Prices and Charts

More Confidence a Bottom is in

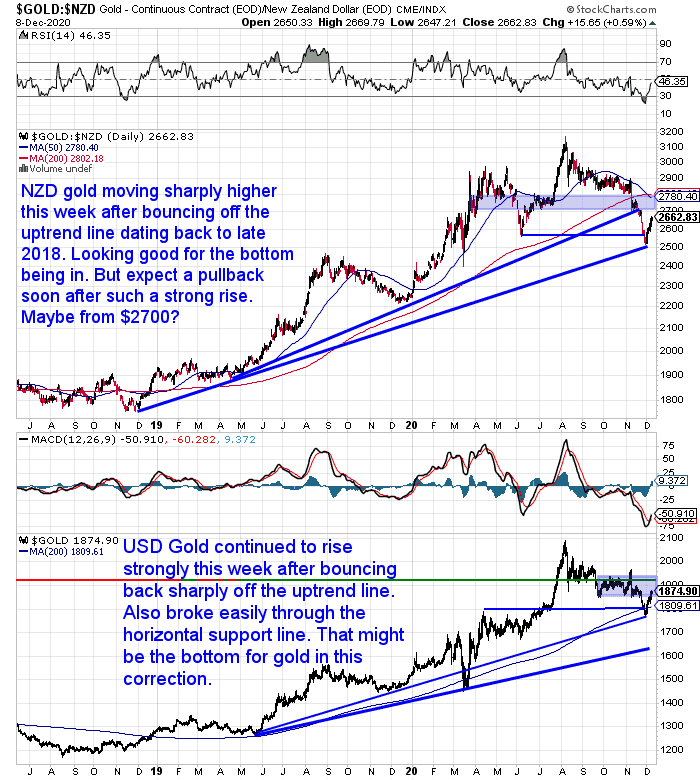

Gold in New Zealand dollars continued to move up sharply this week, after bouncing up from the uptrend line. This sustained move higher gives us more confidence that the bottom we called last week might now be in.

Of course there are no guarantees and a bottom is only visible in hindsight after higher prices have been established. But so far so good.

However, after such a strong run higher, the odds are we will likely see a pullback in the short term. Maybe from the overhead horizontal resistance line around $2700?

A Bottom for Silver Also Looks to Have Been Made

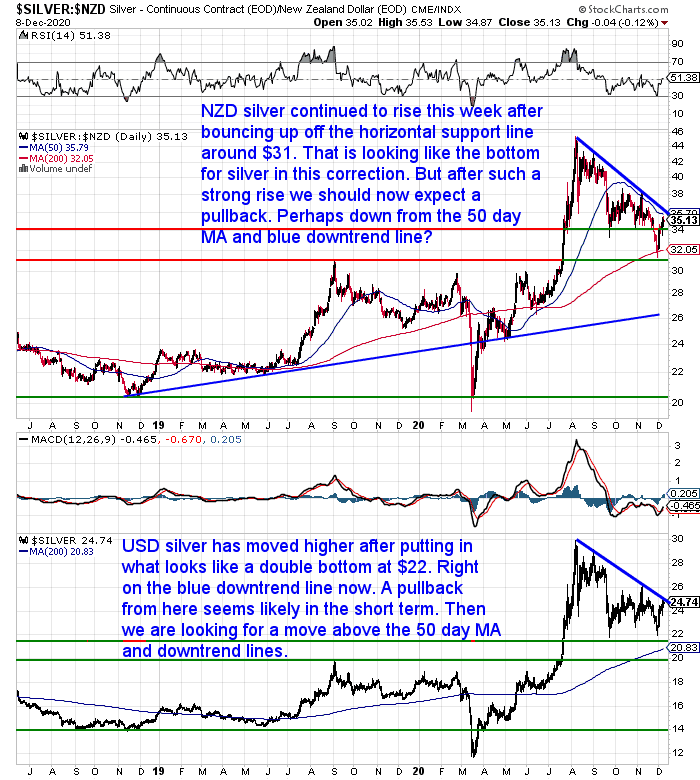

Silver in New Zealand dollars has also seen a strong bounce back. It too looks to have made a bottom at $31. It broke cleanly through the overhead resistance line at $34. It is now close to the 50 day moving average (MA), along with the blue downtrend line.

Just like gold we’d expect a pullback from near there. We may then see a retest of the 200 day MA line, before the next move higher.

That’s our best guess anyway.

So buying anywhere in the low $30’s looks like being a good long term bet.

NZ Dollar Still Ripe for a Larger Pullback

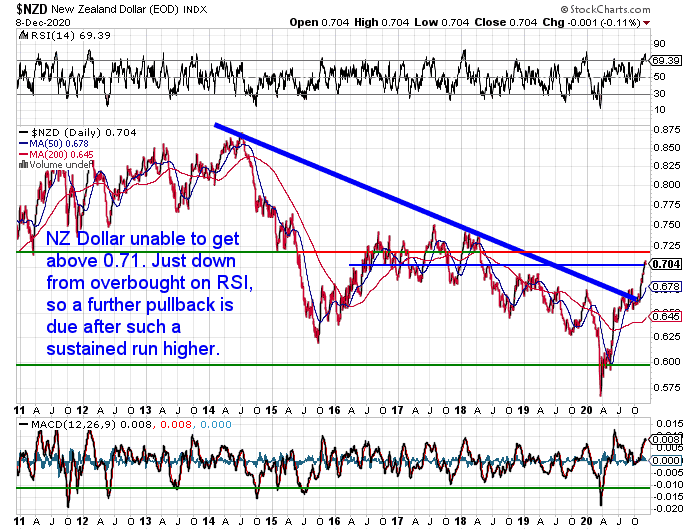

The New Zealand Dollar didn’t manage to get above 0.71 and has pulled back a touch. The Kiwi remains well above the 50 day MA, so we’d bet on a move back down towards there before long. Especially with the RSI barely out of the overbought region (above 70).

Roger J Kerr makes some good arguments here as to why the Kiwi dollar is overcooked and due a pullback.

So as we said last week, a weakening NZ dollar will then likely give a further boost to local gold and silver prices.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

What is the Best Type of Gold to Buy For Trading in a Currency Collapse?

Prior to the Corona-panic, most people probably hadn’t given much thought to the potential of a currency collapse in developed world countries, such as New Zealand. But with even the once conservative Reserve Bank of New Zealand this year joining the currency printing/quantitative easing brigade, and potentially the negative interest rate camp in 2021, the idea of a currency collapse may be on a few more minds these days.

This week we answer a reader question on what is the best type or size of gold to buy for trading in a currency collapse situation…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Do Gold and Real Rates Moving in Tandem Signal a Big Move for Gold?

Back in September, we discussed how real interest rates in New Zealand were negative and likely to get even more negative in the future. See: Real Interest Rates vs Gold Prices – What Can They Tell Us About When to Buy Gold in New Zealand?

Recall that real rates are simply the after inflation interest rate. So if the nominal interest rate is say 1%, but inflation is running at 2% then the real interest rate is -1%.

Negative real interest rates are a common theme the world over right now. Analyst Ryan Miller made a good argument in a post on FXstreet this week that a divergence between gold and real interest rates is pointing to a big move in gold coming.

“Gold has an inverse relationship with real rates. When real rates are high or rising, money flows out of gold and into bonds as there is an opportunity cost in holding gold; it does not pay a yield, whereas bonds do. But when real rates are low or falling, capital flows out of bonds and into an alternative safe investment, often times gold. Over the last ten years there have been several instances when the divergence between gold and real rates have resulted in big moves up in the price of gold in a short time span”.

Miller uses TIPS (treasury inflation protected security) as a proxy for real rates. (TIPS are US bonds with a yield adjusted for the inflation rate).

“The price of TIPS and real rates have an inverse relationship, the same way all bonds have an inverse relationship with their yield. So, if TIPS are rising, then real rates are falling and if TIPS are falling real rates are rising, hence the positive correlation between TIPS and gold.”

(Note: TIPS are in Blue and Gold in Orange in the Chart below).

So normally we’d see gold rising as TIPS rise. Because a rising TIPS price indicates real rates are falling.

“Now, here we are nearing the end of 2020 and TIPS and gold have once again negatively diverged from each other (below), meaning gold is falling alongside real rates. If recent history is any sort of indication, it means a gold rally to new all time highs may be in the near future. Now, I do not make any trading decision based on this or any one thing alone. But when you start to put together the pieces that are calling for higher gold prices, which I have talked about here and here, it becomes much more convincing that this recent weakness in gold is nothing more than a correction before rejoining its uptrend to higher prices.

Bullionvault also reported that implied or expected inflation is on the rise according to TIPS:

“…while bond prices have fallen, pushing yields higher in the face of yet more debt issuance by the US government, implied inflation rates have risen faster to set another 18-month high at 1.87% on 10-year TIPS on Thursday morning.

Last time the bond market’s inflation outlook was this high, back in mid-May 2019, the 10-year US Treasury bond offered a yield of 2.47% and gold prices stood at $1287 per ounce.

With 10-year yields trading today at 0.93%, that put real 10-year rates – adjusted for inflation – down at the lowest in 7 weeks at minus 0.94% per annum, a multi-decade low when first reached in summer 2020 but still 14 basis points higher than when gold prices peaked above $2000 in early August.”

The Bullionvault chart shows the same as Ryan Miller’s chart. Although please note that instead of plotting the price of TIPS, the chart below has the TIPS yield. Hence why the chart shows a convergence instead of a divergence. With the TIPS yield falling while gold also fell. It’s also more recent than the Miller chart. So it shows the start of recent bounce in gold. This could be the start of gold and real rates returning to their normal correlation.

NZ Inflation May Also Surprise to the Upside

In the article on the Kiwi dollar we mentioned earlier from Roger J Kerr, he also makes a good argument as to why inflation in New Zealand may also surprise to the upside:

RBNZ inflation forecast likely to be wide of the mark

Over recent years we have not seen inflation figures surprising to the upside.

Mostly it is falling technology/communication prices over-powering and disguising other price increases and producing very low overall inflation rates.

The December quarter’s inflation numbers being released on 22 January are forecast to increase by just 0.2% by the RBNZ.

Watch out for a number considerably above that, as retailers halt price discounting due to stock shortages, house construction costs increase, higher food prices and local government rates only ever go one way.

Source.

If inflation does indeed have an upside surprise, then real (after inflation) interest rates will head even lower in New Zealand. As we outline in our earlier mentioned article they are already negative.

So gold will likely continue to rise in New Zealand dollars. Have you bought enough to sleep soundly at night?

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: History Says: Great Time of the Year to Buy Gold and Silver - Gold Survival Guide