If you’ve been around the gold sector for a little while you’ve no doubt come across talk of “gold seasonality”. See how seasonality has played out in gold ( and also silver) over the past 18 years…

Table of Contents

Estimated reading time: 6 minutes

What is Gold Seasonality?

Gold seasonality generally refers to the northern hemisphere mid summer lull in precious metals markets. A lull which often seems to match the share market lull at this time of year. This is where the old sharemarket adage “Sell in May and go away” comes from. Likewise it seems to be the case with bullion dealing desks. Perhaps because the big money players that drive the futures markets are on holiday (like their share-trading brethren).

On top of this it is the Indian monsoon season, so the demand from Indian gold consumers typically does the opposite of the weather and “dries up” significantly over the northern hemisphere mid summer months.

The other aspect to gold seasonality is that buying momentum generally returns in the Northern Hemisphere Autumn. Coinciding with the Indian Diwali festival which is in October/November (depending on the lunar cycle). So this often pushes gold higher in the last quarter of the year.

This article from Jeff Clark outlines this seasonal pattern and the best months to buy gold in US dollars: Gold Is Seasonal: When Is the Best Month to Buy?

But Does Gold Seasonality Affect the New Zealand Dollar Gold Price?

The local New Zealand gold price is a function of the gold price in US dollars and the NZ dollar/US dollar Forex rate. So this USD/NZD cross rate could throw this pattern out in New Zealand.

But does it?

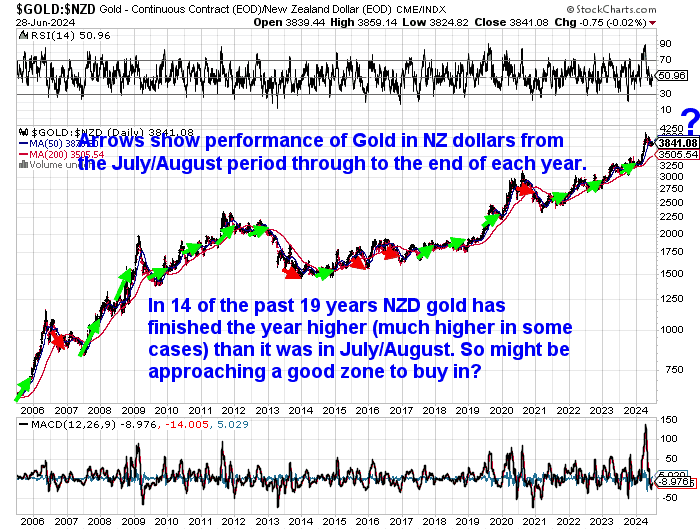

Perhaps the simplest way to check is visually. So we’ve put together a simple chart.

We’ve placed arrows showing the price movement from the July/August period through to the end of the year each year for the past 19 years. Greens arrows indicate the price has gained from July/August to December. Red arrows indicate the gold price has fallen.

The chart clearly shows that in 14 of the past 19, years the NZ dollar gold price has gone up from the July/August period through to December. With the only falls being in 2006, 2013, 2015, 2016, and 2020.

Back in mid 2014 we wrote:

“So after what is getting close to a 3 year correction in gold, and an unusual fall in the July/August to December period last year, could this make now a pretty good buying zone?

We’d hazard a guess to say that it could be. And so far so good with the price edging quietly higher since June.”

That proved to be the case with gold rising in the 2nd half of 2014. But then the following 2 years saw 2nd half falls in price. However, bear in mind that the 2nd half year falls in 2015 and 2016 came after very sharp price rises to start the year.

Then from 2017 to 2019 this second half year strength returned. With NZD gold finishing each year higher than it was in July. Similar to what occurred from 2007 to 2012. Again 2020 saw a sharp surge in the first half of the year, so again not surprisingly gold backed off in the second half.

However 2021, 2022 and 2023 also saw the gold price rise strongly at the start of the year. But then following a mid year correction in each of these years the gold price rose for the latter half of the year.

So overall the gold seasonality in NZD gold looks pretty strong too. With the numbers saying gold is almost 3 times more likely to rise from mid year to end of year, than to fall.

What About Silver Seasonality for Silver in NZ Dollars?

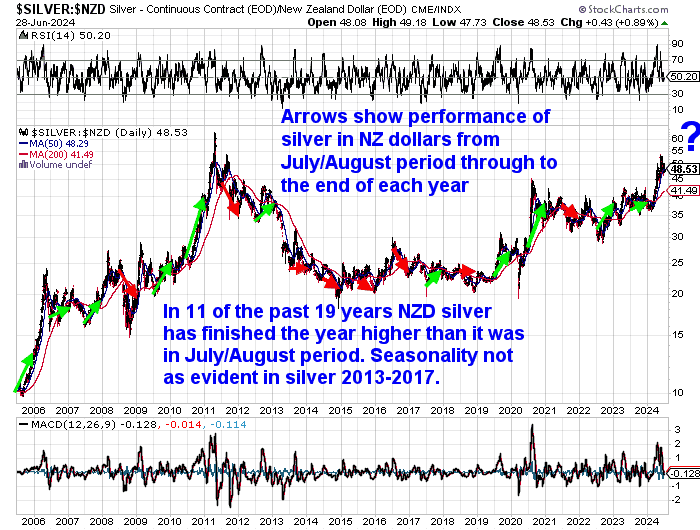

We’ve plotted the same 19 year chart for NZ dollar silver below.

So does this same phenomenon exist for NZ dollar silver? Yes but only just. Over the past 19 years silver has risen in the 2nd half of the year 11 times.

You can see that in 11 of the last 19 years NZ dollar silver has moved higher from July to December versus gold’s 14 out of 19.

Recent history is in evenly split, with silver falling in the 2nd half of the year for 5 of the last 10 years.

Interestingly, in 12 out of the last 19 years did silver head in the same direction as gold in the 2nd half of the year. The other point of note is that the steepness of the green up arrows is often sharper in silver. Indicating silver not surprisingly rises faster than gold.

So NZ dollar silver has been rising very slightly since late 2014. Although silver seasonality has not been too obvious since then with silver falling at the end of the year for 5 out of the last 10 years.

Like 2014 to 2016, this year silver has started the year off with a sharp rise in the silver price. Currently NZD silver is up sharply from the start of 2023.

So can NZD silver, much like 2022 and 2023 also still have a better 2nd half of the year in 2024?

Buying Opportunity for Gold and Silver Approaching?

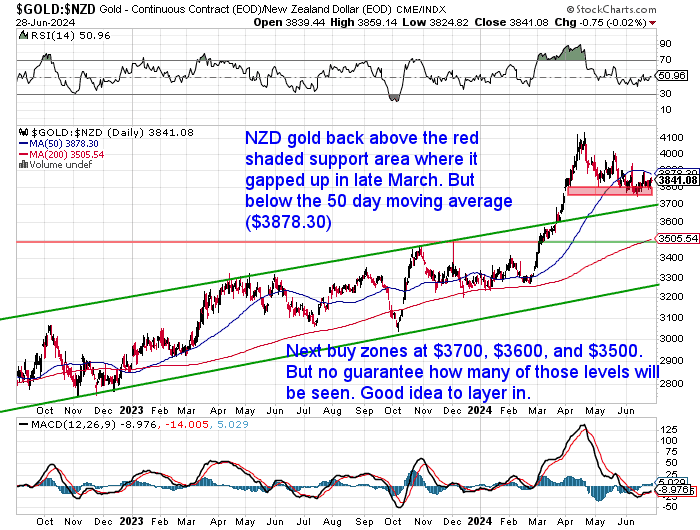

Gold in NZ dollars remains almost $300 below the April highs. It has dipped down below the 50 day moving average and into the shaded support area from where it gapped higher in late March. Any further drop down from current levels looks like being a good buying opportunity.

NZD silver has recently undergone a sharper correction compared to gold. Pulling back from the highest price since 2011 to be down close to 10%. NZD silver now sits just below the 50 day moving average Any further dip (if it eventuates) looks like an excellent chance to buy.

These corrections mean we are likely entering good buying zones for gold and silver here. Combine this with the 2nd half of the year seasonality, along with not very positive sentiment towards gold and silver (despite their recent run ups) and this potentially adds even more weight to the idea of now being a great time to buy gold and silver.

If you’d like a buy gold or buy silver head over to our online bullion shop. Or simply give us a call on 0800 888 465 (+64 9 281 3898 outside NZ). We’re always happy to have a chat about precious metals markets.

Read more: When to Buy Gold or Silver: The Ultimate Guide

(Editors Note: This article was first published in August 2014. Latest updated 1 July 2024).

Pingback: Gold Prices | Gold Investing Guide A Bipolar week for precious metals

Pingback: Gold Is Seasonal: When Is the Best Month to Buy?

Pingback: Is Now a Good Time Buy Gold in New Zealand? - Gold Survival Guide

Pingback: When to Buy Gold or Silver: The Ultimate Guide - Gold Survival Guide

Pingback: First Time Buyer Question: How is Gold Going to Trend in the Next 6 Months? - Gold Survival Guide

Pingback: Cash - a Casualty of Coronavirus - Gold Survival Guide

Pingback: When is the Best Time to Buy Gold? - Gold Survival Guide