|

Gold Survival Gold Article Updates:

Jun 11, 2014

This Week:

- Hedge Funds Betting Against Silver Reaches Record High: Good News?

- 8 Should Ask Questions Before You Buy a Safe to Store Gold & Silver

- Negative interest rate policy by the European Central Bank

- Could Interest rates stay low longer than most imagine?

A review of prices this past week

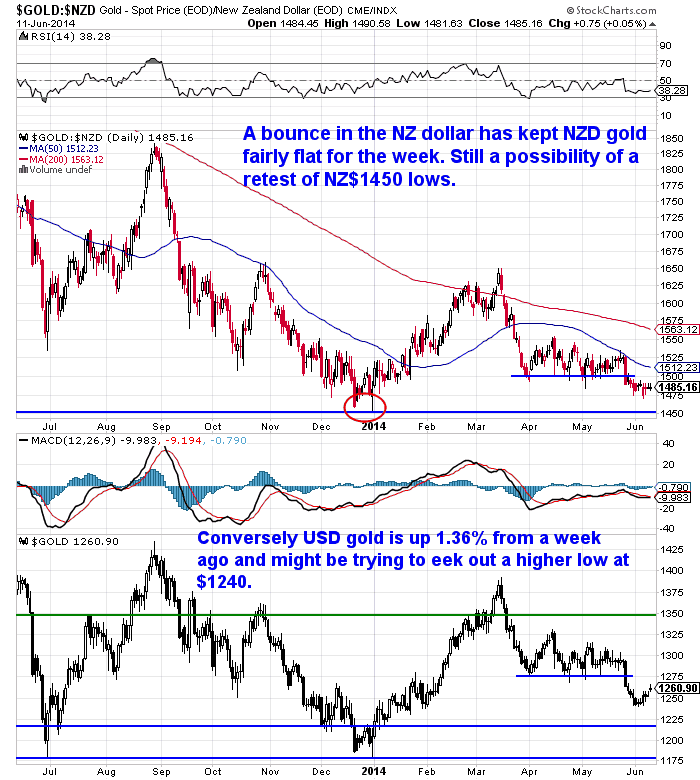

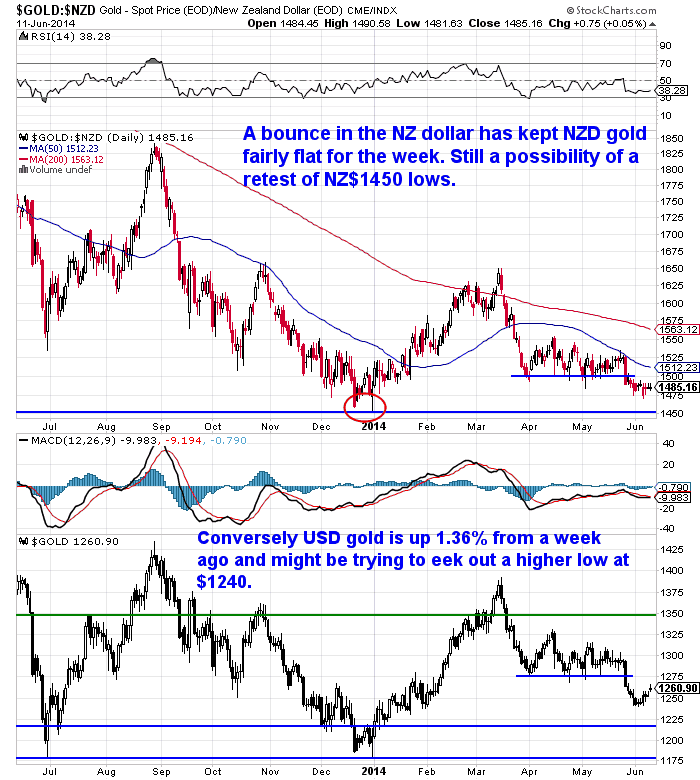

Gold in New Zealand dollars has been failry flat this past week. Trading tightly in the $1475 to $1485 range. Since last week it has fallen $2.81 or 0.19% to $1476.50.

The chart below shows the impact of the again strengthening kiwi dollar. As you can see in the lower half of the chart, the USD gold price actually went up 1.36% for the week. It may well have eked out a higher low in the US$1240 area.

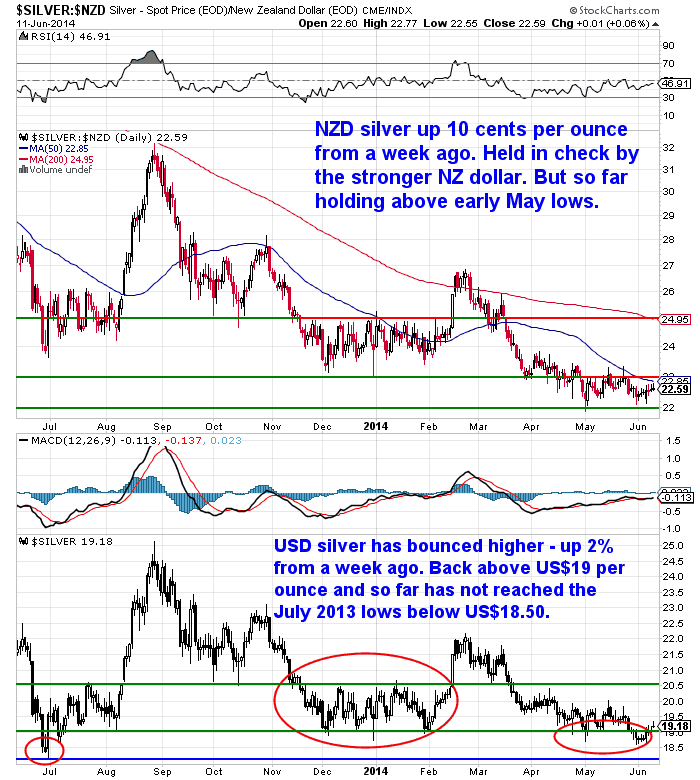

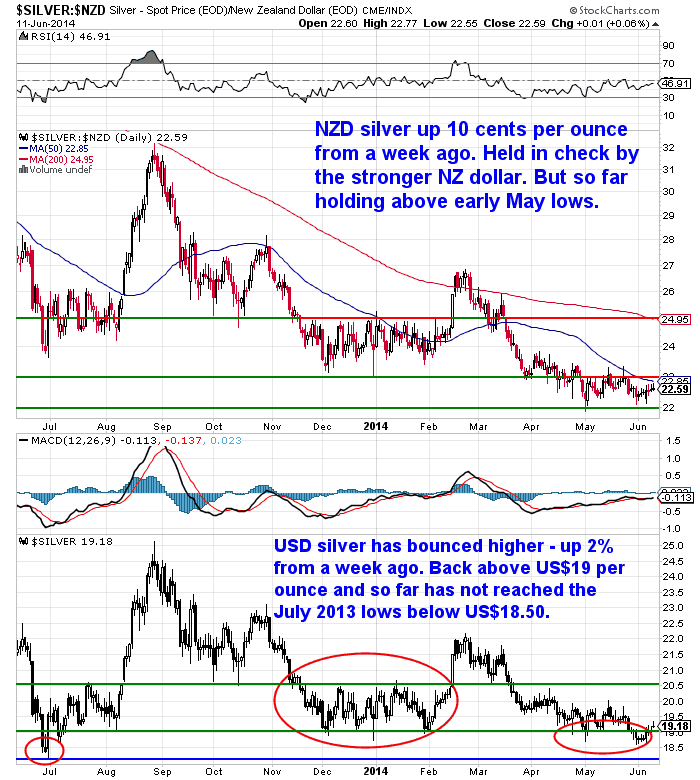

Looking at silver price nz dollars it too has been tempered by the rising kiwi dollar this week. It is at $22.50 today, up 10 cents per ounce or 0.45% from last Wednesday.

While USD silver was up 2.02% from a week ago.

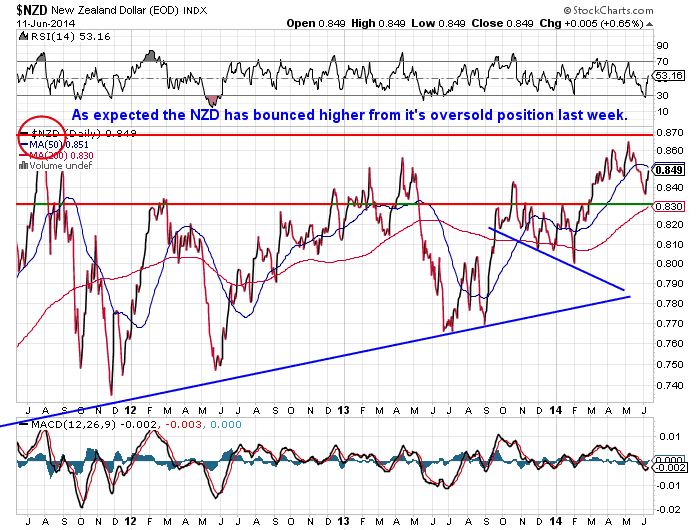

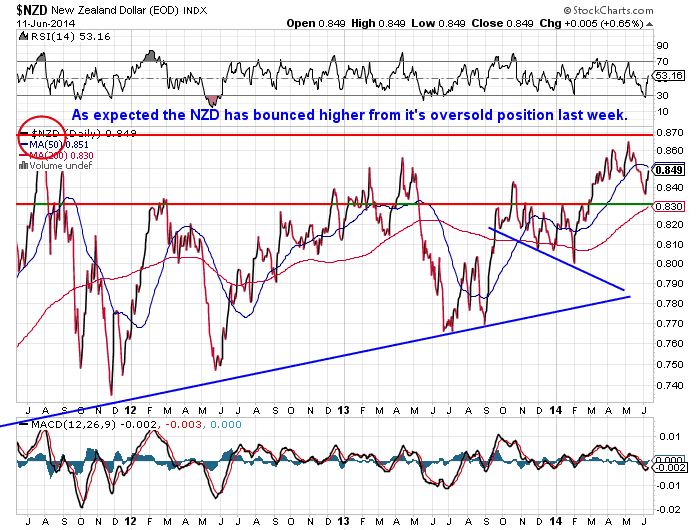

As we expected last week, the NZ dollar has strengthened from it’s oversold position and this has been the dominant factor in local prices of precious metals in the previous 7 days.

With this mornings 0.25% rate rise announcement from the RBNZ the dollar actually spiked up close to a cent. But has remained flat since then. The NZ dollar has risen 1.31 cents from last week or up 1.56%.

We still are not convinced that the dominant opinion of steady as she goes rate rises is so set in stone. While years ago we thought this monetary crisis would result in much higher interest rates. Now we are not so sure. Or at least we are not so sure they are necessarily coming anytime soon.

We’ve actually seen a couple of articles on this topic in the past few weeks that are worth skimming through:

For a US perspective:

Interest Rates Really Could Stay Low for Another 10 Years

For an Australian Perspective:

What if Interest Rates Never Go Up?

We couldn’t find a New Zealand perspective on why interest rates would stay low here though, as no one seems to think they will!

Granted we do seem to be in a better state than the US or Australia. But our theory is that if the US, Europe and Aussie interest rates stay low then ours simply can’t get too far away from theirs either as it would cause an even greater flood of money to come here.

8 Should Ask Questions Before You Buy a Safe to Store Gold & Silver

In case you missed it last week, we posted an article on Buying a Home Safe for Gold & Silver Storage. It’s a subject we’ve had a number of questions on over the years and so finally got around to putting pen to paper or at least finger to keyboard with some thoughts on the subject. So go check out our 8 Should Ask Questions Before You Buy a Safe to Store Gold & Silver if you’ve ever wondered about getting a safe yourself.

Negative interest rate policy by the European Central Bank

Big news this week was the announcement of a negative interest rate policy by the European Central Bank.

“NIRP” is here: Europe officially unleashes negative interest rates

Outside of the alternative media this received surprisingly little coverage. But for our mind it marks the first time a central bank has charged member banks to deposit money with it and is a very significant event. It is a progression of the war on savers and financial repression. It will likely raise European asset prices in the short to medium term.

Why?

Because it’s aim is to discourage banks from holding excess reserves with the ECB and to lend them out instead. Of course there has to be demand for it. But the already wealthy will surely take up the cheap money and run with it.

But in the long run will also likely have a positive impact on precious metals.

It’s also something we discussed back in January following Ronald Stoeferle’s latest in Gold We Trust Chart Book.

While this was referencing the US Federal Reserve, this is still a significant step. A set back in the US could still see such a policy rolled out there too, but we have a precedent set now anyway.

We’ll actually be in the UK and France later in the year. Going via the Dubai gold markets so we’ll give a bit of a boots on the ground report from Europe then.

But from afar this response from their Central Bank shows they are battling hard to overcome the forces of deflation.

Hedge Funds Betting Against Silver Reaches Record High: Good News?

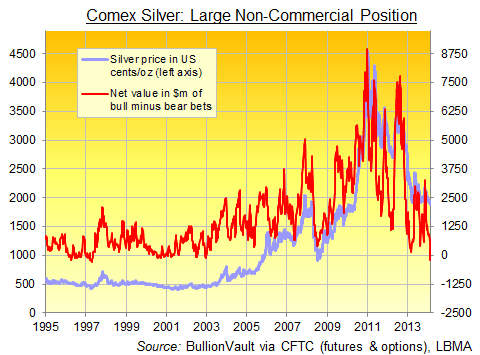

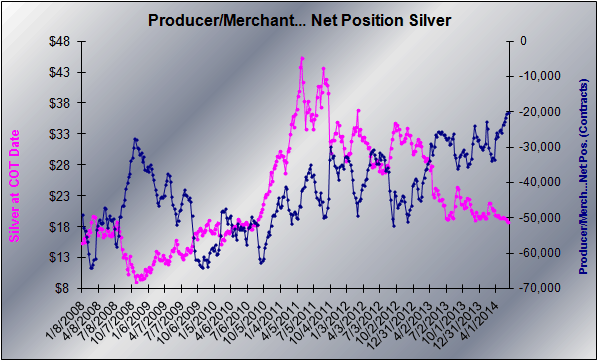

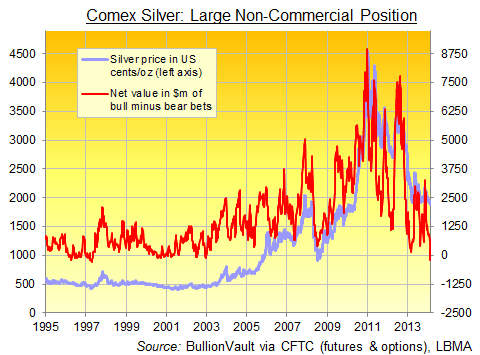

In what could well be good news for the silver price managed money / speculators (i.e. hedge fund) betting against silver reached record highs this week. The chart below shows this as record lows as it is of bullish minus bearish bets. Being below zero means there are more bears than bulls and we are at levels not seen since the 90’s.

Why might this be good news for silver?

Historically this money managed sector is good at being wrong at their extremes. When they get extreme in either direction the price usually moves against them. As evidenced by the highs in 2011 or the lows last year.

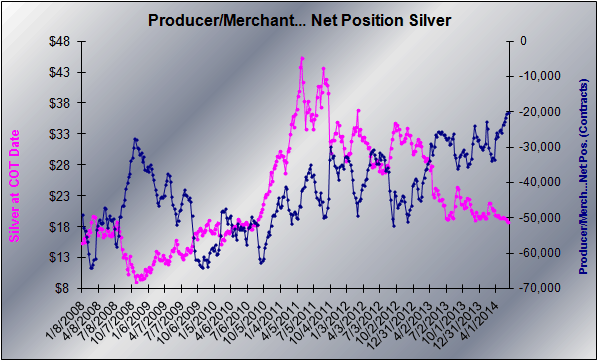

On top of this we can also see the Producer/Merchants sector has close to record low short positions. These are the actual end users of silver engaging in real hedging of the physical silver they refine, use etc. Historically they are the “smarter money” and at extremes are more likely to be right, shown by the inverse relationship with the silver price (pink line) in the chart.

Source.

Alisdair Mcleod makes a good argument for a “short squeeze” being set up in silver by the extreme levels of these 2 groups.

To us it seems like there is an expectation silver (and gold) will go lower from here so perhaps this will means the lows are in for both now? We might even have seen the beginnings of this short squeeze yesterday with silver jumping higher.

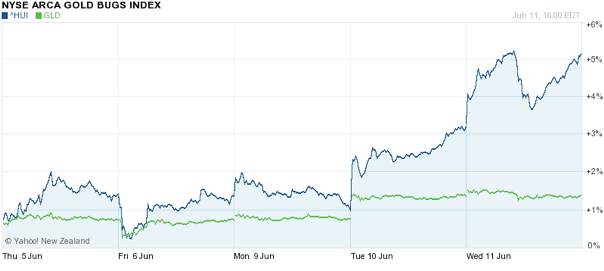

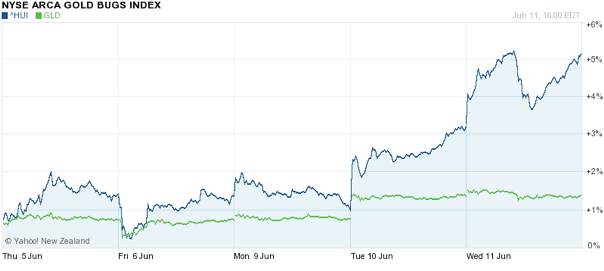

On top of this the mining shares have also been holding up well over the past week. Like the week prior, gold (green line in the chart below) has been fairly flat – up 1.36% in US dollar – while the miners (blue line have actually risen over 5%.

So given the miners often lead the metals higher we could see a bit of a pop here for silver in particular.

However we wonder if in the long run we might not see a steady rise in gold and silver prices to their eventual true value. But rather a reset at some point. So an announcement would come of a new higher gold price overnight. The point is you’d either be on board or not at that point. So the old adage of better a year or 3 early than a day late would definitely be valid.

If you want some financial insurance at near record lows then get in touch.

This Weeks Articles:

Special Deal on 30 oz’s or more of NZ Gold |

Gold Survival Gold Article Updates: Jun. 5, 2014 This Week: -Buying a Home Safe for Gold & Silver Storage -Mining and Environment—Facts vs. Fear -Special Deal on 30 oz’s NZ Gold. We finally have our long promised article on Buying a Home Safe for Gold & Silver Storage this week. So if you’ve been considering that option we hope it is of some help […]

read more…Good Reason for Doom and Gloom Gold Survival Gold Article Updates: Jun. 5, 2014 This Week: -Buying a Home Safe for Gold & Silver Storage -Mining and Environment—Facts vs. Fear -Special Deal on 30 oz’s NZ Gold. We finally have our long promised article on Buying a Home Safe for Gold & Silver Storage this week. So if you’ve been considering that option we hope it is of some help […]

read more…Good Reason for Doom and Gloom |

2014-06-10 01:20:25-04 2014-06-10 01:20:25-04

We try not to be pedlars of “doom porn” here at Gold Survival Guide. However when you offer a different perspective to most in the mainstream it’s probably hard not to be called one. This piece looks at a recent MarketWatch piece poking fun at the increase in gloom and doom predictions in recent years but shows that there are good reasons why these exist. |

America’s Book of Secrets: The Gold Conspiracy

|

Gold Survival Gold Article Updates: Jun. 5, 2014 This Week: -Buying a Home Safe for Gold & Silver Storage -Mining and Environment—Facts vs. Fear -Special Deal on 30 oz’s NZ Gold. We finally have our long promised article on Buying a Home Safe for Gold & Silver Storage this week. So if you’ve been considering that option we hope it is of some help […]

read more…

Gold Survival Gold Article Updates: Jun. 5, 2014 This Week: -Buying a Home Safe for Gold & Silver Storage -Mining and Environment—Facts vs. Fear -Special Deal on 30 oz’s NZ Gold. We finally have our long promised article on Buying a Home Safe for Gold & Silver Storage this week. So if you’ve been considering that option we hope it is of some help […]

read more… 2014-06-10 01:20:25-04

2014-06-10 01:20:25-04 2014-06-10 19:51:32-04

2014-06-10 19:51:32-04 2014-06-11 18:46:36-04

2014-06-11 18:46:36-04