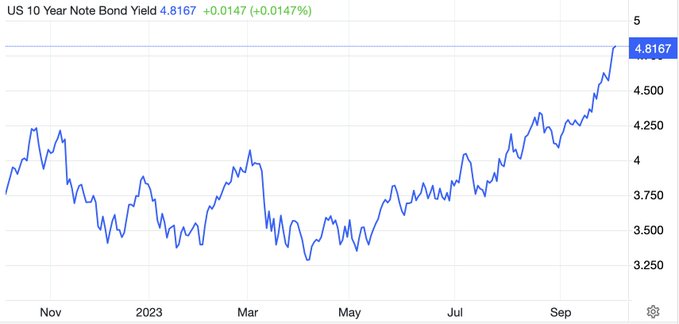

Last week we discussed how significant the surge in interest rates on US treasury bonds has been. This surge is having flow on effects. What might break first? Here’s some things to consider…

Interest Rate Derivatives?

Alasdair Macleod says these higher rates are also causing problems in the interest rate swap market…

“Soaring bond yields are driving a crisis in the $400 trillion interest rate swap market. It is forcing the sale of enormous quantities of collateral. It is only just starting. How can the authorities stop it? Renewed QE?

They’ve already lost control of interest rates!”

Source.

Real Estate?

Zerohedge highlighted the flow on effects to mortgage rates with the US 30Y Mortgage rate at 7.88%, “highest since August 25, 2000”.

Source.

UK Bank Trouble?

After the bank failures in the US earlier this year, there are also some wobbles in the UK…

“Metro Bank customers are urged not to take their money out as bosses say they need to raise £600million to bolster its balance sheet” – Daily Mail

“It is mainly funded by retail and business deposits at a time when sharply rising interest rates in the last year have pushed up deposit pricing as customers shop around for better rates.”

Hmmm. Sounds very similar to the banks that failed in the US…

“If Metro is unable to source extra funding it may have to reduce the amount it lends to customers.

One way to do this would be to reduce the range of products on offer, including mortgages and loans.

The challenger bank is also sounding out buyers for £2.3billion out of its £7.5billion mortgage lending book. “

Source.

The bank has around 76 branches in the UK and 2.7million customers. So it’s not tiny, but it’s also not one of the majors, having customer deposits that amount to only about 3% of the size of Lloyds. But where there’s smoke…

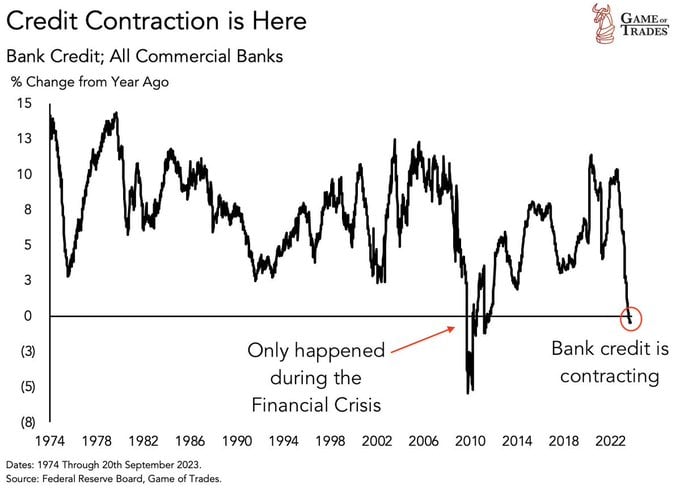

US Bank Credit Contracting

Meanwhile, it seems banks in the US have also been reducing the amount they lend to customers…

“Warning: Bank credit is officially contracting

This has only happened during the Financial Crisis

Buckle up”

Source.

Obviously in a debt based society credit contraction leads to the overall economy also contracting. It also means those who need to refinance might have more difficulty.

Fed to Pivot?

ASB featured this report this morning :

“Atlanta Fed President Raphael Bostic added to other dovish FOMC commentators earlier in the week. He said that there was no need for the FOMC to raise rates further, as the FOMC was on track to bring inflation back to 2%. He also indicated that he thought the US economy was on track for a soft landing, noting that he didn’t see a US recession ahead. Pricing for FOMC rate hikes eased on Tuesday, with a roughly 30% probability of another FOMC rate hike in coming meetings, down from 50% last week.”

Stock Market Rout?

So the expectation of further interest rate hikes is dropping. However, Steven Blitz of independent investment research firm TS Lombard thinks they will keep raising “until something breaks”…

Fed convinced?

TS Lombard’s Blitz: “Probably not, so they will do what they always do, hike until something breaks – and rates are finally at the point where something can be broken. The rising mark-to-market losses on bank balance sheet holdings of UST [US treasury bonds] is the easy choice. As 10Y and 30Y yields continue to rise, the mathematics of their return over a long holding period becomes increasingly attractive relative to stocks. Add in the aging population naturally shifting from equity to bonds, the opposite of the past 30 years, and an equity rout could be in the making. This is not my call to make, but as long as we are thinking about what breaks, etc….”

Fed Pivot on Interest Rates “Almost Delusional”

Meanwhile Twitter/X analyst “The Mad King” points out just how significant the recent surge in US treasury bond yields has been. He also thinks a pivot is not so likely:

“For finance professionals who commenced their careers after 1985 (including me), a continuous decline in rates has been the norm.

We’ve rarely encountered more than one standard deviation, and when we did we knew the Fed’s next move.

Yet now we find ourselves approaching 4 standard deviations!

We are in uncharted territories, and expecting a soon Fed’s pivot is almost delusional.”

Source.

Having run up so fast it’s likely interest rates could pullback and take a pause for a period of time now. But yes, that doesn’t mean the trend is over.

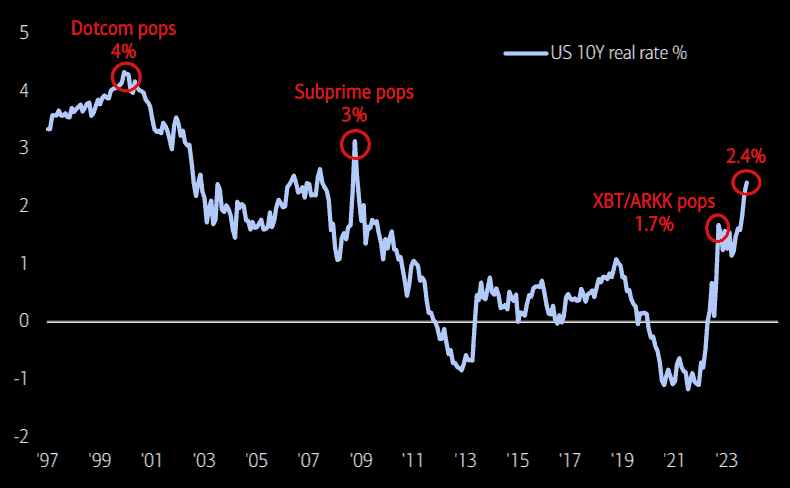

What’s the Next “Pop”?

Last week we highlighted some similarities between the current run up in interest rates and that which occurred in 2008 prior to the financial crisis.

The below chart of the US 10 year bond real (after inflation) interest rate clearly shows the surge in 2008. We can also see how significant the current run up has been.

What’s the next “pop”?

Real rates starting to really hurt…

Source.

We recall in 2008/09 there were gaps of many, many months between the various bank failures. So the question, “what’s the next “pop”?”, seems like something worth considering. Today we’ve shared just a number of possibilities of what could happen next.

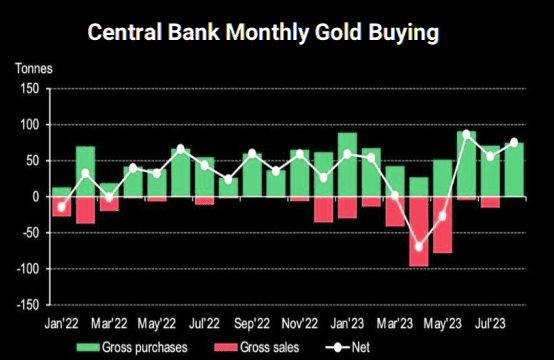

There seems plenty of potential risk about. So maybe it’s wise to follow the world’s central banks in buying gold…

“Central banks have continued to load up on the yellow metal. They added 77 tonnes to their gold reserves in August. Net buying is closing in on recent “highs”. Gold is trading without much trend, but we are at very big levels.”

Source.

You know where to come to find it…

Please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Big Problems Under the Hood of the US Banking System - Gold Survival Guide