“When countries have too much debt, lowering interest rates and devaluing the currency is the preferred path governments take. It pays to bet on it happening.” – Ray Dalio

Ray Dalio, one of the world’s most respected investors, has issued another stark warning about the risks of spiralling government debt. His latest article is: The Most Important Principle to Keep in Mind When Thinking About Large Government Debts and Deficits. Dalio explains why policymakers often resort to lower interest rates and devaluing currencies—rather than facing the tough fiscal reforms needed.

This hidden response can devastate savers. But it creates fertile ground for “hard money” assets like gold and, more recently, cryptocurrencies.

Dalio himself prefers gold but admits to holding “some crypto” as well. So, what does this mean for your wealth? And how should investors think about balancing gold and Bitcoin in an age of rising debt?

Table of contents

- The Hidden Way Governments Tackle Debt

- Short-Term Relief, Long-Term Pain

- Why Hard Money Outperforms in Debt Crises

- Why the Political System Won’t Fix the Problem

- The Sky Is the Limit: US Debt Heading to $41 Trillion

- Protecting Your Wealth: Gold’s Role

- Final Thoughts: What Should Investors Do Now?

- FAQs About Ray Dalio’s Views on Gold, Bitcoin, and Debt Crises

Estimated reading time: 5 minutes

The Hidden Way Governments Tackle Debt

When governments rack up too much debt, their options are limited. Austerity is politically toxic. Default is unthinkable.

So, as Dalio points out, they choose the path of least resistance:

- Lower real interest rates

- Devalue their currency

This approach quietly reduces the real value of debt, making it easier to service. But it comes at a cost:

- Cash savings lose purchasing power

- Bondholders earn negative real returns

- Confidence in fiat currencies erodes

We saw this during the 1970s stagflation. As governments inflated away their debt, gold soared nearly 2,000%, proving its value as a store of wealth during currency devaluation.

Related Reading: Why Ray Dalio Recommends Gold as Protection Against Inflation and Global Economic Crises

As Dalio explains in this video, the hidden way governments deal with too much debt is by lowering interest rates and devaluing their currencies.

Short-Term Relief, Long-Term Pain

While lowering rates and devaluing currency can buy governments time, Dalio warns it often worsens the problem:

“It reduces the returns of holding the currency or debt… which reduces the value of the debt as a storehold of wealth. Over time, it usually leads to even higher debts since the lower real interest rates are stimulative, making the problem worse.”

This debt spiral isn’t confined to the US. Most fiat-currency countries face similar challenges.

Why Hard Money Outperforms in Debt Crises

So how do you protect your wealth when fiat currencies are losing value?

Dalio points to “hard money” assets—those outside the traditional financial system.

- Gold (his primary choice)

- Bitcoin (a digital alternative gaining attention)

Gold’s track record is clear: centuries of resilience during crises. Bitcoin, however, is untested in a true global financial meltdown.

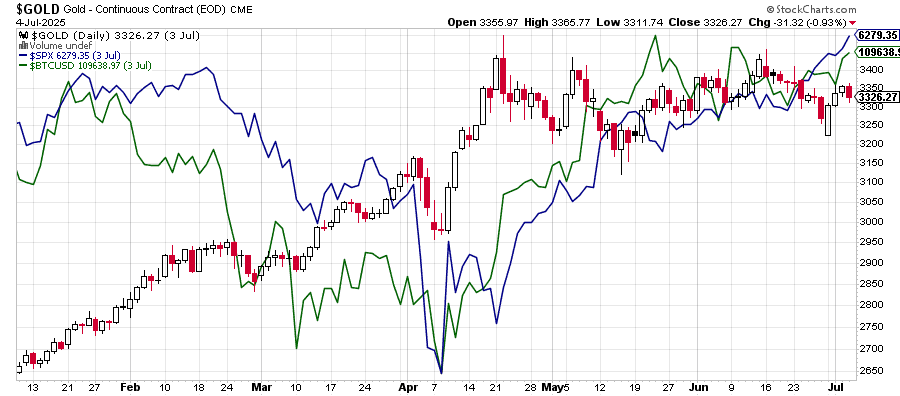

Our chart below highlights the difference:

When the US first announced tariffs in February this year, Bitcoin (green line) fell alongside the S&P500 (blue line). While gold (red/black candlesticks) held steady and continued to rise.

This doesn’t mean crypto has no place. Gold and crypto are not closely correlated, meaning they can complement each other in a diversified strategy.

“As of now and for many centuries across the world, gold has been hard money. Much more recently, some cryptocurrencies have been viewed as hard currencies. I prefer gold, though I do have some crypto.” – Ray Dalio

So maybe it’s wise to have some of both: Learn how to invest in Bitcoin and cryptocurrencies securely here.

Why the Political System Won’t Fix the Problem

In another post, Dalio reflected on meetings with US political leaders. His takeaway? Don’t expect Washington to rein in spending.

The passing of Trump’s Big Beautiful Budget Bill seems to confirm this. Dalio notes that as a result:

“The debt will rise over ten years from about 100% of GDP to 130%… leading to either huge spending cuts, unimaginable tax increases, or a lot of money printing and devaluing.”

Related Reading: Trump’s Tariffs & Precious Metals: Dalio Says Tariffs Are Just the Tip of the Iceberg

The Sky Is the Limit: US Debt Heading to $41 Trillion

As part of the budget bill, the US debt limit was also hiked yet again. Bank of America strategist Josh Hartnett summed it up:

The sky is the limit… “Porky Big Beautiful Bill set to raise US debt ceiling $5tn to $41tn”

For savers, this means the risk of holding cash or bonds is greater than ever.

See how gold has outperformed both of these asset classes, along with stocks, over the last 25 years: Gold vs Stocks, Bonds, Cash & More: A 25-Year Showdown. That outperformance looks set to continue – perhaps even accelerate?

Protecting Your Wealth: Gold’s Role

Gold remains the cornerstone of wealth protection:

- No counterparty risk

- Immune to devaluation

- Historically strong performance during crises

A 15% gold allocation has been shown to improve portfolio resilience—something Dalio himself advocates.

Final Thoughts: What Should Investors Do Now?

Dalio isn’t giving specific investment advice—but his principles are clear:

- Diversify away from fiat currencies

- Hold hard money assets

- Prepare for long-term shifts in the global monetary system

At Gold Survival Guide, we help New Zealanders secure their wealth with both gold and crypto.

Learn how to invest in Bitcoin and cryptocurrencies ➝

Get our Free Gold Buyer’s Guide ➝

FAQs About Ray Dalio’s Views on Gold, Bitcoin, and Debt Crises

Likely because gold has been a proven store of value for centuries, while Bitcoin is still untested in a major global financial crisis. He prefers gold for its historical track record but holds a small amount of crypto as diversification.

Dalio isn’t prescriptive but has suggested in the past that a gold allocation of around 10–15% can act as an effective portfolio diversifier.

Related: Why Ray Dalio Recommends Gold

Not to date. While Bitcoin shares some qualities with gold (limited supply, outside the banking system), it has shown higher correlation to risk assets like stocks during market sell-offs. Gold, on the other hand, has a long history of protecting wealth in crises.

See our chart comparing gold and Bitcoin performance during recent market turbulence.

The safest way is to own physical gold or silver stored securely, and to buy Bitcoin or other cryptocurrencies through reputable platforms. Gold Survival Guide offers guidance on both:

– How to Invest in Bitcoin and Cryptocurrencies

– Free Gold Buyers Guide for NZ