Prices and Charts

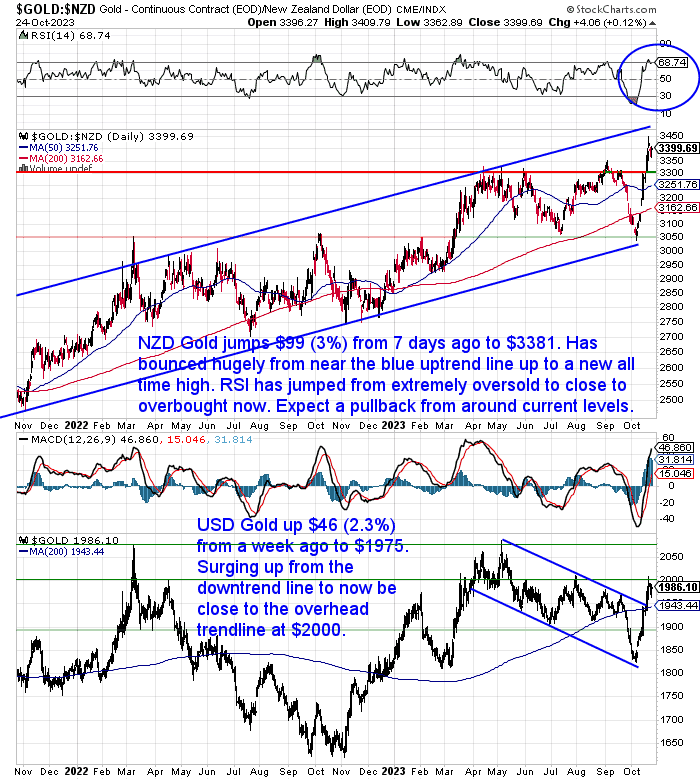

NZD Gold Breaking Out to New All Time Highs

Gold in New Zealand dollars was up $99 or 3% from 7 days prior to be at $3381. We have seen a huge bounce from down near the lower blue trendline in this uptrend channel. NZD gold has gone from the most oversold in years to now being overbought (see RSI circled in blue). Hovering just below the round number of $3400, it is not too far below the overhead trendline in this rising trend channel. So we’d expect a bit of a pullback from somewhere between here and $3500. Buy zones to watch for in any pullback are $3300, the 50 day MA at $3250, and the 200 day MA currently at $3162.

Meanwhile gold in US dollars might not be at all time highs, but it has clearly broken out of the downtrend channel it had been in since April. We need to now see it breach $2000. But a pullback before this is more likely. Maybe back to the 200 day MA which also coincides with the blue downtrend line.

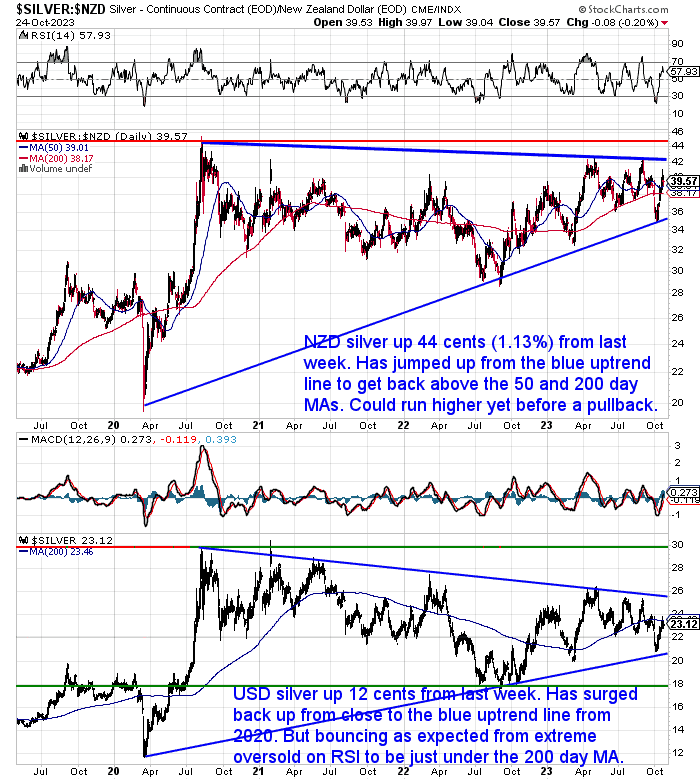

NZD Silver Up Over 1%

The working man’s or women’s precious metal silver was also up but not by anywhere near as much as gold in percentage terms. NZD silver jumped 44 cents or 1.13% over the past week. Like NZD gold it also surged up from the uptrending support line to get clearly above the 50 and 200 day MAs. We could still see it run up to the overhead support line around $42 before a pullback. Maybe watch for the 200 day MA?

The USD silver chart looks similar, although it is sitting just below the key 200 day MA line. Any further dips to the uptrend line, if they happen, look like a great buying opportunity.

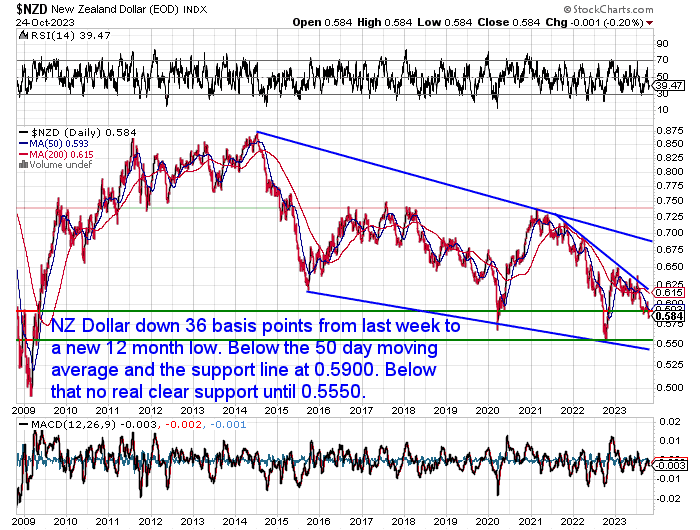

NZ Dollar Hits 12 Month Low

The Kiwi dollar dropped even lower this week. Hitting a 12 month low today at 0.5842. It remains below the 50 day MA and the 0.5900 support line is now the overheads resistance line. So the NZ dollar is still locked firmly in the downtrend.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Q&A Call Recording

Our first Gold Survival Guide Q&A call was well attended and well received last week. Here’s a link to the recording if you missed it:

20 October Q&A Call Recording

We intend to do these monthly at least. So keep an eye out for details of the next one.

Wages from Ancient Greece and NZ Housing in 2023: Both Say Silver Undervalued by a Factor of 20

A common question we received for the Q&A call was our projections on gold and silver prices. However any projection is predicated on the level of currency currently created. So for that reason we prefer to compare gold and silver to tangible things to assess their historical value.

This week’s feature article compares the value of silver in ancient Greece to the buying power of silver today. It argues that silver is undervalued by a factor of 20 and uses two methods to support this claim: the wages method and the housing method.

The wages method looks at how much silver a skilled worker was paid in ancient Athens, and how much a modern worker in the UK construction industry is paid. Converting these both to silver to identify whether silver is under or overvalued today.

The housing method looks at how many ounces of silver it takes to buy the median New Zealand house at different points in time. The article shows that in 1980, it took about 1,000 ounces of silver to buy a house. Read on to see how that compares to today.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Sign of the Inflationary Times?

New Zealand lags behind the rest of the developed world with our inflation tracking CPI data only coming out each quarter. In a sign of the inflationary times, Stats NZ is about to launch a new monthly inflation index from mid November. Called the selected price indexes (SPI), it will track about 44 percent of the CPI’s weighted prices.

An argument was made that more timely data may have resulted in the RBNZ cranking interest rates up sooner and reduced the level of inflation we now have. Perhaps it might have put a dent in this. But the currency had already been created and sent out into the economy so there is no choice but for it to show up in prices.

“Buyer Beware” of Replica Silver Coins at NZ Auctions

One auction house in New Zealand has been auctioning off fake silver coins which some people have paid full value for. As this story highlights it is buyer beware as the Auction house is not legally required to confirm the authenticity of what it sells:

Buyer beware: Lipscombe Auction House selling fake rare coins can not be stopped

Warning from World’s Largest Bank CEO

Jamie Dimon, CEO of the world’s largest bank, JPMorgan Chase, recently had a stark warning in the companies third quarter report:

“Looking ahead to Basel III finalization, we intend to adapt and manage to the new rules very quickly as we have shown in the past. However, we caution that such material regulatory changes would likely have real world consequences for markets and end users.

Currently, US consumers and businesses generally remain healthy, although, consumers are spending down their excess cash buffers. However, persistently tight labor markets as well as extremely high government debt levels with the largest peacetime fiscal deficits ever are increasing the risks that inflation remains elevated and that interest rates rise further from here.

Additionally, we still do not know the longer-term consequences of quantitative tightening, which reduces liquidity in the system at a time when market-making capabilities are increasingly limited by regulations.

Furthermore, the war in Ukraine compounded by last week’s attacks on Israel may have far- reaching impacts on energy and food markets, global trade, and geopolitical relationships. This may be the most dangerous time the world has seen in decades.”

“While we hope for the best, we prepare the Firm for a broad range of outcomes so we can consistently deliver for clients no matter the environment.”

Source.

Big Problems Under the Hood of the US Banking System

Not surprisingly Dimon didn’t mention any risks specific to JP Morgan Chase. But here’s a tweet about the next largest USA bank from Lawrence McDonald, Founder of the @BearTrapsReport:

“I believe Bank of America is insolvent with a 6% Fed funds rate, leverage explodes. If your core capital is impaired, any losses on tertiary assets (credit cards, commercial real estate, asset backed securities) are exponential painful.”

He then went on to share this…

“Veteran banker calling for “TARP 2.0” in Op-Ed to help banks with steep unrealized losses on their securities holdings Proposal would lend up to $1 Trillion against securities that have lost value to Fed’s “meteoric increase” in interest rates”

“It would be a “Trapped Asset Relief Program” instead of “Troubled Asset Relief Program.”

…The “bailout” would not be the loan itself, but the exceptionally low interest rate of the loan (well below what the U.S. government borrows at, likely).

…proposal would go much beyond BTFP, lending at rates up to 300 bps below market rates, whereas BTFP lends at 1 year OIS + 10 basis points”

Source.

So why is a veteran banker calling for another bank bailout program when the March bank failures already saw the BTFP (Bank Term Funding Program)?

This proposal is likely trying to fix this massive problem lurking under the hood of US Banks…

Care of the always excellent John Hussman…

Balance sheet losses and debt burdens

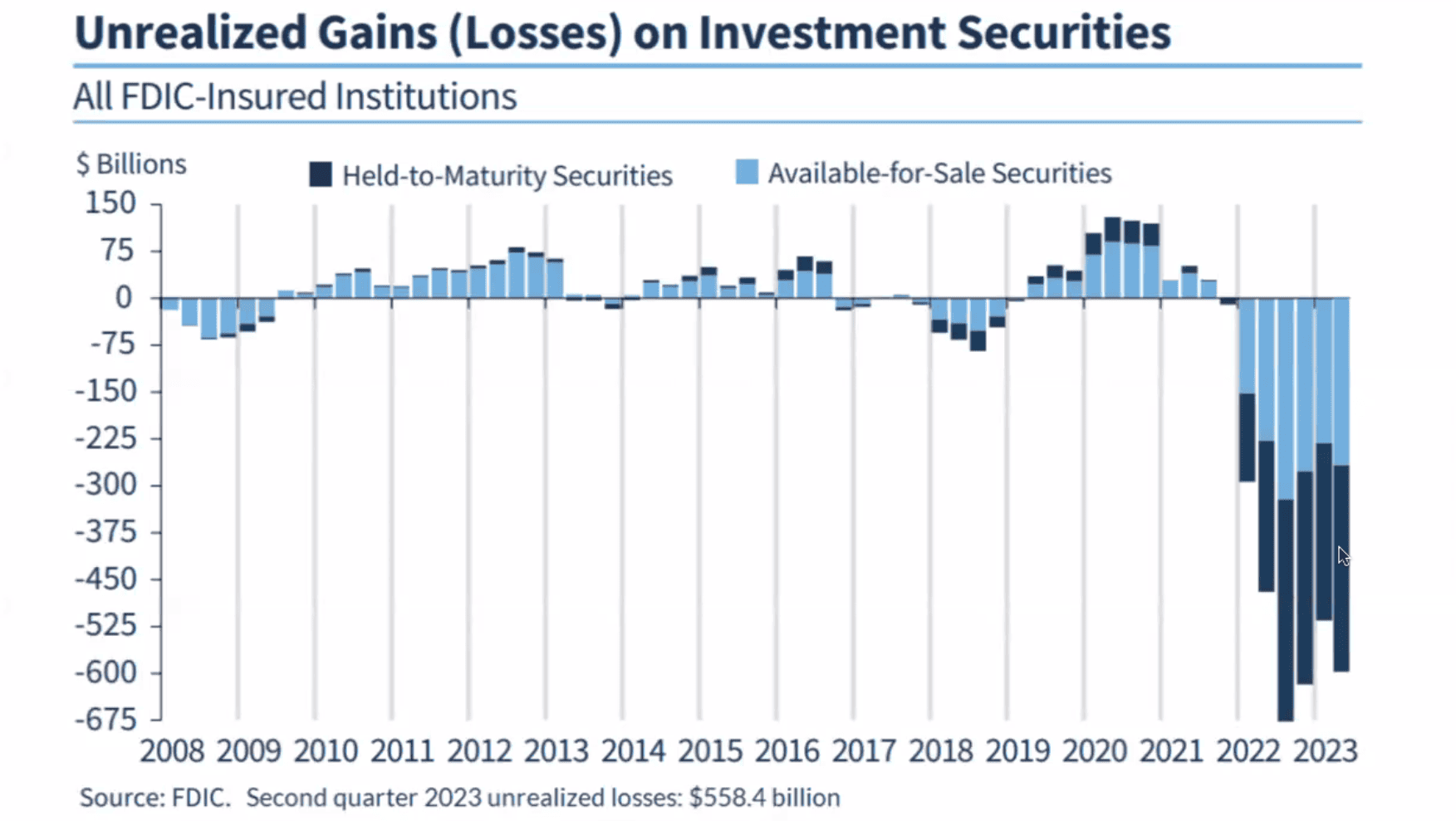

Adding to the “skeleton of instability” created by rich valuations and unfavorable market internals, the chart below shows unrealized losses in the U.S. banking system as of the second quarter of 2023. Notably, 10-year Treasury yields have increased from 3.8% to 4.7% since then, so this profile has undoubtedly worsened in recent months. According to the latest FDIC quarterly banking profile, over 40% of U.S. commercial bank deposits are uninsured – a consequence of a Federal Reserve policy that forced trillions of dollars of reserves into the banking system.

Source.

These unrealised losses dwarf the losses in 2008/09. And while the US does have bank deposit insurance, Hussman points out that only 40% of deposits are currently covered.

Reminder: New Zealand doesn’t yet have any bank deposit insurance in place. Maybe it will by late 2024. See: New Zealand Bank Deposit Protection Scheme – Does N. Z. Have Bank Deposit Insurance in 2023?

US Bank Troubles Going Global?

It seems banking troubles aren’t only limited to the USA:

Recently in China…

Bank run on the Bank of Cangzhou happening in China

CNN: ‘Police in Cangzhou have arrested “many people” suspected of spreading rumors that the bank was suffering a cash crunch because of its exposure to Evergrande…’

Source.

And Canada?

“The major problem I see is how bad of shape many foreign private #banks in many countries outside the US are. Many have absolutely enormous losses on older US Treasury bonds. Plus, the Dollar Index rallying can cause further pain. DXY above 112 acts as a global margin call. Business contacts in Canada told me that Canadian banks may be in the worst shape in their history for many reasons”.

“…There is a lot of Dollar denominated debt outside the US. Many foreign private banks have issued or used too much Dollar denominated debt. When the Fed hikes rates & the Dollar rallies this causes immense problems for Dollar denominated debt outside the US. The other problem is US Treasury losses now. Foreign banks own a lot of older US Treasuries”.

Source.

Referring back to the Hussman report quoted already, Hussman borrows an analogy from Mark Buchanan of a “sandpile”:

“Imagine peering down on the pile from above and coloring it in according to its steepness. Where it is relatively flat and stable, color it green; where steep and, in avalanche terms, ‘ready to go,’ color it red. What do you see? They found that at the outset, the pile looked mostly green, but that, as the pile grew, the green became infiltrated with ever more red. With more grains, the scattering of red danger spots grew until a dense skeleton of instability ran through the pile. Here then was a clue to its peculiar behavior: a grain falling on a red spot can, by domino-like action, cause sliding at other nearby red spots.

If the red network was sparse, and all trouble spots were well isolated one from the other, then a single grain could have only limited repercussions. But when the red spots come to riddle the pile, the consequences of the next grain become fiendishly unpredictable. It might trigger only a few tumblings, or it might instead set off a cataclysmic chain reaction involving millions. The sandpile seemed to have configured itself into a hypersensitive and peculiarly unstable condition in which the next falling grain could trigger a response of any size whatsoever.”

So all these news items mentioned above highlight there are a lot of risks in the global financial system. Some in plain sight, likely others more hidden. We can think of them as many piles of sand. What grain of sand will it be to set one of their piles tumbling down?

For years we’ve heard warnings which included specific dates of an impending crisis. But picking a date is a fool’s errand.

As John Hussman points out…

“Remember, financial markets aren’t linear. It’s impossible to explain the inflation of the 1970’s as a linear function of observable variables (unless one of the variables is inflation itself). The value that investors place on paper currency and government debt is a function of confidence in long-term fiscal and monetary restraint. As economist Peter Bernholz has noted: “There has never occurred a hyperinflation in history which was not caused by a huge budget deficit of the state… In all cases of hyperinflation, deficits amounting to more than 20 per cent of public expenditures are present.” We’ve exceeded that level in each of the past five years – even in 2019, before the pandemic – but that in itself provides no information about whether or when we might observe a break in confidence.

The sandpile can tolerate a persistent trickle of expanding debt, loose policy, extreme overvaluation, and banking losses for quite some time. Ponzi schemes can go on for years. All we might observe for a while are a few localized “tumblings” like Silicon Valley Bank, or a temporary spike in inflation, and we might imagine that everything is contained. Meanwhile, risk quietly extends across the whole system as a “skeleton of instability.” When a confidence bubble finally breaks, it tends to break abruptly. The unwelcome consequences can further undermine confidence and amplify the crisis, as they did with inflation in the 1970’s, tech stocks in 2000-2002, and the global financial system in 2007-2009.

…My main concern is that the instability of the complex system that we call the “financial market” features growing stress on a broad range of interconnected components, particularly across credit, debt, equity, and banking measures. In Buchanan’s words, these interconnected components create a “skeleton of instability.” There need not be a proportional relationship between the size of the last grain of sand, the length of the last straw, or the weight of the landing butterfly, and the extent of the catastrophe they provoke. When the bough breaks, my sense is that it may break abruptly.”

This is an excellent point. The system is so inherently unbalanced that it may not take a massive jolt or event to set it off. Beware the grains of sand…

Please get in contact for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|