Prices and Charts

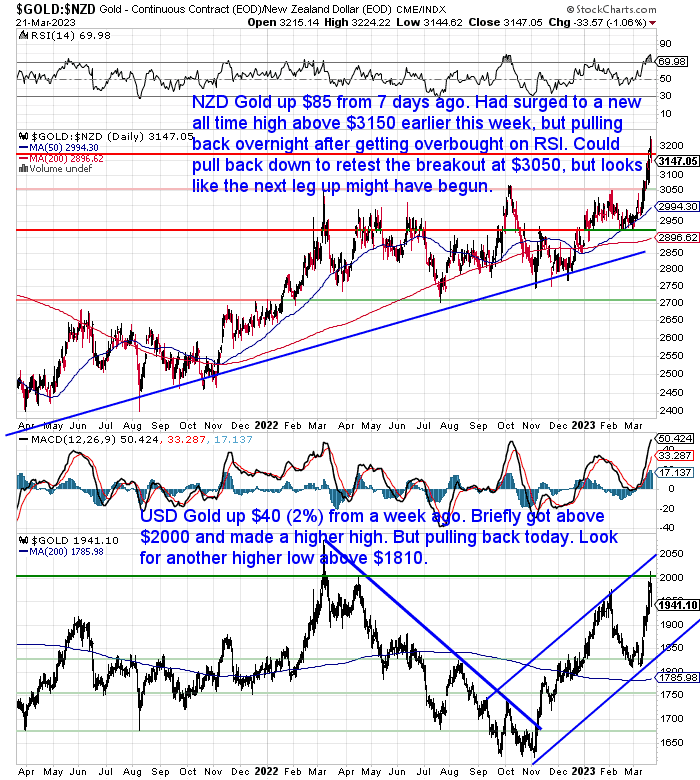

NZD Gold Surges to New All Time High

old in New Zealand dollars is up $85 from 7 days ago. But it has dropped sharply today after surging to a new all time high earlier this week of close to $3200. This pullback is not a surprise as NZD gold had gotten very overbought (above 70) on the RSI (see the top of the chart). We could now see gold fall to retest the breakout at $3050. Next area of support would then be the 50 day MA at $2994. So both those marks are buying zones to watch for if you have been sitting on the fence.

USD gold shot up briefly above $2000 this week but is back down below $1950 today. It could also drop further yet. Look for a higher low anywhere above $1810. We’ll likely see USD gold remain in this upwards trending channel. Expect a challenge of the all time high at $2075 before too long.

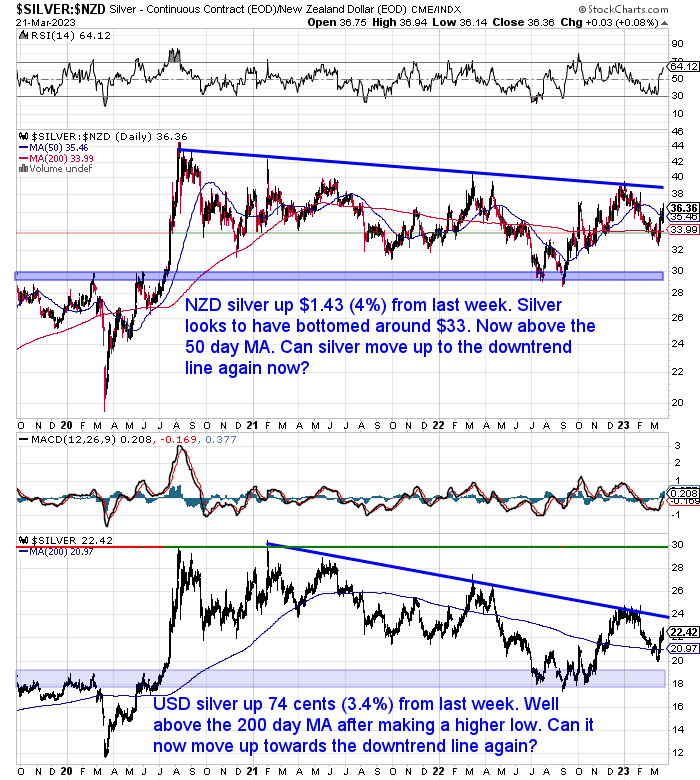

Silver Playing Catch Up to Gold This Week

NZD silver outperformed NZD gold this week. Up 4% and getting back above the 50 day moving average. Now we’ll see if silver can keep rising while gold likely continues to have a further pullback. Looking for silver to get back up to the blue downtrend line and eventually break that too.

Pretty much the same situation for USD silver. It also is not too far below the overhead downtrend line.

In a crisis gold usually outperforms silver early on. But we might see silver catch up down the track further.

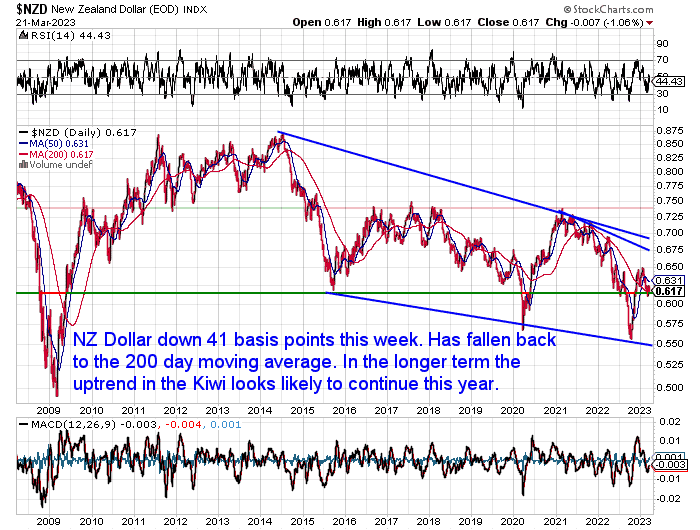

NZ Dollar Back Down to the 200 Day Moving Average

The Kiwi dollar was down 41 basis points this week. Dropping back to the 200 day moving average again. In the long run we’d still expect the US dollar to weaken further. So the uptrend in the Kiwi could well continue this year. But given the outlook for NZ isn’t so rosy either maybe any NZ dollar gains will be at a slower rate?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

SVB Bank Failure: Why Fractional Reserve Banking is Not the Problem

Last week we discussed the potential ramifications of the SVB bank failure in NZ. We outlined how there is currently still no government guarantee of bank deposits in NZ.

Global ratings agency S&P this week reported that Asia-Pacific region banks have reasonable buffers to cope with contagion risks stemming from the collapse of the Silicon Valley Bank (SVB).

“The agency said Asia-Pacific banking systems were in good shape to manage if SVB’s default became more troublesome or complex than envisioned, but pointed to New Zealand as a notable outlier among the region’s developed banking sectors.”

Source.

In last week’s gold and silver update we touched briefly on the topic of demand deposits vs time deposits. But this week we thought it a good idea to delve into this topic in some more depth. Why?

Because the structure of modern fractional reserve banking means that the risk to just about any bank is much greater than most people would think.

Here’s what we cover in this week’s feature article

- Why SVB Failed

- SVB Failure Highlights Problems with Modern Fractional Reserve Banking

- Silver and the Birth of Fractional Reserve Banking

- How Much Did the Silver Storehouses Keep on Demand?

- How This Concept of Fractional Reserve Banking has Degraded Even Further Over the Centuries

- What Lies Ahead

- Why Modern Fractional Reserve Banking Means Any Bank Can Be at Risk

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

The Answer to Modern Fractional Reserve Banking… Inflation

On this topic of duration mismatch and time vs demand deposits, we came across an article from Doug Casey:

Casey concludes with:

“The fractional reserve banking system, with all of its unfortunate attributes, is critical to the world’s financial system as it is currently structured. You can plan your life around the fact the world’s governments and central banks will do everything they can to maintain confidence in the financial system. To do so, they must prevent a deflation at all costs. And to do that, they will continue printing up more dollars, pounds, euros, yen, and what-have-you.”

Source.

That approach certainly looks likely.

Problem: Low Interest Rates and Currency Printing. Solution: More of the Same???

Here’s what David Blanchflower, a member of the Bank of England’s (BOE) monetary policy committee during the global financial crisis of 2008, said this week:

“The Bank of England should slash interest rates and stop selling government bonds in the wake of the turmoil in the banking sector, a former Threadneedle Street policymaker has said.

David Blanchflower, a member of the Bank’s monetary policy committee during the global financial crisis of 2008, said official borrowing costs should be cut from 4% to 3% at this week’s meeting.

…Blanchflower, together with fellow economist Richard Murphy, also urged the Bank to reverse quantitative tightening (QT), under which it is gradually selling off the bonds it bought in order to boost the money supply and support the economy between the 2008 financial crisis and the Covid-19 pandemic.”

Source.

So Blanchflower and Murphy recommend low interest rates and currency printing as the solution to…

… a problem caused by low interest rates and currency printing!

Yes we’re sure that will work!

But, as Alistair Mcleod pointed out this week to King World News, the US central bank has already implemented a program that is likely to be inflationary:

“It is worth repeating, that funding long maturities off a short-term book has always been a no-no in banking. But of the $4.5 trillion USTs and $2.7 trillion Agency debt on the banking system’s books, we now know that a considerable portion of that is likely to be in long maturities. This is why the Fed has introduced a Bank Term Funding Program, offering to buy in all bond debt at par on a one-year loan. According to JPMorgan, up to $2 trillion of bonds might be involved, adding to the Fed’s QE, and similarly is likely to be impossible to reverse.

It is hardly surprising that markets appear to be waking up to the inflationary consequences, particularly if other central banks introduce similar facilities.”

Source.

Another Economist: RBNZ Should Shift Inflation Goalposts

It seems we are continuing to be educated and prepared for a situation where we just have to accept high inflation here in NZ too.

A couple of weeks ago we reported on this headline:

“Why the Reserve Bank could be forced to shelve its [1-3%] inflation target”

This week another [ex-]bank economist is saying the RBNZ might have to shift its inflation target higher, maybe to 4%…

“The Reserve Bank (RBNZ) may have to discuss modifying its 1-3 percent inflation target amid higher consumer prices in the post-COVID era, prominent economist Cameron Bagrie says.

Bagrie said there could be a discussion about that target within the next couple of years.

“You start to wonder… when push comes to shove, as those economic costs of taming inflation start to sink in, whether we sit back and think about, ‘Maybe there’s an easier solution here; it’s shifting the inflation goalposts.’

“On some levels, I’m thinking that’s not the right decision but in a world of supply shock after supply shock, you wonder whether a 1-3 percent inflation target is actually the right target,” Bagrie told AM.

…”Two percent inflation, I think, is going to be a lot more difficult to achieve than what we’ve seen over the past 30 years,” Bagrie said. “Why? Because… it’s no longer that low inflation environment we’ve been used to,” he said, pointing to costs associated with climate change and a shift away from globalisation.”

Source.

But yet again the discussion of why, is only because of supply shocks, the end of globalisation, and climate change costs. No mention that the high inflation was caused by the central banks extremely low interest rates and currency printing in the first place!

Odds are the persisting inflation will get blamed on the weather!

We continue to think that stagflation is the most likely outcome to all of this. We’ll see a sluggish economy but at the same time high rates of inflation.

So it’s worth remembering that gold always shines during stagflation. Gold went up 25.5 times in the stagflationary 1970s bull market. Silver went up 38 times in price.

If you’re ready to buy please get in touch for a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|