|

Gold Survival Gold Article Updates

Mar. 27, 2014

This Week:

- Could These Currency Charts Indicate an Asia-Pacific Slow Down? – How Would This Affect New Zealand?

- Silver continues to under-perform gold

This week we have a number of articles on the website for you to peruse. Likely of most interest to NZ residents will be our feature article:

Could These Currency Charts Indicate an Asia-Pacific Slow Down? – How Would This Affect New Zealand?

In this we take a look at what the currencies of various nations throughout the Asia-Pacific region have done over the past 5 years. Trying to draw a few conclusions as to what they may mean for the future for us in New Zealand.

Given news of some “difficulties” in China this might be a timely consideration.

The central planners in China are attempting the unenviable task of transferring them from a purely export led economy to one with more balanced internal consumption. We’ve read many many opinions on China of late and these are certainly diverse. Who knows exactly how it will play out but to us it seems there is some risk there at the very least.

The Aussie dollar has been rising of late. Presumably because the current slowdown in China means a new stimulus package from them that will boost Australia’s fortunes again like it did post 2008. We’re not sure if this is such a one way bet though as the credit bubble in China probably doesn’t need blowing up even more and it would seem the leaders there know that.

Anyway please check out that article and let us know your thoughts. You can leave a comment at the end as to whether we are barking up the wrong tree here or not!

We also have a short video interview with Jim Rickards where he discusses the possibility of government revaluations. Along with a piece looking at the upside in Junior mining shares. Then finally an interesting podcast with a Bitcoin enthusiast who has some interesting remarks regarding gold and bitcoin. Interestingly his comments do tie in with what we wrote about last week in: If/When the US Dollar Collapses, What Will Gold be Priced in?

Where we said:

—–

Here’s our ideal. A free market for money as we discuss in more depth here. The Gold Standard: What Do We Think About it?

In this case virtual currencies may also rise up – ala Bitcoin and others. However we think in a true free market for money it’s likely they would need some tangible backing. So perhaps gold and silver as store of value, unit of account (again goods priced in ounces not dollars), but some technological addition to aid in the means of exchange?

Just like any free market, odds are the best currency would become the most popular and rise to the top. Throughout history the best money has been gold and silver. We’re not sure that technology will necessarily change that.

—–

As usual the article links and intros are further down the page.

But now a look at precious metals price movements over the past week.

Well the possibility of further downside we mentioned last week has played out. With some further decent falls for both gold and silver since last Wednesday. Gold especially had risen for two and half months with barely a pause so it was due.

Gold in NZD is down $54.33 per ounce or 3.45% since last Wednesday to $1520.46

While Silver in NZD is down $1.16 or 4.79% to $23.06

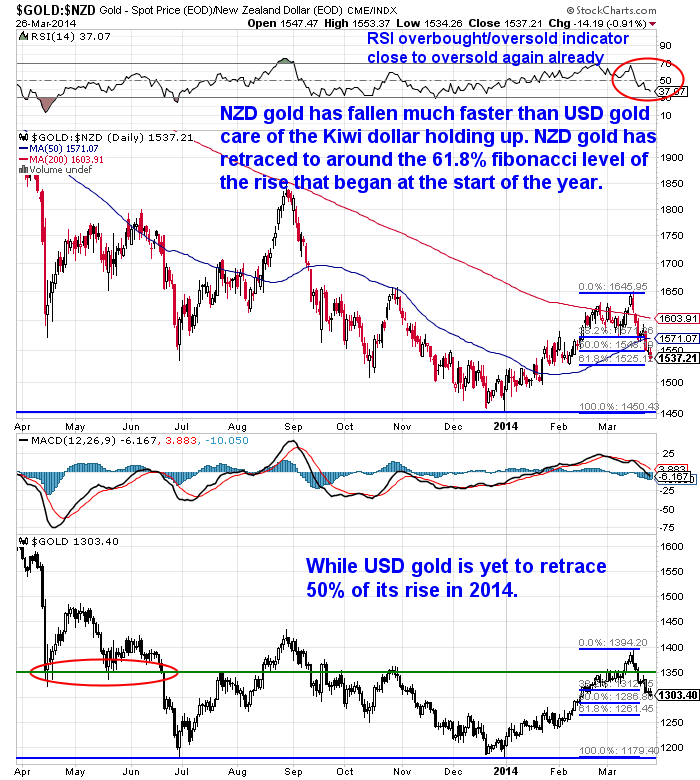

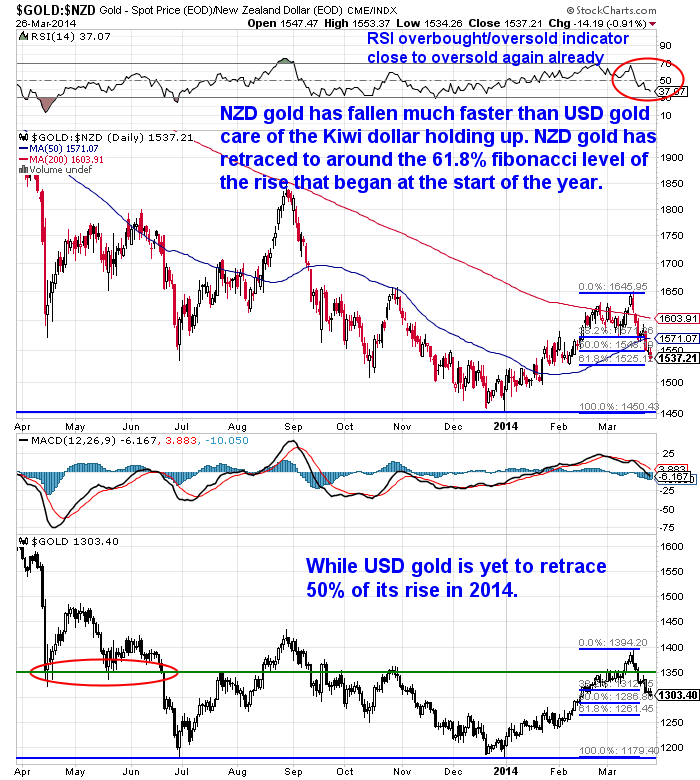

As you can see in the chart below NZD gold has had a couple of big down days since last week. It is now below the 50 day moving average and has retraced around 61.8% of the gain from the start of the year.

We can see the kiwi dollar strength over the past couple of weeks has meant the NZ gold price has fallen relatively further than the USD gold price – which has not quite retraced 50% of its move up since 2014 began.

As we outline in this weeks feature article even after the recent interest rate hike by the RBNZ and then the announcement of the NZ Dollar/Chinese Yuan direct convertibility agreement the kiwi has yet to reach the highs of 2011. So we think this adds some weight to the important idea that most of the good news is already priced into the NZD.

Why does this matter?

Because if NZD is close to topping out (as per our last chart in this weeks feature article), then this might make right now a very good time to be buying gold for New Zealanders. Particularly with the USD gold price standing a decent chance of finding a floor somewhere around here.

Silver continues to under-perform gold

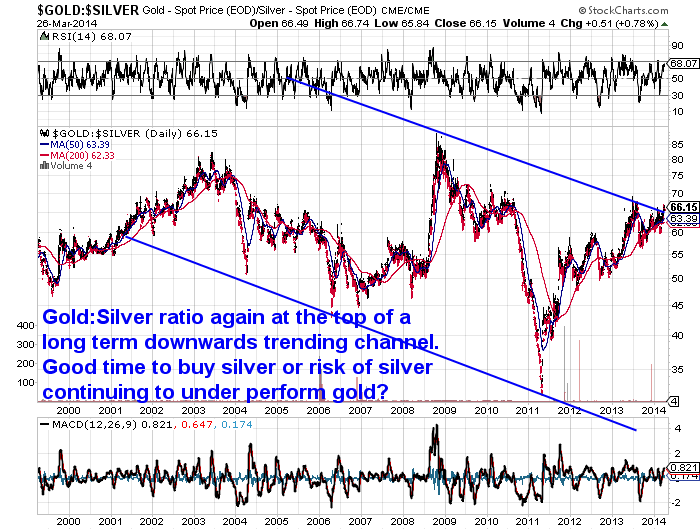

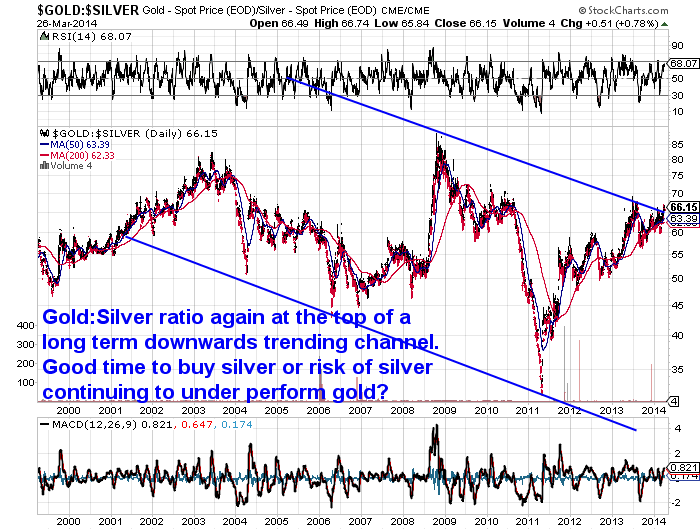

The gold/silver ratio (how many ounces of silver you can buy with an ounce of gold) has risen to 66 today.

So while gold has retraced some of its move up, you can see in the chart below NZD silver is now very close to the lows it reached in December. Given we are close to oversold now on the RSI we might well see a bounce up from here now.

So this could make for a decent risk/reward scenario for buyers of silver here. Again particularly with the NZD close to the highs from 2011.

Just one final thing to add this week.

We read some reports this morning that point to the ECB potentially opening the monetary floodgates to stem the low levels of inflation – or rather deflation – across much of Euroland.

First, from the Telegraph’s Ambrose Evans-Pritchard where it seems the German Central Bank is perhaps now not so rigid in its stance against ECB money printing.

Monks recant: Bundesbank opens the door to QE blitz

And also from the Wall Street Journal commenting that the ECB may consider negative interest rates as it’s next step in financial repression:

—–

“ECB Mulls Bolder Moves to Guard Against Low Inflation

Officials Indicate They Will Consider Negative Interest Rates, Asset Purchases

European Central Bank officials sent strong signals Tuesday that they are willing to consider dramatic steps to guard against dangerously low inflation, suggesting that the bank is prepared to shed some of its traditionally cautious approach.

The possible tools, cited by some top policy makers from different parts of the euro zone, include effective negative interest rates — meaning rates so low that commercial banks would essentially pay the ECB to park their extra cash overnight. They also include purchases of government or private-sector debt to hold down long-term rates and spur lending. …

“We haven’t exhausted our maneuvering room” on interest rates, Bank of Finland Governor Erkki Liikanen, told The Wall Street Journal in an interview in Helsinki. Mr. Liikanen is on the ECB’s 24-member governing council. Asked what tools the ECB has remaining, Mr. Liikanen cited a negative deposit rate as well as additional loans to banks and asset purchases.”

—–

While Evans-Pritchard states that:

—–

“Roughly speaking, inflation since June has been running at a rate of minus 1pc in France since, minus 2pc in Holland, Belgium, and Slovenia, minus 4pc in Italy, Spain, and Portugal, minus 6pc in Greece, and minus 10pc in Cyprus. Sweden and Switzerland are also in deflation.”

—–

Perhaps the reduction in QE from the US Fed is already having some impact with capital returning to the US? With deflation seeming to be rearing its head and trouble brewing in China, we still think it’s not all going to be smooth sailing from here.

As we mentioned at the start of February (In: Why is Silver Lagging Gold?), this deflationary fear could well be a factor keeping silver down compared to gold. But if we see a central bank response it could well give silver a serious boost down the track.

Makes silver look like a pretty good punt at the moment perhaps?

This Weeks Articles:

| Why Jim Rickards Thinks Gold Could Quickly be Valued at $5000 |

2014-03-25 21:04:33-04 2014-03-25 21:04:33-04

Jim Rickards has been featured in 4 out of the 5 episodes that Mike Maloney has released so far in the ‘Hidden Secrets Of Money’ series. His first book ‘Currency Wars’ was a bestseller and is highly recommended reading for anyone who wants to get an understanding of economics from ‘the inside’. In this video they […]

read more…

Could These Currency Charts Indicate an Asia-Pacific Slow Down? – How Would This Affect New Zealand? |

2014-03-26 04:19:51-04 2014-03-26 04:19:51-04

Most analysis we’ve read lately leans towards the kiwi dollar continuing to rise and reach parity with the USD dollar. But as we’ve mentioned a few times lately we’re not sure this is such a one way bet. Coincidentally last week in Chris Weber’s most recent report he touched on the performance of the Asia-Pacific […]

read more…

Mt. Gox’s Downfall Shows the Power of Creative Destruction: Erik Voorhees Interview

2014-03-23 17:58:07-04 2014-03-23 17:58:07-04

An interesting interview this one on the topic of Bitcoin and sound money. Of particular note to followers of gold and silver is the discussion of “hard digital currencies”… Mt. Gox’s Downfall Shows the Power of Creative Destruction: Erik Voorhees Interview Bitcoin evangelist and Coinapult Cofounder Erik Voorhees gives us his thoughts on the demise […]

read more…

Junior Mining Stocks to Beat Previous Highs

2014-03-24 19:43:19-04 2014-03-24 19:43:19-04

The first chart below looks hard to believe – that select mining shares could outperform gold itself and the broader mining stock index by such a huge margin in such a short space of time. But the second chart is just as telling. Gold mining shares still have a lot of catching up to do […]

read more…

Reader Question: “Why would a fall in the NZ dollar be a negative?”

2014-03-19 01:18:20-04 2014-03-19 01:18:20-04

Gold Survival Gold Article Updates Mar 18, 2014 This Week: If/When the US Dollar Collapses, What Will Gold be Priced in? Reader Question: “Why would a fall in the NZ dollar be a negative?” Precious metals have been due a pull back We’re a day early with this weeks update as we […]

read more…

|

|

2014-03-25 21:04:33-04

2014-03-25 21:04:33-04 2014-03-26 04:19:51-04

2014-03-26 04:19:51-04 2014-03-23 17:58:07-04

2014-03-23 17:58:07-04 2014-03-24 19:43:19-04

2014-03-24 19:43:19-04 2014-03-19 01:18:20-04

2014-03-19 01:18:20-04

Pingback: We Have Seen This Play Before | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Gold Merchants/ Users expect higher gold prices in 2014?