Prices and Charts

New All Time High for NZD Gold

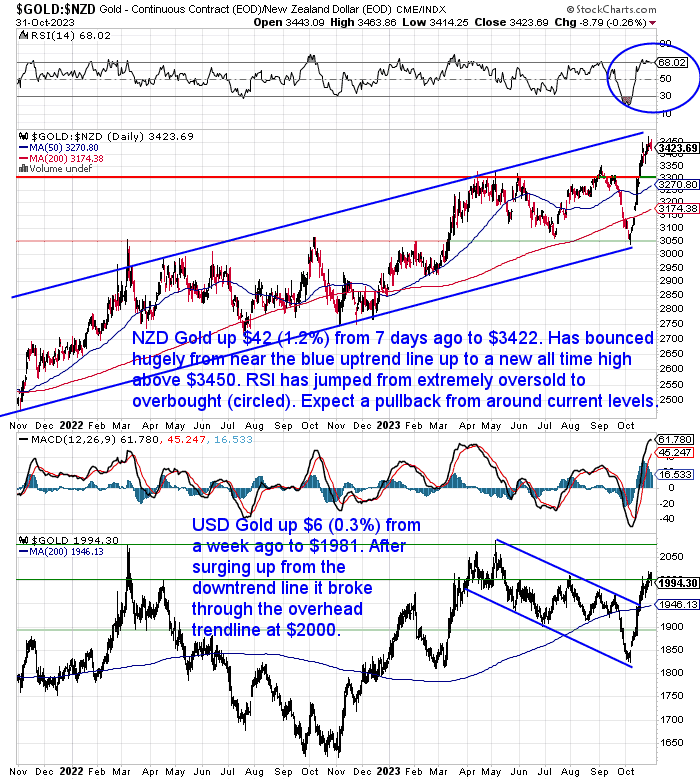

Gold in New Zealand Dollars hit a new all time high above $3450 this week. It is down a little from that high but still up $42 (1.2%) from 7 days ago. There has been a huge bounce of over $400 since the low around $3050. The RSI (circled) has jumped from extremely oversold to now be overbought. So we are watching for a pull back from around current levels or maybe up near the upper blue uptrend line in this rising trend channel.

In USD terms gold also breached a significant hurdle, closing above $2000 for the first time since July. USD gold has now clearly broken out of the downtrend channel it has been in since April. There’s a good chance we’ll see it challenge the all time high above $2050 before too long.

NZD Silver Hovering Under $40

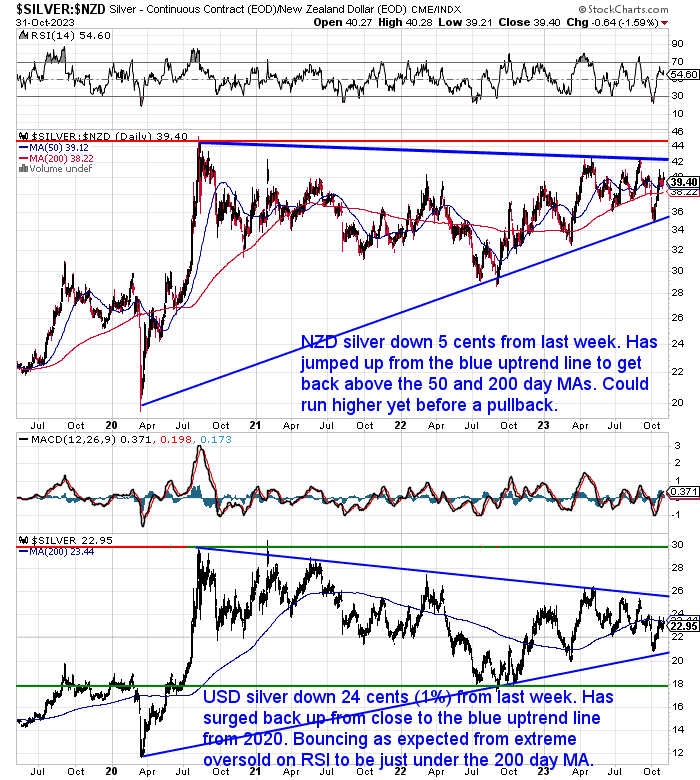

Silver in NZ dollars has also seen a big jump after touching the blue uptrend line. But unlike gold it hasn’t broken any key levels yet. Continuing to hover just under $40 but above the 50 and 200 day moving averages. Any dip down to the latter should be seen as a buying opportunity. A clear break of $42 is the next overhead resistance level to watch for.

USD silver remains more in a gentle downtrend than the sideways range that NZD silver is in. US$24 is the next level to watch for. The silver price continues to get more and more compressed in this wedge pattern.

Kiwi Dollar Just Above Recent 12 Month Lows

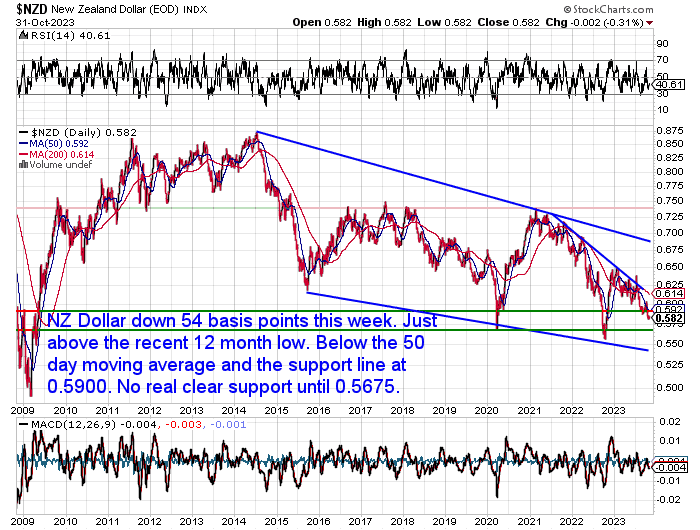

The Kiwi dollar was down 54 basis points or nearly one percent this week. Sitting just above the recent 12 month lows under 0.5800. The next obvious support line to watch for is 0.5675.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Q&A Call Recording

Our first Gold Survival Guide Q&A call was well attended and well received 2 weeks ago. Here’s a link to the recording if you missed it:

20 October Q&A Call Recording

We intend to do these monthly at least. So keep an eye out for details of the next one.

Should I Buy Gold and Silver Coins or Bars in 2023?

After the question, should I buy gold or should I buy silver, selecting between bars and coins is probably the next most common query we get.

This week’s feature article takes a deep dive into answering this question.

Here’s some of what is covered:

- Should I Buy Locally Produced NZ Gold and Silver Or Overseas Manufactured Coins or Bars?

- Coin Purity

- Bullion Coins vs Collectible Coins

- Why You Should Consider Where You Are Likely to Be When you Sell

- Why Demand For Lower Denomination Silver Increased in Recent Years

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

US Stock Market vs Gold: Going in Opposite Directions

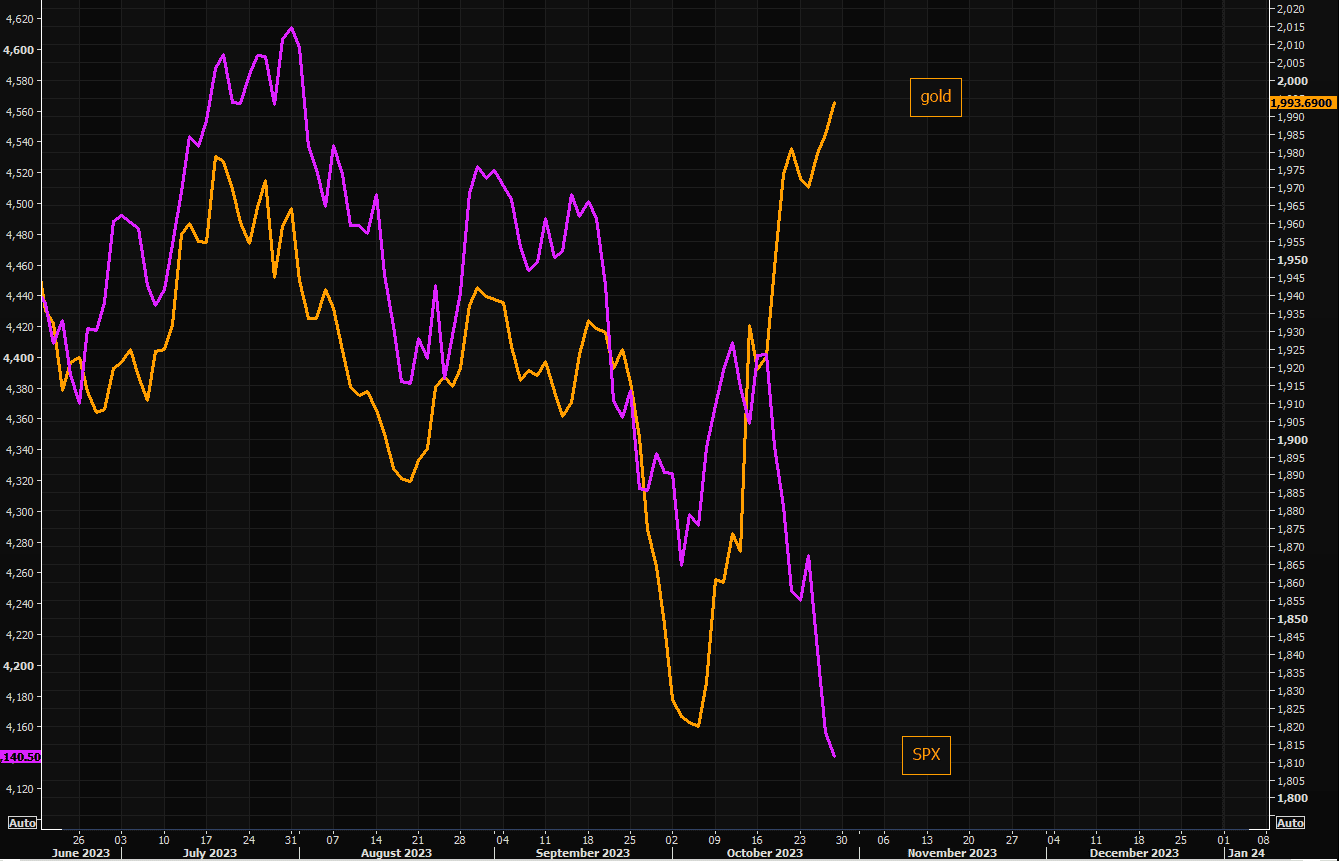

The Market Ear points out that the US S&P500 stock market index (SPX) is moving in the opposite direction to gold currently. Until recently they had both been drifting lower:

THE global hedge in a pic

Gold continues moving higher today again. This continues to be the number one hedge. SPX vs gold moving in opposite directions…

Source.

Mainstream media is just starting to notice:

“Gold is officially outperforming stocks in 2023 as October rally continues”

This article also points out that gold outperformed US stocks in 2022 and 2020. But our bet is that to the average person they still think this is just a small blip in an overall trend of the stock market outperforming gold.

(As we point out here in the very long run (100 years) shares or stocks should outperform gold.)

However, to us it seems more likely that we are in the early stages of a long term trend where gold outperforms the stock market.

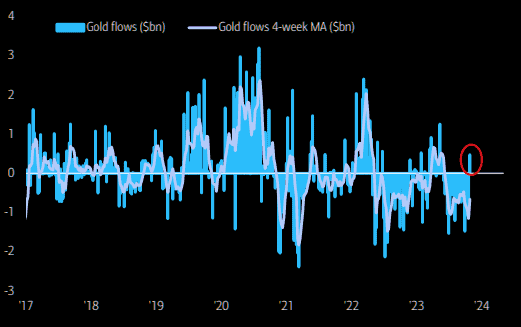

Perhaps it’s not surprising that most people missed the recent run up in gold prices which followed a sharp pullback:

They missed the golden low

First inflows into gold since May post the big squeeze. So most missed the great gold melt up…

Source.

This chart gels with what we have witnessed in terms of current demand. With very little buying during that run up in price during October. This was actually the quietest month we have seen this year. Not what you normally see as something hits all time highs, as gold in NZ dollars did last week.

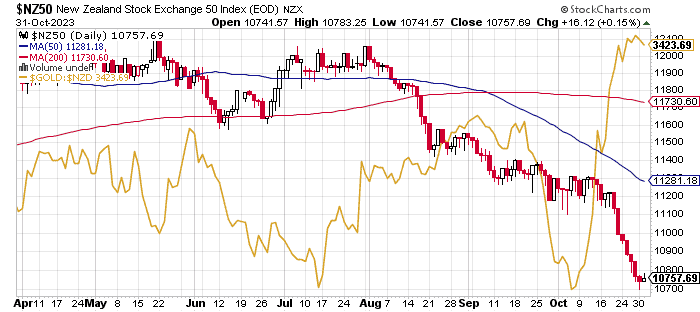

New Zealand Sharemarket Hits 16 month Low

So what about in New Zealand? How is our stock or share market going?

Here’s a couple of news reports from the past week highlighting the recent poor performance of the New Zealand Sharemarket:

[October 27th] New Zealand Market Report: The New Zealand sharemarket hit a 16-month low with a fall of nearly 1% following further mixed messages on company earnings from the latest annual meetings. The S&P/NZX 50 Index continued to slide throughout the day on light trading and closed at 10,766.82, down 81.72 points or 0.75%.

Source.

[October 30th] New Zealand Market Report: The New Zealand sharemarket had its seventh successive fall as it continued to be battered by increased interest rates and a weak NZ dollar. The S&P/NZX 50 Index recovered slightly in the afternoon and closed at 10,741.57, down 25.25 points or 0.23%.

Source.

Yesterday the NZX50 index rose a touch to 10,757.69. It’s up slightly today as we write.

The chart below of the NZX50 and Gold in NZ dollars looks pretty similar to the S&P500 index vs gold chart above. Although the NZ chart is not showing quite such a close correlation in recent months, nonetheless NZD gold is clearly heading up and the NZX50 is clearly now heading down.

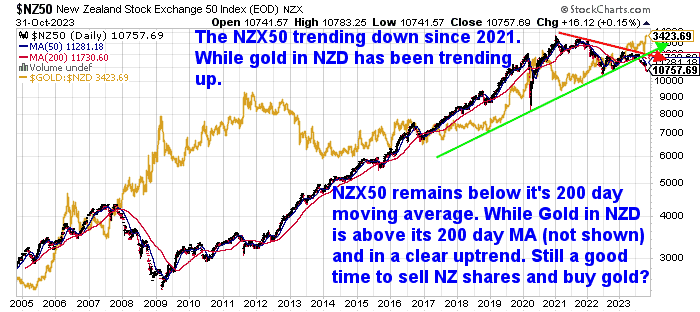

Let’s zoom out for a much longer view over the past 20 years.

To our eyes it looks like the start of 2021 is looking very similar to the start of 2008. Where the NZ sharemarket and the NZD gold price departed ways. From both trending up together to that of the sharemarket falling and the gold price rising.

Our bet is this is just the start of a much longer term trend.

A Negative Positive Gold Article?

As already noted this week gold in NZ dollar terms hit an all time high above $3450.

Here’s a sort of positive article which somehow still comes off as sounding negative towards gold:

“Over the long run, gold still holds its purchasing power value, outstripping inflation in NZ dollar terms. But it can cost money to hold it, it gives no income, and converting it back into local currency comes with costs too”

It points out that when adjusted for inflation gold has not hit a record high, although the chart shows it is not too far off.

Interesting isn’t it, that we rarely ever see inflation adjusted prices for the share market or real estate?

NZ Housing Downturn Over? Or Just A Pause?

Speaking of real estate, Corelogic thinks the housing market downturn is now over.

Downturn over: Here’s how much house prices really fell. The housing market downturn is over, Corelogic says.

“Chief property economist Kelvin Davidson said it showed the first rise in property values since March last year, up 0.4% in October and 0.1% over the past three months.

That takes the peak-to-trough fall in national values to 13.2% or an average loss of $138,000.”

Source.

We still wonder if we might see something more like the 70’s. With various waves up and down. We might even see house prices rise in dollar or nominal terms, but actually fall in real or after inflation terms.

Higher For Longer

It might be that “higher for longer” interest rates that turn out to be the biggest headwind for property.

This stuff article wonders “Why we keep incorrectly calling the interest rate peak”

Source.

Their reasoning:

“In simple terms, inflation proving more difficult to tackle than expected has led to higher rates for longer in many parts of the world. On top of that, many governments are running fiscal deficits that require funding – the risk of which affects the price of debt. Central banks are also moving from being buyers of bonds through quantitative easing to sellers – their absence as buyers of bonds is pushing rates up.”

The article goes on to quote various bank economists. Most of whom think there will be maybe 1 or 2 more OCR increases by the RBNZ. Although…

“Jarrod Kerr, chief economist at Kiwibank, said he still expected the next OCR move to be a cut in May next year. “We may be wrong in the timing but we’re confident in the direction.”

None of them predict higher interest rates in the long term.

ASB senior economist Chris Tennent-Brown said the RBNZ might still do a couple of increases. But then he went on to say that:

“…some time in the next five years a rate of 6.69% would seem to have been an expensive option. But he said he did not expect significant movements in the short term.”

What if over the next 5 years 6.69% seems very normal or even low?

Here’s our forecasts:

Inflation – Higher for longer

Interest Rates – Higher for longer

House Prices – Lower for longer

Sharemarket – Lower for longer

Gold – Higher for longer

Silver – Higher for longer (eventually)

How are you positioned to weather these potential secular trends?

Please get in contact for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|