Prices and Charts

NZD Gold Hovering Just Below Recent Highs

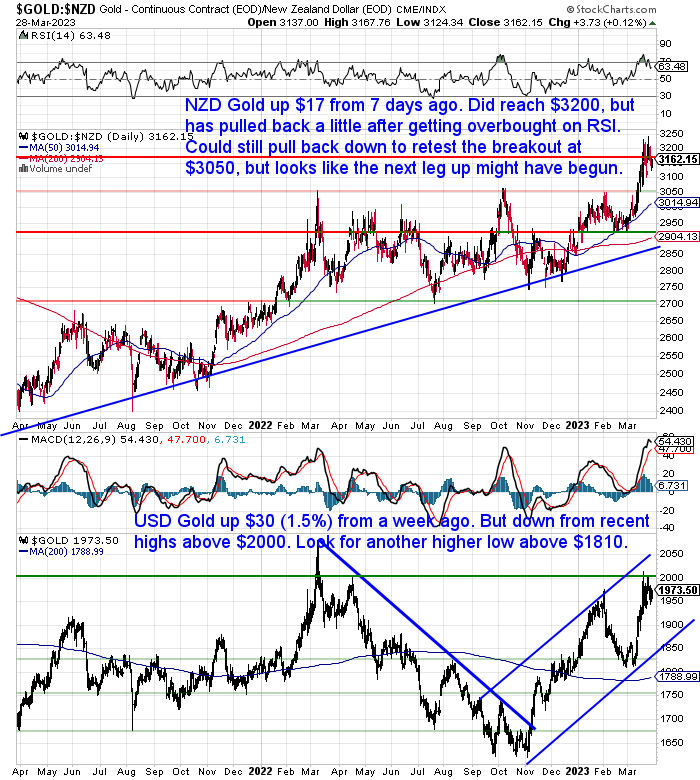

Gold in NZ Dollars was up half a percent or $18 from a week ago. Today it is hovering just above the horizontal support line at $3150 that was the previous all time high. But NZD gold has pulled back from the high above $3200. With gold sitting just below overbought it could yet pull back to retest the breakout at $3050. The next buyzone to then watch for would be the 50 day moving average (MA) at $3015. However, with a clear breakout to new highs having occurred, it is likely that we are now in the early stages of the next leg up in gold.

Conversely, USD gold is still a little way from new all-time highs. But the USD, along with the Swiss Franc, is one of the few currencies where gold hasn’t recently made an all time high. However, with the troubles in the US banking system the odds favour the USD gold price also heading up to test the all time high from 2020 and 2022 before too long.

NZD Silver Outperforms Gold Again

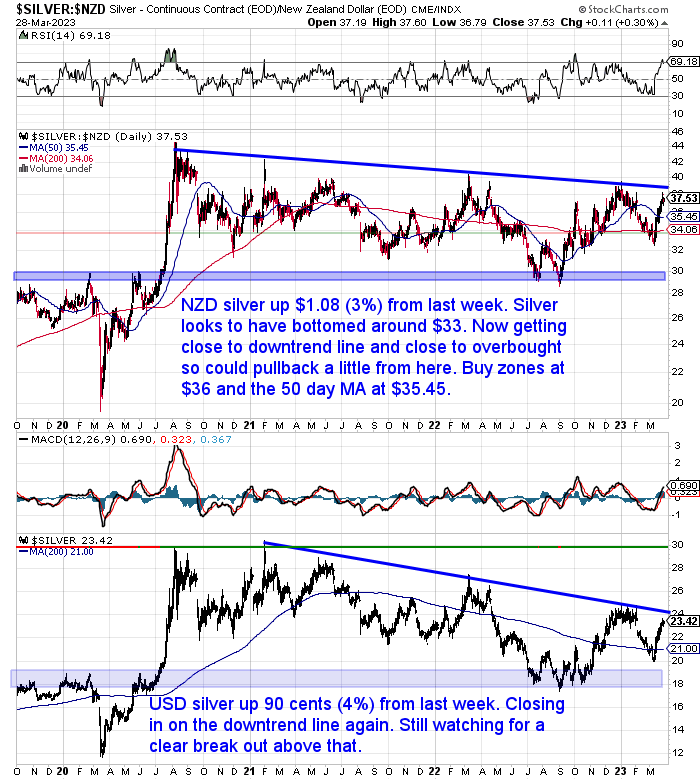

Silver in New Zealand dollars was up 3% to again outperform gold. NZD silver is closing in on the overhead downtrend line once again. Having touched this line 3 times since 2020 are we finally close to seeing a breakout? With the RSI only just out of overbought, we’d expect to see a pullback first. Buy zones are at $36 and the 50 day MA at $35.45.

Silver continues to show that it requires a fair dollop of patience. But these periods of sideways action are not uncommon. Then when it runs it will run up fast.

USD silver is in a similar position. Not far from the downtrend line. So we’re also watching for a breakout above that line in USD silver too.

NZ Dollar Still Trading Between 50 and 200 Day Moving Averages

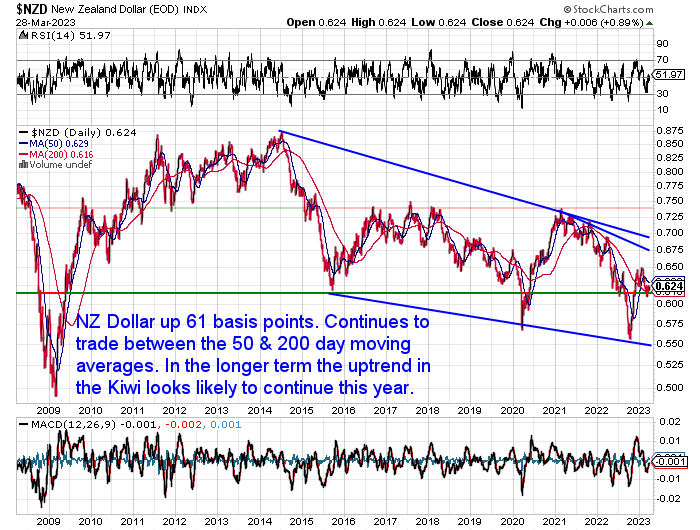

The Kiwi dollar bounced back 1% this week. It continues to trade between the 50 and 200 day moving averages. We’re still thinking the uptrend in the Kiwi will continue later this year. But the banking crisis may somewhat counterintuitively add some strength to the USD as money flows out of other assets and back into the USD in times of uncertainty.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

What is the Best Type of Gold to Buy For Trading in a Currency Collapse?

The current banking “issues” in the USA have more than a few people concerned about the wider ramifications. One of the worst case scenarios some people are considering is a full on currency collapse.

So in this situation what is the best type of gold to buy?

In this week’s feature post see why gold’s higher value means it may not be so good for trading for smaller everyday goods. And what you might want to consider instead…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

A Recent Interview With Gold Survival Guide Founder

Our friend Kyron Goss of FreedomCo interviewed us (Glenn) last week. We discussed the goings on at SVB, time deposits vs demand deposits, and how modern fractional reserve banking relies totally on confidence for banks to remain solvent.

You can catch the full recording on Youtube here.

Huh? Fed Hikes Interest Rates While Injecting Billions

Another point we discussed with Kyron is the perversity of the USA central bank’s response to the SVB bank failure. That is the Bank Term Funding Program (BTFP). This allows any bank to borrow from the Fed at low rates using the book value not the market value of any bonds they hold. Therefore any banks that are facing depositors withdrawing funds on a larger than expected scale, can instead borrow from the Fed and not be forced to sell any bonds at a loss. Ironically if the Fed had this in place a few weeks ago SVB wouldn’t have failed either.

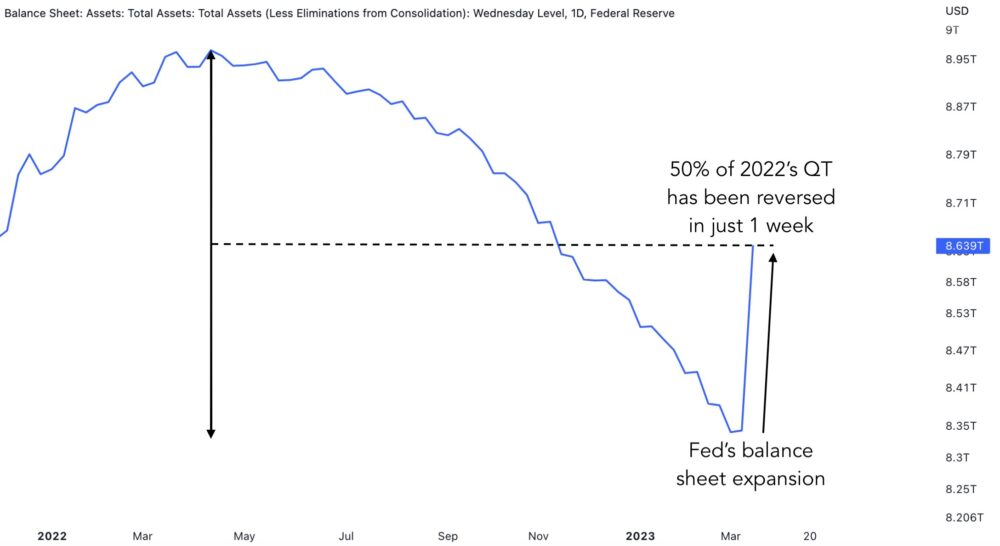

We had read that JP Morgan analysts thought this might be drawn upon to the value of $2 trillion over the course of the year that it is to run! That sounded like quite a lot. Surely the US financial system isn’t in that bad shape?!! Well after just one week the Fed balance sheet has already grown by $300 billion!

So it seems there are many banks needing to avoid selling bonds at a loss.

As this tweet points out:

50% of 2022’s Fed tightening has been reversed in just 1 week!

Fed injects $300B into balance sheet in 1 week for bank bailouts

Liquidity injection has driven all SP500 bull runs since 2009

Here’s why it won’t happen this time

A thread…

Source.

The rest of the tweet thread is worth reading as the author outlines why this reversal won’t help the sharemarket but has been and will continue to help the gold price…

Here’s a chart dating back to 2008 to show just how massively the Fed balance sheet has been expanded. But also how little they managed to contract it during 2022, before completely reversing course.

Source.

But back to why this new BTFP is so perverse. That is because it is the complete opposite of what the US and all other central banks are trying to do in battling the inflation they have caused!

On one hand they raise rates to dampen demand and supposedly reduce inflation. While on the other they inject $300 billion in one week to effectively bail out banks for their poor investment management.

Now we have seen the argument that this will not be inflationary as it is just going to banks and won’t result in any new currency. However it is going to banks because depositors are withdrawing their funds. Depositors are likely not just stuffing it under a mattress, but rather moving it to another bank. So the struggling banks are able to continue to operate and make further loans, while their previous deposits move to another bank. That sounds like an expansion of the currency supply to us. How about you?

A History of Financial Crises in NZ

In the past week we have seen Deutsche Bank Credit Default Swaps (CDS) jump as their default insurance hit the highest level since 2018.

Then we saw Charles Schwab CDS’s explode higher as well.

So behind the scenes all is not well it would seem. As a result we are seeing many articles in the mainstream media about what the current risks are.

Brian Eston, an “independent scholar, economist, social statistician, public policy analyst and historian”, wrote an interesting piece on the history of financial crises in New Zealand’s short 200 year history. There were a couple we hadn’t come across before too. But he concludes:

“The recent financial crashes of Silicon Valley Bank, Credit Suisse and all may increase the urgency for passing the [New Zealand deposit insurance] legislation even though each failure occurred for different reasons although rising world interest rates are a part of each’s story. In the early 1970s, rising interest rates brought down at least four New Zealand financial institutions.

Will there be another global financial crash? The answer is probably one day, but it may not be soon. On the other hand, I would be remiss not to wonder whether the recent failures are harbingers of something bigger perhaps precipitated by the rise in interest rates. I remember thinking about – and writing about – this possibility in 2007, as the odd financial institution fell over, although I never dreamed about how complicated the GFC would be.

So what should you do, if you think the possibility is significant? Currently your best choice is to be cautious about your return – the higher return, the greater the risk – and to choose financial institutions which are well supervised and regulated by the Reserve Bank of New Zealand.

One option would be to draw all your savings out. A banknote is, in effect, a deposit in the Reserve Bank which is as safe as the government of New Zealand is safe. The catch is that you will get no interest on the note and there is the risk of theft (or fire); buy a safe.

So depositing in sound financial institutions has its attractions, despite the inherent instability in the financial system.

Source.

Withdraw Your Deposits From the ‘Inherently Unstable’ Banks as Bank Notes? Or…

However, there is another risk to your bank deposits Brian Easton doesn’t mention. That is that of loss of purchasing power once you have withdrawn your deposit in the form of bank notes. (Or for that matter, if you leave your deposits with the bank you are still losing purchasing power due to inflation, even while you are earning some interest).

So maybe gold and silver would be better? You may not earn any interest in them either. But with inflation still very high the odds of gold and silver holding their purchasing power over the coming years are much better than a bank note. Plus they have no counterparty risk at all. And they don’t burn as easily as an RBNZ bank note!

If you’re ready to buy please get in touch for a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: The (Not So) Slow Death of the Dollar - 9 Recent Indicators of the Dollars Demise - Gold Survival Guide