Prices and Charts

An Even Weaker NZ Dollar Holds NZD Gold Price Up

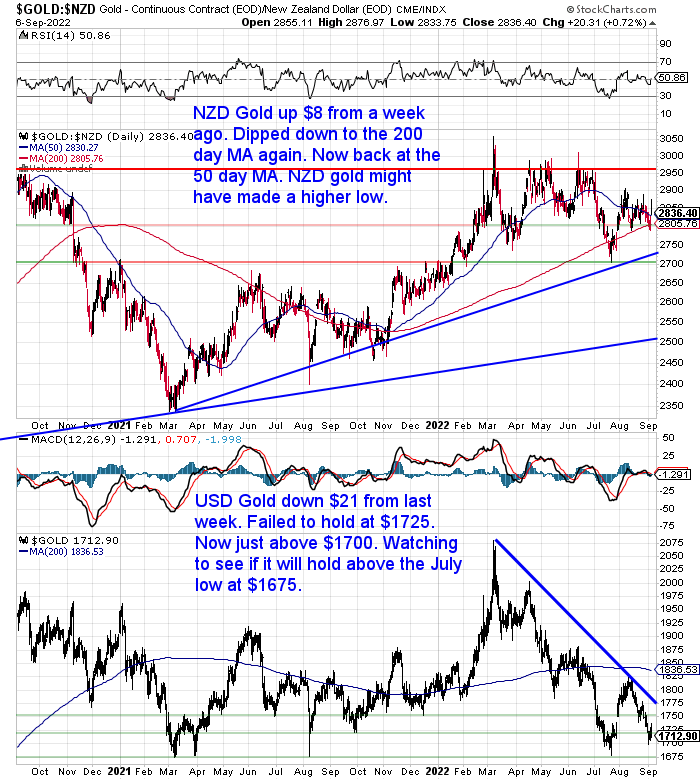

Gold priced in New Zealand dollars is up $8 from a week ago. It did dip down to the 200 moving average (MA), but now sits at the 50 day MA. The further weakening of the New Zealand dollar is supporting the local gold price. It may even have put in a higher low. So far at least it is holding well above the July low of $2700.

The same can’t be said of USD gold. It is now sitting at $1700, not that far above the July low of $1675. So we’re watching to see if it can hold above that level.

Weaker Kiwi Not Enough to Keep NZD Silver in the Positives

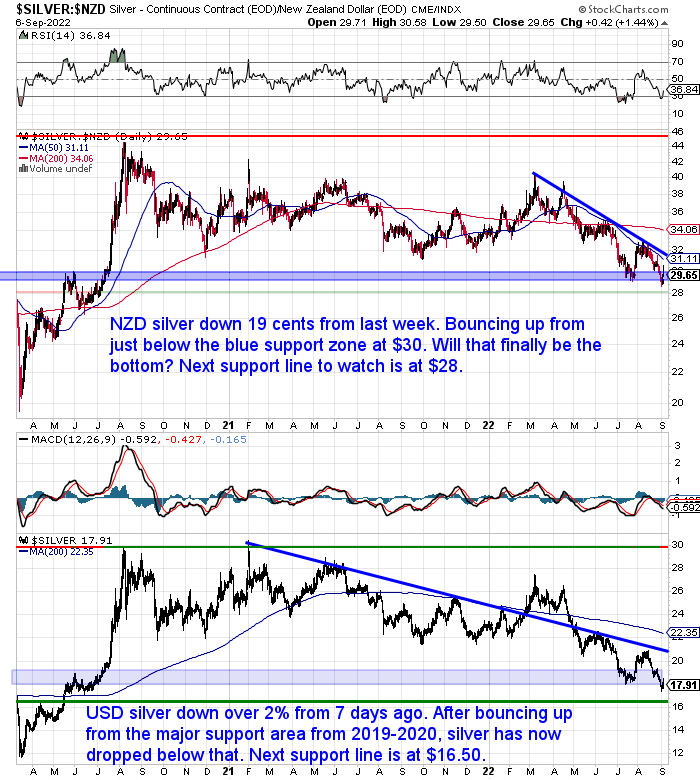

But the weaker Kiwi dollar was not enough to get the NZD silver price into positive territory this week. Down 19 cents from 7 days prior, it also got below the July low during the week, but is up from there now. It is now just up out of oversold, so we’re still watching to see when the final low will be. So far silver is definitely just following the industrial metals lower. At some point its monetary attributes will rise to the fore, just like they did in 2008. But it could go lower before this happens.

New Zealand Dollar Lowest Since May 2020

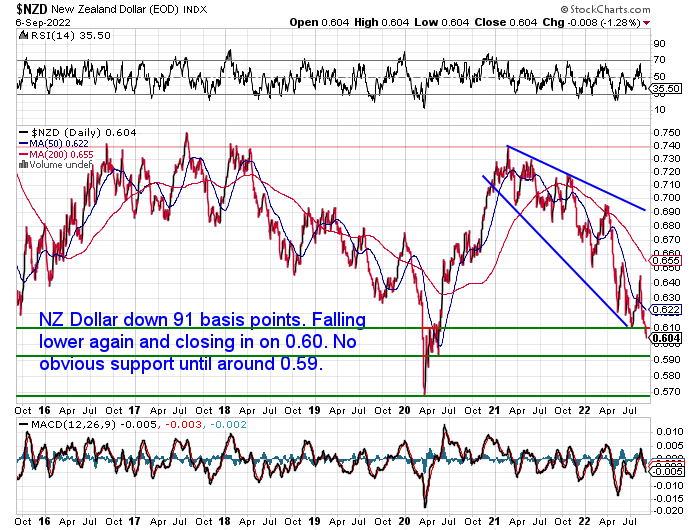

As discussed already, the New Zealand dollar weakened further this week. Hitting a new low that it hasn’t touched since May 2020. It is now closing in on 0.6000. The next obvious support is at 0.5900 and below that the 2020 low of 0.5700.

So we haven’t entered the period of strength for the Kiwi that we had been expecting.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Tax Bracket Creep – “Taxation by Stealth” But on Top of Inflation Itself

Here’s an article discussing the need for the government to increase the tax brackets where each level of tax is set.

‘Taxation by stealth’: Inflation means tax brackets need ‘urgent attention’

Read more

Interestingly they call it “taxation by stealth” when the real stealth tax is actually inflation itself!

But tax bracket creep certainly doesn’t help. They point out that:

“New Zealand taxpayers’ average individual tax bill has increased from $8887 a year in the 2016/2017 year to $10,044 in the 2020/2021 year.”

So that’s an extra $1157 in tax paid on average. Then combine that with 7-8% of current inflation rates and it’s no wonder many people are finding it tough to get by.

S&P500 – What If It Keeps Following the 2008 Path?

Lately we’ve been saying that the majority don’t think we’re in a major market correction. Certainly not one that could last potentially years.

But what if it just matched the 2008 stock market crash?

This chart shows that the 2022 correction in the US S&P500 index has so far followed the 2008 fall surprisingly closely. What if it continues to and we see a 40% fall?

SPX – what if 2008 really plays out?

We have been showing you the 2008 analogy chart over the past months. What used to be “random” observations has turned into very similar px action to what we saw in 2008. Imagine the “final” part starts playing out?

Source.

Why Buy Gold? No Fiat Currency Lasts Forever – Even the NZ Dollar. Devalued 7 Times in 17 Years…

The performance of gold and silver is surprising many including us currently. Although we have been surprised many times before. We should by now know that the monetary metals can stay low for longer than we might expect. But then they will bounce back much faster than could be expected too.

Therefore at times like these it is worth looking at the big picture reasons to hold gold and silver. These are for protection against outlier events. One of which is the end of fiat currency. Because as history shows no fiat currency lasts forever.

This week we delve into the history of the New Zealand dollar, which for such a young currency has much more to it than you may think.

Here’s what’s covered:

- How Many Currencies Have Failed Since 1975?

- What About New Zealand? How Has the New Zealand Monetary System Changed Over the Past Century?

- NZ Dollar Devalued 7 Times in 17 Years!

- 1967 – 1985: Let the Devaluations Begin

- Prepare for the Demise of the New Zealand Dollar

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Electricity Prices: Another Lehman Moment in the Making?

Speaking of outlier events – could the sky high increases in European electricity prices be another Lehman moment in the making? (Recall that when Lehman Brothers filed for bankruptcy in 2008, this one bankruptcy caused a contagion that spread to banks across the planet).

Ben Hunt tweets:

And how will this problem be solved? David Brady points out the probably not that surprising answer:

Are you prepared for “outlier events”?

Get in touch if you have any questions about securing your wealth and legacy from such risks:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|