Prices and Charts

Has Gold Bottomed?

Sorry we missed last week’s update. Normal service resumes today. So the numbers in the weekly change table above are in comparison to 2 weeks ago.

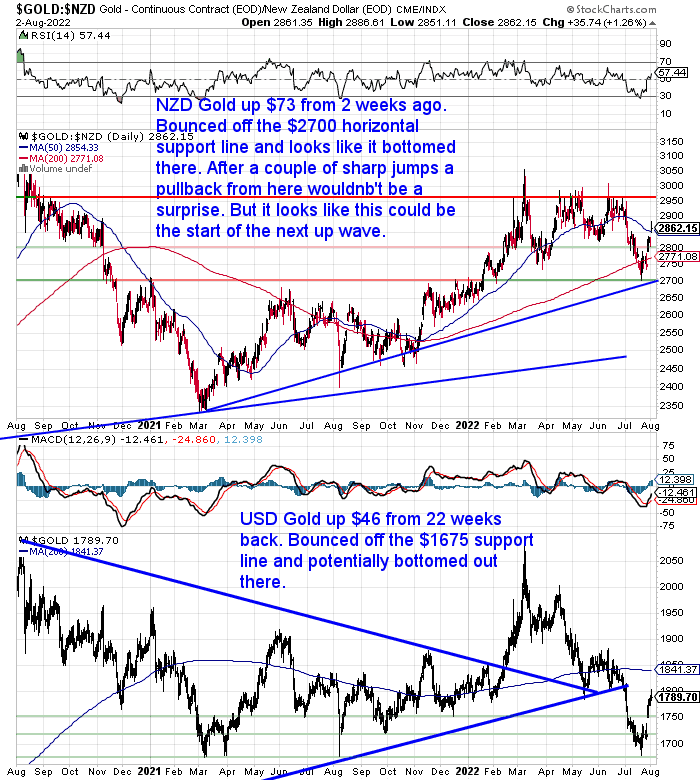

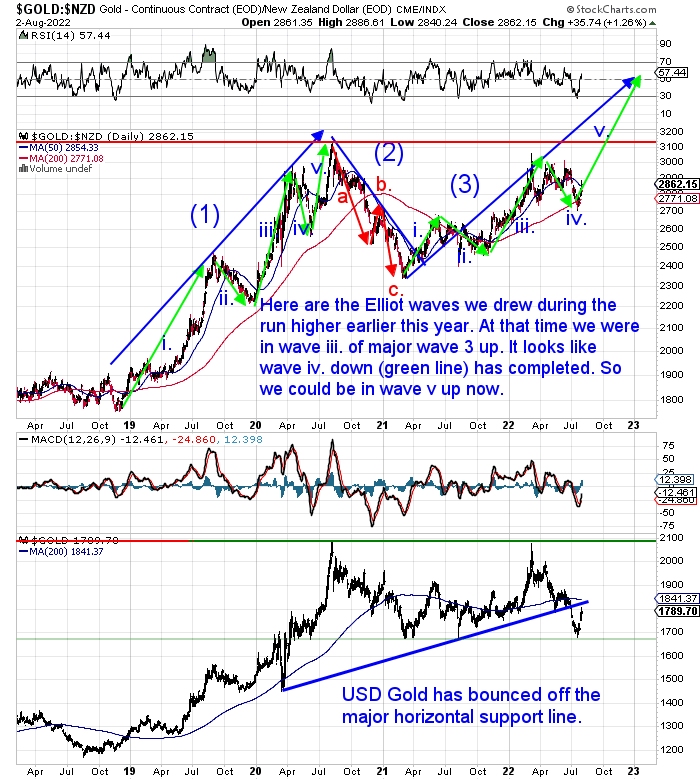

Since then gold in both NZD and USD are up 2.7%. NZD gold looks like it has bottomed at the $2700 horizontal support line. There has been a powerful surge higher from there. With the price now sitting above the 50 day moving average (MA). But after such a sharp jump it wouldn’t be a surprise to see gold pull back a little from here. Maybe to $2800 or even the 200 day MA? That would allow it to backfill the jumps in price that we have seen since Friday.

But it does look to us that we are now in the next wave up after an a, b, c, wave down. The waves we drew earlier this year seem to have played out pretty close. 2 weeks ago we stated, “… right now we are pretty close to where we guess that wave down might end. So perhaps we are now close to seeing wave v up begin?”

So far that looks to have been pretty on the money. Don’t get too excited as we aren’t always this on the money with our calls! But it does seem that wave v up may have just started. Likely without anyone really noticing yet.

Silver Up Over Twice as Much as Gold

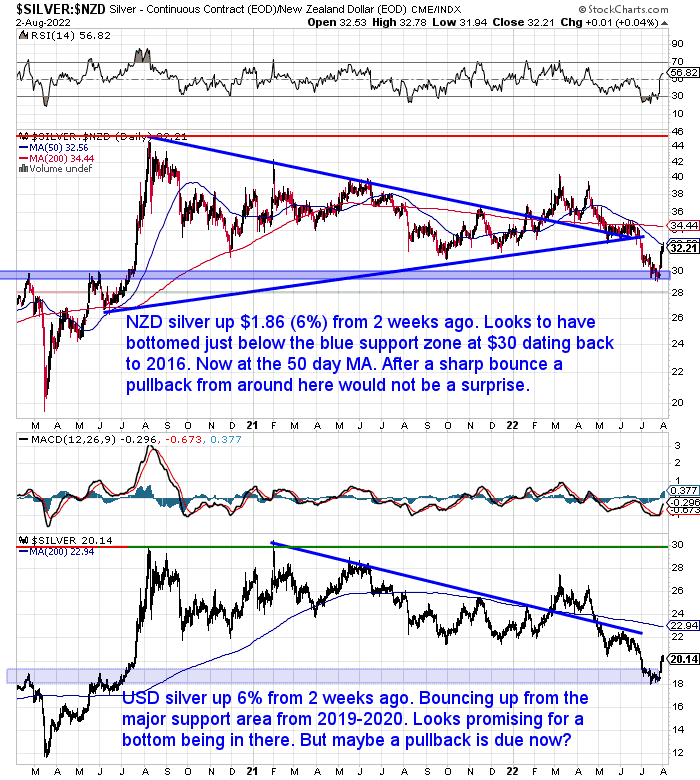

Silver has also shot higher from 2 weeks ago. Up over 6%, over twice as much as gold.

Silver in NZ dollars appears to have bottomed out just below $30 since our last update. It is now sitting just under the 50 day MA. So this could be a likely place for it to pullback a little after such a sharp run higher.

We’ll have more evidence in this week’s feature article supporting the notion that gold and silver have bottomed.

NZ Dollar Unchanged From 2 Weeks Ago – But Looks to Have Bottomed

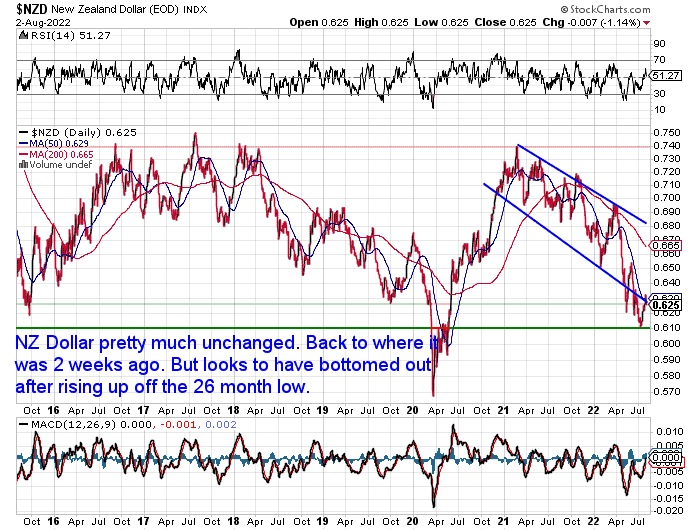

The New Zealand dollar is basically unchanged from our last update 2 weeks back. It does look like it has bottomed out around 0.61. So we may see a medium term uptrend in play now.

But our guess remains that rises in gold and silver will be greater than the rises in the NZ dollar. So gold and silver priced in NZD will still rise, just maybe not as fast as USD gold and silver.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Gold and Silver Commitment of Traders (COT) Report: A Beginners Guide + What it Says About When to Buy in 2022

For gold and silver it remains the paper price or the futures market where the price is set.

We can observe what is happening in the futures market through the Commitment of Traders (COT) report that the US Commodity Futures Trading Commission (CFTC) releases each week.

But to be honest we don’t regularly pay too much attention to this report. However when the numbers from it reach extremes in either direction, history shows these are very good indicators of a turn in the gold and silver markets.

Two weeks ago we referred to such a position arising:

“Here’s another factor pointing to a bottom for silver possibly being close. The short positions in the silver futures for the commercial hedgers is at a level that has only occurred a handful of times in the past decade.”

Source.

But we know terms like short and long positions and futures trading might make your eyes glaze over.

So today we have a beginners guide to the COT report. A short and simple explanation as to what it is.

Although probably even more importantly, our reasoning why the current numbers are pointing to gold and silver likely bottoming out around here.

This post covers:

- What is the Commitment of Traders (COT) Report?

- The Current Positions in the Commitment of Traders Report for Gold and for Silver

- What is a “Short Squeeze”?

- What is “Short Covering”?

- Is a Gold and Silver Short Squeeze Coming?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Should We be Calling For an Inquiry into the RBNZ’s Response to Covid?

The Reserve Bank of New Zealand has (rightly!) been coming under a fair bit of criticism lately. With annual inflation up 7.3 percent, the largest jump in 32 years, we’ve seen more articles like this one asking, “Is Inflation the Reserve Bank’s Fault?”

Our short answer: Yes!

Surprisingly the RBNZ are now even admitting it!

“Reserve Bank Governor Adrian Orr has acknowledged that monetary policy has played a part in the country’s very high inflation rate. Orr said a report from former governor Graeme Wheeler and Bryce Wilkinson, a senior fellow at The New Zealand Initiative, would be considered as part of a review.”

Read more

Others like this one discuss the need for an inquiry into the RBNZ response to Covid.

It concludes:

“But politics isn’t the reason we should want an inquiry. Rather we should want one to explain to the public, properly, what happened and why. And take on board lessons as to how to improve our ability to respond to future crises as much as is possible given we don’t know what will cause the next crisis.”

So should we all be calling for a review into the RBNZ response?

We’d say rather than reviewing the RBNZ covid response, we’d prefer more people start to wonder why we have central banks at all? Why do we need (mostly) grey haired men deciding on the price of money?

But that is just our wishful thinking. We think central banks will eventually cease to exist, but it won’t come about because of a logical review. But rather because they will be demonstrated to be the cause of the very problem they are charged with overseeing. Probably in such an obvious way that people won’t stand for it any longer. In short, it will have to get worse before it gets better.

Maybe, as this article points out, we’ll even see many central banks (including ours) “reverse course on tightening interest rates as their economies either go into recession, or teeter on the edge of it”.

That could be one way we see even higher and more persistent inflation than all the mainstream economists currently predict.

Meanwhile regardless of the exact order of responses we think it wise to be prepared for even more debasement of your currency.

How prepared are you?

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|