Prices and Charts

Stronger Kiwi Dents NZD Gold Price

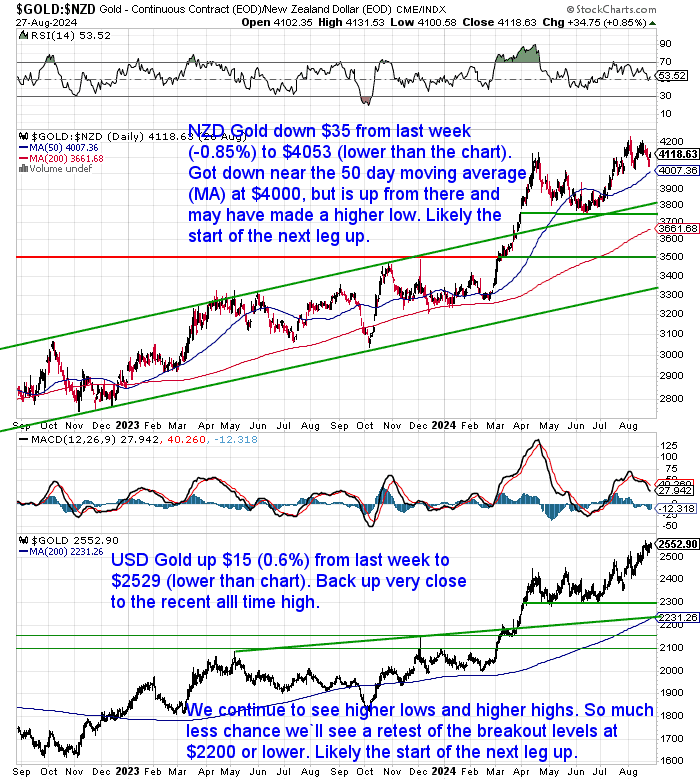

NZD gold was down $35 from a week ago to $4053, due to a stronger Kiwi dollar. NZD gold did get down close to the 50 day moving average (MA) at $4000, but then rose up from there. It still looks like the next leg up has likely started. But perhaps we’ll see some consolidation above $4000 first?

In USD terms gold was up $15 to $2529. Today it is back very close to the recent all time high. The USD gold chart looks more conclusively like a breakout and start of the next leg up, as we continue to see a series of higher highs and higher lows. The odds of a return down to the breakout levels of $2200 or lower seem much less now. Likely the best option is just to be buying any brief dips that occur.

Silver Again Outperforming Gold

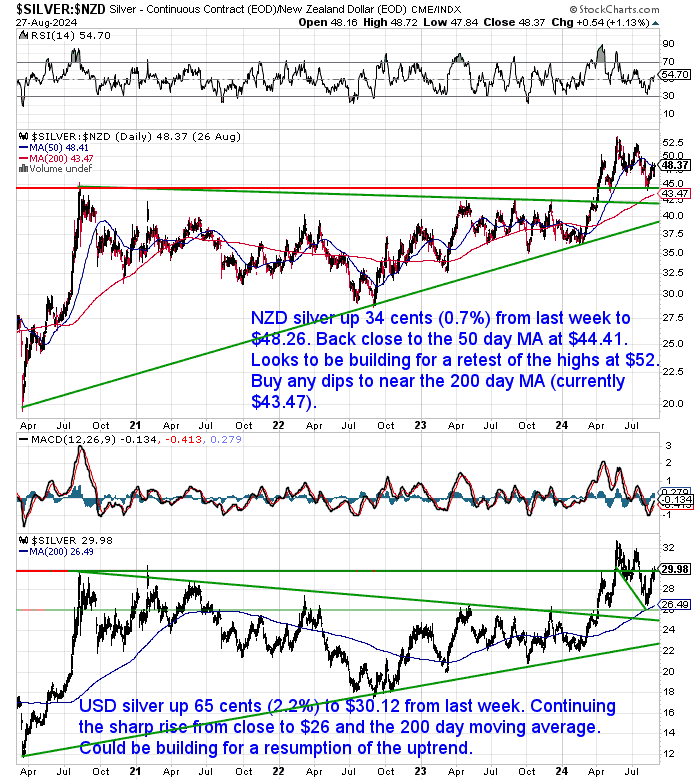

Unlike NZD gold, silver in NZ dollars was up this past week. Rising 34 cents or 0.7%. It is now back very close to the 50 day MA and looks to be building for a retest of the highs around $52. So any further dips to the 200 day MA (currently $43.47) look to be a good buying opportunity.

While USD silver rose 2.2% or 65 cents from 7 days ago. Continuing the sharp rise from close to $26 and the 200 day MA. Silver could be building for a resumption of the uptrend.

NZ Dollar Breakout?

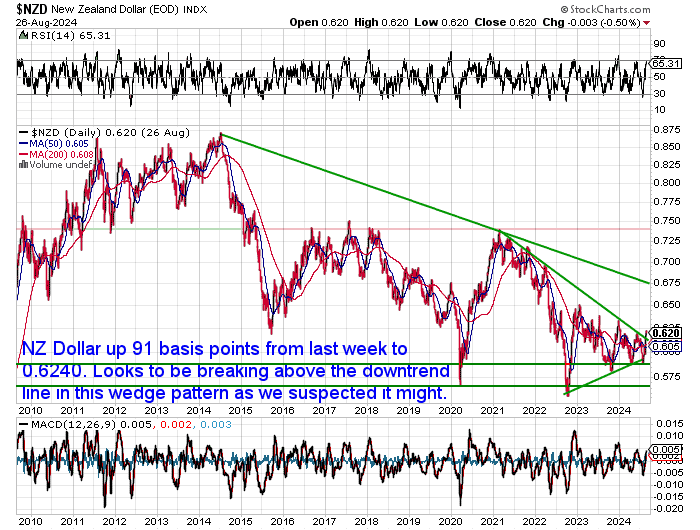

As we suspected it might, the New Zealand dollar looks to be at the start of a breakout from this wedge pattern of the past few years. It just probably needs to run a little higher to confirm this.

So we may have switched into a pattern of the Kiwi being stronger than the USD for a period of time now. As we said last week this would mean that precious metals prices in NZD terms will rise less than in USD terms.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Brace for Impact? How Gold Might Behave in the Next Financial Downturn

The financial world can be a turbulent place. Whispers of a potential stock market crash started after the recent falls due to the unwinding of the Yen carry trade. This week’s feature article explores the question: how might gold react in the next stock market crash?

The article investigates:

- Historical examples of gold price movements during past financial crises

- Why some experts believe gold could act as a safe haven in an economic storm

- Factors that could influence the severity of a potential gold price drop

Intrigued by the potential role of gold in the face of economic turmoil? This article delves into historical data and expert opinions to help you understand how gold might perform during the next market correction.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

NZ Economic Activity: Deferred or Cancelled?

Now that interest rates are being cut, some bank economists think because this was an “engineered recession” by the RBNZ, and not caused by an external shock, that we could see a pick up due to economic activity having been deferred rather than cancelled.

However, we’d more likely agree with Mr Kiernan than the bank economists quoted in the below article:

“Gareth Kiernan, chief forecaster at Infometrics, said the counterpoint to the “deliberate” and engineered nature of the recession was the overstimulated boom in the economy before it.

“In other words, I see the upturn and following downturn as the unusual parts, rather than the downturn and future upturn.”

He said the question of how much activity was deferred was the wrong way around.

“I see the current hole in economic activity occurring because that activity already occurred two years prior, having effectively been borrowed from the future due to extremely low interest rates and stimulatory fiscal policy. That view essentially implies that there is no ‘missing’ activity now that might be caught up in coming quarters as interest rates become more favourable.

“Specifically regarding the housing market, my view remains that interest rates would need to drop substantially before property becomes an affordable or attractive purchase for either owner-occupiers or investors. In other words, affordability remains a major constraint.

“Further worsening in the labour market over the next nine months will also be a key factor discouraging people from taking on debt and keeping buyers out of the market.”

Source.

We’d agree that years worth of spending and consumption was brought forward due to extremely low interest rates and all the government support that was dished out during the lockdowns. So it might take a while to work all that out of the system.

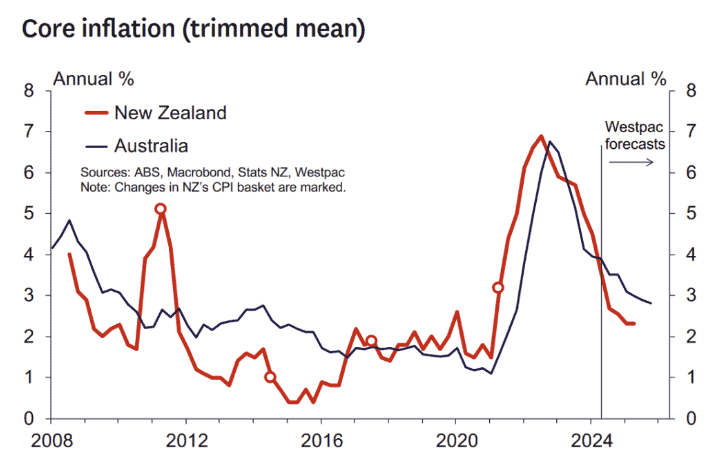

But New Zealand may be ahead in the current cycle compared to the likes of Australia where inflation remains higher:

“Australians are enduring the highest interest rates in more than a decade, with mortgage relief unlikely until next year amid stubborn inflation in key sectors, such as rents and utility bills.”

Source: Why Australia is behind New Zealand and the US in inflation, interest rate fight

However to us it seems more likely that we’ll see a “muddle through“ economy, with any improvements likely to be minor. More likely we’ll see unemployment remain elevated and the chance of inflation rising further. So the watchword would be: Stagflation.

Gold Versus Equities: Comparing the Wrong Risk

In the Herald this week was an article by Greg Main, a director and wealth management adviser at Jarden Wealth Limited. He looked at how various investment categories perform in an inflationary environment including property, shares and also gold:

“Comparing inflation hedges – gold versus equities

Many investors turn to gold as a hedge against inflation, but its effectiveness varies. Gold is more of a safeguard against economic shocks or currency devaluation, especially when a country prints more money without increasing production. The recent rise in gold prices has been driven by various factors, with central banks buying more gold to diversify their reserves away from US dollar-based investments. However, gold has provided only a slightly positive inflation adjusted return per annum over the long run.

According to economist Professor Jeremy Siegel, equities have historically delivered the highest inflation-adjusted returns. His research shows equities have consistently outperformed bonds and gold in real terms, delivering higher returns and preserving purchasing power.”

Source.

We don’t generally shout about how well gold does during inflationary periods. Historically it has been more correlated with negative real (or after inflation) interest rates. Although these do often align with higher inflation, as it is the higher inflation that creates the negative real interest rates.

However, in trying to point out what’s wrong with gold he actually highlights what the main reasons are today for buying gold. It’s not just inflation:

“Gold is more of a safeguard against economic shocks or currency devaluation, especially when a country prints more money without increasing production.”

With US government debt recently hitting $35 trillion, it seems a virtual certainty that the only way to reduce the impact of this is via currency devaluation. And because every currency on the planet including the NZD dollar is linked to the US dollar, they will all head lower.

We also wouldn’t compare gold to stocks. We see stock as investments and gold as simply savings. Over the very long run gold should only provide a very small return compared to inflation. Because it is simply money. Whereas stocks are investments in businesses that have earnings and should do much better than inflation over the long run.

But today there is a very real risk of “economic shocks”. These are times when equities generally perform very badly.

Finally, the fact that other central banks have been buying so much gold is also surely a warning sign more people should be taking note of?

So overall gold is an insurance policy that covers you for all these very real risks – it’s not simply an inflation hedge.

NZD Gold Price Up Almost $1000 Since Mid 2023

We doubt Mr Main, or most people for that matter, are aware that the NZD gold price is up almost $1000 since the middle of 2023.

We also hadn’t realized until this week while updating a presentation that we last did at the end of July 2023. The presentation featured some charts of the NZ housing to gold and NZ housing to silver ratios. Here’s how the numbers have changed in that time:

NZ Housing / Gold Ratio

July 2023: NZ Median House price $780,000 / NZ Gold Price $3168 = 246 ozs

July 2024: NZ Median House price $753,000/ NZ Gold Price $4,155 = 181 ozs

NZ Gold Price: + $987 or 31%

NZ Housing / Silver Ratio

July 2023: NZ Median House price $780,000 / NZ Gold Price $38 = 20,500 ozs

July 2024: NZ Median House price $753,000 / NZ Gold Price $48.63 = 15,484 ozs

NZD Silver Price: + $10.63 or 28%

As we alluded to in recent months, it is likely this central bank buying that has caused the increase in price. So far there remains very little public purchasing.

It seems obvious that central banks will continue to buy gold. They have to in order to hedge their US dollar holdings which are virtually guaranteed to lose value.

At some point institutional investors and also the public will join the buying. The public will also then likely buy silver – they’ll see it as much more affordable than gold.

So there is potentially much more demand for gold (and silver) to come.

The time to be in is before this next wave of interest arrives.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|