Prices and Charts

NZD Gold Volatile – But No Net Change Since Last Week

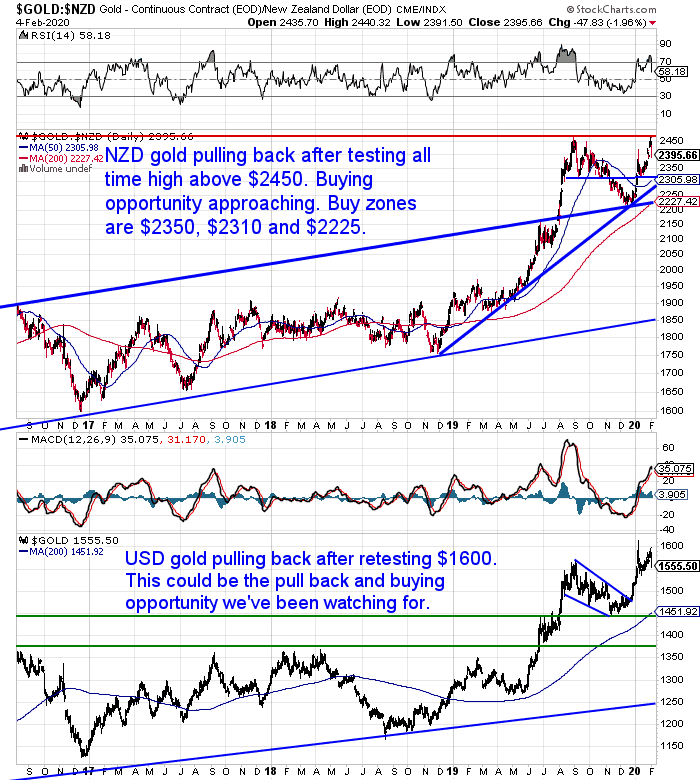

Over the past couple of weeks the NZD gold price had jumped sharply higher. Most likely in response to worries about the spread of the Coronavirus into a global pandemic. On Monday the NZD gold price actually tested the all time high from last year. Nudging briefly above $2450

However in the past couple of days, a good chunk of that rise has been given back. With NZD gold back under $2400. We could yet see a further fall. NZD gold may “backfill the gap up”. That is the price might yet move back to where it made the jump up on the chart just under 2 weeks ago.

After that other buying zones to watch for are $2350. Then strong support could be the 50 day moving average and horizontal support at around $2310ish. This also coincides with the steep rising trendline from late 2018.

Then finally the 200 day MA and rising support line (blue) at around $2225.

Of course there are no guarantees gold will even fall that far. But those are areas where you could split your available funds and buy some tranches.

Contrarian Indicator – Gold May Not Fall Much?

There has been very little buying interest during this recent rise from late December. To us that is a contrarian indicator. Meaning gold may not fall as much as people expect.

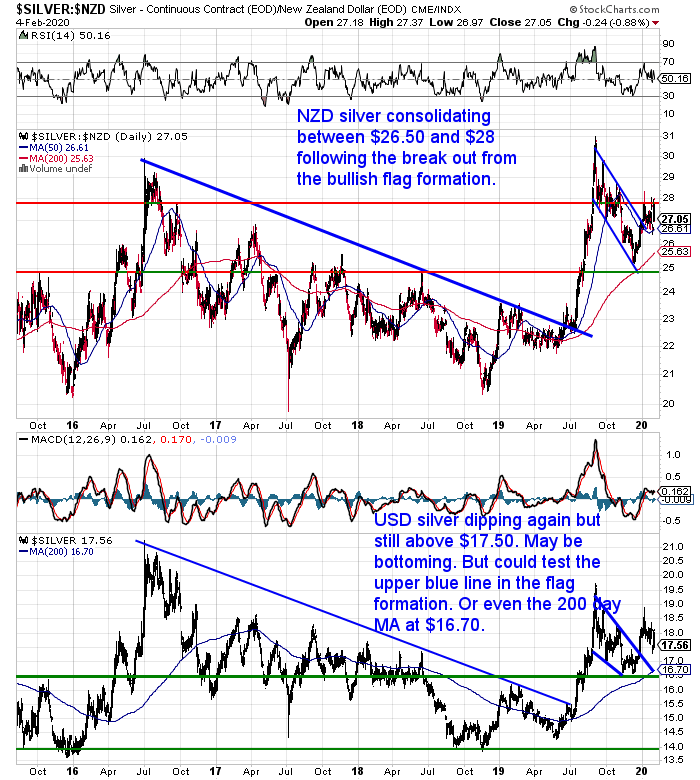

NZD Silver Still Holding After Breakout from Flag Formation

Despite dropping lower today, NZD silver is actually up over 2% from last week. Silver is consolidating between $26.50 and $28.00 after breaking out from the flag formation. Continues to lag gold though.

Coronavirus Fears Push NZ Dollar Even Lower

The Kiwi dollar fell even further this week. It broke through the 200 day moving average line and the red rising trend line. Before bouncing off horizontal support at 0.6450.

The question now is whether the Kiwi can get back in an uptrend after falling for all of 2020 to date?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

Wise Words on the Coronavirus from Sovereign Man

There is a lot of fear about the spread of the Coronavirus. Our guess is that the truth is somewhere between the hysteria of a massive global pandemic on the scale of the Spanish Flu, and those that think it’s a storm in a teacup.

But we saw these wise words from Sovereign Man this week:

“Remember the facts: statistically speaking, you’re far more likely to die being crushed by a vending machine than you are from the Coronavirus.

But it still doesn’t hurt to have a Plan B.

It’s hard to predict how people and governments will react. We’ve already seen flights cancelled, quarantines, visa suspensions, and more.

And if the virus appears to be spreading, you can bet that there will be a run on surgical masks and potentially even food at the grocery store.

There’s certainly minimal downside to thinking through some of those steps in advance, i.e. stopping by the drug store to buy a mask/goggles, or buying some extra non-perishable food, just in case there’s a stampede next week.

Even if the Coronavirus is a distant memory by Valentine’s Day, you won’t be worse off having those things in your house.

And that’s the whole idea behind a Plan B: no one has a crystal ball. We don’t know what’s going to happen with the Coronavirus, or how people and governments will react.

This isn’t about paranoia. It never is. Sensible, rational people think through risks, especially when there’s an obvious one on the table.

Again, it’s not like anyone is going to be worse off for having some extra non-perishable food, water, or medical supplies around the house. But if the worst happens, you’ll really benefit from cautious, forward thinking.”

Source.

We can put forward much the same argument for holding some gold and silver. Holding some gold in your investment portfolio offers you protection in times of crisis. Without any real downside risk.

But you need to be prepared in advance.

As Sovereign Man said if the virus spreads there could be a run on food at the grocery store.

In China, there have been many supermarkets where the shelves have been completely cleaned out by people stocking up.

We have seen a massive increase in demand over the last 2 weeks at our Emergency Food NZ sister website. As a result many products are now out of stock.

But the idea of the shelves being bare has some relevance to gold and silver too…

“We’ve read how German farmers during the Weimar Republic eventually refused to accept German Marks as payment for their food, but accepted gold for their produce back then.”

In light of this current issue, the following question from a reader is likely to be of interest to you too…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Will This Coming Decade Resemble the 1970’s?

Bill Bonner this week was pondering something we have often wondered too. Could this decade resemble the 1970’s?…

“Let’s look at the two periods. And let’s see who got ripped off then…and who’ll get ripped off this time…

Then: The ’70s followed a 20-year period of low interest rates.

Now: Interest rates have generally been on a downtrend for 40 years.

Then: The stock market had been rising since the end of the Second World War. The Dow hit an all-time high in 1968, over 950.

Now: Stocks have been rising since 1980, with two major interruptions. In 2000, the dotcom bubble burst. In 2007, the real estate bubble burst. Each time, the Fed came to the market with more money (inflation).

Then: Unemployment was low in 1970.

Now: Ditto.

Then: GDP growth had been strong since the war.

Now: We are still in the longest business expansion in US history.

Then: The federal government had overspent in the 1960s…on its Great Society and War in Vietnam flimflams.

Now: It has overspent on entitlements at home and the War on Terror abroad.

Then: By the early ’70s, officials felt they could no longer continue with normal financial policies. They had made a mess of US finances and couldn’t trust markets to sort it out.

Normally, the US government would honour its commitments to overseas governments, who held billions of US dollars. They had enjoyed the right to exchange them for gold, at a fixed rate, since 1792, with only occasional interruptions during times of war.

Instead, the feds pulled a switcheroo, introducing a new money that was not backed by gold. That act was viewed as a ‘technical’ adjustment, not something ordinary citizens should worry about.

Now: In August 2019, under pressure from Donald Trump, the Fed ceased normalizing interest rates. And on 17 September 2019, overnight interest rates spiked to 10% — a clear sign of too much borrowing and too little savings. The normal thing would have been to let buyers and sellers work it out. That’s what markets are for.

Instead, the Fed stepped up its inflation, feeding new money into the short-term lending markets at the rate of about $60 billion a month.

Then: Consumers got ripped off in the ’70s. On average, prices doubled. And overseas dollar-holders lost out, too, when they could no longer redeem their dollars at the old rate.

But investors fared even worse. In nominal, new-money terms, stockholders ended the decade about where they started it. But if they tallied it in old, gold-backed, pre-1971 dollars, they lost 92% of their wealth.

Bond investors didn’t fare much better. In gold-backed dollar terms, investors who bought 10-Year US treasury bonds lost 87% of their wealth.

In short, bondholders, stockholders, and dollar holders all ended up as bag holders.

Now: Our guess is that the 2020s won’t turn out much different.”

Source.

Bonner doesn’t say it above. But gold outperformed just about everything in the 1970’s. For more on that see: Gold Cycles vs Property Cycles: When Will Gold Reach Peak Valuation?

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Gold at New All Time High in NZD - 7 Year High in USD - Gold Survival Guide