Prices and Charts

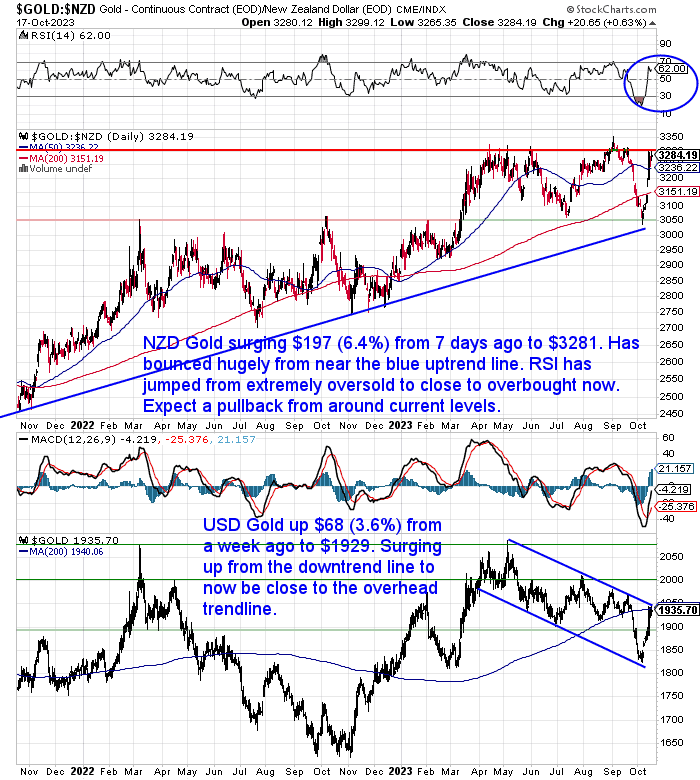

Huge Bounce Back in NZD Gold

Gold in New Zealand dollars had a huge surge this week. Jumping almost $200 from 7 days prior, now at $3281. Back close to the previous highs from earlier this year. So the bounce back has been even swifter than the fall down close to the blue uptrend line.

The extremely oversold RSI indicator (circled) is now suddenly not that far from being overbought. So we’d expect to see a pullback pretty soon. Maybe even back down to the 200 day moving average (MA). As we might need to back fill the gap up from there.

Despite all the negativity towards gold, in NZD terms it remains clearly in an uptrend. So any further dips down towards the blue uptrend line should be viewed as a buying opportunity. Just maybe not a very long lasting opportunity if this last dip was anything to go by.

USD gold was up $68 (3.6%) to $1929. After bouncing off the lower line in this short term downtrend channel USD gold has jumped right back up to the overhead trendline and the 200 day MA. We’d expect a pullback from around here.

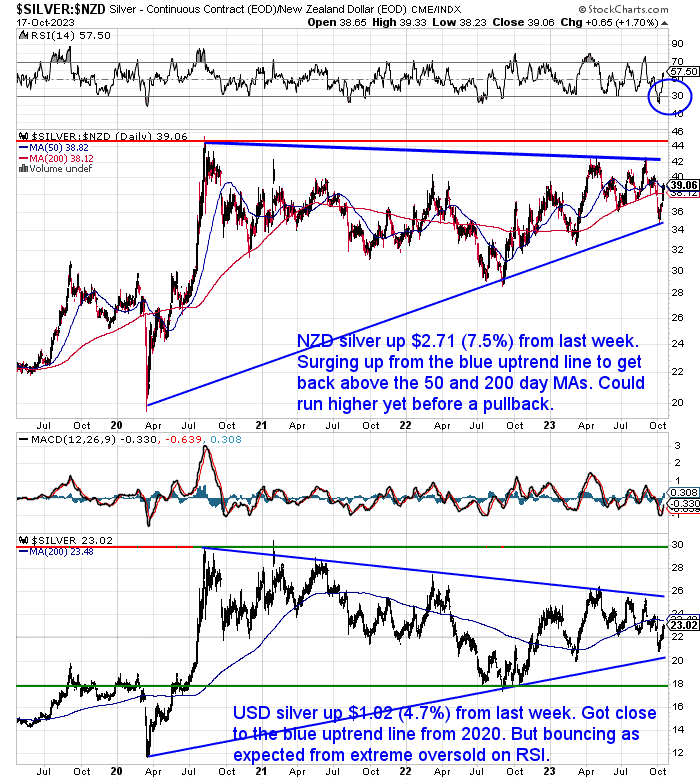

NZD Silver Shoots 7.5% Higher

Silver in New Zealand dollars vaulted even higher than gold. After getting close to the uptrend line dating back to 2020, it was up $2.71 or 7.5% from a week ago. When there’s no one left to sell, that’s usually when we see large moves like this. But for now silver remains in this ever narrowing pennant formation. It can continue to bounce up and down in this range for a little longer yet.

Meanwhile USD silver jumped over $1 per ounce or 4.7%. It sits just under the 200 day MA after bouncing up from close to the uptrend line.

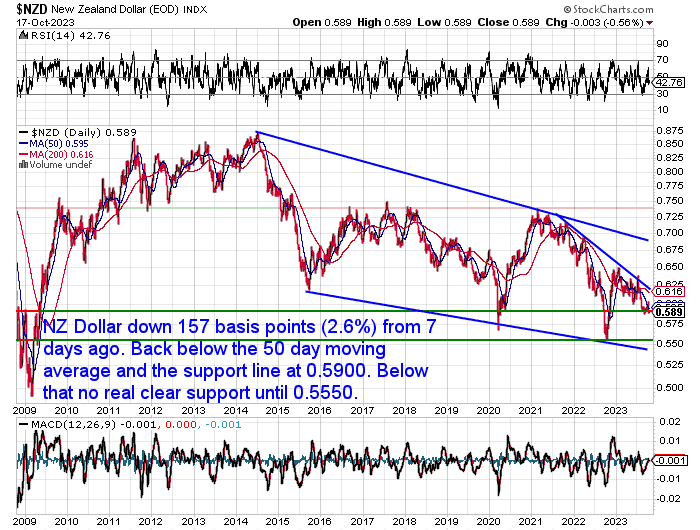

NZD Drops 2.6%

The Kiwi dollar was down 157 basis points or 2.6% from last week. The sharply weaker NZ dollar gave local gold and silver prices a serious boost. The NZD is back down below 0.5900 now. There is still no real clear support from current levels down to 0.5550.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

The Fourth Turning and Gold: What’s Still to Come in This Crisis?

The Fourth Turning is a theory developed by Neil Howe and William Strauss, who studied the generational cycles in the USA and found a repeating pattern of four stages that correspond to the seasons of life. Each stage, or turning, lasts about 20-22 years and has a different social mood and collective consciousness. The Fourth Turning is the winter, where a transformational crisis occurs that destroys the old order and creates a new one.

We are now in the final five years of the Fourth Turning, which began in 2008 with the global financial crisis. According to Howe and Strauss, we can expect more turmoil, chaos, and conflict before the crisis reaches its climax and resolution. In this week’s feature article, we look at what might still be to come. Plus we explore how the Fourth Turning might align with action in gold and silver markets.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

NZ Inflation Rate Drops to 5.6% – Back to Normal in a Year?

Newshub reports:

Annual inflation has continued its downward trajectory, providing some relief for Kiwis hit by the cost of living crisis. Statistics NZ said the consumer price index (CPI) was 5.6 percent in the 12 months to September, falling 0.4 percentage points from June’s annual data.

Source.

Here was ASB’s take on the inflation numbers:

• “Q3 inflation surprises to the downside, with annual CPI inflation falling to its lowest in two years

• Some of the near-term risks identified by the RBNZ were evident, but disinflationary forces are growing, with easing core inflation rates highlighting a cooling underlying inflationary impulse

• Despite 5%+ annual inflation, a confluence of factors should push inflation lower over the medium term. The hurdle to an OCR hike is high and we don’t see the OCR moving above 5.5%. The RBNZ will remain wary and will likely maintain restrictive OCR settings for as long as is necessary to deliver sub-3% inflation

A moderating underlying inflation pulse will encourage the RBNZ to “look through” much of the Q3 quarterly lift in inflation, with inflation still on track to fall below 3% by the end of 2024.”

Wondering what the factors are that will push inflation lower? Here’s what they reckon:

“In their October monetary policy review (see our take here), the RBNZ reiterated OCR settings were restraining inflationary pressure and that overall inflation was on track to fall below 3% by the end of next year. We broadly concur, and believe conditions are in place that should push NZ inflation lower over time.

We can cite the following:

• Easing supply chain disruptions and lower global inflation rates, although we are keeping close tabs on oil prices.

• Global and domestic economic prospects are also weaker, with commodity export prices well below 2022 peaks.

• Financial conditions have tightened appreciably, with at least a further 60bps of mortgage rate hikes in the pipeline even if the OCR does not move higher.

• The household sector is being walloped by soaring living costs. Increased consumer resistance to paying higher prices should limit how much price setters can push through.

• Price pressures from the labour market appear to be cooling. Our earlier research had flagged the state of the labour market as being a key determinant for inflation persistence. The work-ready composition of strong net immigration (see our more recent research here) and record rates of labour force utilization look should help push core inflation lower.

• Larger expenditure weights for components at cyclical peaks (domestic and international airfares are close to 30% and 60% respectively above pre-COVID levels) imply a greater deflationary impulse as these prices decline.

So to summarise and simplify all that, ASB analysts are basically saying that the inflation we have seen in recent years is just a relatively short term blip. Consumers are feeling the pinch and so price setters won’t be able to raise prices much more.

Of course this assumption is based upon the theory that “inflation” is simply caused by businesses putting up prices. But rather we’d say putting up prices is the result of the monetary inflation already created in the past! Our bet is that there is more to come.

We have had years of artificially low interest rates, so now we are seeing rates surging to make up for this. In much the same way we had years of monetary inflation, so now we are seeing the resulting price increases in everyday goods.

ASB and the central bank believe the worst is behind us and we’ll be back to under 3% in a year or so. Just like they also believe interest rates have likely peaked.

We believe the opposite is far more likely.

USA CPI Rising Again?

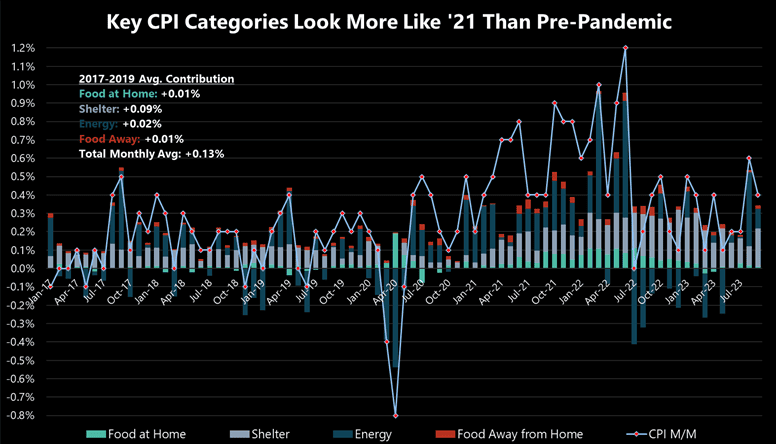

Looking to the USA, we can perhaps see proof of the next round of inflation appearing. The chart below shows the month on month change in price of the necessities of life, food, shelter and energy. The recent months do not seem to show a return to pre pandemic levels yet…

CPI smells like that 21 spirit

“Although M/M CPI prints over the past 12mo had plenty of encouraging aspects, the last few have better resembled early ’21, when inflationary pressures really started to accelerate. Clearly, the intermediate path isn’t a sustained trajectory of lower M/M prints, and that could be an issue for the headline Y/Y prints (and equities). “

Source. Jefferies

War on Inflation is Over?!!

But establishment economist Paul Krugman says:

The war on inflation is over. We won, at very little cost

Readers added context

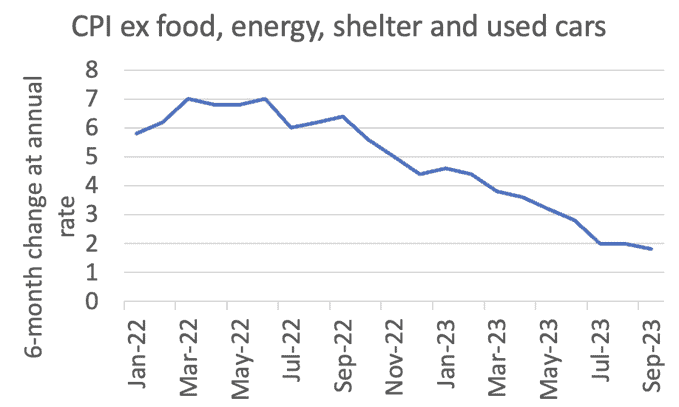

The exclusion of food, shelter, energy, and used cars is misleading. All prices included in CPI shows year over year inflation at 3.7% as of September 2023 bls.gov/cpi/

Source.

Although the very helpful community notes in Twitter/X point out that the war only seems to be over if you exclude all the necessities of life!

Also if you look at alternative measures of US core inflation these have actually surged higher in September.

So we’d say it’s a bit early to declare the war on inflation over. To carry on that analogy we’d say it’s more likely a small battle was won which will lull the generals into thinking the war is over. Meanwhile pockets of marauding “necessities of life” guerilla soldiers are starting to cause trouble all over the country. This will recruit others into the fight and war will surge on for many years.

Paulo Macro: Inflation Reality Check Coming

An excellent post from Paulo Macro elaborates on what may still be to come in terms of interest rates and inflation.

Paulo explains why interest rates have been rising (bond prices falling) and how next will come the realisation that inflation is going to remain high.

“Many seem surprised that real rates are screaming as nominals rise and inflation expectations remain anchored.

But that’s only because inflation swaps or breakevens haven’t moved.”

It can be a little hard to follow for the lay person as he does speak in financial lingo a bit. But the summary is that nominal (i.e. quoted/normal) interest rates have been rising sharply but so have real (after inflation) interest rates. Because inflation swaps or breakevens are what most finance guys follow. For now these remain “anchored”. So if people expect inflation to stay about the same and interest rates rise, then real interest rates rise too. He doesn’t mention this but this is likely why gold has been struggling of late.

He then goes on to say that the expectation may give way to reality. Just like how bond interest rates have surged higher to match the reality of the level of risk in lending right now. So might inflation expectations change in a hurry once the masses realise these are not returning to “normal” anytime soon.

“The Trade After the Trade [meaning the trade after betting on bond prices to fall/interest rates to rise] is actually a world where nominals go from doing the adjusting because they were “wrong,” to breakevens adjusting because they ARE wrong.

In other words, the REAL narrows not because nominal ylds fall but because inflation swaps and breakevens rise.”

He believes we are still at least a few weeks away from the rise in inflation expectations. Maybe this will coincide with the US government shutdown dead line in November.

He finishes off with:

“Anchored is to 2023 what Contained was to 2007.”

And yes – then gold finally works.”

Source.

We don’t know if gold will take off in November. But it certainly surged this week. While some will say this was due to the war between Israel and Palestine, this surge actually took place a few days later. So it’s not so likely directly due to the war.

But if inflation expectations climb, or maybe if the sharemarket takes even more of a dive, then we’ll see more people turn to gold. Better to be in position before either of these come to pass.

Please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Big Problems Under the Hood of the US Banking System - Gold Survival Guide