|

Gold Survival Gold Article Updates

Apr 2, 2014

This Week:

- Inflation Is Coming, What to Do—NOW

- NZ Dollar down sharply overnight

- Gold Merchants/Users expect higher gold prices in 2014?

A couple of podcasts and one article on the website this week. They’re linked down the page further.

Particularly interesting were the numbers crunched by Casey Research researcher Alena Mikhan. This article (Inflation Is Coming, What to Do—NOW) looks at some recent (as in past few decades) inflationary periods across a number of nations, and shows the impact on gold demand. It offers some numerical lessons on when the best time to buy is.

First, as usual let’s see what’s happened to gold and silver since last week.

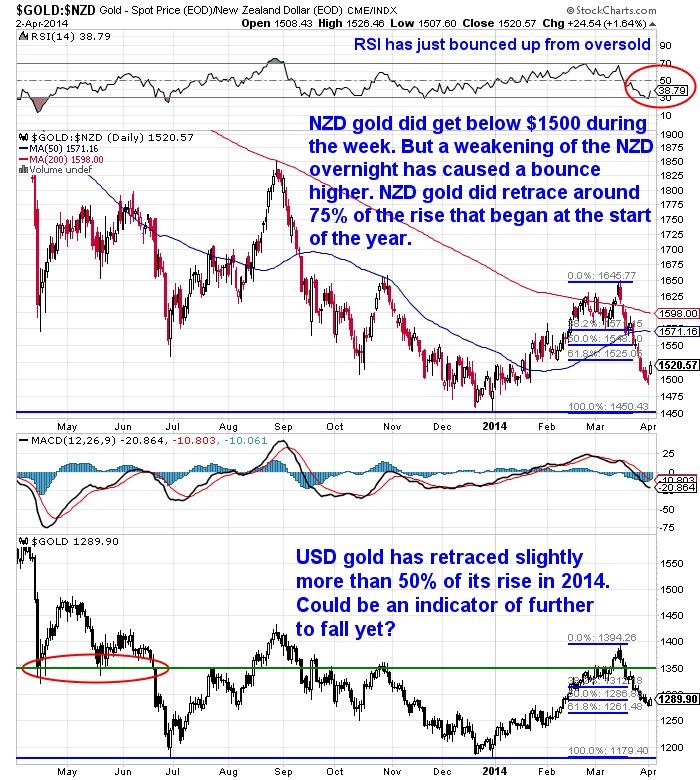

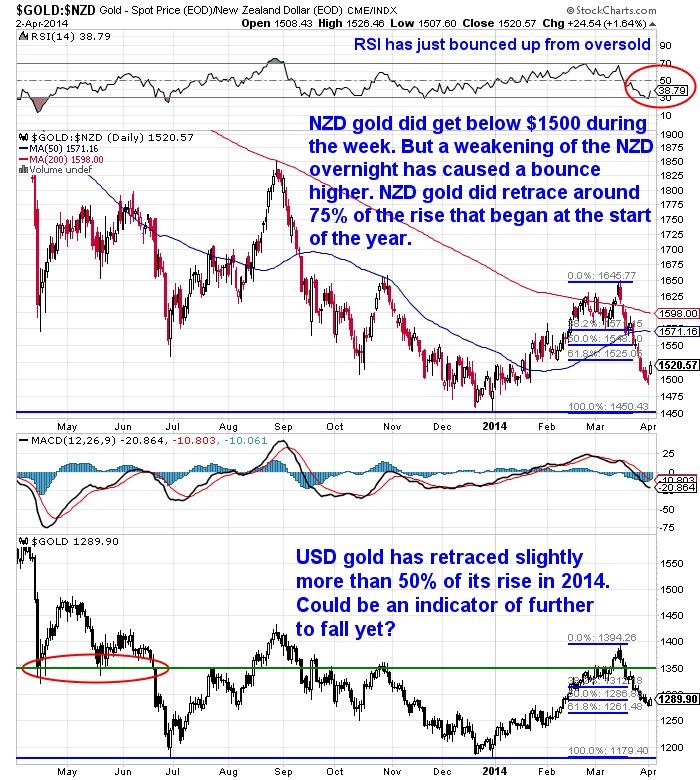

Gold in NZ dollars fell further from a week ago. Getting below NZ$1500 earlier this week, today it is back up to $1510, down $10.46 per ounce or 0.69% from last Thursday.

Meanwhile silver is actually up 32 cents or 1.39% from a week ago to $23.38.

Both metals did move higher in USD terms overnight but the much weaker kiwi dollar was the main factor in the sharp bump higher for both metals since yesterday.

You can see in the gold chart below that the local gold price has retraced around 75% of its move higher since the lows at the end of December. While the lower half of the chart shows USD gold has retraced just slightly more than 50% of its move higher.

This could well be a bearish factor indicating further to go yet. Maybe even a retest of the December lows of $1180? However there are some counter arguments to this which we’ll get to later on.

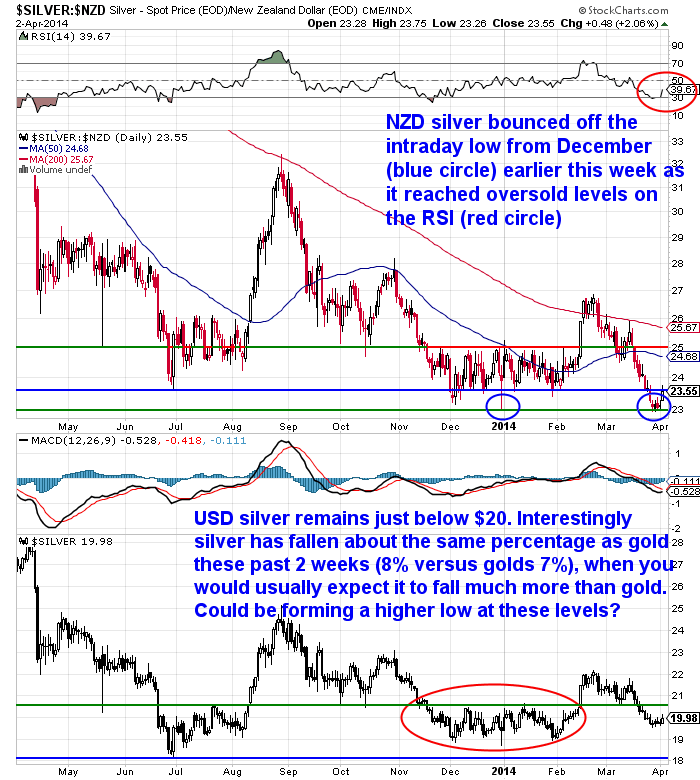

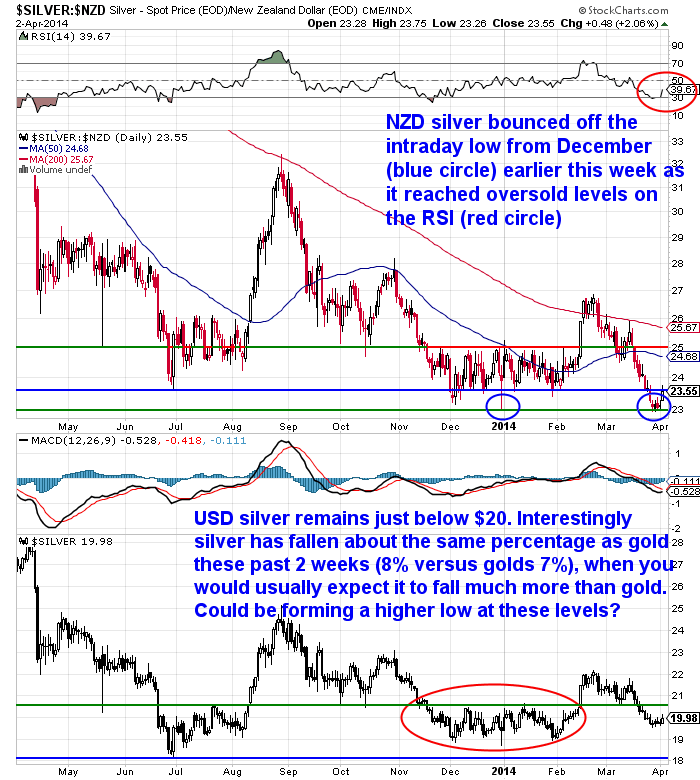

First though, a quick look at silver too. The chart clearly shows silver in NZ dollars has retraced fully the rise since December. In fact the prices earlier in the week touched on the intraday low from late December. Silver just like gold reached oversold levels so has bounced higher.

Silver in US dollars is hovering around the $20 mark. As we note in the chart a very interesting point is that while gold has fallen 7% in the past couple weeks, silver “only” fell 8%. Normally when gold takes a tumble like this you’d expect silver to fall even more – maybe even up to twice as far. So that is perhaps a positive.

So silver (in USD) may be trying to eek out a higher low at these levels.

NZ Dollar down sharply overnight

As we mentioned earlier, the NZ dollar dropped sharply overnight, likely on the back of international milk prices falling again overnight. It seems a lower payout for dairy farmers for the next year may be on the cards now. The other angle to this is that perhaps now the Reserve Bank may not raise their benchmark interest rate at its next gathering in late April, so that would dampen demand for the Kiwi dollar. Who knows?

Roger Kerr gave his angle on this a couple days ago, along with thoughts on RBNZ Forex intervention and is worth a scan we reckon.

He reckons:

—–

“Intervention would seem unlikely and it would be more effective for the RBNZ to just not increase the OCR at the end of April, surprise the pundits and that would cause greater NZD selling and depreciation.

The RBNZ may come under pressure to do just that if the TWI stays up above 80.0 over the next four weeks.

Further falls in WMP prices at the next Fonterra/GDT auctions on Tuesday 1 April and Tuesday 15 April may do the RBNZ’s currency intervention job for them.”

Source.

—–

He picked that pretty well, as there was a hefty tumble in Whole Milk Powder prices on Tuesday.

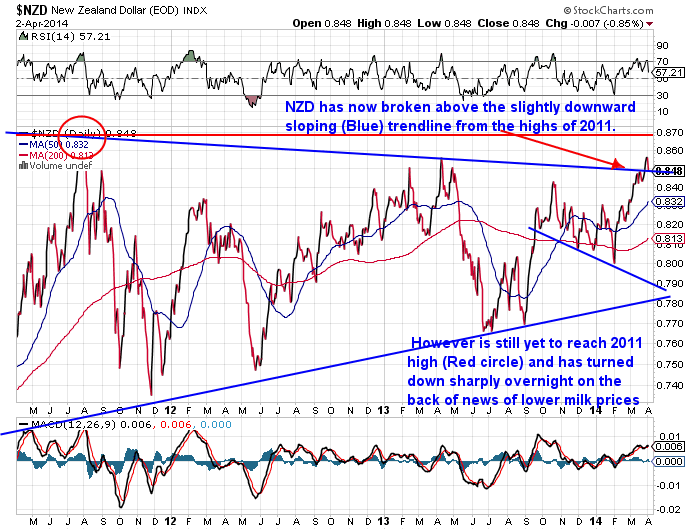

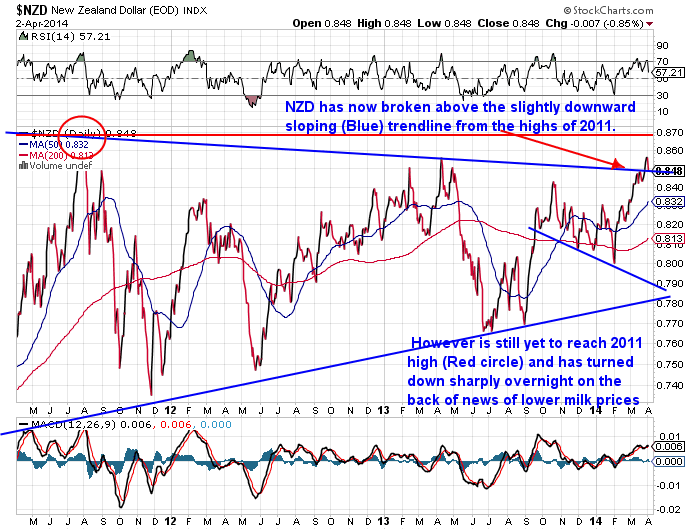

However, the chart we featured a week ago (Could These Currency Charts Indicate an Asia-Pacific Slow Down? – How Would This Affect New Zealand?) showing the NZ dollar bumping up against a downward sloping resistance line did not play out.

As you can see below, during the week the NZ dollar did poke its head above the line we have shown for the last few weeks, that we thought might turn it back down.

However the NZ dollar has yet to get to new highs above the 2011 high (Note: see the red circle on the chart – the 2011 high is obscured by the moving average info). So now it will be interesting to see whether it can get above the 2011 high.

It still seems to us that most expect it to keep heading higher from here. Although the IMF this week said it is overvalued by 5-15%. See IMF says kiwi dollar overvalued.

We’d rather not be on their side! But we don’t think it has got too much further to run from here. So an interesting crossroads we are at here. Nonetheless it’s quite likely the NZ dollar will move up to test the 2011 high at some point now.

The unknowable question is that if that happened would gold and silver prices be higher or lower than now? That is, will there be a better chance than right now to buy gold and silver for New Zealanders? As always we have to consider what the gold and silver price is doing in US dollars and what the NZD/USD cross rate is. No simple feat.

Gold Merchants/Users expect higher gold prices in 2014?

As we mentioned earlier USD gold has retraced just slightly more than 50% of its move higher from December. This could well be a bearish factor indicating that gold may fall further yet. There is not a great deal of “support” between current price levels and the December lows of $1180-90.

However some COMEX Commitments of Traders data last week could make a good counter argument to this.

Gene Arensberg of the Got Gold Report covers the topic in detail drawing some clear conclusions as well.

Data from the CFTC as of Friday showed that commercial traders on the COMEX had covered in a week over 32,000 contracts of their short position. A very large number last seen in March 2012, which was second only to the highest occurring in August 2008 of over 42,000 contracts.

This move can be seen in the chart below. As the blue line rises the net short position is getting smaller and vice versa.

So, what is significant about this?

First, perhaps an explanation of who the Producers/Merchants are.

—–

They “include the largest bullion dealers, refiners, manufacturers, fabricators, jewelry makers and the bullion trading banks they end up trading through on the New York and London bourses. In short, PM’s include much of the “gold trade” who use futures to hedge….”

“The Producer/Merchants (PM) are nearly always net short because they are primarily using futures to hedge.”

—–

So the Producers/Merchants are the actual users of the metal, who are using futures contracts to hedge their physical metal purchases. Simply put, if the price falls they have some protection against physical purchases they have made at higher levels.

Arensberg draws a couple of conclusions from this data:

—–

“First the obvious. With gold having touched as high as $1390 earlier in the trading week, but by then, on Tuesday, having sold back down to the $1310 level… apparently the largest, best funded and presumably the best informed traders of gold futures on the planet thought that gold had already moved lower enough to motivate them to reduce their hedges in a very big way.”

—–

Secondly…

—–

“…with gold near $1300 in March of 2014 (now), the amount of gold hedged by the gold trade – the gold business players/operators – on the COMEX division of the CME — is at an extremely LOW level. Simply stated the gold trade is not at all motivated to hedge gold with a $1300 handle, so says the graph.”

—–

(See the graph below which shows short positions of these Producers/Merchants again close to the all time lows reached back in December.)

—–

“From what we see here and in the positioning of the U.S. banks in futures from last month we here at Got Gold Report have to believe that the gold trade now expects and is positioning for a higher, not a lower gold price in 2014. The sudden, overly large reduction in the Producer/Merchant gross shorts this COT week is kind of an earthquake in that regard.

Any way one wants to look at it, the gold trade got the heck out of a very large number of hedges on a not-all-that-big move lower for gold this week. Sure does seem like they were in a hurry in that regard.”

—–

The full article is here if you need a more complete explanation. It’s not easy getting your head around this futures stuff!

The key point here is that this is the “smart money”. Not speculators but chiefly users of gold whose business depends on buying and hedging at the right price. So if they are positioning themselves for a higher gold price in 2014 then we think that bears taking some notice of.

If you’d like to side with them and hedge yourself, be it against a lower New Zealand dollar, a breakdown in the global financial system, or good old government debasement then get in touch. As always we’re happy to answer any questions by phone or email.

This Weeks Articles:

| Silver continues to under-perform gold |

2014-03-26 23:19:12-04Gold Survival Gold Article Updates Mar. 27, 2014 This Week: Could These Currency Charts Indicate an Asia-Pacific Slow Down? – How Would This Affect New Zealand? Silver continues to under-perform gold This week we have a number of articles on the website for you to peruse. Likely of most interest to NZ residents […] 2014-03-26 23:19:12-04Gold Survival Gold Article Updates Mar. 27, 2014 This Week: Could These Currency Charts Indicate an Asia-Pacific Slow Down? – How Would This Affect New Zealand? Silver continues to under-perform gold This week we have a number of articles on the website for you to peruse. Likely of most interest to NZ residents […] |

read more…

US Government Is Unaffordable and Unsustainable, Says David Walker |

2014-03-26 23:19:12-04Gold Survival Gold Article Updates Mar. 27, 2014 This Week: Could These Currency Charts Indicate an Asia-Pacific Slow Down? – How Would This Affect New Zealand? Silver continues to under-perform gold This week we have a number of articles on the website for you to peruse. Likely of most interest to NZ residents […]

2014-03-26 23:19:12-04Gold Survival Gold Article Updates Mar. 27, 2014 This Week: Could These Currency Charts Indicate an Asia-Pacific Slow Down? – How Would This Affect New Zealand? Silver continues to under-perform gold This week we have a number of articles on the website for you to peruse. Likely of most interest to NZ residents […] 2014-03-30 21:30:16-04Even though this podcast is a discussion of the USA not New Zealand, it is always worth paying attention to where the US is headed. Given they have the global reserve currency, what goes on in the US of A will always have a bearing on what happens here at the bottom of the world too… […]

2014-03-30 21:30:16-04Even though this podcast is a discussion of the USA not New Zealand, it is always worth paying attention to where the US is headed. Given they have the global reserve currency, what goes on in the US of A will always have a bearing on what happens here at the bottom of the world too… […] 2014-03-31 16:51:15-04The folks at Casey Research continue to think that inflation is coming and is inevitable. They’ve put together some very interesting data that we’ve not seen before on very recent inflationary episodes from many countries around the globe. It points to the fact that now is the time to be prepared for what may come later… Inflation […]

2014-03-31 16:51:15-04The folks at Casey Research continue to think that inflation is coming and is inevitable. They’ve put together some very interesting data that we’ve not seen before on very recent inflationary episodes from many countries around the globe. It points to the fact that now is the time to be prepared for what may come later… Inflation […] 2014-04-02 16:45:36-04Marc Faber was in Melbourne, Australia this week for an interesting conference over there. From what we’ve read about his presentation he seems to cover some similar ground in this podcast… Don’t Keep Your Gold and Silver in the US, Says Marc Faber By Gloom Boom & Doom Report publisher Marc Faber discusses the fragile state of the […]

2014-04-02 16:45:36-04Marc Faber was in Melbourne, Australia this week for an interesting conference over there. From what we’ve read about his presentation he seems to cover some similar ground in this podcast… Don’t Keep Your Gold and Silver in the US, Says Marc Faber By Gloom Boom & Doom Report publisher Marc Faber discusses the fragile state of the […]

Pingback: Gold Prices | Gold Investing Guide Bank Bail-Ins Going Global