Prices and Charts

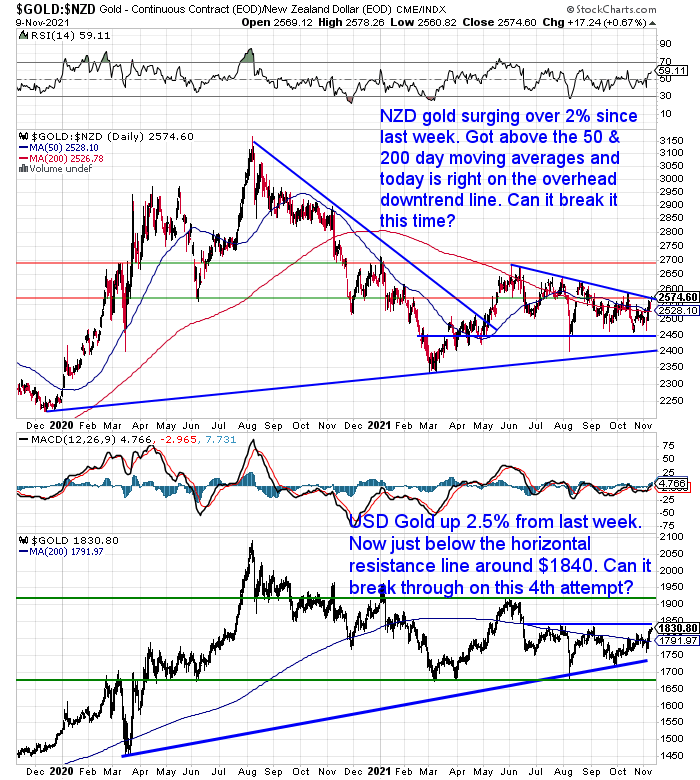

NZD Gold Bouncing Back Over 2%

Gold in New Zealand dollars continued it’s comeback this week. Rising over 2% to get conclusively above the 50 and 200 day moving averages. Today it sits right on the blue overhead downtrend line. It has not managed to get above this line despite multiple attempts since June. Can it break above it this time? Who knows?

But it wouldn’t surprise us to see it turn down once again. As there is still room for NZD gold to bounce up and down a bit more between the horizontal support line around $2450 and this downtrend line. But we get the feeling that a break out should not be too far away now.

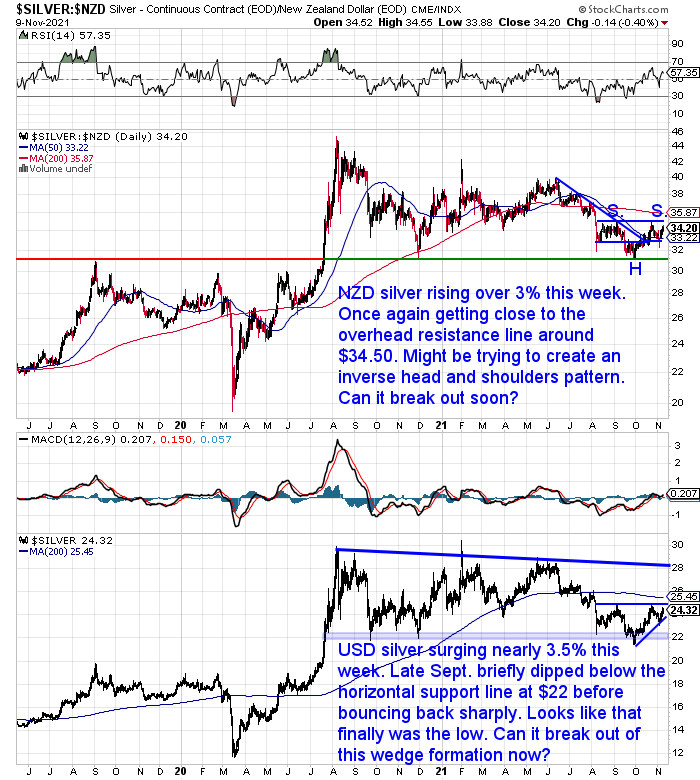

NZD Silver Head and Shoulders Pattern Forming?

Silver in NZ dollars was up 3% this week. Once again it has gotten close to the overhead resistance line around $34.50. It hasn’t been above that level since early August. Silver looks to be forming what is called an inverse head and shoulders pattern (marked with S, S and H on the chart below). It might need to continue to trade in the sideways range for a bit longer yet to build out the right hand shoulder. The theory being that once the break out from the right hand shoulder happens we should see silver move back to the $40 level that silver dropped from in June.

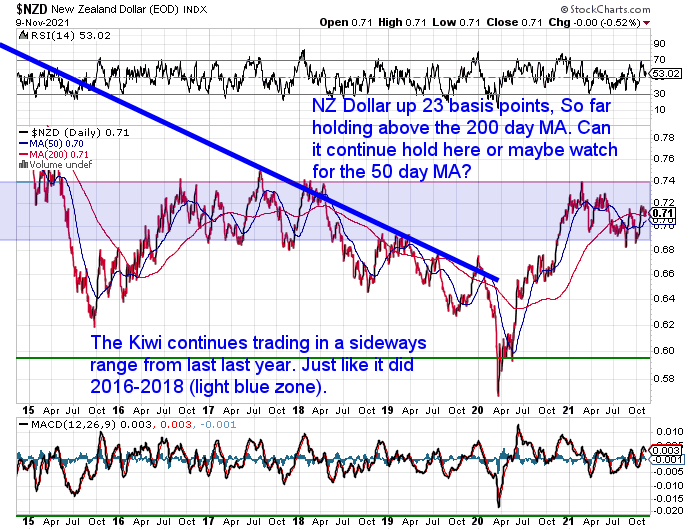

Not Much Change in the Kiwi Dollar

The New Zealand dollar is up 0.33% from 7 days ago. So far it has held above the 200 day moving average. So it could be building to strengthen further from here. But in the longer term the Kiwi still seems to be in this large sideways trading range between 0.68 and 0.74.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Bullion Coins or Numismatic (Collectible) Coins? Which Should I Buy in 2021?

Here’s a question from Suzanne from a couple of weeks ago:

“I have heard several times that it is better to buy collectable coins rather than bullion. What do you think about this in these unusual times.

If so where can you find collectable gold?”

We have a full article on this topic.

In it we explain why we (almost) always recommend buying bullion coins like Canadian silver and gold maples or bars over collectible coins. But you’ll also learn when there could be an exception to this rule…

- What’s the Difference Between a Bullion Coin and a Numismatic Coin?

- Why Buy Limited Mintage Silver Coins?

- Here’s a Possible Benefit to Buying “Semi-Numismatic” Silver Bullion Coins

- Why You’re (Usually) Best to Stick to Buying Bullion Coins

- Semi-Numismatic Coins For Less Than Bullion Coin Prices

After reading that if you still want actual collectible coins then you’d need to check out a coin/collectibles shop or check trademe for collectible coins. But as the article says these usually come with high premiums above the spot price and you need to know what you are doing to buy the right one.

Greed Index is Approaching Extremes

In last week’s feature article we pointed out that shares/stocks recently hit a new all time high in the US.

We also looked at a measure last week that showed stocks were overvalued compared to currency in circulation, while gold was undervalued against the same measure.

Here’s a recent astounding number from the Market Ear – as of end of September:

Astounding Numbers about Stock Markets

Global equities have seen $765bln of inflows year to date…this is the largest 9 month inflow ever by a factor of 3x. In fact equity inflows in the last 12 months have been larger than the prior 25 years cumulatively. (GS)

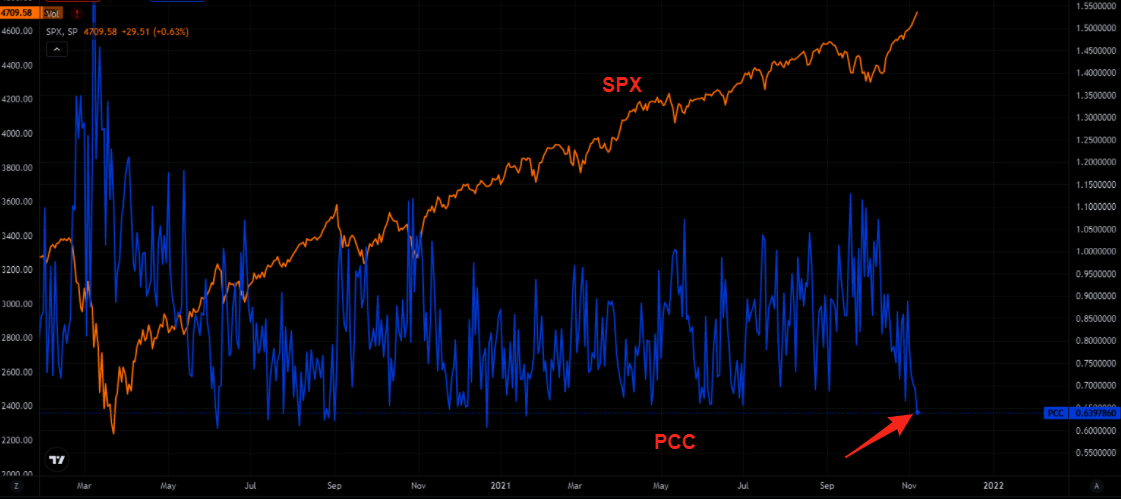

Then this week the Market Ear points out how people are piling into calls. Remember calls are options to buy a share in the future at today’s price. Effectively a bet that the stock market will go up. While a put is something you buy if you expect the market to go down, or at least to hedge against the risk of a fall. Seems no one is buying puts currently as shown in the chart below.

Remember puts?

Put hate is becoming stronger each day. The upside crash is the new crash people are “hedging”.

Let’s see how this plays out from here, but such extreme put hate should be noted…especially as it truly feels we can never go down again.

Tradingview

On top of this the fear greed index is getting close to extreme greed levels.

Greed is good

We are seeing the highest extreme greed readings in a long time.

We are not there yet…but getting closer, or?

CNN

Now none of these numbers or measures means a stock market crash is happening tomorrow. But they are pointing to a correction possibly not being far away. They are warning signs. Be aware.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Risks to the NZ Economy are Growing, But Also Now Being Reported

Have you noticed there are more mainstream media articles appearing about the risks to the New Zealand economy due to the government’s handling of COVID19?

Here’s a few that we’ve seen lately.

Granted this one is from a Libertarian, but it did appear on the very mainstream Stuff website:

It points out a report from Wellington think tank, the NZ Initiative: Walking the Path to the Next Financial Crisis.

“Four scenarios are offered; one benign, two concerning, and one catastrophic.

Best case: governments become fiscally prudent, pay down debt, and economic growth solves all our problems. This could happen. I could stick to the healthy eating regime recommended by my GP. Both are equally probable.

More likely, we face decades of low growth and lost opportunities as we endure a Japanese-style managed decline or, equally possible, a return to the high inflation and high unemployment our parents and grandparents enjoyed in the 1970s. The advantage of this approach is that inflation is a means of paying off the debt; a form of polite default.

It is the final option that should have our political class paying attention. “A calamitous global asset market collapse occurs. It is much worse that the GFC. Investors panic, liquidity dries up… Economic activity implodes… Unprecedented economic distress and unemployment, in living memory, would spark public anger and unrest.”

This isn’t likely, but it is a possibility and organisations like the Initiative are openly writing about it. “Unfortunately, the trends outlined in this report suggest that the odds of some unexpected event triggering a major global financial catastrophe are alarmingly high.”

The writer Damien Grant goes on to point out:

“Over the last decade Kiwis have borrowed heavily to get into the housing market. They have been able to afford million-dollar plus mortgages thanks to the cost of borrowing being lower than the economic literacy of our politicians.

Now, as inflation begins to take hold, banks are starting to raise rates. Unlike the US example, those caught will not be the no-income, no job, no assets debtors but a wide swathe of middle New Zealand. More concerning, the financial institutions exposed are not second tier intermediaries whose bankruptcies triggered the GFC, but the big-four licensed trading banks.”

That is an important point. Those most at risk in NZ are the middle class not the no income earners that were hit in the USA by the GFC.

Two Major Risks to NZ Economy

Over at interest.co.nz Roger J Kerr this week highlighted other risks to the NZ economy:

“Two major risks for the NZ economy in 2022 stem directly from what policy changes the Reserve Bank and the Government will make with monetary and fiscal policy respectively from here: –

If the RBNZ over-react to the sudden surge in the inflation rate by tightening monetary policy too rapidly over coming months, they run the risk of unnecessarily sending the economy into recession. Should the RBNZ endorse the current aggressive forward interest rate market pricing at their next monetary policy statement on 24 November, they will increase the risk of economic recession. They have the opportunity to hose-down the over-hyped interest rate market expectations of much tighter policy conditions, but there is a big question as to whether the RBNZ will have the intestinal fortitude to give the markets the finger! The central bank Governors of Australia and England did exactly that this last week. As the Bank of England Governor, Andrew Bailey stated a few days ago “Putting interest rates up, I’m afraid, isn’t going to get us more gas”.

A damning report from the Government Treasury last week warned Finance Minister, Grant Robertson that economic growth over coming years will not be enough to provide extra revenue into the Government to repay all the additional debt that has been taken on over the last 18 months. Fiscal policy will need to be tightened by either increasing tax rates or reducing Government spending. A Labour Government will not be doing the latter, so businesses and households should strap themselves in for taxation increases that will impede both consumer spending and investment.

The probability of the “doomsday” scenario for the NZ economy in 2022 of falling house prices, falling commodity export prices, a global equity market downward correction and both monetary and fiscal policy being tightened by too much at the wrong time, has arguably gone up a notch.”

Source.

Now the obvious question is have you done the best you can to prepare for these risks?

Do you have enough financial insurance in case your investments take a hit?

Please get in contact if you’d like a quote or have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|