Yep we’re going to say it. Silver in NZ dollars looks to have bottomed. We’ll show you why from a technical and sentiment perspective a NZD silver bottom looks likely to us. Plus why there could be some hefty moves for silver ahead.

NZD Silver Technicals

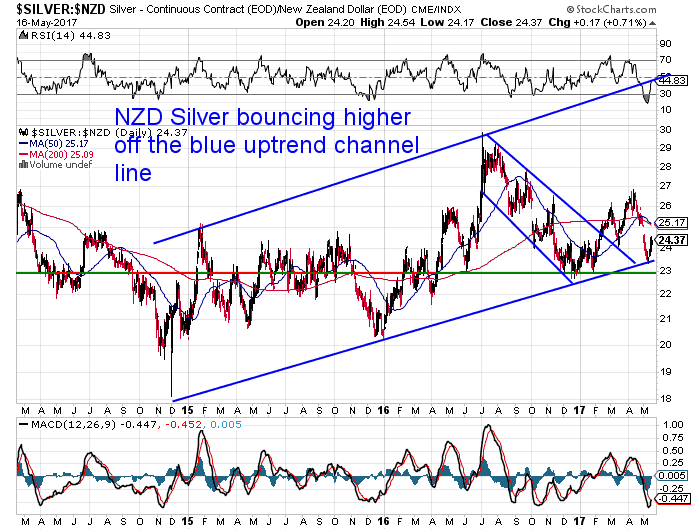

To us silver in New Zealand Dollars or even for that matter in US Dollars looks to have bottomed out over the past week.

This movement up off the long term trend line in the below chart offers a pretty compelling reason to be buying silver right now.

It appears a higher low from the low in December 2016 has formed. Which in turn was a higher low than in December 2015 and likewise in November/December 2014.

This month saw the overbought/oversold RSI indicator reach it lowest level in almost 4 years (see the top of the chart). The RSI has now bounced back out of the oversold region below 30.

Gold:Silver ratio

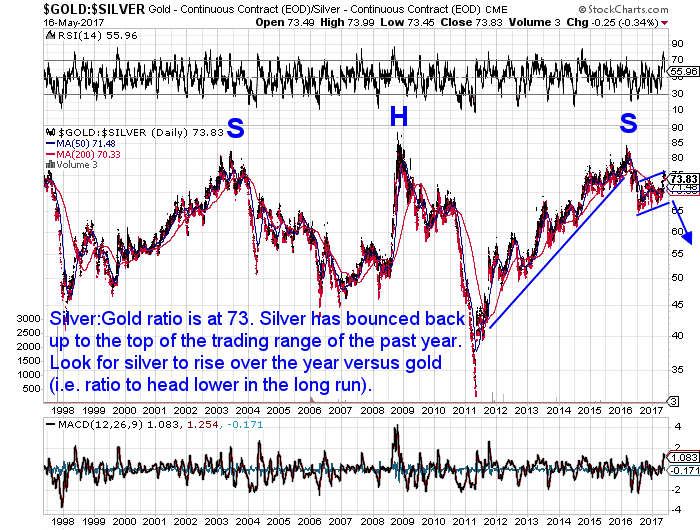

The silver to gold ratio is also looking topping at the moment. This is the amount of ounces of silver it takes to buy an ounce of gold.

The ratio reached the top of trading range it has been in over the past year. It looks set to head lower from here. Meaning silver would rise faster than gold.

To see how the Gold Silver Ratio is calculated, how it can be used, and where it might head to next see: What is the Gold/Silver Ratio?

Silver Sentiment

There seems little belief in the return of a bull market in silver.

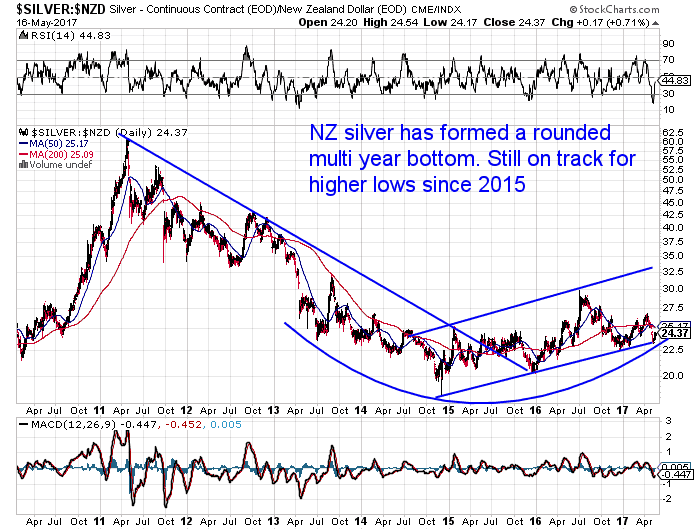

This despite the fact that the long term chart clearly shows silver in NZ Dollars bottoming out in late 2015 and putting in the above mentioned “higher lows” since then.

But as we’ve reported recently demand so far in 2017 from retail precious metal buyers has been very low. This despite the fact that silver bottomed out in December and then moved pretty steadily higher.

We’ve had many comments from people exasperated with the performance of gold and silver. Again even though they have been quietly rising for 18 months. There is not much confidence that gold and silver are heading higher. Take this comment recently on our Facebook page:

Market manipulation is a bloody pain. What’s happening to the price? Compare gold/silver to the “free markets” bitcoin which is currently over $1700 USD! Your thoughts?

Our thoughts were that prices are looking like a gift to buyers at the moment. Also come to think of it we should have said now might be a handy time to trade some cryptocurrency for some silver. Bitcoin antagonist Chris Duane thinks so:

But so too does bitcoin and silver proponent Bix Weir:

So sentiment seem pretty grim to us. Just ripe for a contrarian silver bottom to occur.

Futures Market Commitment of Traders (COT) Report Data Also Turning Bullish

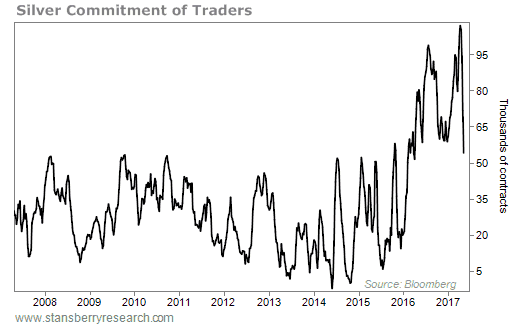

The COT report data is also turning bullish. Last month speculative traders had become incredibly bullish on silver especially. But the silver sell off has caused many to reverse their position.

COT data showed speculative futures traders had remained relatively bullish. Now they’re giving up, too…

According to the latest COT report published Friday, net speculative positions dropped by nearly 20,000 contracts last week. They’re now down almost 50% from their all-time high set last month…

As they say ideally this level will drop even further yet. But the futures traders have moved from being almost all over on the far right of the ship to now be back in the middle at least.

Also looking at the COT data from another another angle is Ted Butler. Rather than looking at overall speculative bets in silver as the above chart shows, Butler instead looks at the commercial short interest.

This is the bullion banks, miners and actual hedgers of silver. Not just those betting on price rises and falls. Butler believes that an unexpectedly large move higher in silver is coming due to the changing structure of the silver COMEX market.

I know that the price of silver has been declining on a daily basis nonstop for three weeks now, itself an unprecedented move, but I also know the reason for the decline and how the sharply improved COMEX market structure has always guaranteed a rally in a reasonable period of time. The only question is whether on the next silver price rally will JPMorgan add aggressively to its COMEX short positions. I’m suggesting JPMorgan is not likely to add to short positions on the next rally. [JPMorgan is the largest player in the silver market]

At the heart of the unprecedented move higher in the price of silver is the manner in which it will occur. It will be a price move like no other. It will be the greatest short covering rally in history. That’s guaranteed because the COMEX silver short position is the largest and most concentrated short position in history. There is no buying force in the financial markets more powerful than panicky buying by those forced to cover short positions. The largest short position ever holds the potential for the greatest short covering rally ever.

…In silver that means that at some point the concentrated COMEX short position no longer increases, but instead gets covered for the first time on rising prices. The main reason is a subtle yet distinct change in the composition of the big concentrated short position in COMEX silver.

JPMorgan has amassed a physical stockpile of silver of at least 600 million ounces by my calculations at an average cost of around $20 an ounce, all while continuing to make hundreds of millions of dollars in manipulative COMEX short selling. This epic accumulation has changed the composition of the concentrated COMEX short position more than any single factor.

No longer is the largest COMEX silver short subject to extreme financial damage should silver prices explode. Instead, JPMorgan has pulled off the accumulation of the largest silver hoard in world history on declining prices. The bank has never been better positioned for a silver price explosion. In other words, there has never been a better time, from the selfish perspective of JPMorgan, for the price of silver to rip higher or a worse time for the other big shorts. And the recent deliberate price takedown has further reduced JPMorgan’s COMEX short position, greatly enhancing the prospects that JPMorgan won’t be adding to its COMEX short position whenever the next silver rally gets rolling.

Should JPMorgan not add to its COMEX short position on the coming silver price rally, then it will be only a matter of time before the remaining big COMEX shorts wake up to the fact that they are toast. By “a matter of time” I am referring to days and weeks. When silver prices rise sufficiently, the remaining shorts will panic and begin to try to cover their short positions. This buying will send silver prices skyward and then touch off all sorts of other buying, including investment buying and then industrial user buying, perhaps the most potent buying of all.

…The big shorts, apart from JPMorgan, appear to be mostly foreign banks according to CFTC data. The speculating foreign banks are precisely the type of short sellers most likely to panic when silver prices start to rally and it begins to take hold on them that JPMorgan is no longer the shorts’ protector and short seller of last resort.

…The whole silver manipulation has become more obvious than ever, particularly this last deliberate selloff. The concentrated short position hit an all-time extreme a few weeks back on a rally to only $18.50 – the largest such short position at the lowest price ever. You have to ask where this thing is headed. How much longer can a manipulation last that is obvious to more observers than ever before?

No we know of no one that has researched the structure of the silver COMEX market more than Ted Butler. We hope his analysis proves to be correct.

Read more: Gold and Silver Commitment of Traders (COT) Report: A Beginners Guide

UPDATE: Since Butler wrote this a few days ago there are signs of this short squeeze potentially starting already as James Turk refers to here.

But even if Butler’s theory doesn’t play out, it still looks to us like silver is at a low risk and potentially high reward entry position.

So have you been watching silver fall for the past month, preferring not to try and “catch a falling knife”?

Well, it looks to us like the silver knife has hit the ground and bounced back up. So perhaps now might be a safer time to buy as you can grab the handle on the way up – rather than risk the blade on the way down?

Bonus Offer Expires 25 May:

Bonus Offer Expires 25 May:

Free Survival Kit

We have a bonus offer going on any order of 500 x 1 oz Canadian Silver Maple Coins this week.

Currently $14,680 for 500 x 1oz Canadian Silver Maples fully insured via Fed Ex directly to you anywhere in New Zealand or Australia. Still around $1000 cheaper than a few weeks ago.

Currently $14,680 for 500 x 1oz Canadian Silver Maples fully insured via Fed Ex directly to you anywhere in New Zealand or Australia. Still around $1000 cheaper than a few weeks ago.

Free Bonus: Got a car? Get a Glove Box Survival Kit valued at $69 with any Monster box order.

The survival kit contains:

1 x Silver Survival Blanket

1 x Essentials First Aid Kit (Red)

2 x Light Sticks

1 x Eco Poncho

2 x Dust Mask

1 x Clear Safety Glasses

1 x Hand Sanitiser 60ml

1 x Keyring CPR Mask

1 x Roll of Insulation Tape (Blue)

1 x Paracetamol Tablets (20pk)

1 x First Aid Tips Booklet

1 x Clear Zip Bag

Go here to get a quote for the latest price.

To better understand what technical analysis is, and help with timing when to buy gold or silver and check out this article: Gold and Silver Technical Analysis: The Ultimate Beginners Guide

To learn more about when to buy gold and silver see this article: When to Buy Gold or Silver: The Ultimate Guide

The ratio reached the top of trading range it has been in over the past year. It looks set to head lower from here. Meaning silver would rise faster than gold.What is the Gold/Silver Ratio?

Pingback: What Does Short Covering Mean for the Price of Silver? - Gold Survival Guide