Prices and Charts

Sharply Weaker NZD Pushes NZD Gold Up

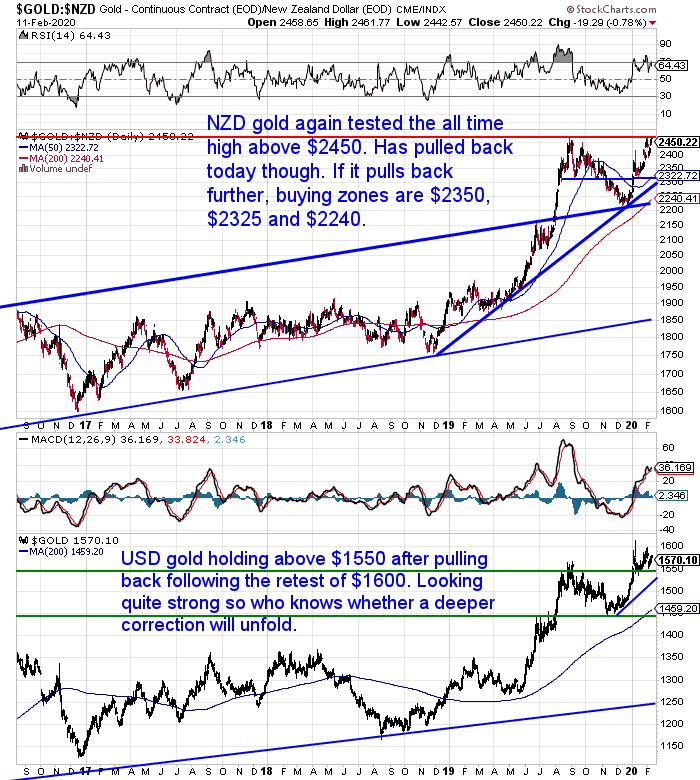

The New Zealand dollar dropped over 1% this week. That helped bump the NZD gold price up over 2%. For the second time in two weeks gold tested the all time high from August last year. Although it is down slightly today to around $2450.

So gold has had a very strong start to the year. Recouping all the fall from the last quarter of 2019 in just over a month of 2020. It wouldn’t be a surprise to see a pullback from here. We’ve marked out some buy zones to watch for on the chart below. There’s no guarantee any of these will be reached with gold looking so solid. But they are good areas to grab a position in the yellow metal.

NZD Silver Up But Lagging Gold Still

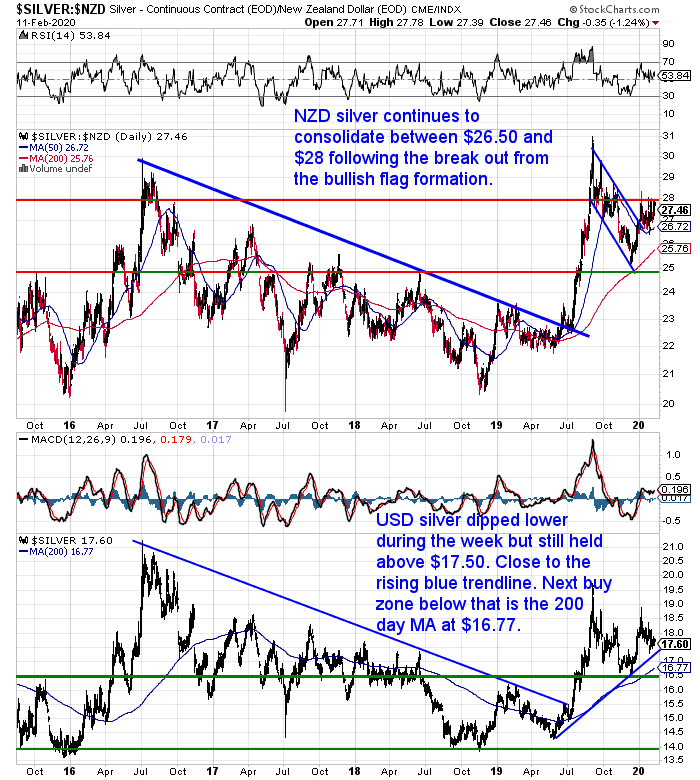

NZD silver was up about 1.5% for the week. Still continuing to lag gold overall. And still consolidating between $26.50 and $28.00. The 50 day moving average is proving to be solid support so far. Therefore buying around these levels looks like a good long term bet.

Coronavirus Fears Continue to Weigh on NZ Dollar

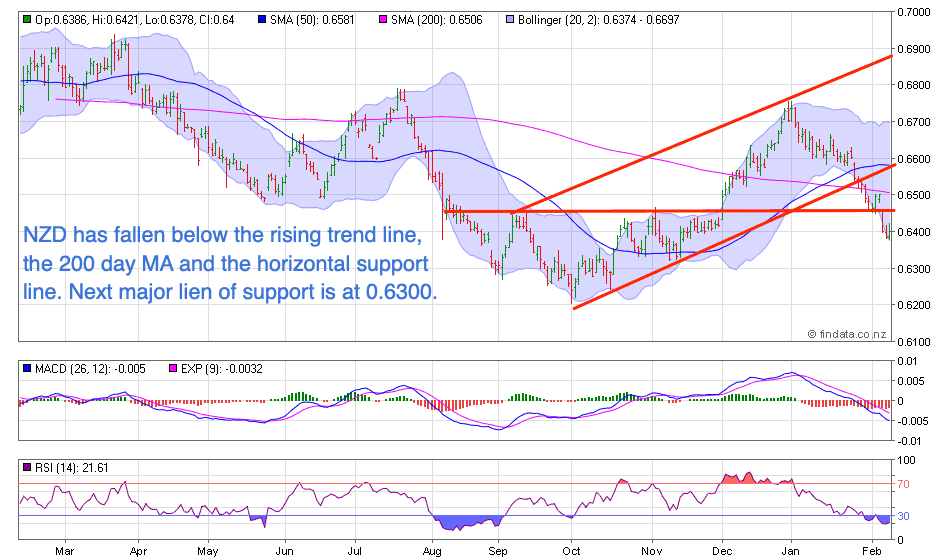

As noted already, the Kiwi dollar is where the action has been this week. Failing to get back above the 200 day moving average, and then also falling below the line of horizontal support we drew last week.

The next major line of support is now at 0.6300.

10 Year Chart NZ Dollar

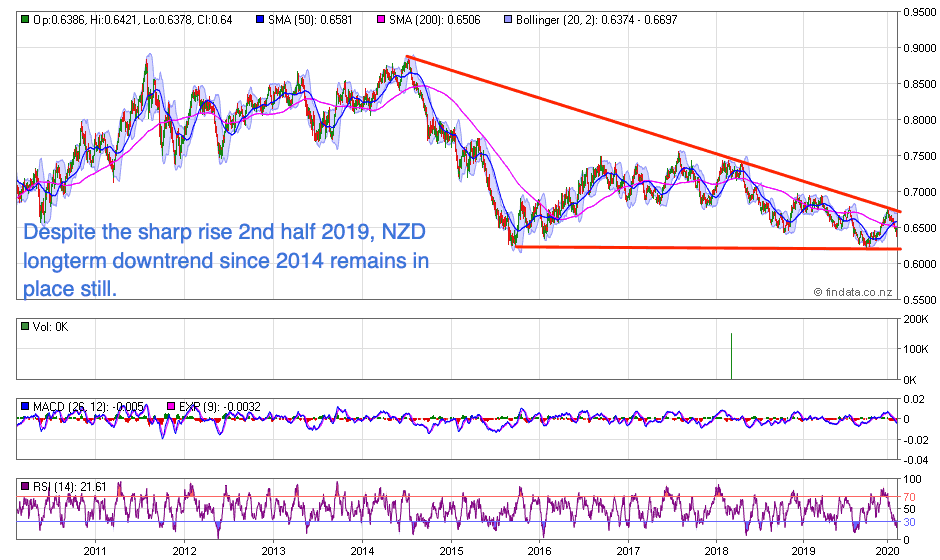

Let’s take a long term look at the NZ dollar today too. The 10 year chart shows that despite the sharp rise in last quarter 2019, the Kiwi failed to get above the downtrend line that has been in play since 2014.

Thus far in 2020 the scare surrounding the Coronavirus has put paid to our prediction that the Kiwi would be up slightly for 2020. Although 1 month does not a year make! But the New Zealand dollar has some work to do to get back into an uptrend again.

Buying gold gives you protection in case this trend lower for the NZD continues.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

Why is Gold More Valuable Than “Worthless Paper”?

A reader who understands the monetary system is likely dying also writes:

“Some commentators, including yourselves, consider gold & silver to be part of a defensive approach to conserve wealth.

Unfortunately I can’t eat gold or silver & it won’t pay my insurance, rates, or services bills & won’t put fuel in my tank.

…Surely real value lies in food, energy, productive land, seeds, livestock, water etc.”

We answer his question and also comment on:

- How You Can’t Eat Gold But…Why That Doesn’t Matter

- Could “The Powers That Be” Change the Rules on Owning Gold?

- Why Gold Has Been Favoured as Money Throughout History

- Why Gold (and Silver) Are Not Investments

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Economists Reduce NZ Economic Growth Forecasts Due to Coronavirus

It doesn’t take a rocket scientist to deduce that the Coronavirus will impact New Zealand. Even if it doesn’t make it to our shores.

New Zealand bank economists are…

“seeing a short, sharp, shock that will hit economic growth strongly in the first half of the year, followed by a fairly swift recovery. But the big caveat on that is the assumption/hope that the impact of the outbreak will not become long and drawn out.

And nobody knows at this stage.

Based on what is known about the economic impacts already, the economists are expecting a big blow to March quarter GDP figures.

The Westpac economists already last week reduced their forecast of March quarter GDP growth to 0.1%, whereas without coronavirus they say they would have expected 0.7%.

This week ASB economists followed suit, also chopping 0.6% off their March quarter forecast, although they are now actually tipped a retraction in the quarter, with a -0.1% figure.

BNZ economists have shaved 0.5 percentage points off their forecasts, but spread across the first two quarters.

They now have 0.4% growth for Q1 and 0.2% for Q2 “having taken a cumulative 0.5% off these two quarters, from what we had at the start of the year”.

ANZ economists have also done their trimming across two quarters, and they too have taken a combined 0.5% points off”.

As the report says it is really just guess work at this stage. But even so, the economists are only considering the impacts of reduced demand out of China:

“With Chinese visitors temporarily blocked from entry and accounting for 11% of visitor arrivals, tourism-related services will bear the brunt of the impact. $1.3bn in education exports to China will also be impacted, with China accounting for around 15% of student visa arrivals. Forestry and seafood exporters have also been impacted, but we believe most of NZ goods exports should remain in demand.”

ASB specifically said in a report out on Monday;

“We are not detecting many signs of the virus impacting NZ adversely via financial channels. Equity markets are off lows. The economy’s key shock absorbers are working: the NZ dollar and interest rates are lower than they would otherwise be. A severe virus outbreak in NZ could push the NZD lower and see markets price in higher NZ risk.”

Could the Virus Cause a Financial Panic?

However Jim Rickards this week pointed out that there are other risks to consider. It’s not just about how big a hit to GDP there could be:

“There’s another aspect of this growing crisis that you’re not hearing about in the mainstream press…

That’s the possibility of global bank freezes if the coronavirus triggers a mass panic.

Bank freezes have actually arisen in recent years in Cyprus (2013), Greece (2015) and now Lebanon. It’s true that these freezes have been contained to a single country each time and have not gone global, but it may just be a matter of time before one such crisis spins out of control.

And that could be the coronavirus. I’m not saying it will happen. But the potential is there.”

What will cause the freeze? Rickards points out that in previous financial panics it has been the central banks bailing everyone out. But:

“…In the next crisis, who’s going to bail out the central banks?

Each bailout gets bigger than the one before. Each crisis gets bigger than the one before. We are now at the point where the ability of central banks to reliquify the system is in doubt because they’re so heavily stretched. The central bank balance sheets are extremely bloated and probably getting bigger.

Central banks have printed so much money already, it’s not obvious that they can do it again from the current levels without destroying confidence in the dollar, and all major currencies.

The question is, where will the liquidity come from in the next financial crisis if it can’t come from the central banks?

The answer is the IMF. The International Monetary Fund has the only clean balance sheet out of the major financial institutions. It can print money. They call it the SDR, the Special Drawing Rights. I call new world money.

…When it comes time for the IMF to issue world money (SDRs) to reliquify the world, there’s going to be a negotiation period. It will take months to complete. During the last crisis this took 11 months. That was when the crisis hit in September, 2008 we saw Lehman Brothers hit a crisis, the IMF began to issue SDRs in August 2009.

…Even though they react on a case basis, it’s going to take, an estimated 3 or 4 months at least to get SDRs issued. In that interim period between the crisis and the time the IMF can react, central banks will be paralyzed.

They’re likely going to lock down the system.

When I say lock down, they’ll start with money market funds. I can’t think of a greater misnomer than the money market funds. People think that money market funds are money. They’re not money; they’re mutual funds regulated by the SEC. People think they can just call up their broker, sell to the money market fund and the money’s in my bank the next day.

That will not be true in this crisis because everyone will be doing the same thing. That is what happened in 2008 when Ben Bernanke and Hank Paulson went to the White House and said to the President that the system’s melting down and he must act.

That was such a shock then, that when it happens again they’re not going to give you your money. They’re going to lock it down. The problem is, and this is where the ice-nine metaphor comes in, is that when it is spreading you can’t just lock down part of the system.

If you lock down money market funds, people are just going to take their money out of the banks. Then you’re going to have to close the banks. Then people are going to sell their stocks, then you’re going to have to close the stock market. Every time you shut one path to liquidity, people are going to turn to another path.

The metaphor of ice-nine is that it spreads from molecule to molecule, institution to institution, requiring a freeze on the entire system. It happened in part in 1914, 1931, 1933 and to gold in 1971. There’s no precedent for a total freeze but we’re getting closer to that point.

The question is, how do you protect yourself against that?

…Investors can prepare now by allocating some of their wealth to nondigital assets outside the banking system such as gold, silver, land, fine art and natural resources.”

Our uneducated guess remains that the coronavirus will get worse before it gets better.

But that in the end the impact may not be as bad as the worst case scenario.

People are taking it seriously. We have sold out of most long life food products on our sister website Emergency Food NZ.

So we likely won’t see widespread bank freezes as Rickards warns could be possible in the worst case. But the current monetary system remains on its last legs. When it ends no one knows. However the preparation in case of a worst case scenario from the Coronavirus, is just the same as the preparation for an eventual change to the monetary system.

As Rickards says make sure at least some of your wealth is outside the banking system in non digital assets.

So get in touch with any questions about buying gold and silver you may have.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Gold at New All Time High in NZD - 7 Year High in USD - Gold Survival Guide