Prices and Charts

Gold Bouncing Back This Week

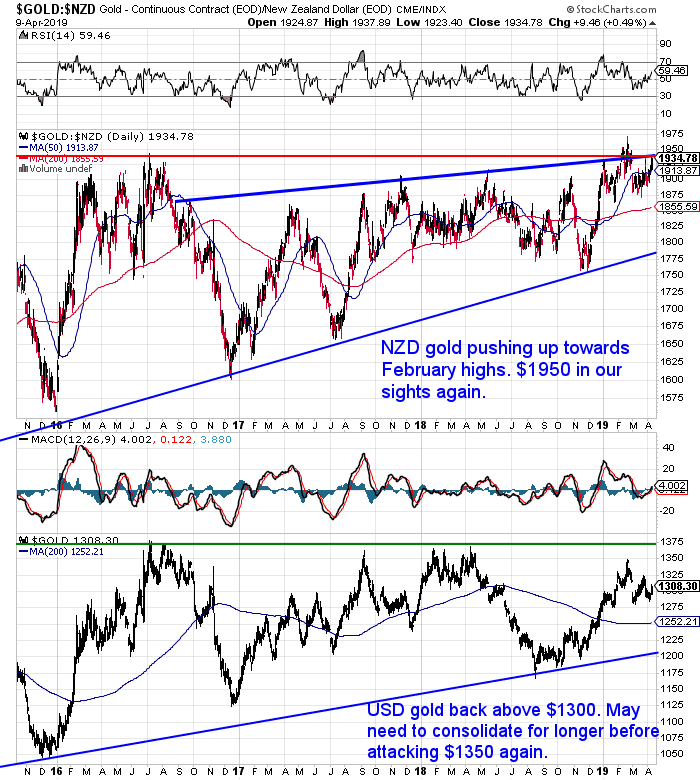

NZD gold has jumped quite sharply this past week. Up over 1 percent.

It is now sitting not too far below the February (and multiyear) highs just above $1950.

We may need to see gold consolidate in this $1875 to $1950 range for a little longer yet. Before it attempts a crack at new highs.

While in US dollar terms gold is back above $1300.

Silver Also Bouncing Back

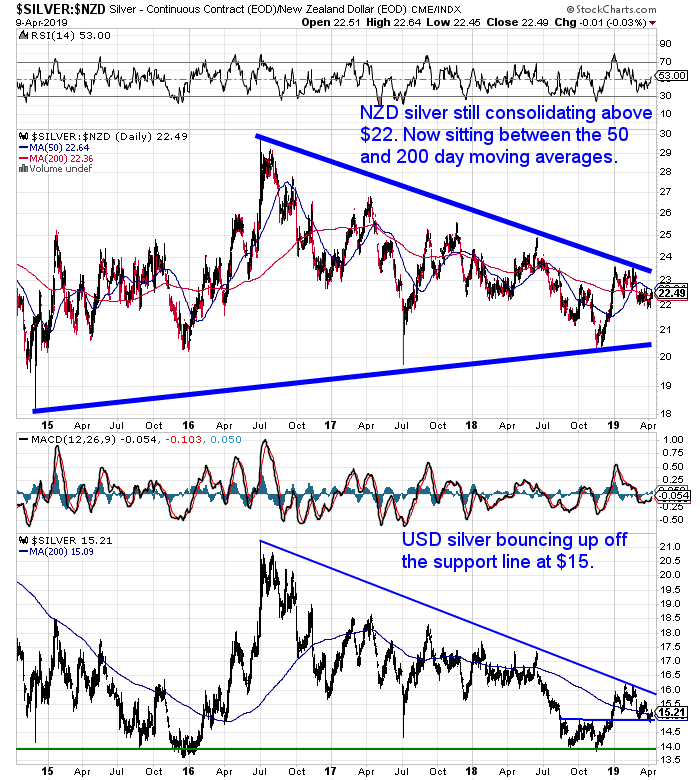

Silver in NZ dollars has also bounced back after dipping to test the $22 level. NZD silver now sits between the 50 and 200 day moving averages.

As we’ve been saying for a while, it will take a clear breakout from gold before silver also follows higher.

NZ Dollar Fall Continues

The NZ dollar continued to fall further this week after the change of tack from the RBNZ to an easing bias the week before. The Kiwi is now at its lowest since January. It sits just above the horizontal support line at 0.67 and right on the 200 day moving average.

So it looks like holding in the sideways trading range for now. But the pressures are building and a break lower could be on the cards yet.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

Bank Capital Changes: What is the RBNZ Preparing For?

The RBNZ is pushing ahead with its plans to significantly increase the amount of capital that NZ banks are required to hold. Even in the face of opposition from the banks, but also previous RBNZ governors.

These are significant changes. So just what is it the RBNZ is preparing for? Their media releases clearly spell it out. Read about that below…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

History Says Gold Performs Well Before, During and After a Financial Crisis

Various indicators are pointing to at the very least a recession being not too far off.

But what if we get more than just a recession? Casey Research has put together some research showing how gold (and other metals) perform before, during and after a financial crisis.

Right now we might be in a similar period to 2007 – the run up to the financial crisis. So what can we expect based upon last time…

“We’re …seeing a lot of flashing red lights, or ominous indicators. For example, a rise in the Japanese yen, which in the past has coincided with times of financial trouble as the yen is seen as a safe haven by investors.

…And the rising yen isn’t the only troubling sign.

As you know, personal and corporate debt continues to pile up. Household debt is reaching unprecedented levels. It just topped $13.5 trillion in 2018, a new record.

We saw a huge run-up in debt before the last financial crisis. And none of those problems were fixed. They all just got kicked down the road.

Then, there’s the inverted yield curve. That’s the spread between long-term and short-term Treasuries – when that spread goes negative, it has historically meant that we’re in, or about to enter, a recession. The spread between the 10-year and 3-month Treasury yields has plunged to almost zero in recent months, threatening to go negative.

So a lot of red flags are popping up at the same time. This suggests that we could be nearing the end of the bull market in stocks… as well as the business cycle.

Justin: What does all this mean for commodities?

Dave: Here’s the thing about commodities. They tend to do well in the late stages of the business cycle.

Heading into the last financial crisis, gold had a huge spike. Platinum and oil also went on big runs. So spikes in certain commodities can often indicate that we’re in the late stages of the business cycle.

We’re seeing that again. Certain commodities are showing signs of life. Palladium – the sister metal to platinum – just had a huge run. It topped $1,600 a few weeks ago, which was an all-time high.

Oil is coming back. West Texas Intermediate crude is up 50% since late December.

Gold also had a notable bump, rising from $1,200 per ounce in late 2018 to above $1,300.

These aren’t the sorts of huge runs we saw in 2007. But certain commodities are coming back to life.

Justin: So should investors be positioning themselves in commodities right now? Or should they be moving to cash?

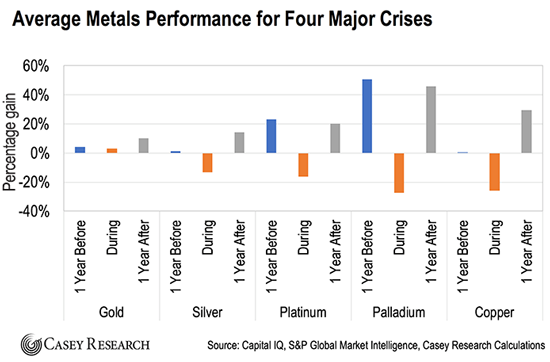

Dave: That’s a great question. My team and I looked into this recently. We analyzed how certain metals – major base metals, minor base metals, and precious metals – fared before, during, and after the last four big financial crises.

We found that you need to be very selective about what commodities you own. You especially want to be careful with how much exposure you have to base metals like copper and zinc. These metals tend to get hit hard during financial crises.

One reason for this is that there’s a lot of paper investment in copper. In other words, its price isn’t just a reflection of its actual use. Many people are speculating on it. Those people will liquidate their positions if there’s trouble. So I’d be very careful with copper exposure these days.

But there are some base metals that fare better. Historically, battery metals like vanadium and cobalt didn’t perform nearly as badly during crises because they don’t have that kind of speculative element in the market.

Justin: Interesting. So are there metals that have historically done well during crises? I have a feeling you’re going to say gold.

Dave: Yeah. As you suspect, gold is a good place to invest in before and during crises. Based on our research, gold outperformed all the other precious metals. It tends to perform really well ahead of financial crises. For example, gold had a huge run in 2007 and 2008, rising over 50% in under 12 months.

So gold is a perfect place to hide if you think there’s a crisis on the horizon. You could make a lot of money in the period leading up to the crash. If you sit on the sidelines, you’re going to miss that.

We also found that gold held its value well through crashes. It was almost even.

…Justin: And what about after the crash? Is that also a good time to hold onto gold?

Dave: We found that gold, along with the other precious metals, tends to perform really well in the year after crashes.

…In the few years immediately after crashes, gold and the other precious metals have been real outperformers. It takes longer for the base metals to come back.

…So there are cases where other metals do well. But gold, silver, platinum, and palladium have usually done the best in the first few years following a financial crisis.

…Justin: So it sounds like gold is the place to be for both speculators and long-term investors.

Dave: Yeah. Based on its track record, gold should deliver the safest and steadiest returns in the coming years. It also has the potential to deliver the biggest gains… before, during, and especially after a crash.”

Source.

The chart above confirms gold is your best choice, before, during and after a financial crisis.

As we said earlier, the current period is starting to resemble the year or 2 leading into the 2008 financial crisis.

The numbers above show gold can perform really well in just such a period.

So don’t wait until the crisis hits to try to buy your financial insurance. Get some today.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|