ONE DAY GOLD DEAL

With prices falling, as is often the case people aren’t buying.

So today only we have a special from one of our suppliers who

needs to move some gold.

Today only for NZ gold 9999 purity:

$30,000 plus at spot plus 2.5%

(Normally $1719; today $1702)

$100,000 plus at spot plus 2.25%

(Normally $1706; today $1698)

$200,000 plus at spot plus 2%

(Normally $1702; today $1694)

Ph 0800 888 465 or reply to this email

This Week:

- More Skirmishes in the War on Cash

- Trump vs Reagan

- Gold Traders Indicators Might Have Turned to a “Buy”

- Fed Rate Hikes and Gold Prices

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1758.91 | – $41.45 | – 2.43% |

| USD Gold | $1173.35 | – $16.05 | – 1.34% |

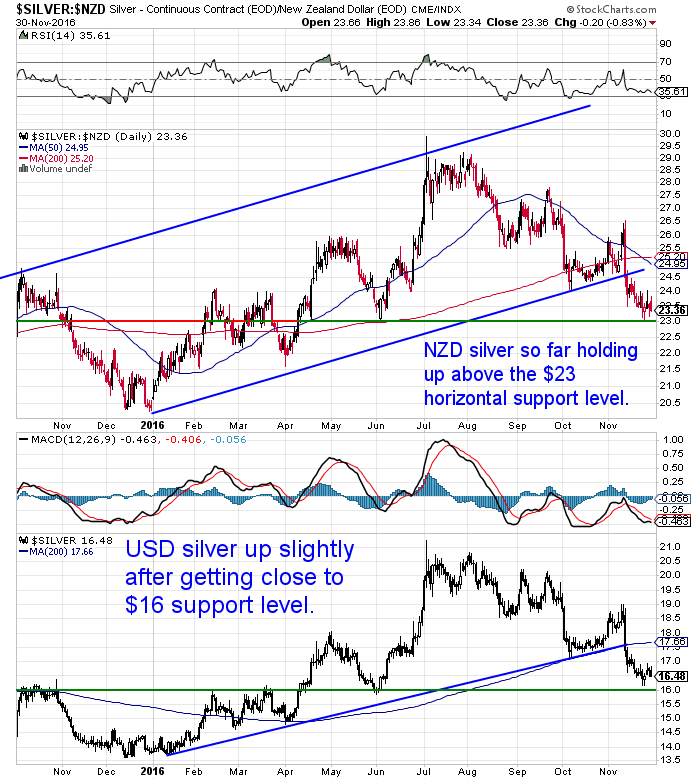

| NZD Silver | $23.34 | – $0.10 | – 0.42% |

| USD Silver | $16.51 | + $0.11 | + 0.67% |

| NZD/USD | 0.7073 | + 0.0078 | + 1.11% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1594 |

| Buying Back 1kg NZ Silver 999 Purity | $711 |

NZD Gold has headed even lower this week. But now it is not far above the horizontal support line at $1650. This also coincides with the rising trendline which currently sits not too far below $1650 as well. With the overbought/oversold RSI indicator the most oversold it has been since the end of last year and the MACD indicator also very oversold, NZD gold looks ripe for a bounce higher from here.

Meanwhile NZD silver bounced up off the $23 level this week and is trying to bottom out around that mark.

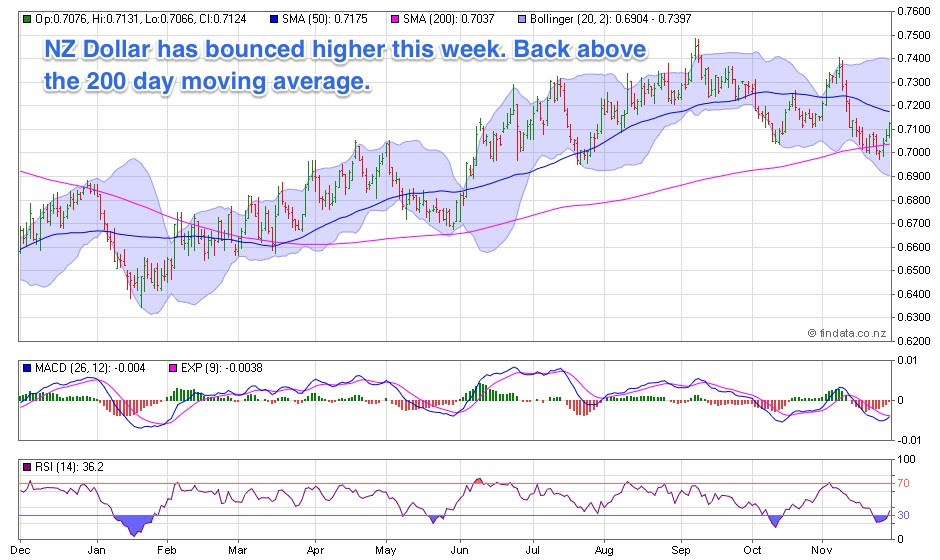

The Kiwi dollar has jumped higher this week and is once again back above the 200 day moving average. It remains in the uptrend it has been in all year.

More Skirmishes in the War on Cash

Following our feature article on the War on Cash last week, we’ve spotted another couple of related items that have received little press.

The Dollar Vigilante reported that in Spain “Minister of Finance and Public Service, Cristóbal Montoro has reportedly just announced “anticipated measures in order to ‘reduce the use of cash.’

Although we are yet to see that reported anywhere else yet.

But trawling through the Bank for International Settlements (BIS) website this week we spotted the transcript of a speech given by the Deputy Governor of Sweden’s central bank, the Riksbank.

Sweden already has one of the lowest uses of cash on the planet. Now their central bank is contemplating issuing “e-krona” as an alternative to cash.

This means citizens would be able to hold an electronic form of central bank money. Currently only commercial banks can have “accounts” with the central bank. In this case everyday people would be able to also. While they say “it would not be to replace cash”, this is surely another step along the road to that end.

- “I would claim that there is currently a need among the general public and companies to have access to central bank money and that this need will still be there in the future. Perhaps not everyone has this need and perhaps not all of the time, but as the need exists, I think the Riksbank should be able to meet it. I consider that the Riksbank should carefully consider meeting the general public’s need for central bank money by supplying this in some electronic form. Let me call them e-krona, which you can put in an e-wallet.

- Let me also be clear about the reason. If the Riksbank chooses to issue e-krona, it would not be to replace cash, but so that the e-krona can act as a complement to cash. The Riksbank will continue issuing banknotes and coins as long as there is demand for them in society. It is our statutory duty and we will of course live up to it.”

But then they get to the real reason for have a digital currency – even if they do downplay this rationale:

- “Some economists advocate that the central bank should replace cash with a digital currency that can be given a negative interest rate, for instance by reducing the balances on e-krona accounts or not redeeming e-krona at their full value. These advocates say that this would make it easier for the central bank to implement an efficient monetary policy with a negative interest rate.10 This reasoning is based on the central bank being prevented from setting a negative interest rate to the extent considered necessary to stimulate economic activity. Personally, I am not convinced that this problem would arise in Sweden and I would once again like to say that the Riksbank has a statutory requirement to issue banknotes and coins. I see e-krona primarily as a complement to cash.”

- Source.

Yes well, e-krona issued only “as a complement to cash” is easy to say now. But as the use of cash in Sweden diminishes further, it won’t take much to find an excuse to remove it altogether. Yet another straw in the wind. We’ve seen a lot of them float by recently!

Trump vs Reagan

The overall “narrative” at the moment still seems to be that a Trump Presidency will really get the US economy going and we’ll see a repeat of the debt fueled Reagan boom of the 1980’s. Stock markets have been moving higher on this expectation. Long term bond interest rates also shot higher on the expectation of higher inflation.

However there are some stark contrasts between what Reagan inherited versus what Trump now will. So this likely won’t play out as simply as the US building their way to a better future.

Here’s Bill Bonner:

- ““Trump will cut taxes and spend more money. We’ll get a replay of the Reagan Boom,” investors said to themselves.

- The Dow, the S&P 500, the Nasdaq, and the small-cap Russell 2000 all hit new record highs. Bonds lost $2 trillion, as investors feared higher rates of inflation.

- But as bond prices go down, bond yields go up. Rising bond yields mean rising borrowing costs throughout the economy. That does not stimulate a boom; it pinches it off.

- That’s the big difference between Reagan and Trump… between 1981 and 2017.

- Mr. Reagan rode into office carried by solvent people who wanted an end to inflation. Mr. Trump is borne along on the march to Washington by an army of debtors who would like to see more of it.

- Mr. Reagan could enjoy a boom, as people took advantage of falling inflation and dropping interest rates. Mr. Trump, alas, cannot. He will suffer a bust caused by rising rates and increasing prices.

- He and his Treasury secretary will be sorely tested. The gators will snap at them. The foxes will outsmart them. The debt bomb will blow up in their faces.

- And the swamp will suck them down.”

Jim Rickards goes into even more detail about the differences between the two eras:

- “Trump won’t have falling interest rates like Reagan had. He’s going to face increasing interest rates instead. Inflation won’t be falling dramatically. He’s facing the possibility of increasing inflation, which means higher food prices and higher prices at the pump. He doesn’t have a low debt-to-GDP ratio like the 34% Reagan inherited. He’s actually inheriting a high debt-to-GDP ratio of 100%.

- Trump is going to try to run the Reagan playbook in a non-Reagan environment. That plan could immediately hit a wall. It could result in something like stagflation, where we get the inflation from spending and deficits, but you don’t get the growth. That’s because after eight years and $10 trillion, we’re facing the reality of diminishing marginal returns. That’s when each new dollar of stimulus fails to produce as much growth as the dollar before. Basically, the first dollar you spend in an expansion is a lot more powerful than the ten-trillionth dollar you spend.

- …There is a good chance that cutting taxes right now will help the economy, but not enough to produce the growth required to make up the difference. That means larger deficits. Add all that new spending on top of it and the debt-to-GDP ratio is going to increase.

- Where are we going to get the borrowing capacity unless the Fed accommodates it?

- If the Fed accommodates it, it’ll produce inflation. If the Fed doesn’t accommodate it, we’re going to hit the wall and enter recession. That’s two possible outcomes, recession or inflation. Neither one is good. We can even get the worst of both worlds, and that’s the stagflation I mentioned. I’ll be writing and speaking a lot more about this.

- The Reagan/Trump analogies are interesting. But there are major differences that people are not focusing on and a lot of reason to be concerned.

- Right now, I would say that if things get really bad and we have a financial crisis, you’re going to want gold. If the economy grows, but we get inflation, you’re going to want gold.

- All signs point to gold as a safe haven asset in this environment.”

The action in the price of gold certainly doesn’t indicate this at the moment. But that is precisely the best time to buy! When the price is down and the expectation is that it won’t be of any use.

The Russian central bank seems to be following this sentiment as their…

- “…gold-buying accelerated in October, with Russia’s central bank buying 48 tonnes of gold bullion, the largest addition of gold to Russian monetary reserves since 1998. The Russian central bank gold purchase is the biggest monthly gold purchase of this millennium.

- …The Russian central bank declared in May 2015 that Russia views gold bullion as “100% guarantee from legal and political risks.”

- Source.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare? For just $290 you can have 4 weeks emergency food supply.

For just $290 you can have 4 weeks emergency food supply.

Gold Traders Indicators Might Have Turned to a “Buy”

5 days ago Jeff Clark noted that:

- “the “smart money” is turning more bullish on gold…

- Last Friday’s Commitments of Traders (COT) report – which reflects positions as of November 15 – showed that commercial traders have reduced their net short position to fewer than 200,000 contracts.

- That’s still large compared with the 100,000-150,000 net short position that often marks a bottom for the price of gold. But it’s trending in the right direction. And it’s down substantially from the 340,000 net short position when the gold price peaked in late July.

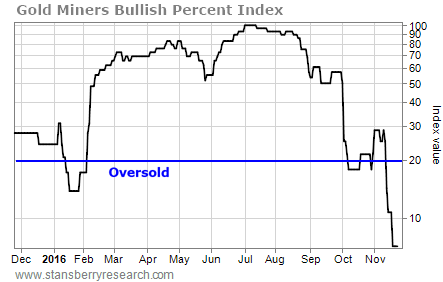

- Also, the Gold Miners Bullish Percent Index (or “BPGDM”) looks ready to turn higher from an oversold condition.

- Take a look at this chart…

- BPGDM measures the percentage of gold stocks that are trading in a bullish formation. It’s a measure of overbought and oversold conditions for the gold sector. Readings of more than 80 – like we saw in July – indicate overbought conditions. When the BPGDM drops to less than 20, it indicates oversold conditions in the gold sector.

- Buy signals occur when the BPGDM turns higher from oversold levels.

- As you can see from the chart, the gold sector is now even more oversold than it was back in January, just before the massive gold-stock rally. The next uptick in BPGDM should mark the start of the next rally.”

- Source.

Since this was written the BPGDM index has risen back up above 10. Gold mining stocks have held up well compared to gold which has actually fallen further in recent days. It’s also likely that the Commitment of Traders report will also show a further fall in traders net short position, although it is not out until the end of the week.

There has been very little buying of precious metals lately. Which is why one of our suppliers has a special going today in order to move some excess gold on.

So while no one can be sure the bottom is in for this correction, there are a number of signs pointing to that being the case.

Read more: Gold and Silver Commitment of Traders (COT) Report: A Beginners Guide

Fed Rate Hikes and Gold Prices

It seems a virtual certainty (according to futures markets) that the US Federal Reserve will raise their benchmark interest rate in a few days time. Yet again we are seeing many articles about how this will have a negative impact on gold. Just as we saw this time last year before the first Fed rate increase.

History now shows that just the opposite occurred and gold rose strongly soon after the first Fed rate increase.

NIA just published some further research showing what has occurred previously upon the second rate hike in a cycle.

- “NIA believes that gold will explode well past $1,367.10 per oz in 2017! Look for gold to begin its next major rally as soon as next month’s probable rate hike is out of the way!

- Historically, gold has achieved its largest price gains after the second rate hike of a new Fed Rate Hike Cycle!

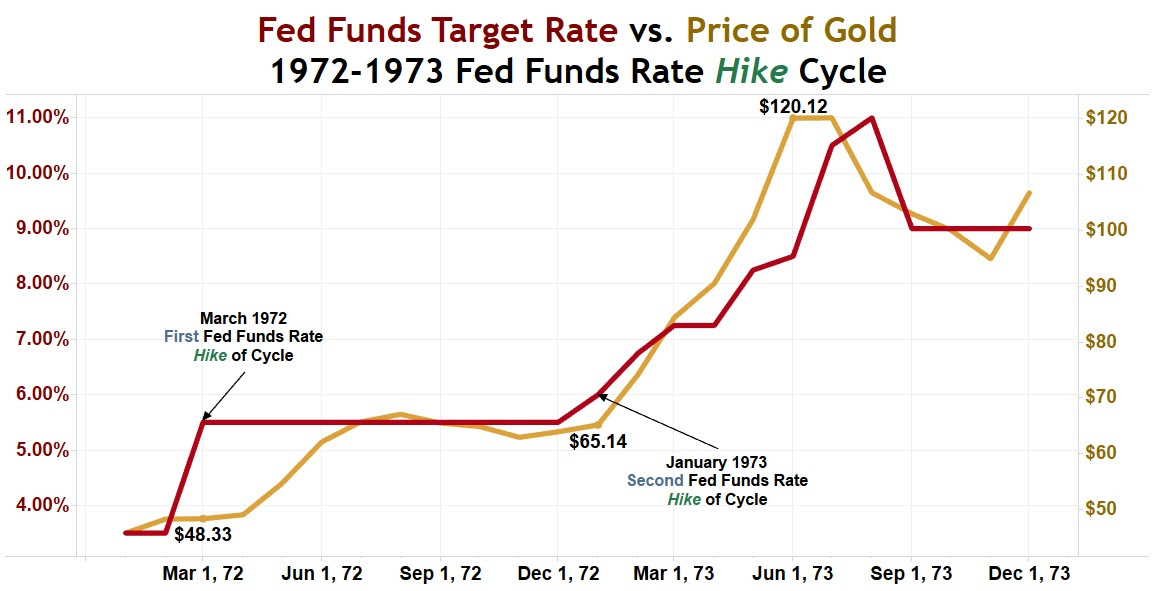

- In March 1972, a new Fed Funds Rate Hike Cycle began when the Fed raised rates by 200 basis points to 5.5%. The second rate hike of that cycle didn’t occur until January 1973. During the 10 month period in between, gold increased 34.78% to $65.14 per oz – equal to an average gain of 3.478% per month.

- Immediately after the second rate hike, gold prices began to explode! Over the next 5 months, gold rallied 84.4% to $120.12 per oz – equal to an average gain of 16.88% per month. Gold rose 4.85X faster after the second rate hike!

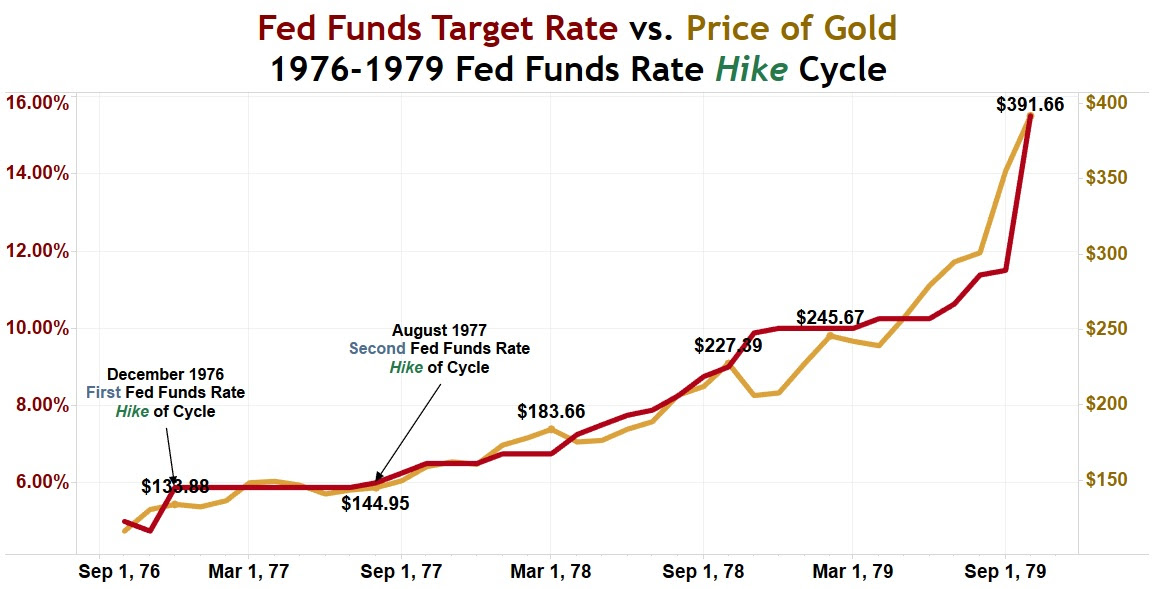

- In December 1976, a new Fed Funds Rate Hike Cycle began when the Fed raised rates by 113 basis points to 5.88%. The second rate hike of that cycle didn’t occur until August 1977. During the 8 month period in between, gold increased 8.27% to $144.95 per oz – equal to an average gain of 1.034% per month.

- Immediately after the second rate hike, gold prices began to explode! Over the next 19 months, gold rallied 113.25% to $391.66 per oz – equal to an average gain of 5.96% per month. Gold rose 6.33X faster after the second rate hike!

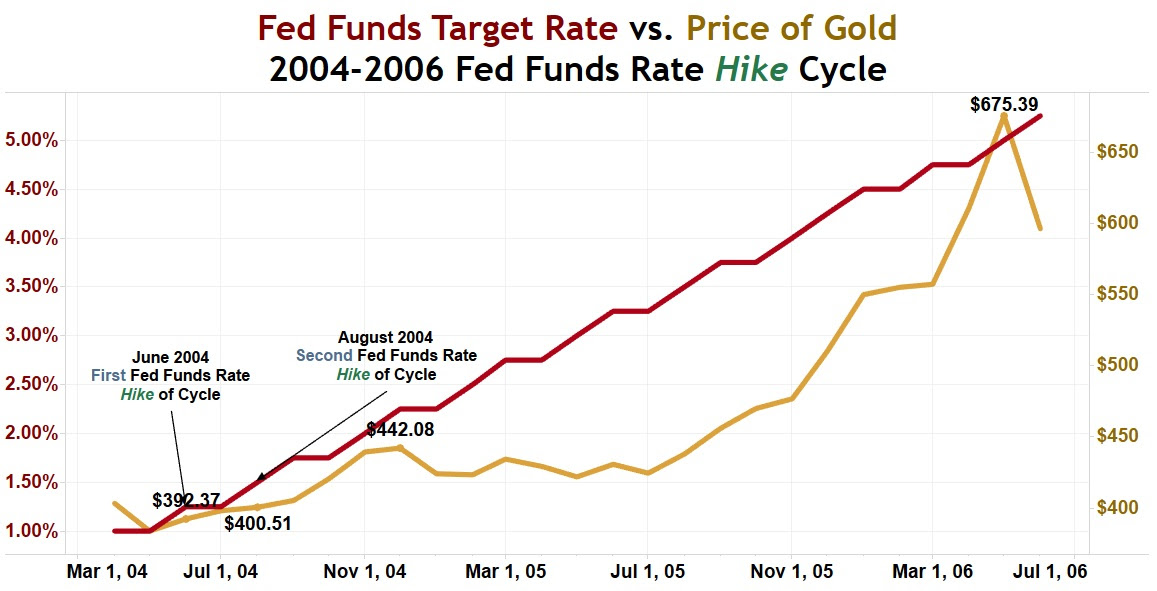

- In June 2004, a new Fed Funds Rate Hike Cycle began when the Fed raised rates by 25 basis points to 1.25%. The second rate hike of that cycle occurred in August 2004. During the 2 month period in between, gold increased 2.075% to $400.51 per oz – equal to an average gain of 1.0375% per month.

- Immediately after the second rate hike, gold prices began to explode! Over the next 21 months, gold rallied 68.63% to $675.39 per oz – equal to an average gain of 3.27% per month. Gold rose 3.15X faster after the second rate hike!

- On average, gold rallied 4.78X faster after the second rate hike of the only three comparable Fed Rate Hike Cycles that began with a Fed Funds Rate of less than 5%!

- Source.

This would seem at first glance completely counter intuitive. But the numbers don’t lie. While the consensus is that gold has much further to fall yet, it seems likely we are pretty close to a bottom if not there already. And this historical data shows that next year could have quite a movement higher too.

Read more: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold?

In NZ dollar terms we are now very close to the multi year rising trendline and also very oversold.

So in the long term this will likely prove a decent entry point. Take advantage of the today only deal for some lower priced local gold.

Get in touch if you have any questions about the buying process. David is only too happy to answer them.

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

Gold Price Going Where? – Mike Maloney at the Silver SummitWed, 30 Nov 2016 4:48 PM NZST  The Silver Summit was in San Francisco 2 weeks ago and Mike Maloney gave a 1 hour presentation (see further down the page). He was also on a Q&A panel and was asked the question “Where is gold going in the near term?” There is a short 5 minute video below with his answer. He actually […] The Silver Summit was in San Francisco 2 weeks ago and Mike Maloney gave a 1 hour presentation (see further down the page). He was also on a Q&A panel and was asked the question “Where is gold going in the near term?” There is a short 5 minute video below with his answer. He actually […]

|

Doug Casey on Globalism and the Worldwide Populist RevoltWed, 30 Nov 2016 1:37 PM NZST  The Brexit leave vote and the Trump election win were supposedly as a result of rising levels of nationalism or populism in the UK and US. As a result we’ve seen a lot of the mainstream media looking at the downsides of populism. While praising the idea of globalism, explaining it as a flattening of […] The Brexit leave vote and the Trump election win were supposedly as a result of rising levels of nationalism or populism in the UK and US. As a result we’ve seen a lot of the mainstream media looking at the downsides of populism. While praising the idea of globalism, explaining it as a flattening of […]

|

What These “Mysterious Deaths” Tell Us About Our Global Banking SystemWed, 30 Nov 2016 11:50 AM NZST  Have you read about the spate of suspicious deaths of banking executives in recent years? When you look at each of them it is hard to imagine they are just coincidences. Here is a couple of examples from back in 2013 that are highly suspicious indeed… What These “Mysterious Deaths” Tell Us About Our Global […] Have you read about the spate of suspicious deaths of banking executives in recent years? When you look at each of them it is hard to imagine they are just coincidences. Here is a couple of examples from back in 2013 that are highly suspicious indeed… What These “Mysterious Deaths” Tell Us About Our Global […]

|

War on Cash + Bond Bear Market Has BegunFri, 25 Nov 2016 2:27 PM NZST  This Week: War on Cash: Implications for New Zealand The Spreading Bondfire and the Rising Price of Gold Two Days with the Real and Wannabee Elite Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1700.36 – $36.57 – 2.10% USD Gold $1189.40 – $36.35 – 2.96% NZD […] This Week: War on Cash: Implications for New Zealand The Spreading Bondfire and the Rising Price of Gold Two Days with the Real and Wannabee Elite Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1700.36 – $36.57 – 2.10% USD Gold $1189.40 – $36.35 – 2.96% NZD […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9amClick here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |

Pingback: The Worst Thing to Happen to the U.S. Dollar Since 1913 - Gold Survival Guide